What Everybody Ought To Know About Investment Property On Balance Sheet

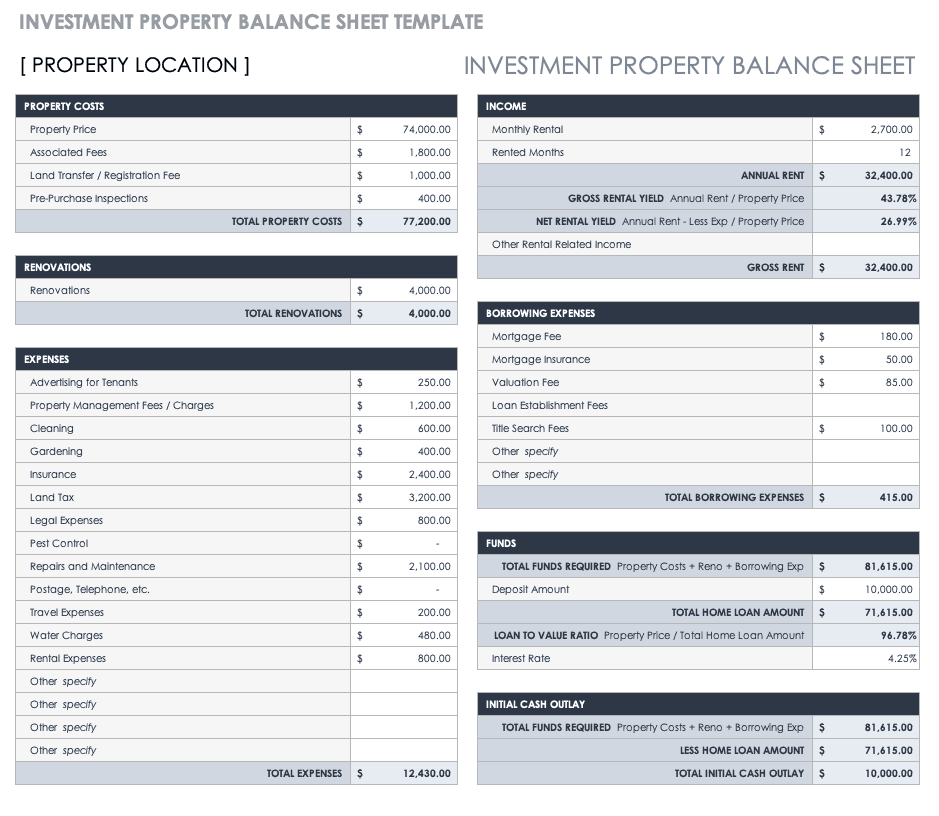

On 31 december 2015 the fair value of the investment property had increased to £220,000 and on 31 december 2016 it had increased further to £225,000.

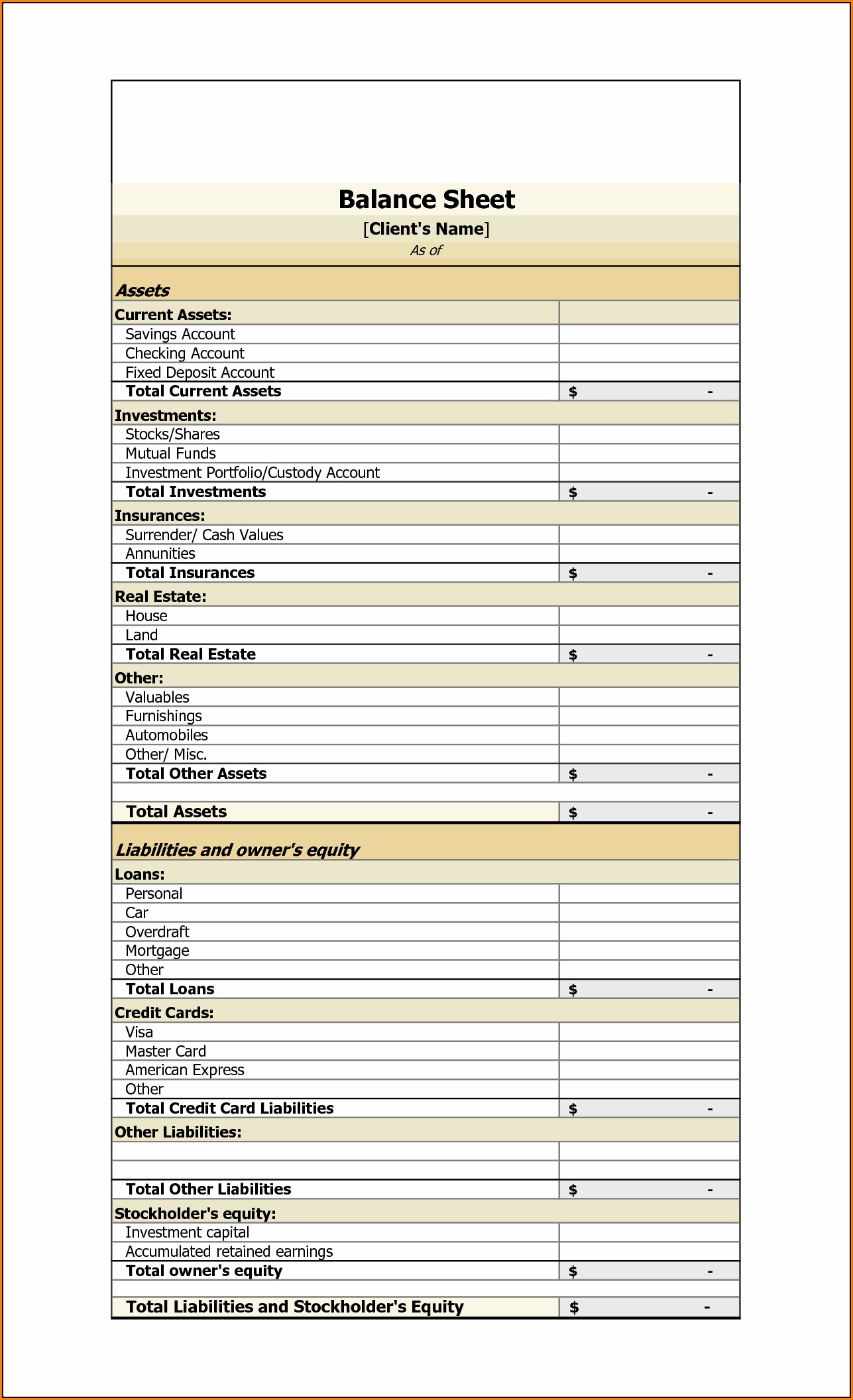

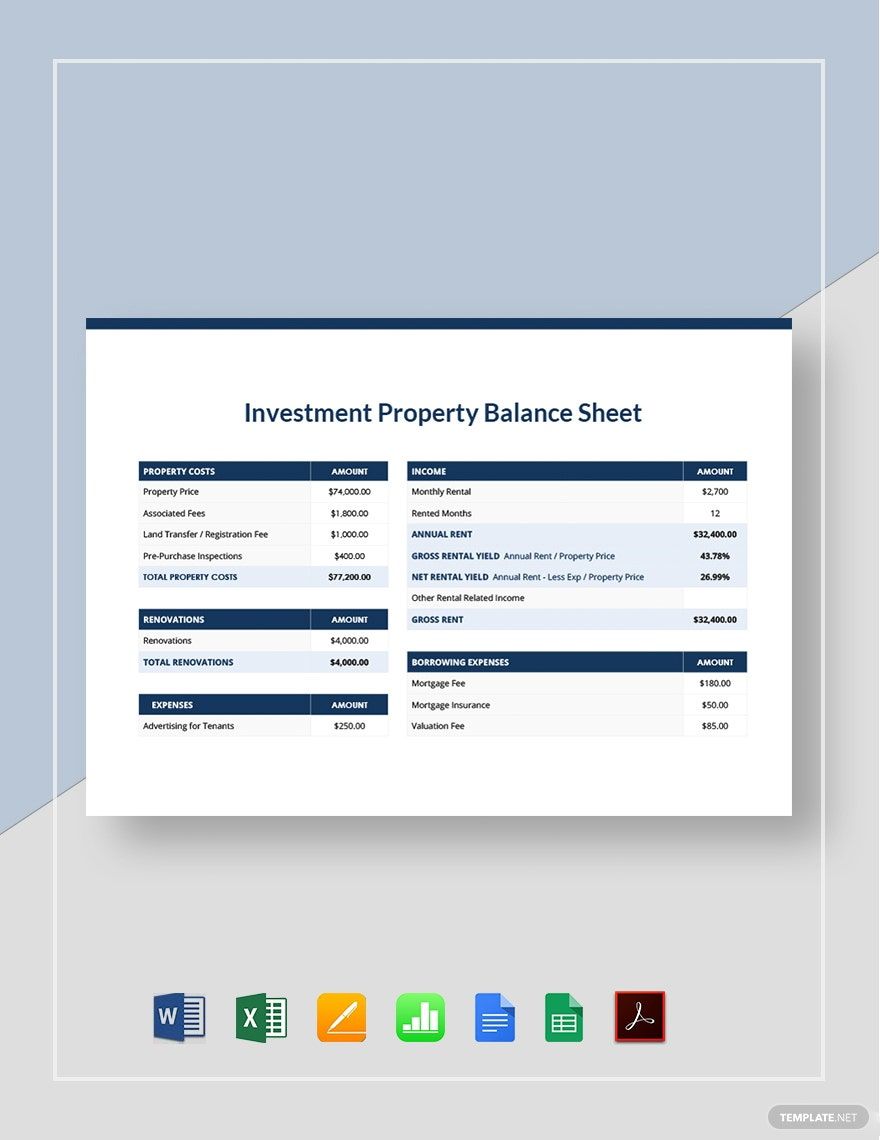

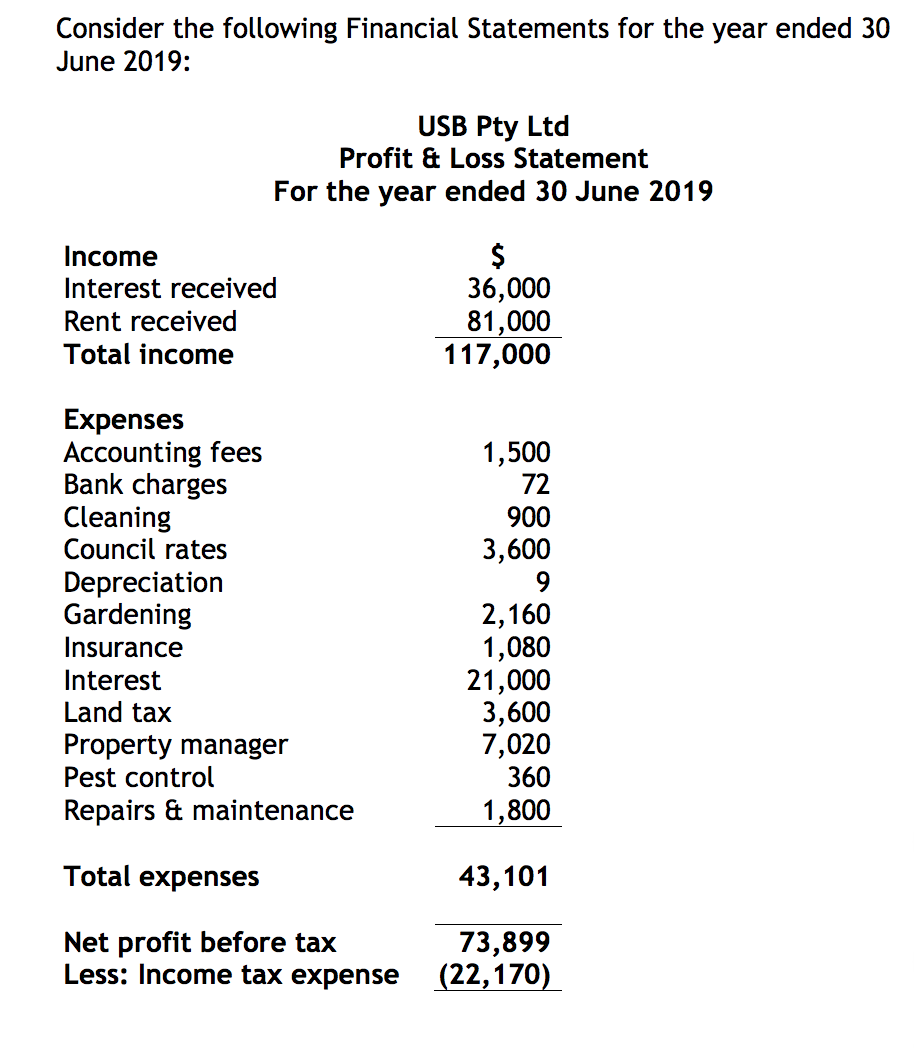

Investment property on balance sheet. Investments might include stock, stock funds, or bonds. Ias 40 applies to the accounting for property (land and/or buildings) held to earn rentals or for capital appreciation (or both). It lists all assets, liabilities, and equity related to your property.

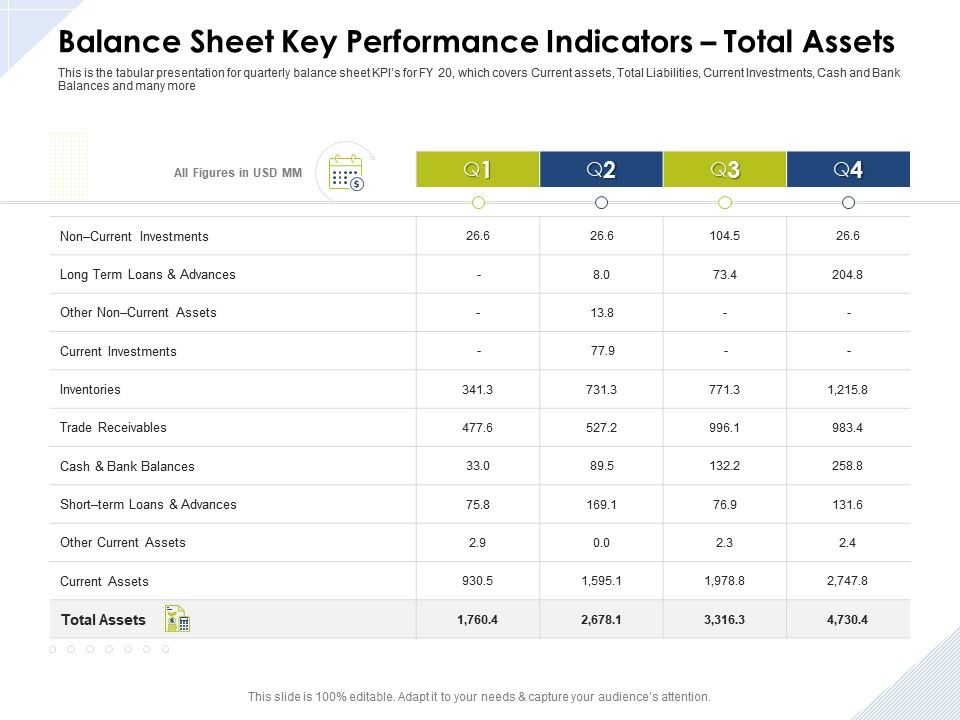

Ias 1 refers to the balance sheet as the statement of financial position. Assets = liabilities + shareholder’s equity. May be subsequently measured using a cost model or fair value model, with changes in the fair value under the fair value model being.

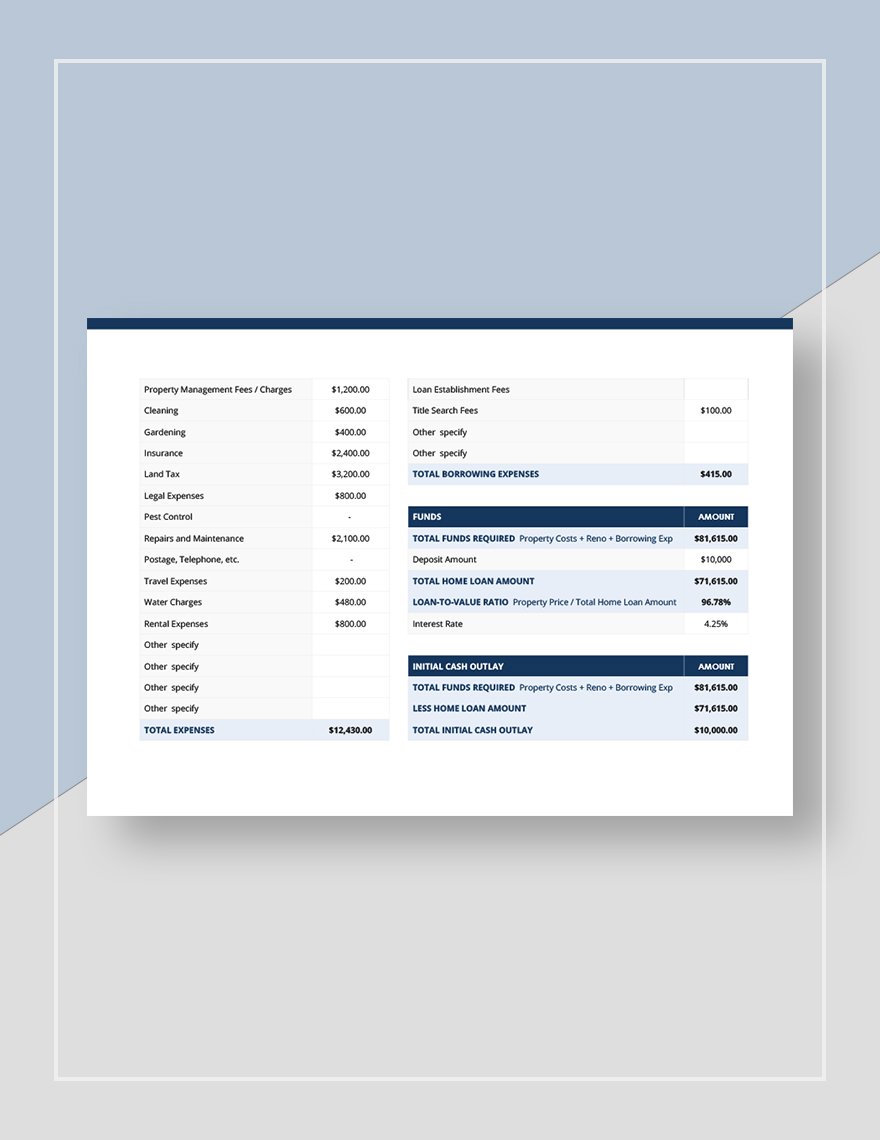

Industry insights hi, i have just started using accounting software (freeagent) for a limited company property rental business. Key sections of a real estate balance sheet are assets, liabilities, and owner’s equity. In general, a balance sheet contains 3 portions.

Under ssap 19, investment properties are required to be included on the balance sheet at open market value and are not subject to depreciation. Investment property is property (land or a building—or part of a building—or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both, rather than for: The frs 102 glossary defines investment property as:

(a) use in the production or supply of goods or services or for administrative purposes, or (b) sale. Finally, investment property is presented 6 separately on the balance sheet and subject to the disclosure requirements in ias 40. Investment property is separately defined as property (land and/or buildings) held in order to earn rentals and/or for capital appreciation.

The chart of accounts for rental property ). Or • sale in the ordinary course of bus.

A rental property balance sheet is a summary of all of the assets and liabilities, and equity, of your rental property at a given point in time. Investment property is defined in the glossary to frs 102 as:

Fixed assets are shown net of accumulated depreciation on the balance sheet. [ias 40.5] examples of investment property: Use in the production or supply of goods or services or for administrative purposes;

Investment property is property that an entity holds to earn rental income and/or capital appreciation. Typically, investments are securities held for more than a year. It generates cash flows mostly independently of other assets held by an entity.

Your balance sheet includes all asset, liability, and equity accounts from your chart of accounts (see: Use in the production or supply of goods or services or for administrative purposes, or If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.”

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)