Unbelievable Tips About Are Expenses On The Balance Sheet

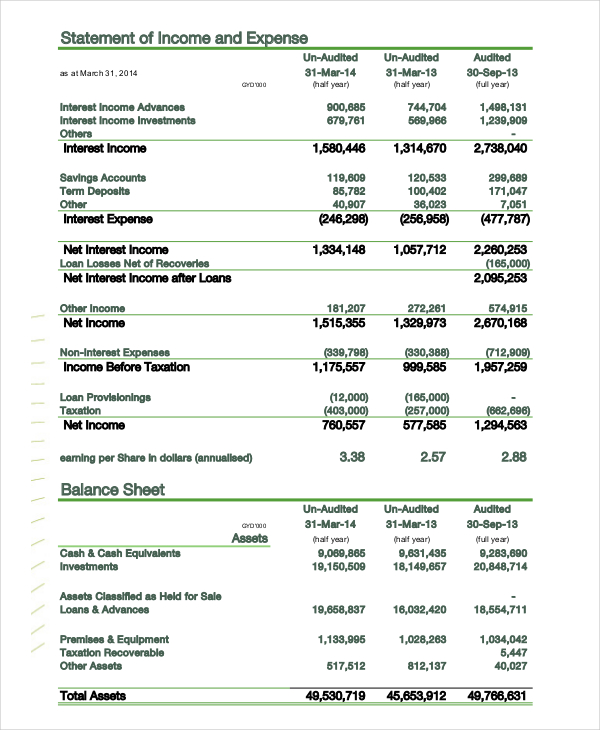

How an expense affects the.

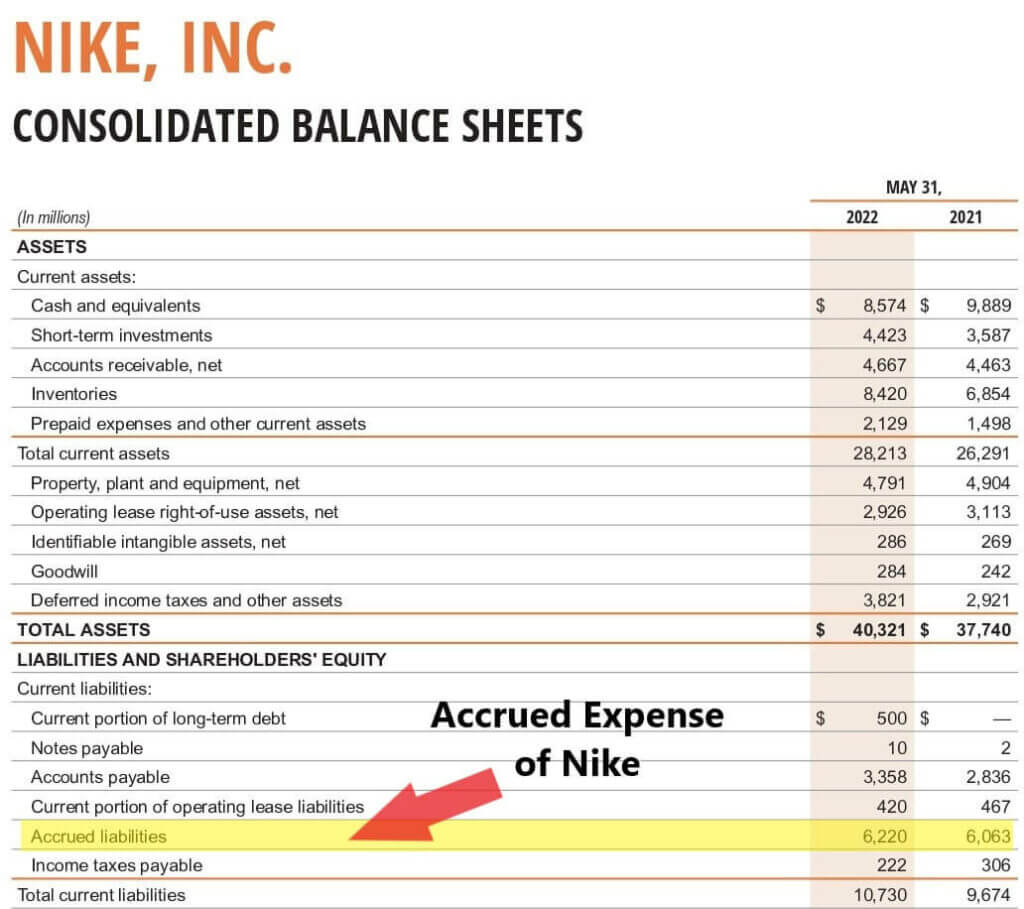

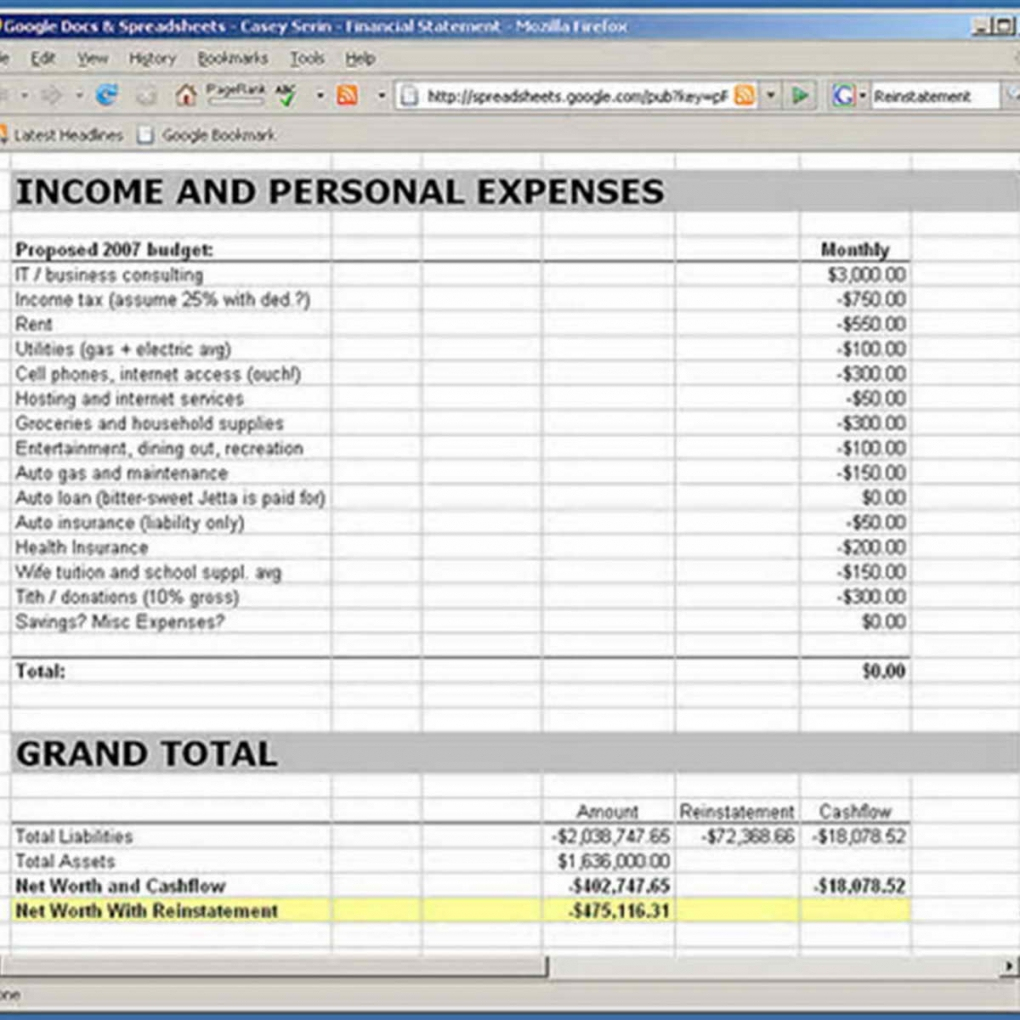

Are expenses on the balance sheet. Accrued expenses are recorded on the balance sheet as a current liability since they are expected to be paid within one year or one operating cycle, whichever is longer. Straight to pnl vs first to balance sheet. Expenses are deducted from revenue to arrive at profits.

The only difference between an expense and a capital expenditure is that an expense has been recognized under the accrual principle and is reflected on the income statement, whereas a capital expenditure goes straight to the balance sheet as an asset. Balance sheet (many of the links in this article redirect to a. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

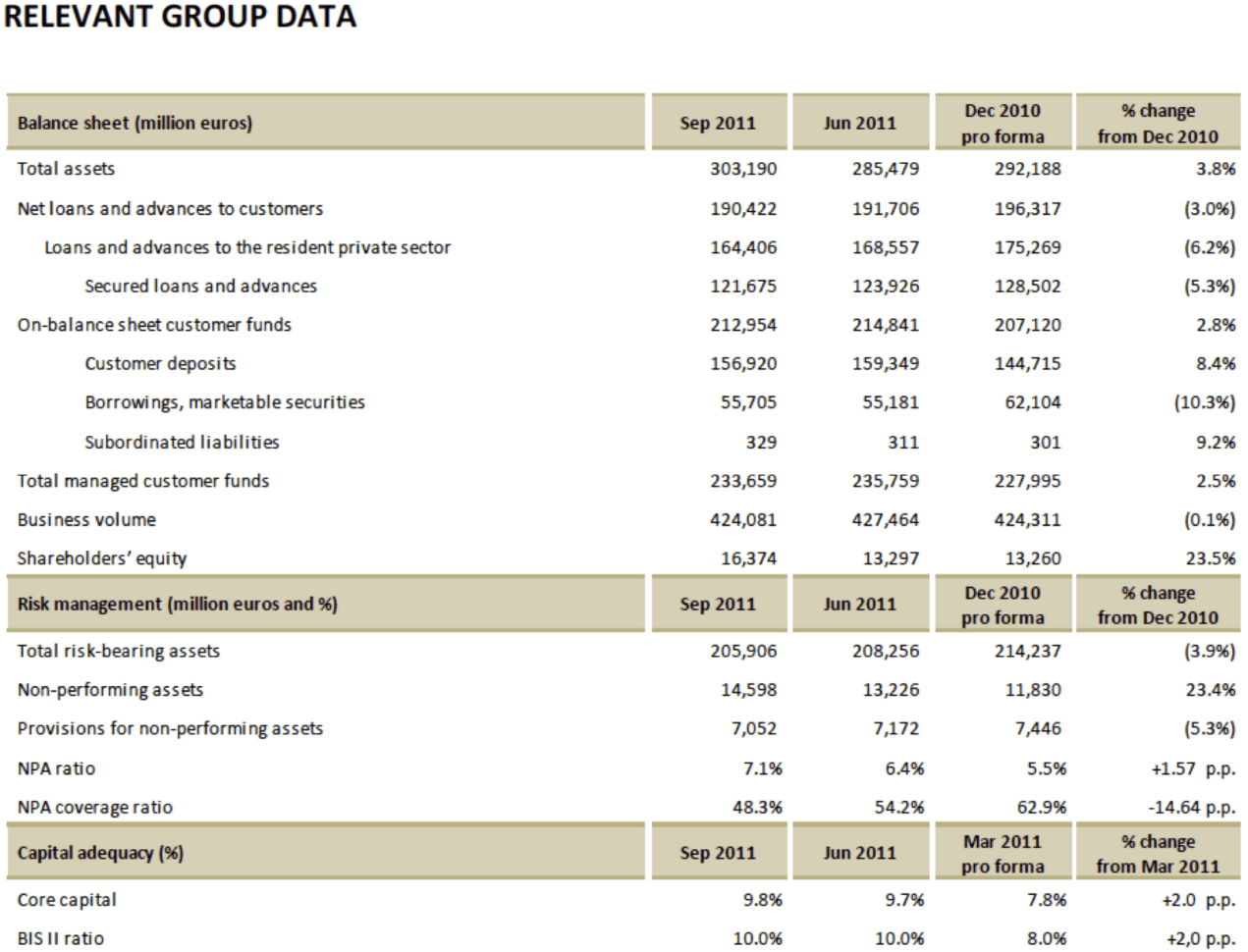

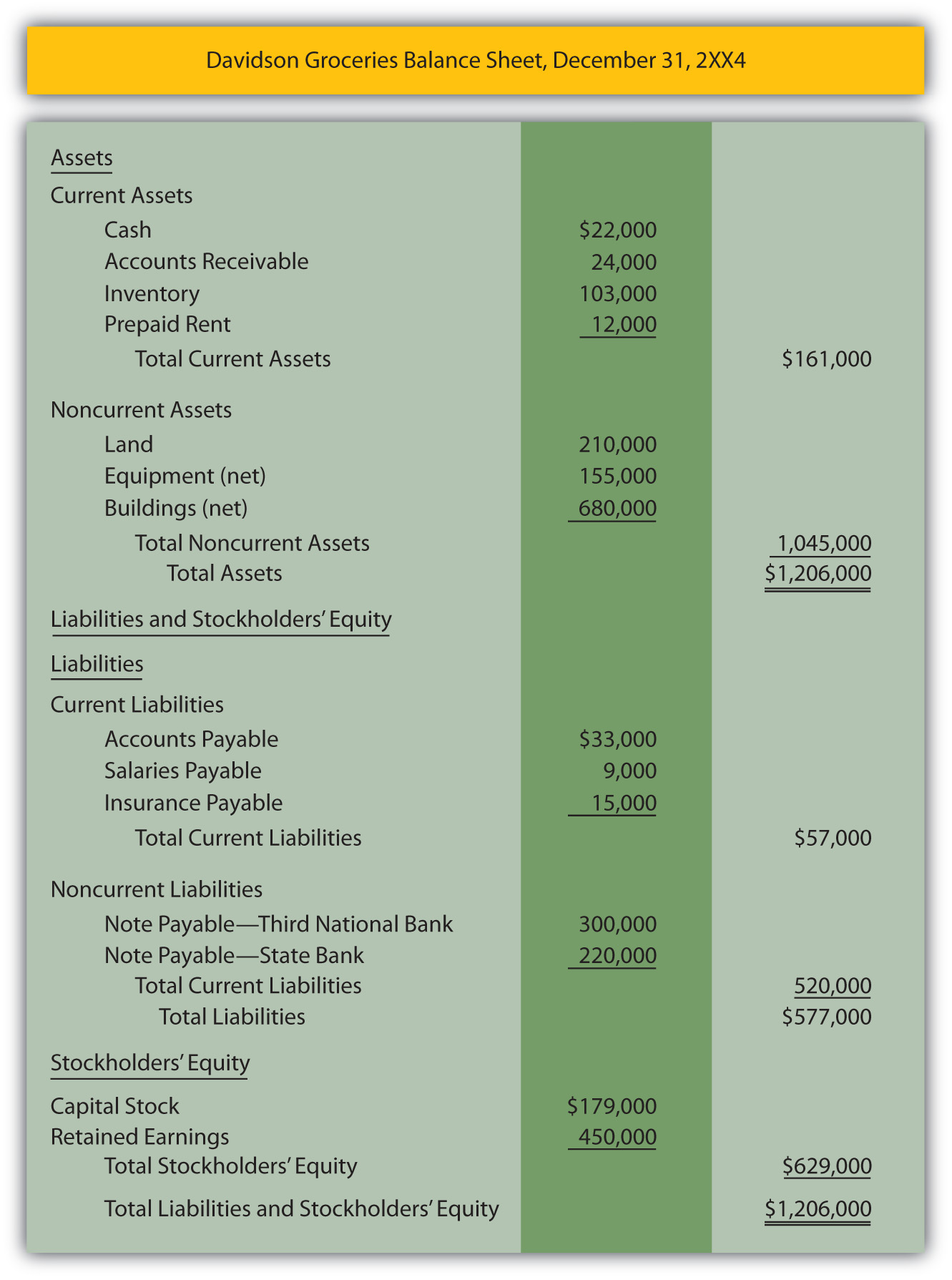

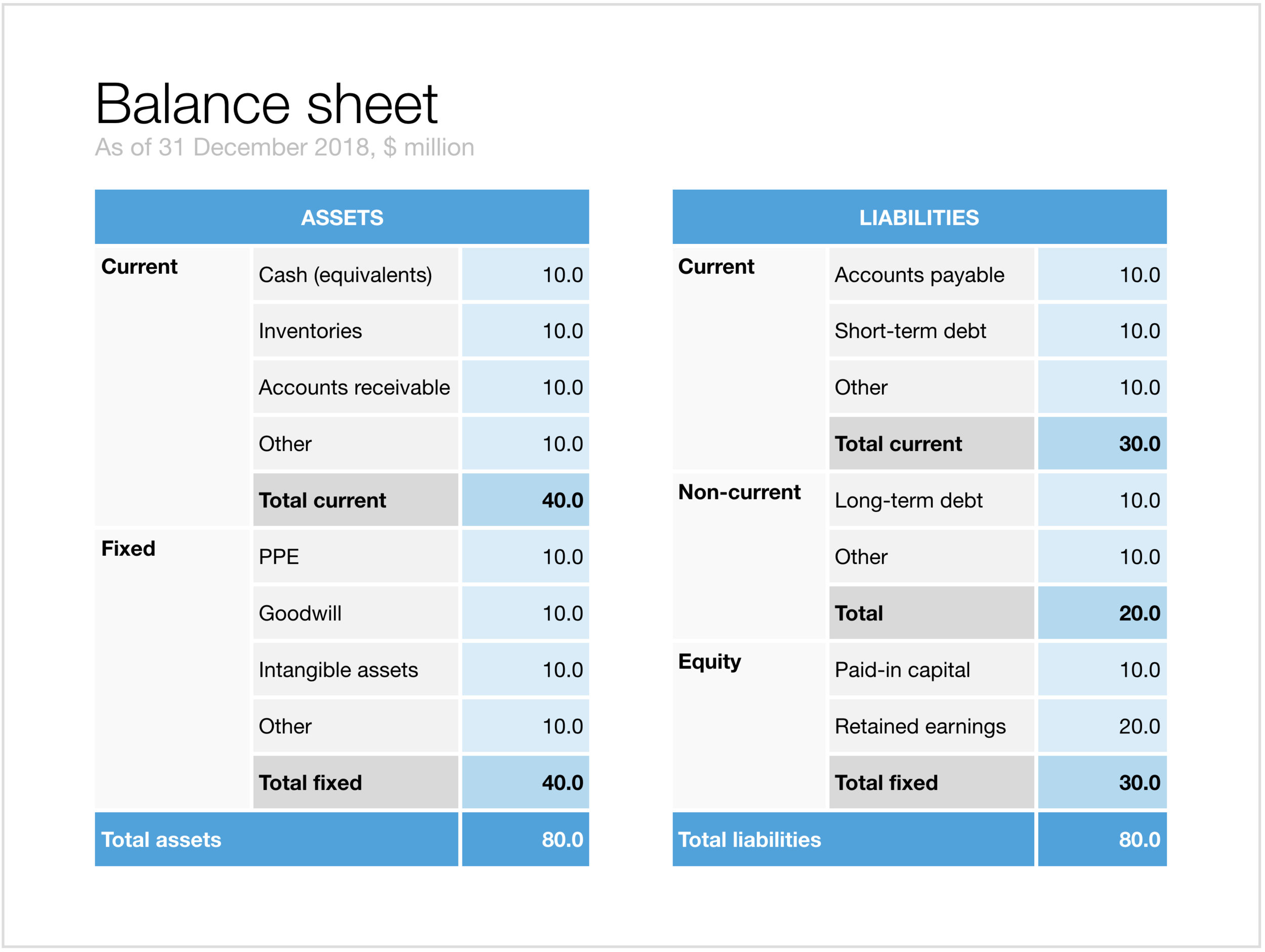

Option one is straight to the profit and loss statement, effectively bypassing the balance sheet. The balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time. What is the balance sheet?

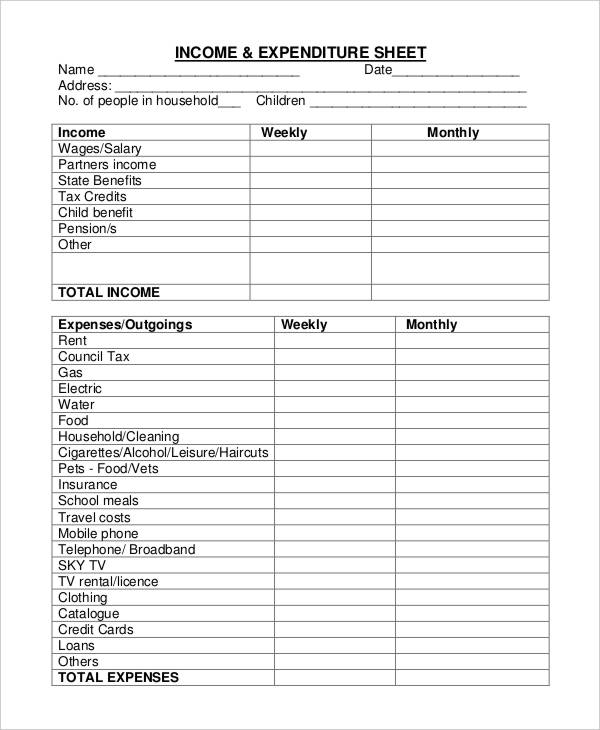

It can also be referred to as a statement of net worth or a statement of financial position. Cost of goods sold (cogs): How does an expense affect the balance sheet?

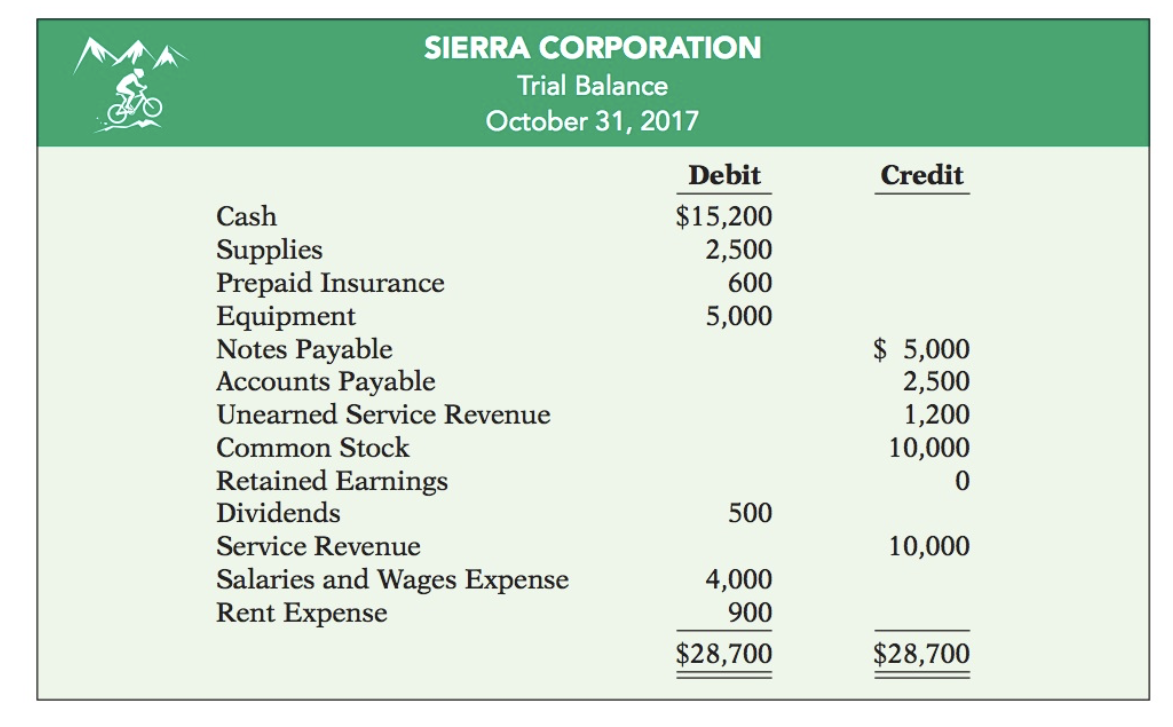

2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; Identify connected elements between the balance sheet and the income statement. Here are some examples of common expenses and their effect on the balance sheet:

The balance sheet shows assets, liabilities, and shareholders' equity. They are shown on a company’s monthly income statement to determine the company’s net income. The term balance sheet refers to the way assets always equal (or balance) liabilities plus owners' equity.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. 2023 — these faqs update question 9 to provide that a united states military service member who is a wrongfully incarcerated individual and who receives back pay following the reversal of a court martial conviction may not exclude the payments under section 139f if the. All revenues the company generates in excess of its expenses will go into the shareholder equity account.

Where does depreciation expense go on a balance sheet modified: Differentiate between expenses and payables. Assets = liabilities + owners' equity.

There are two options: A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet covers a company’s assets as defined.

Net income and retained earnings. The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. Although the balance sheet and the p&l statement contain some of the same financial information—including revenues, expenses and profits—there are important differences between them.