Outrageous Info About Capital Investment In Balance Sheet

A balance sheet recession implies that households and enterprises have high levels of debt, resulting in sluggish consumption and investment, which in turn causes.

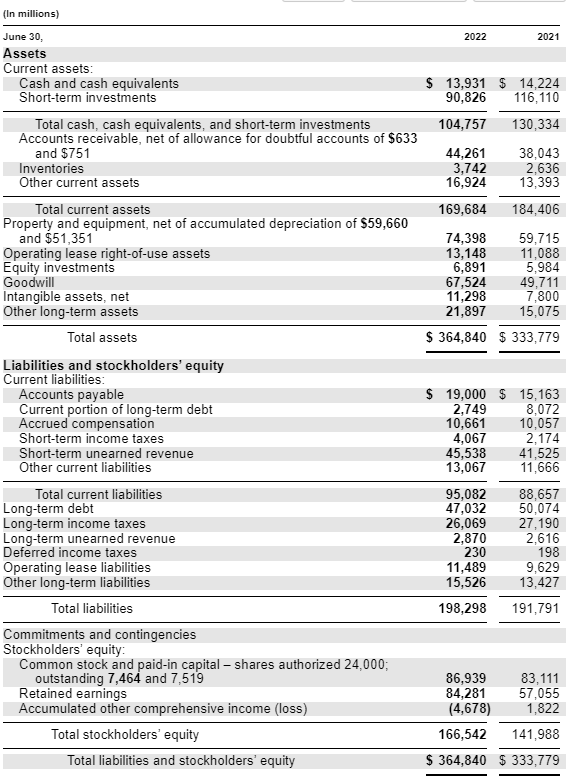

Capital investment in balance sheet. Share capital and the balance sheet through the fundamental equation where assets equal liabilities plus equity, we can see that assets must be funded through one of the. Its strong balance sheet and decent liquidity. Has given the following details.

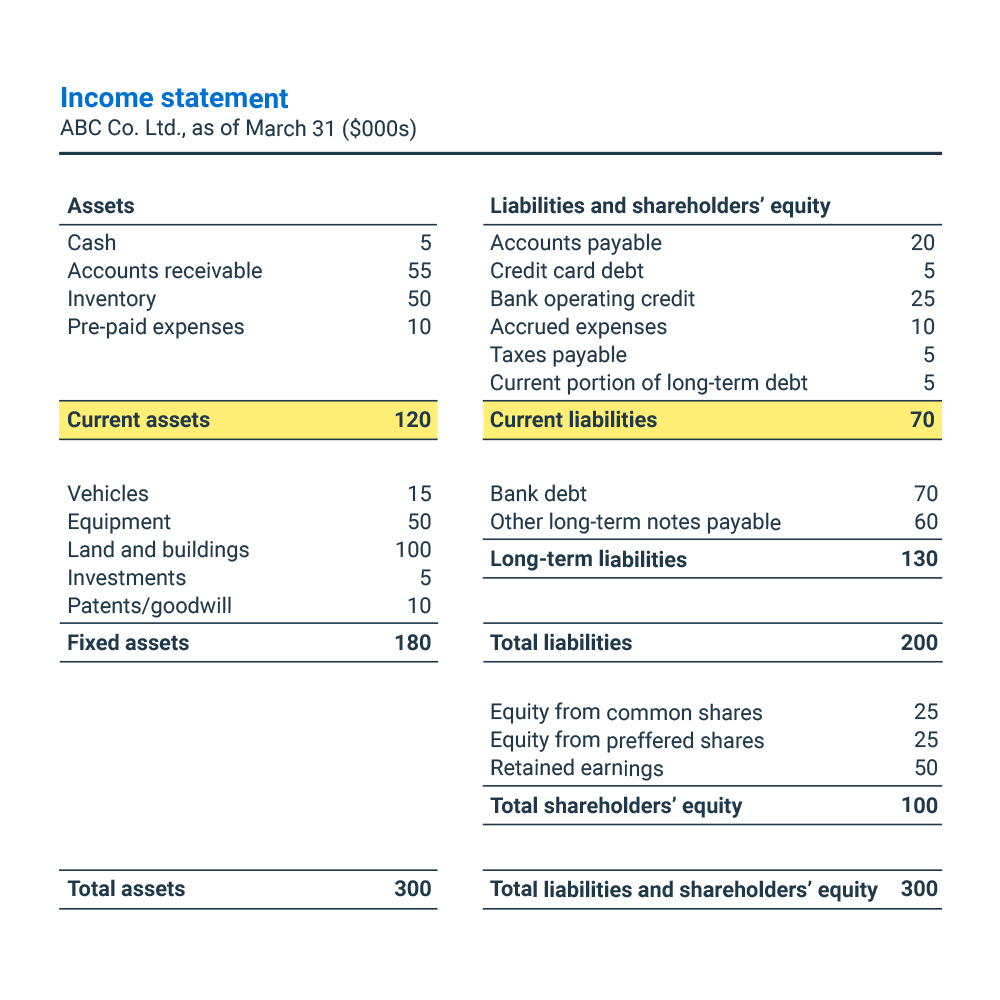

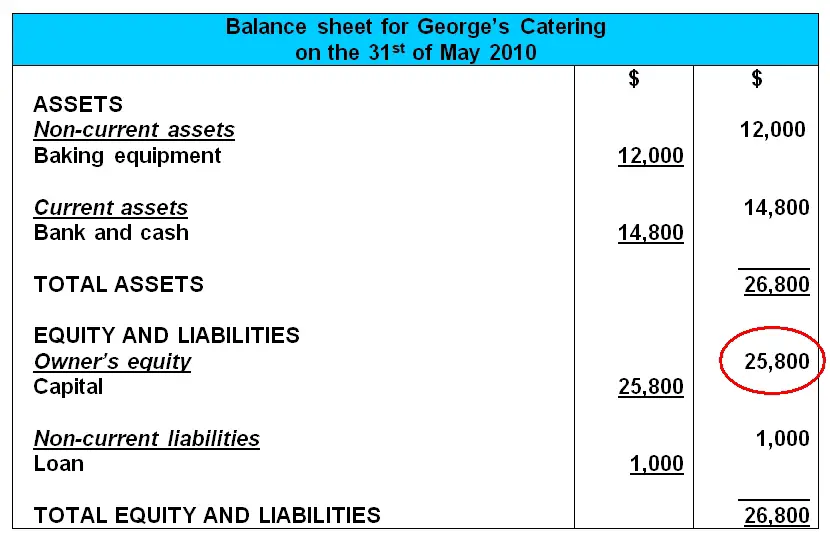

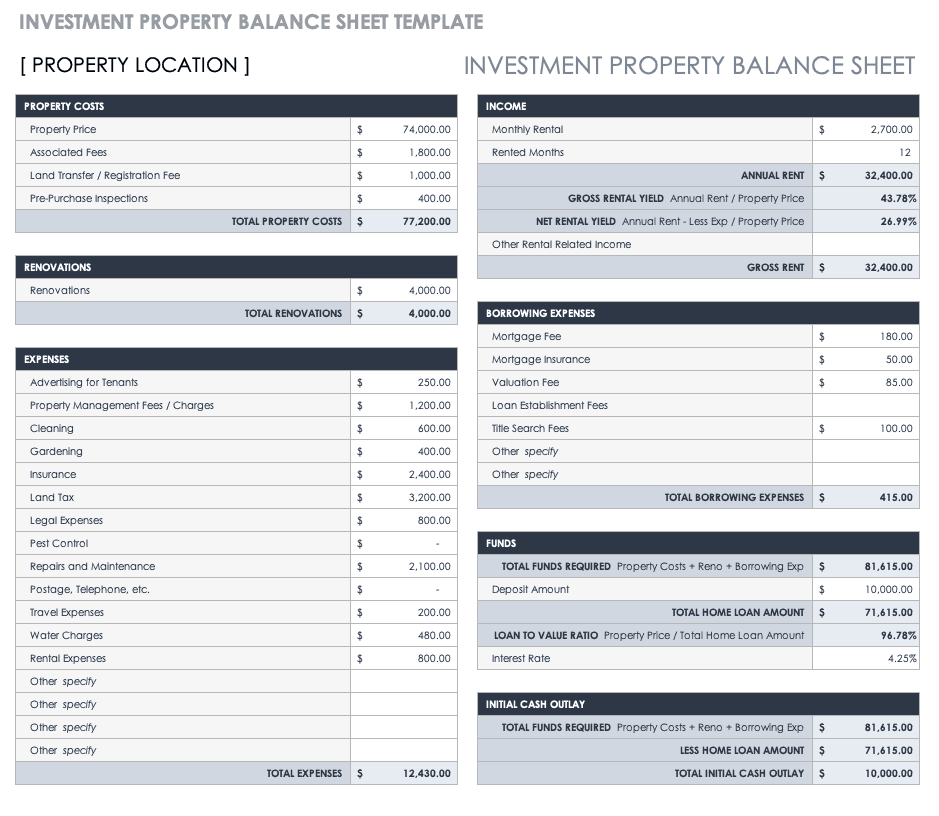

Set up a capital investment forecast step 2. Use the below data given for the calculation of economic. A balance sheet is a financial document that a company releases to show its assets, liabilities and overall shareholder equity.

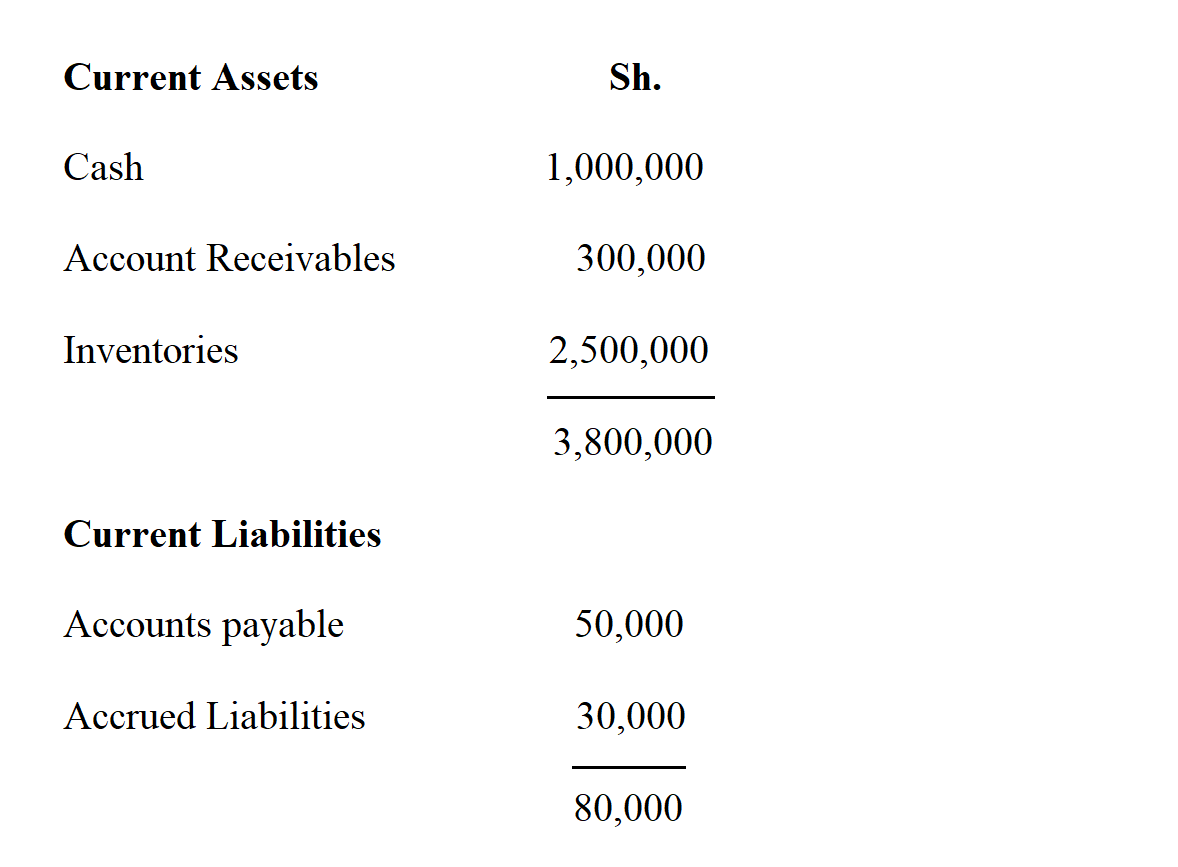

Let us take the example of a company and compute its capital investment in 2018 on the basis of the following information, depreciation expense of $8,000 (income. Texas capital (tcbi continues its strategic plan. A company's balance sheet provides the information necessary to calculate capital employed.

In the financing approach, investors. On one side of the equals sign is your company's total assets. Investments might include stock, stock funds, or bonds.

Balance sheets are useful tools for. A strong balance sheet and liquidity are likely to help sustain its share repurchase plan. Add variable and fixed costs step 4.

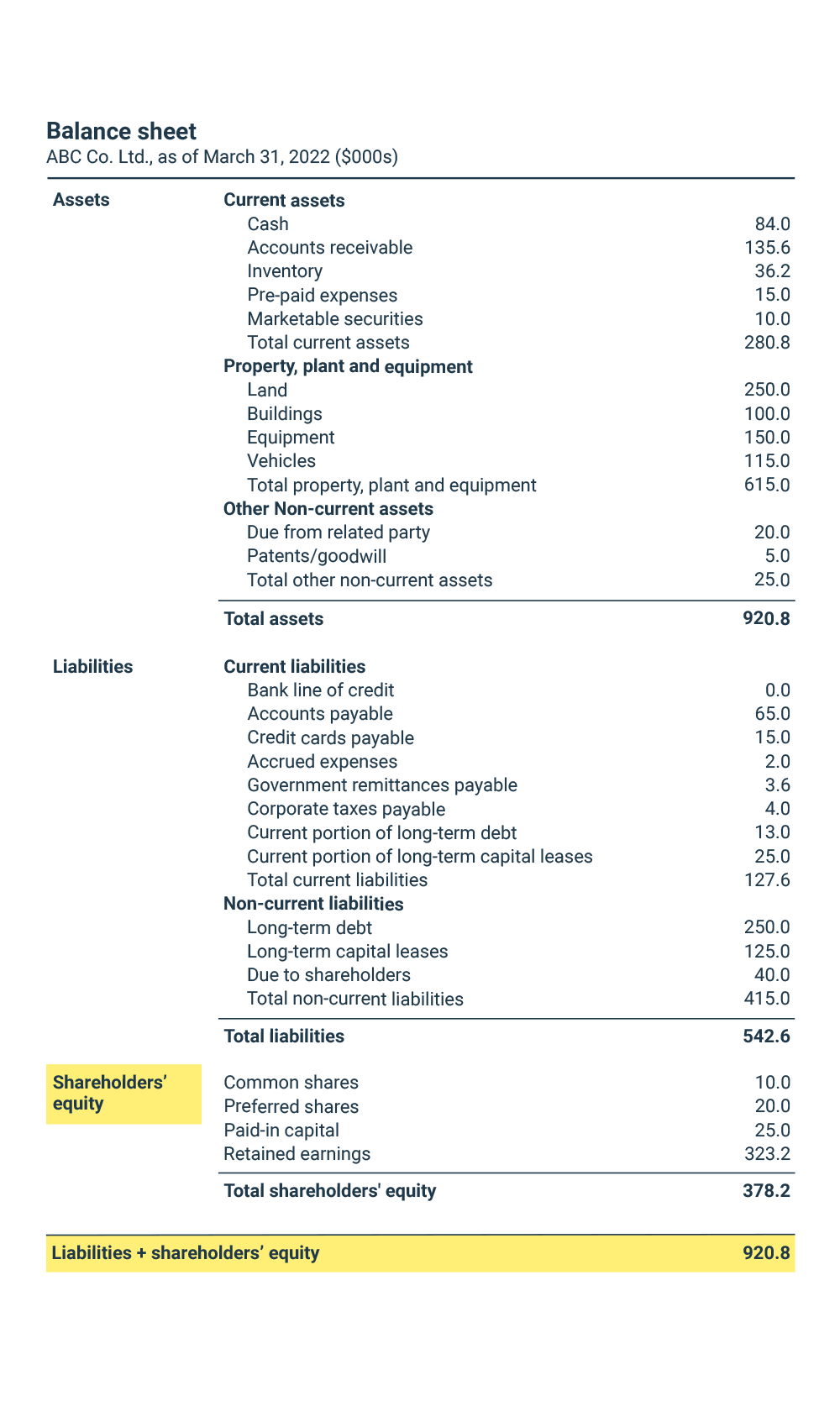

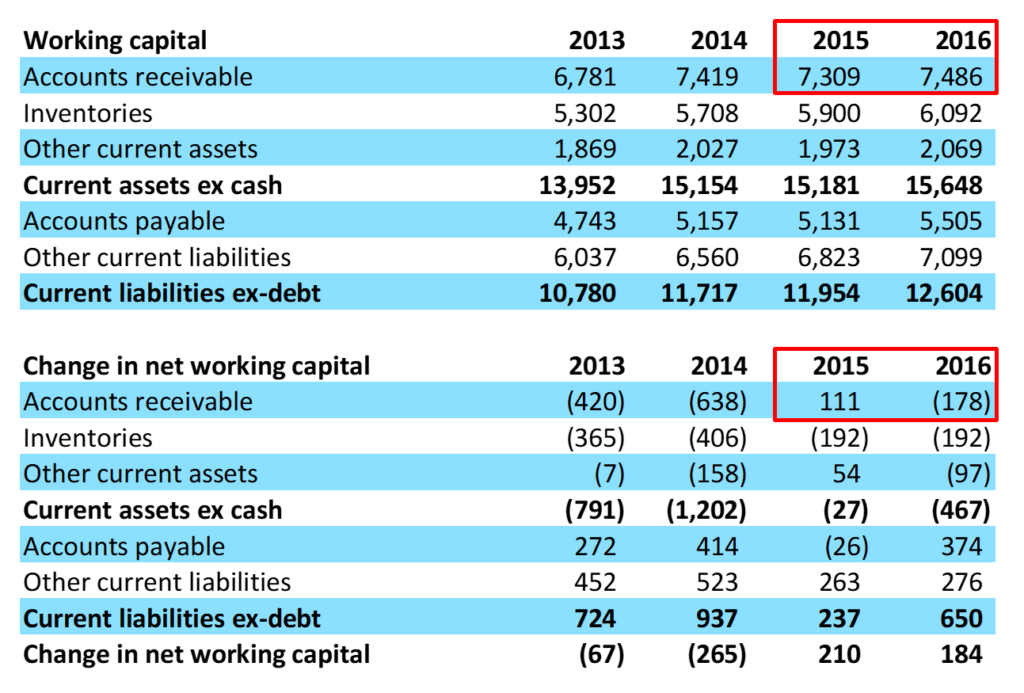

Examples of capital expenditures include improving or purchasing assets such as. Texas capital bancshares, inc. The working capital is a specific subset of balance sheet items, and calculated by subtracting current liabilities from current assets.

Each of the first three sections contains the balances of the various accounts. Generally speaking, the balance sheet is an equation where assets equal to capital and liabilities and must be true for each balance sheet to be accurate. Tcbi remains committed to boosting revenues through its strategic initiatives.

Cash in the bank, inventory, accounts receivable and investments all go on the balance sheet as. These assets may include cash, cash equivalents, and marketable. Fixed assets are shown net of accumulated depreciation on the balance sheet.

Key metrics to review from a company's balance sheet when. So, you are required to calculate the invested capital of the firm. Summary invested capital is capital invested in a company by debtholders and shareholders for companies, invested capital is used to expand operations and further.

Create a revenue forecast step 3. Capital expenditures are often referred to as capex or capital expenses. Common stock (par value) and.

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)