Perfect Tips About Salaries Income Statement

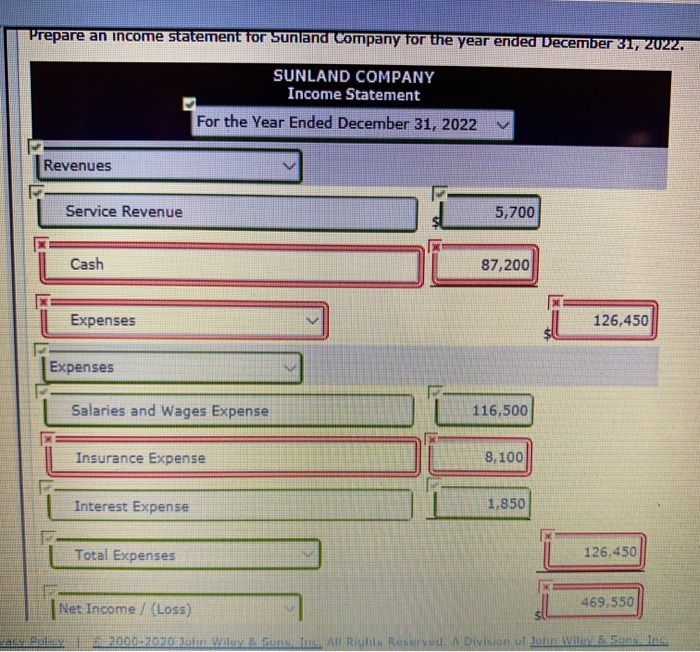

It also shows whether a company is making profit or loss for a given period.

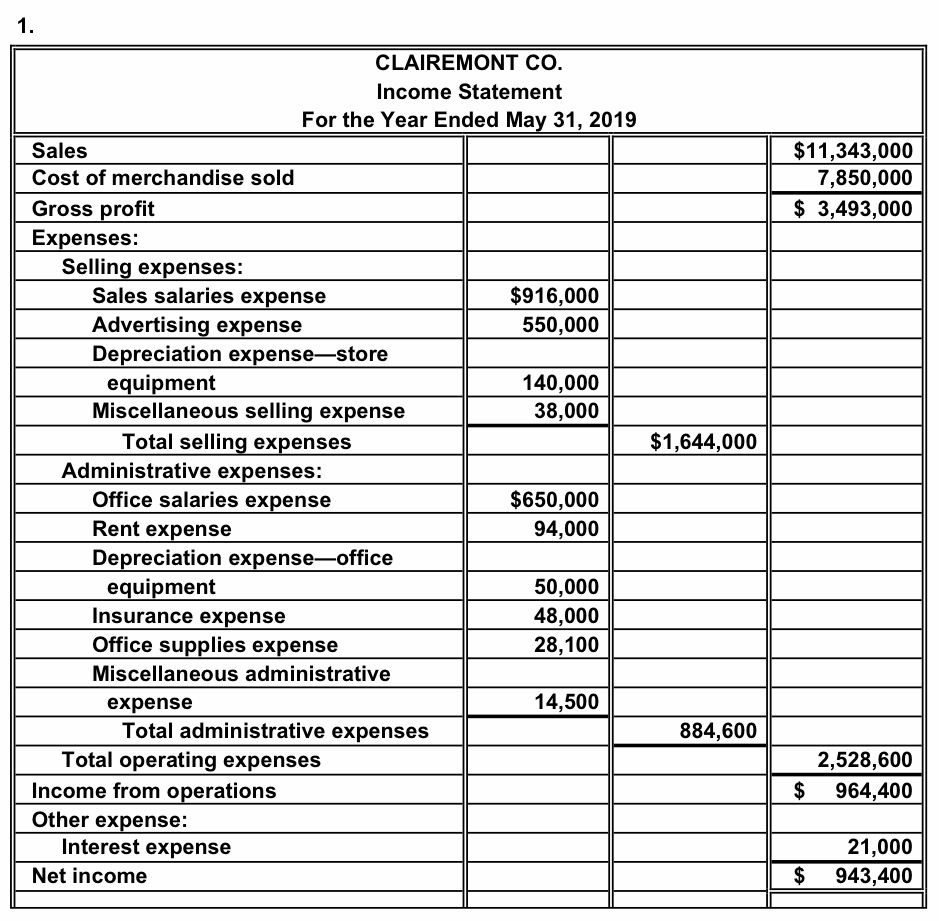

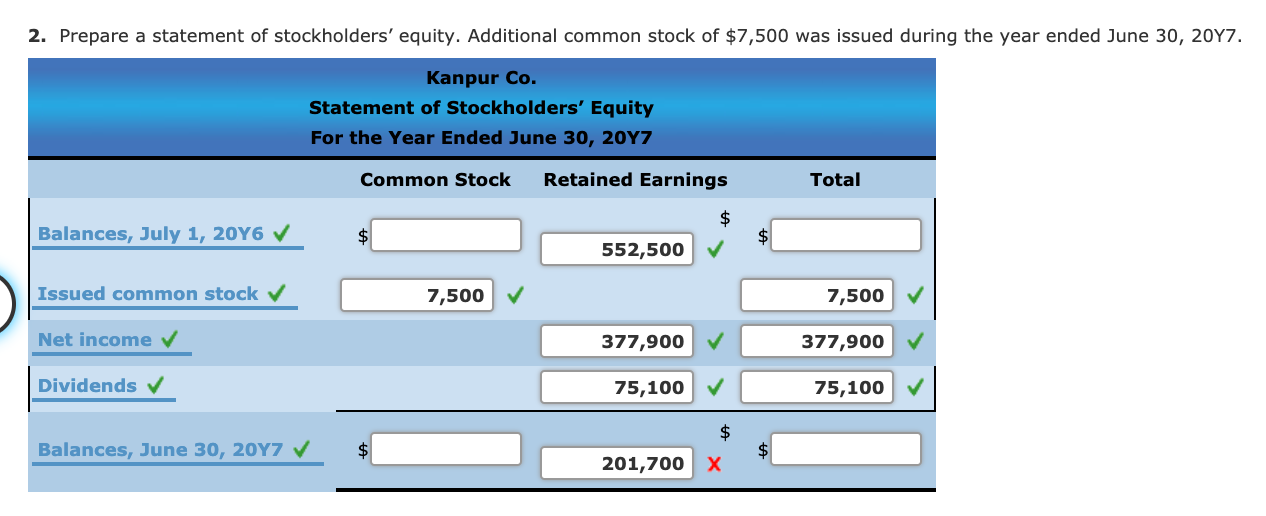

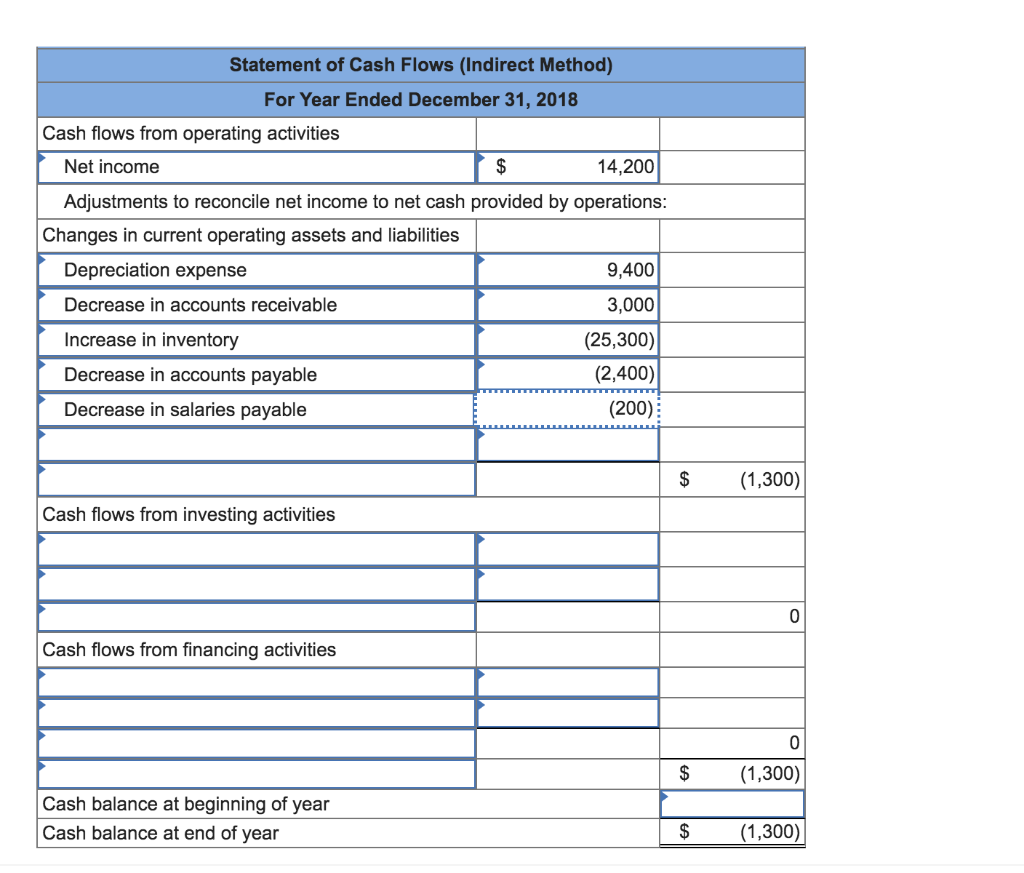

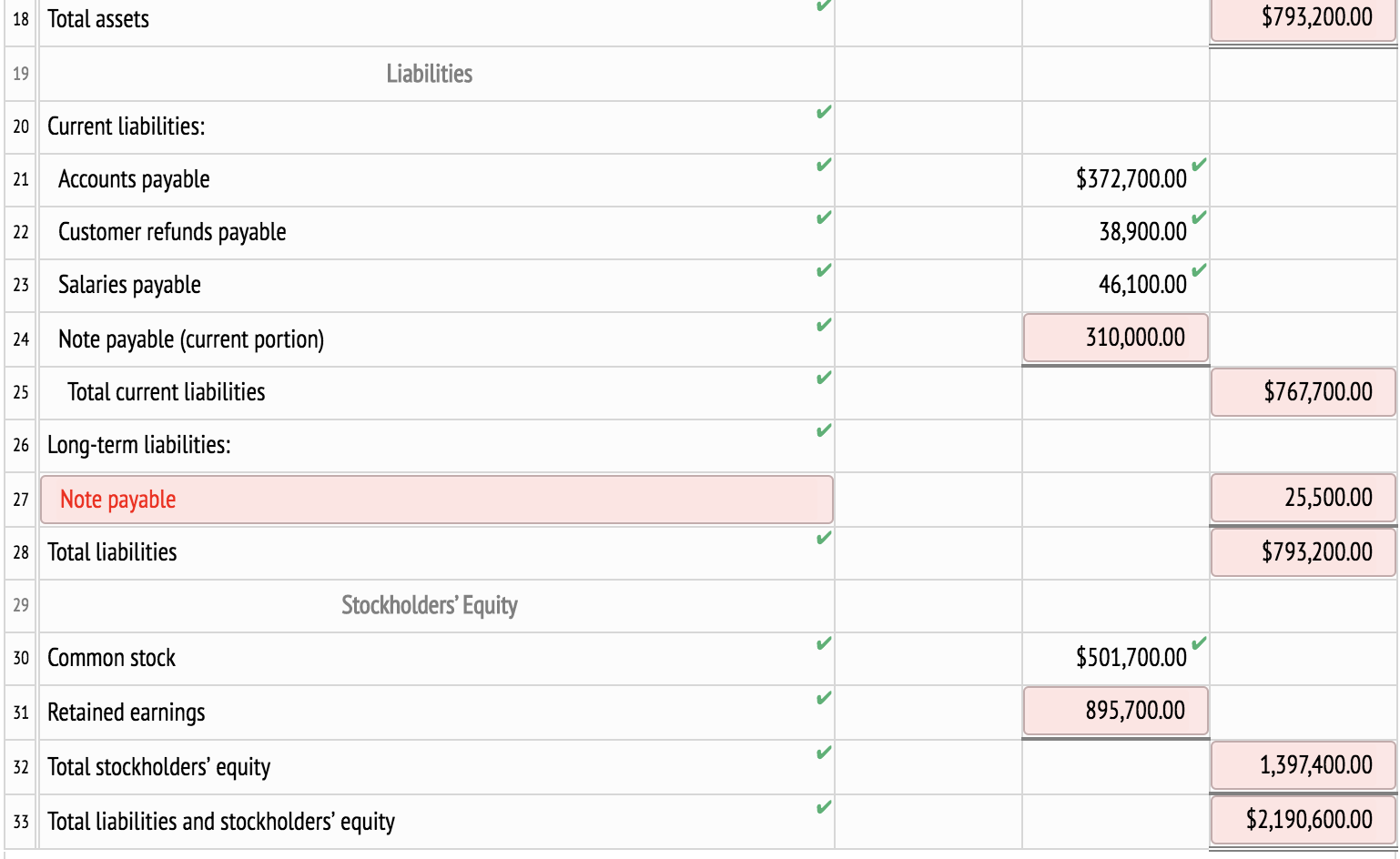

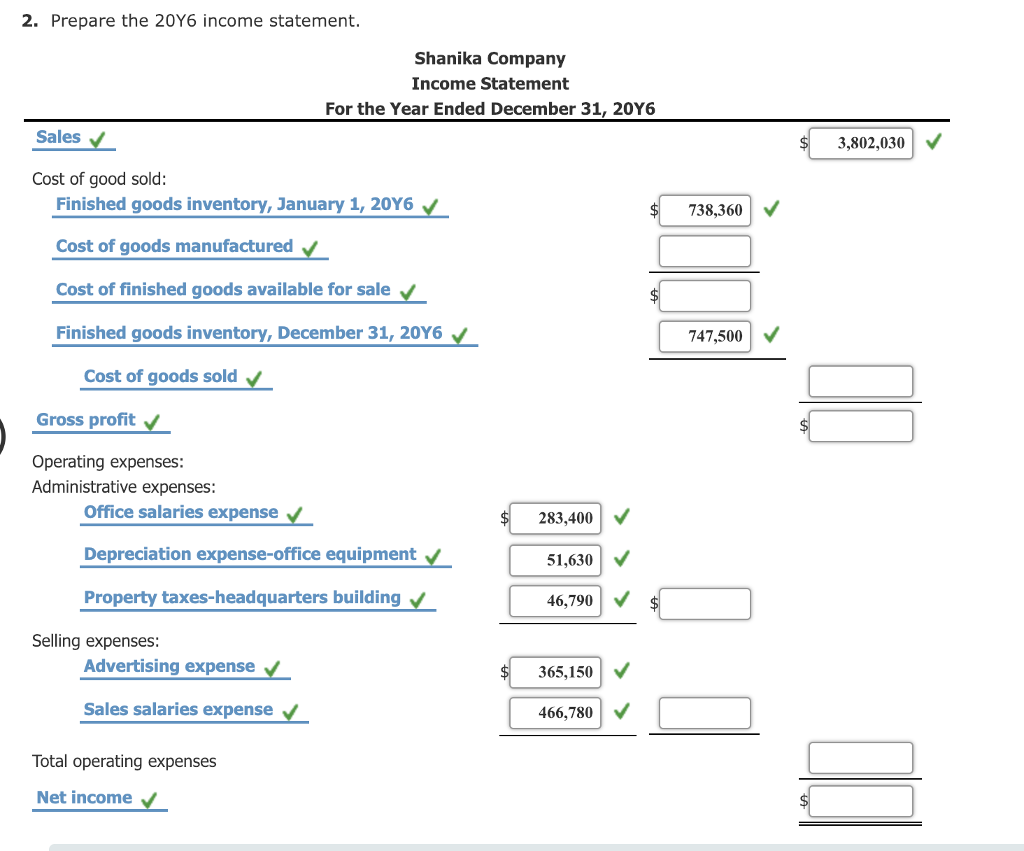

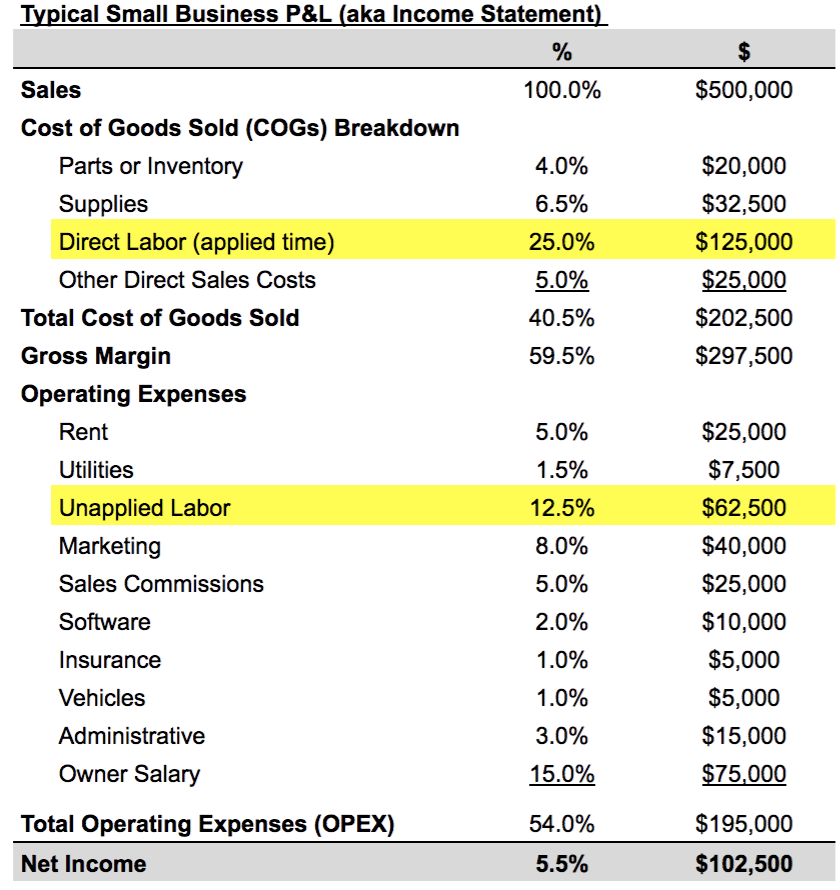

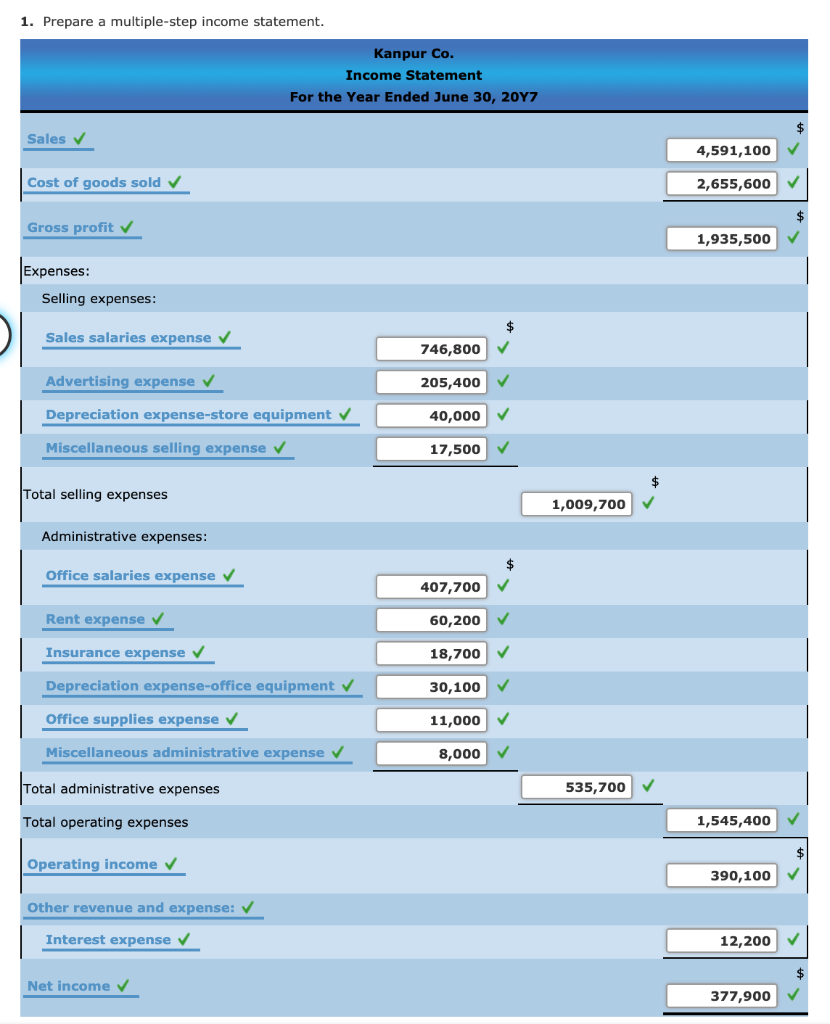

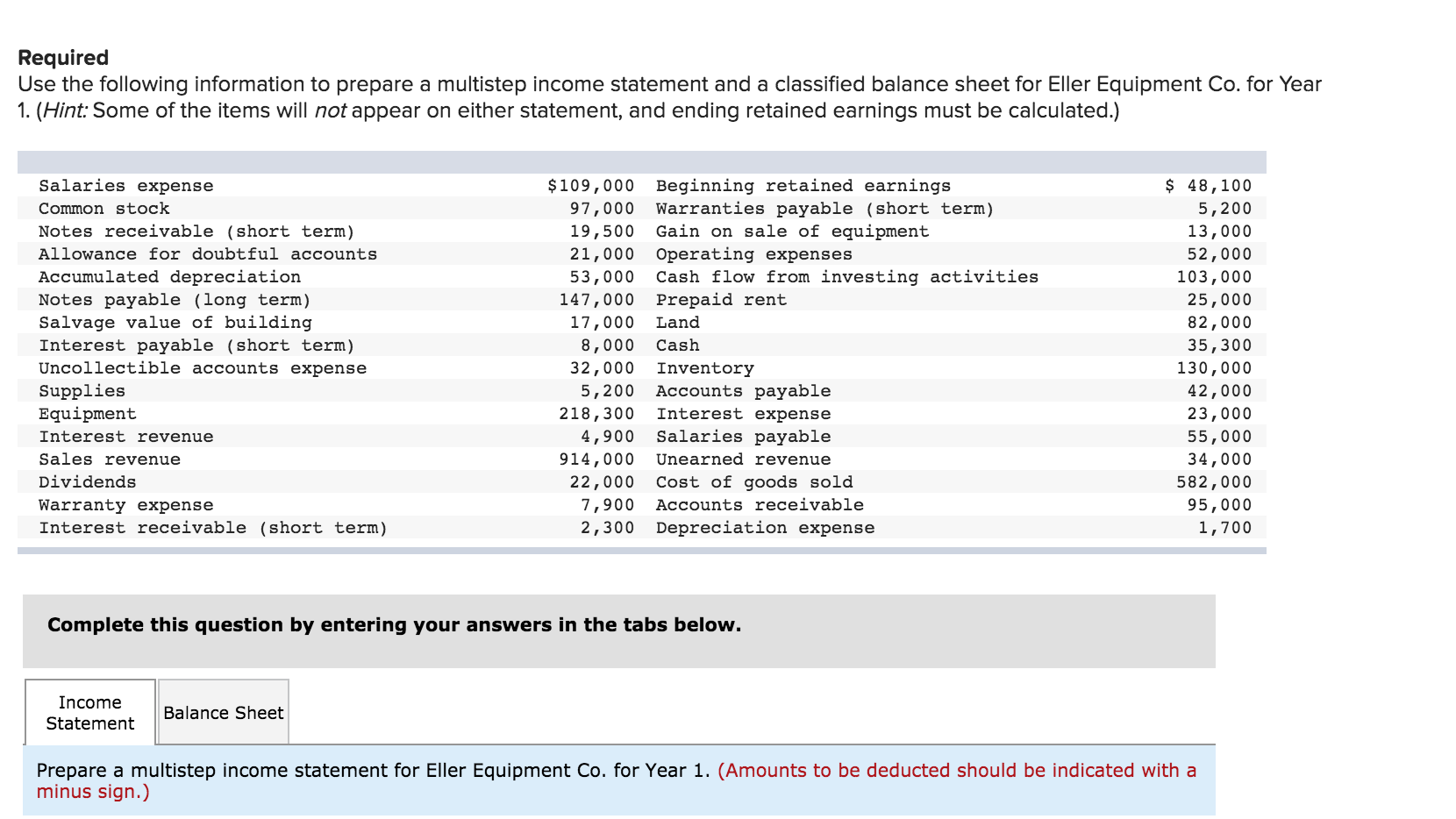

Salaries income statement. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. This is typically a percentage of sales, which is paid on top of a base salary. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

The income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the cost of goods sold from the total revenues, and the second formula states that the operating income of the company is derived by subtracting the operating expenses from the tot. Learn what an income statement is, how accounts payable affects income statements and the differences between accounts payable and expenses. Revenue, expenses, gains, and losses.

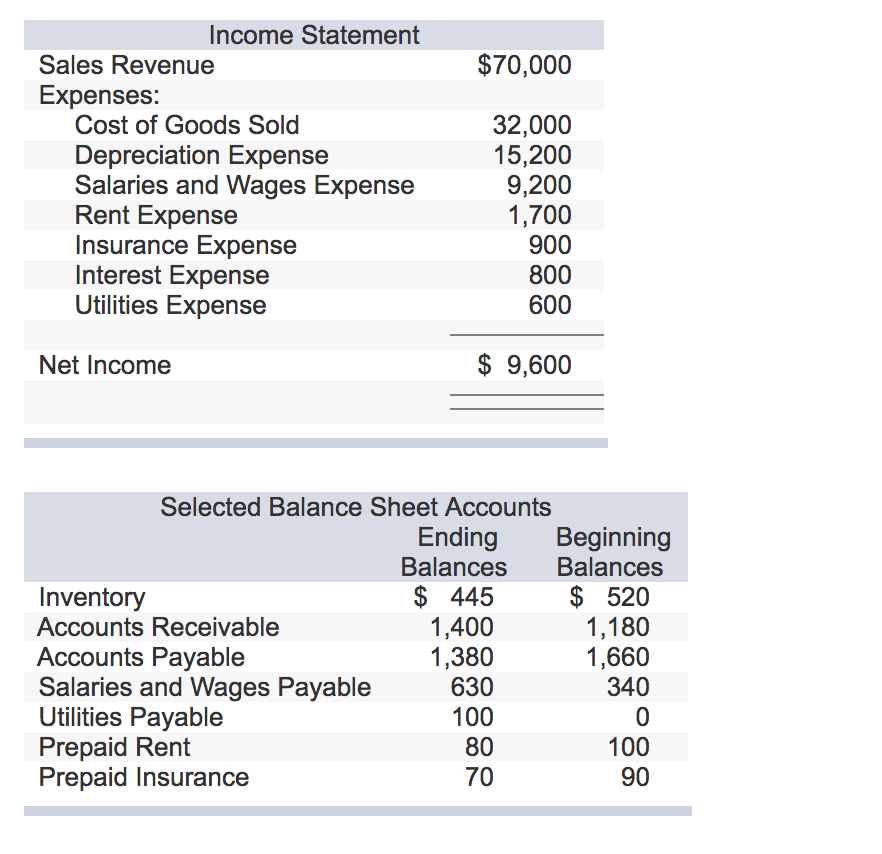

For example, some fixed costs are salaries (but not wages), rent, utilities, and insurance. Selling, general administration, etc.) are part of the expenses reported on the company's income statement. How to prepare an income statement.

This may include employee salaries, sales commissions and building rental expenses. Pick the duration that you want to use for calculating your income statement. A sales commission is the amount of compensation paid to a person based on the amount of sales generated.

Pick a timeframe to report on. It shows all revenues and expenses of the company over a specific period of time. An income statement is a document that tracks a business's revenue and expenses over a set period of time.

The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Wage expense is typically combined with other expenses on the income statement. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance sheet.

By abigail tracy january 19, 2024 income statement reports show financial performance based on revenues, expenses, and net income. Choose a time period for your income statement. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

The income statement equation represents the fundamental accounting formula used to calculate a company’s net income. There are three main types of wage expenses: It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

The income statement focuses on four key items: Most companies create annual income statements, though you can prepare one for other periods of time, depending on your company's needs, like by month or by quarter. (1) times wages, (2) piece wages, and (3) contract wages.

Salaries and wages as expenses on income statement. An income statement is a financial statement that shows you the company’s income and expenditures. His decision to allow a vote on a labour amendment saw tory and snp.