Fine Beautiful Tips About Consolidation Meaning In Accounting

This method is typically used when a parent entity owns more than.

Consolidation meaning in accounting. If you consolidate or go through consolidation, it means combining assets, liabilities, and other financials. Ensure that all entities follow consistent accounting. Companies often use consolidation to increase efficiency and profitability while reducing costs.

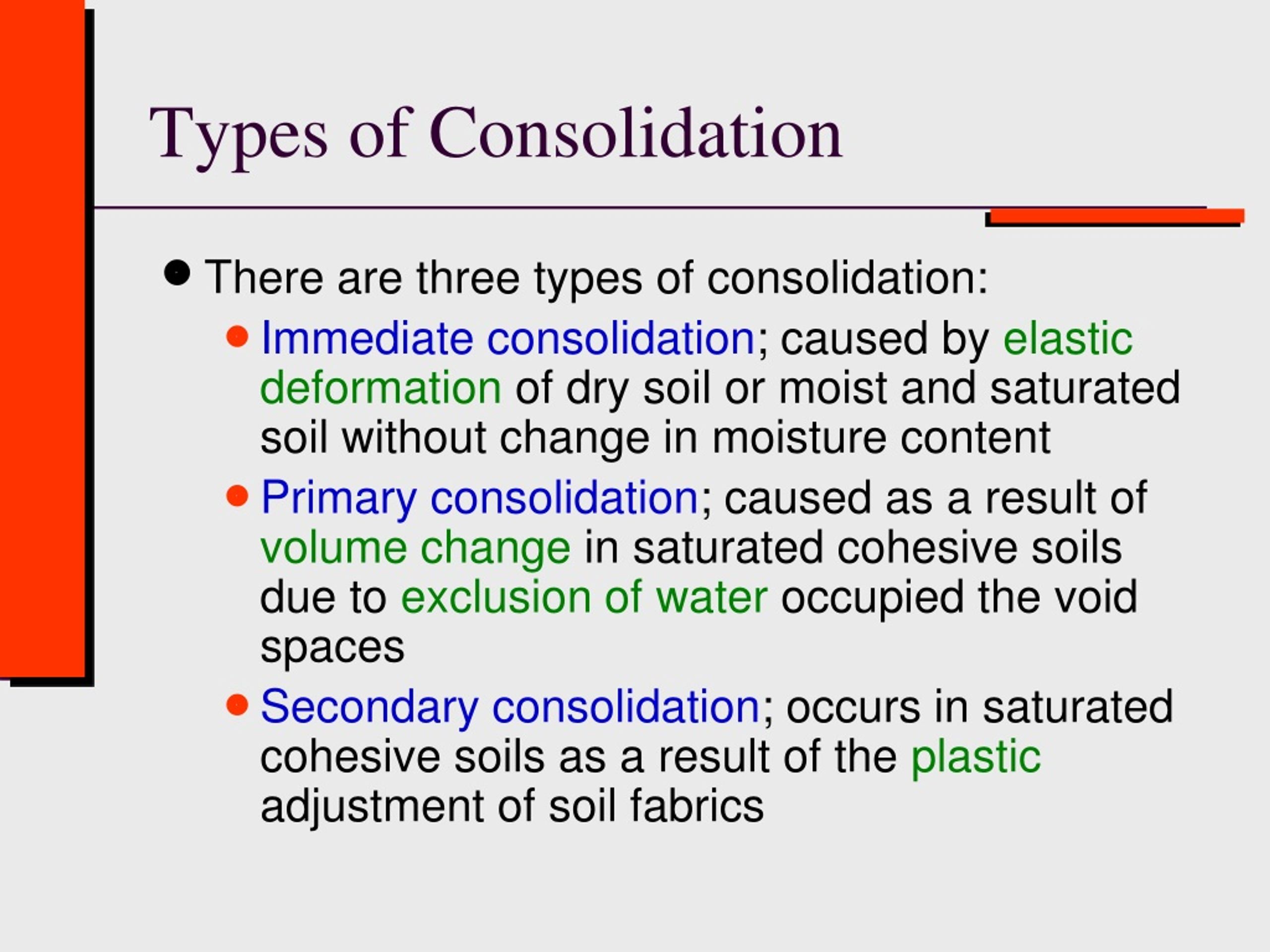

In april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989. Ifrs 10 was issued in may 2011 and applies to annual. Consolidation is the process of combining multiple entities or assets into one.

Consolidated financial statements are the financial statements of a group of entities that are presented as being those of a single economic entity. This includes their trial balances, general ledgers, and supporting documentation such as transaction records, invoices, and reconciliations. In financial accounting, the term consolidate often refers to.

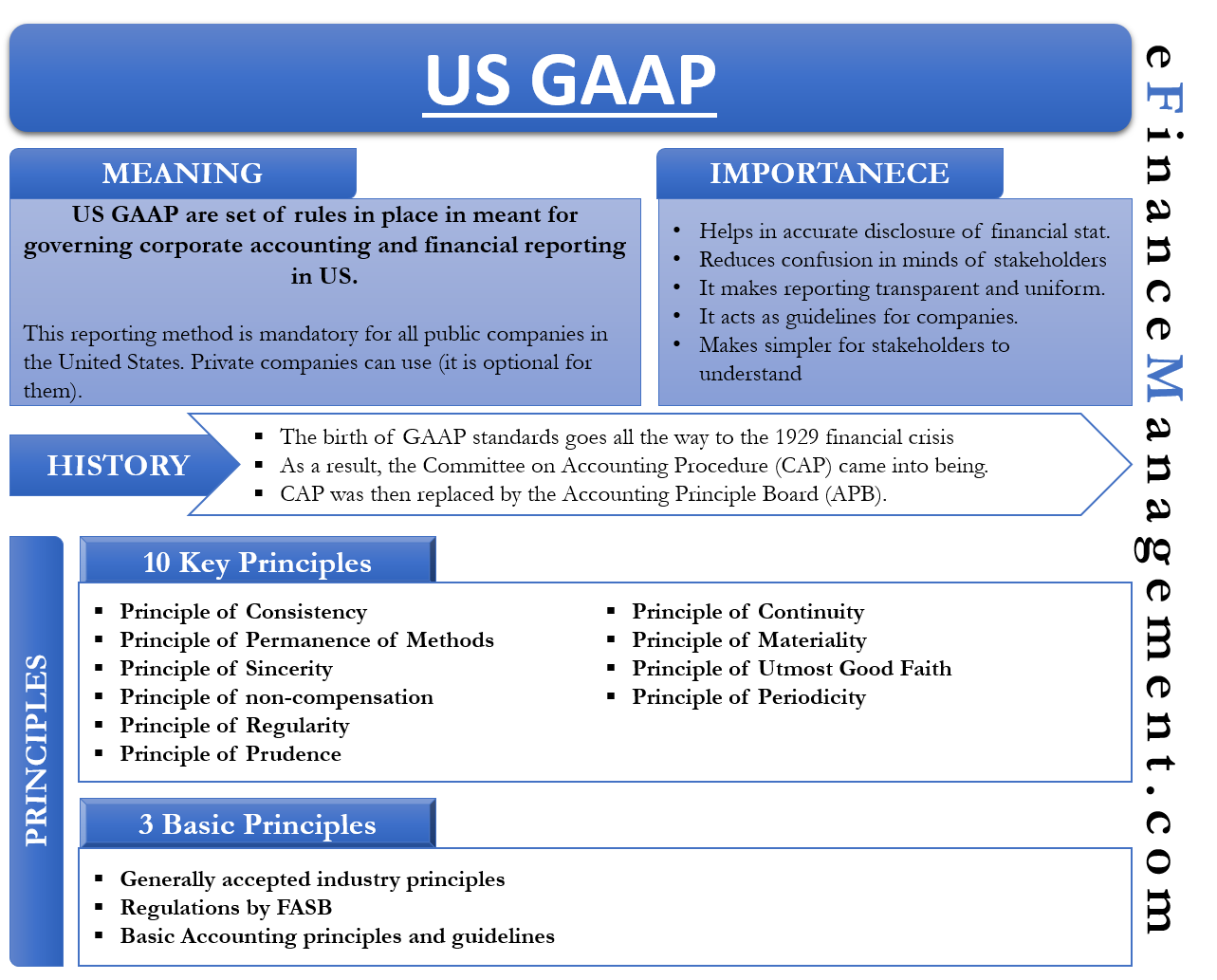

Financial accounting consolidation works with companies that own more than 50% shares of the subsidiary company. Financial statements, including consolidated financial statements, must report the substance of transactions and arrangements. Under us gaap, there are two primary consolidation models:

Significant influence occurs when an investor has a significant influence on the operating and financial policies of the company they invest in, which is typically considered having at least 50% of the shares. Consolidation accounting is a process whereby financial reports of subsidiary companies are put together and then combined with those of the parent company. What is consolidation in accounting?

The parent company owns the subsidiary company and holds control over it. To consolidate (consolidation) is to combine assets, liabilities, and other financial items of two or more entities into one.

The objective of consolidated financial statements is to present the results of the group in line with its economic substance, which is that of a single reporting entity. It can refer to various activities, including merging two or more corporations, asset transfers between businesses, and debt repayment strategies. More than just joining together, consolidation in accounting is a list of precise processes fundamentally rooted in accounting’s best practices.

In other words, it’s a report that combines all the activities of a parent company and its subsidiaries on one report. Consolidation in accounting refers to the process of combining the financial statements of a parent company and its subsidiary entities. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’ the diagram below shows an example of a typical group structure:

Key takeaways consolidation is a. The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet, income. On the radar briefly summarizes emerging issues and trends related to the accounting and financial reporting topics addressed in our roadmaps.

Consolidation is generally interpreted as market indecisiveness, which ends when the asset’s price moves above or below the trading pattern. In this blog post, we will delve into the concept of consolidation in accounting, explore the consolidation method and process, and discuss the rules that govern this practice. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Consolidate_colorv1-a3c1be00e6344ca7b265869d516bb4c3.png)