Brilliant Tips About Purpose Of Cash Flow Budget

The cash budget provides a company.

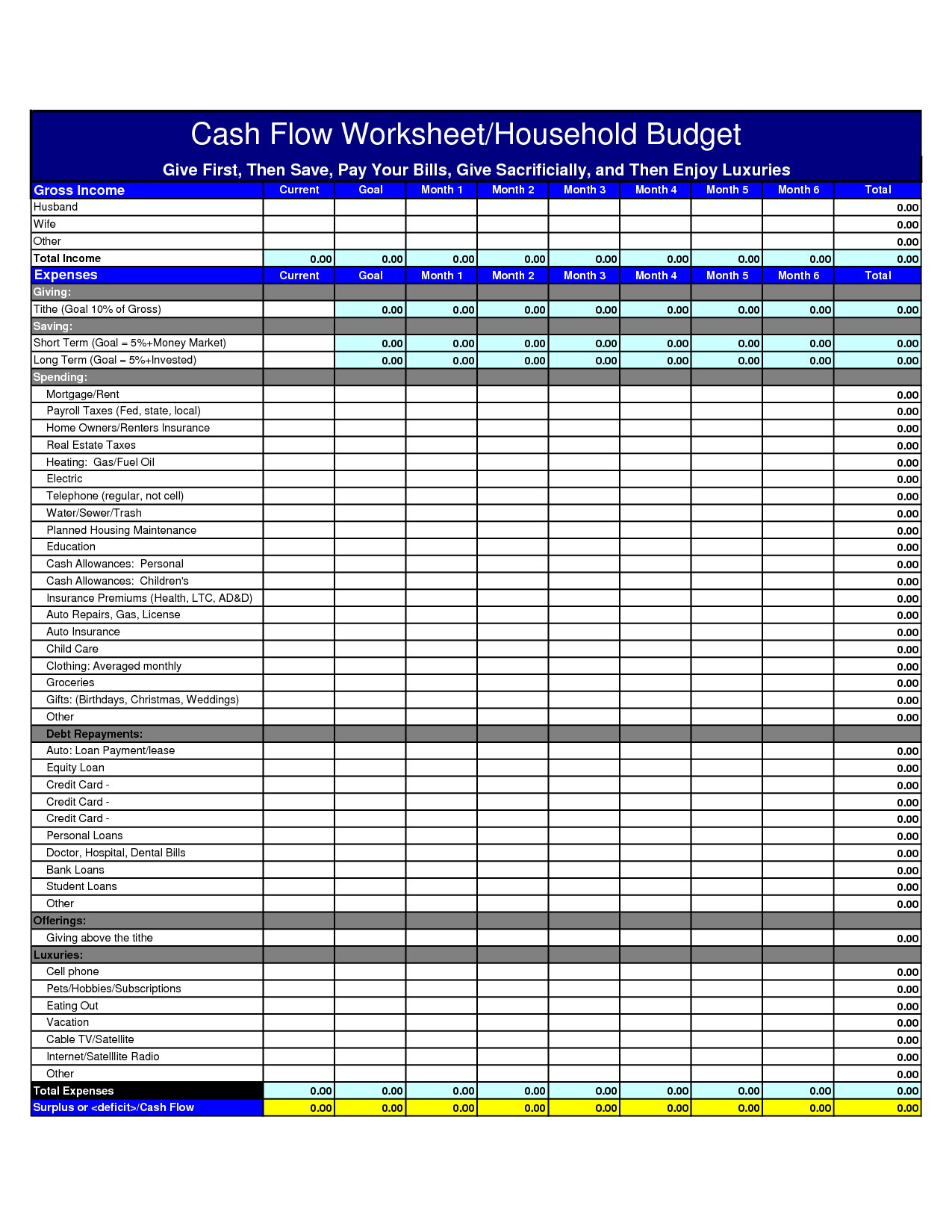

Purpose of cash flow budget. In short, all cash inflows and outflows that your business is likely to. A cash budget is a financial planning tool that outlines the expected cash inflows and outflows cash flow refers to the movement of money into and out of a. They can be weekly, monthly, quarterly or an annual.

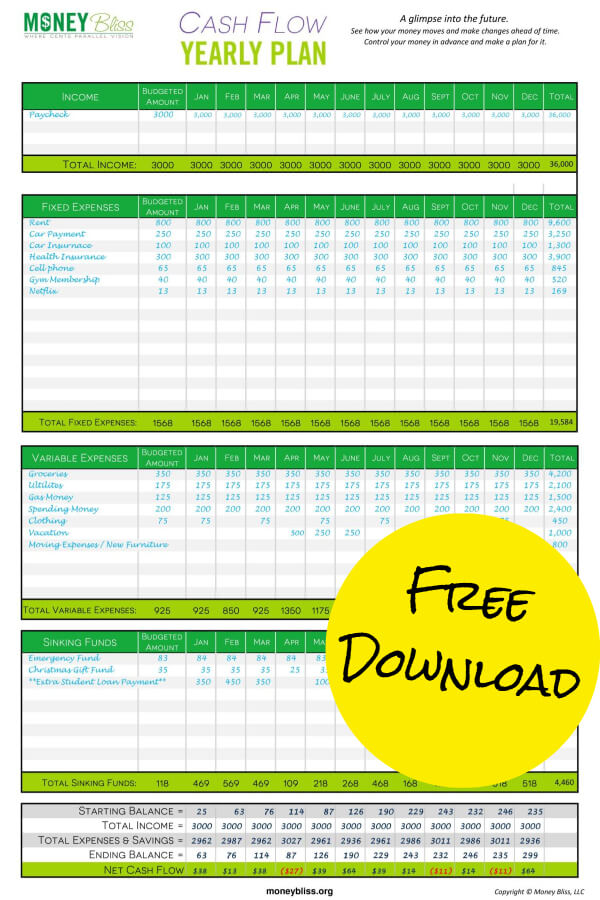

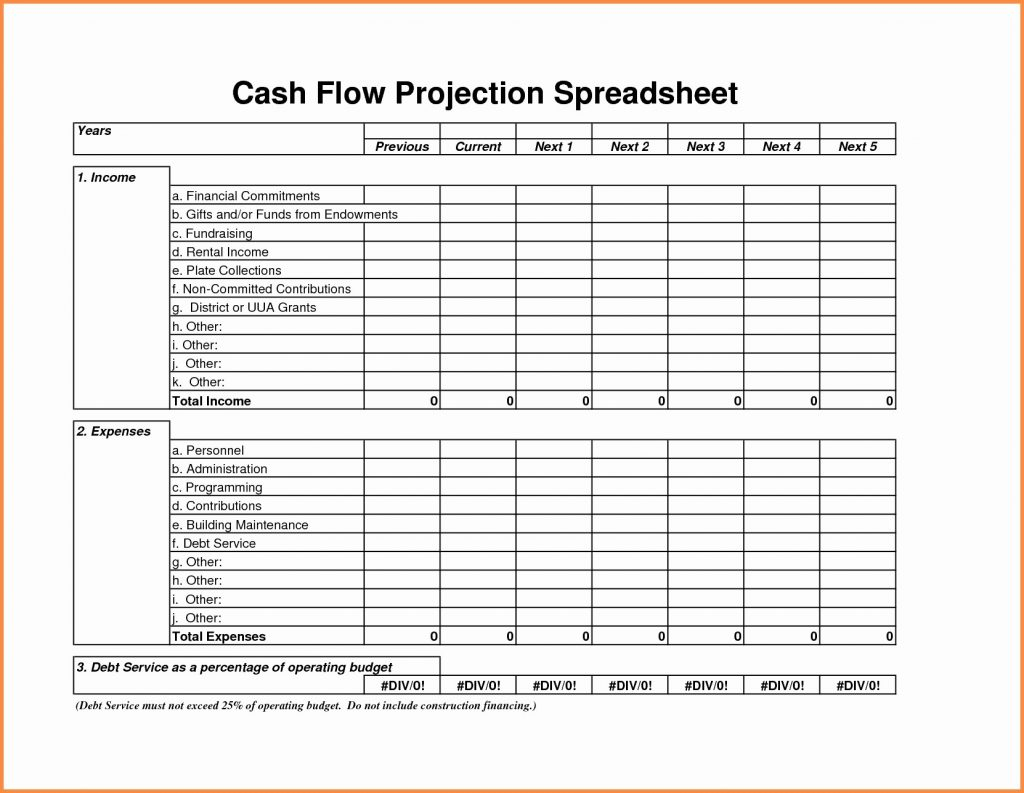

A cash budget is an estimation of the cash flowsof a business over a specific period of time. this could be for a weekly, monthly, quarterly, or annual budget. Operational expenses accounts payable accounts receivable so, what is included in a cash flow budget? A cash flow budget estimates your business’s cash flow over a specific time period.

A cash budget is a document that estimates a business' cash flows over certain periods, such as weekly, monthly or annually. Look at your “typical” budget that you have created. Explanation the cash budget is a type of budget that estimates cash inflows and the use of cash during a specific period.

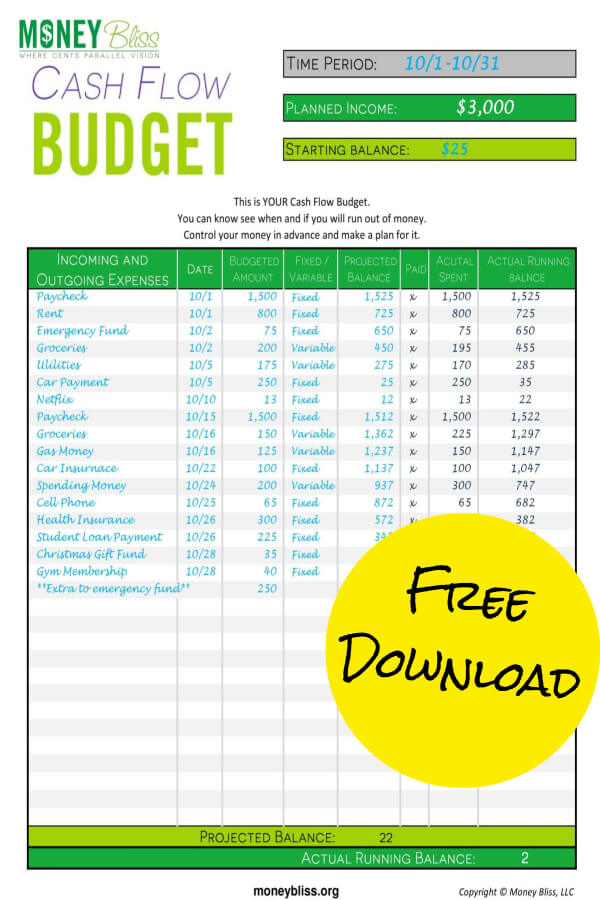

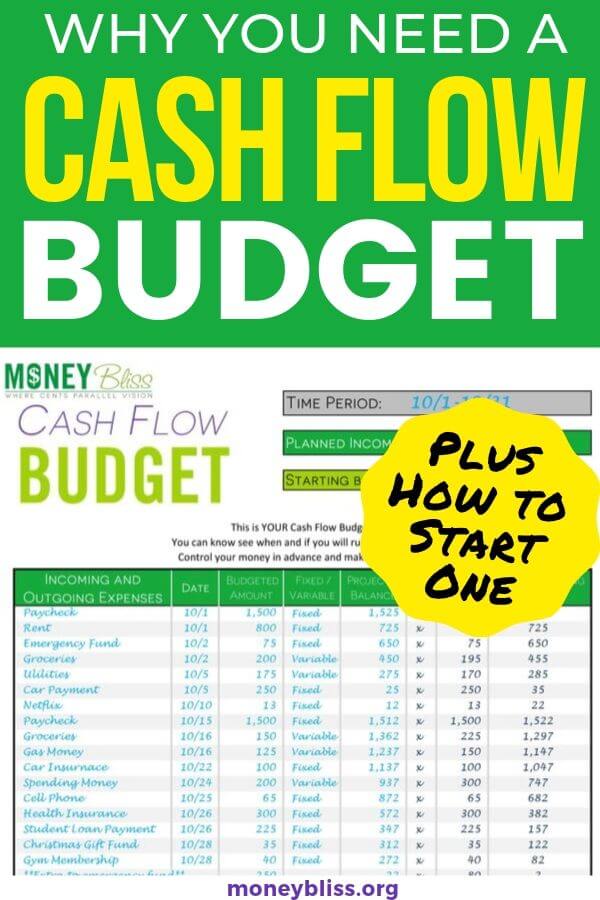

The steps to make a cash flow plan are pretty simple: Definition of cash flow budget. Basically, the starting point of preparing the cash budget is to do the cash receipt projections.

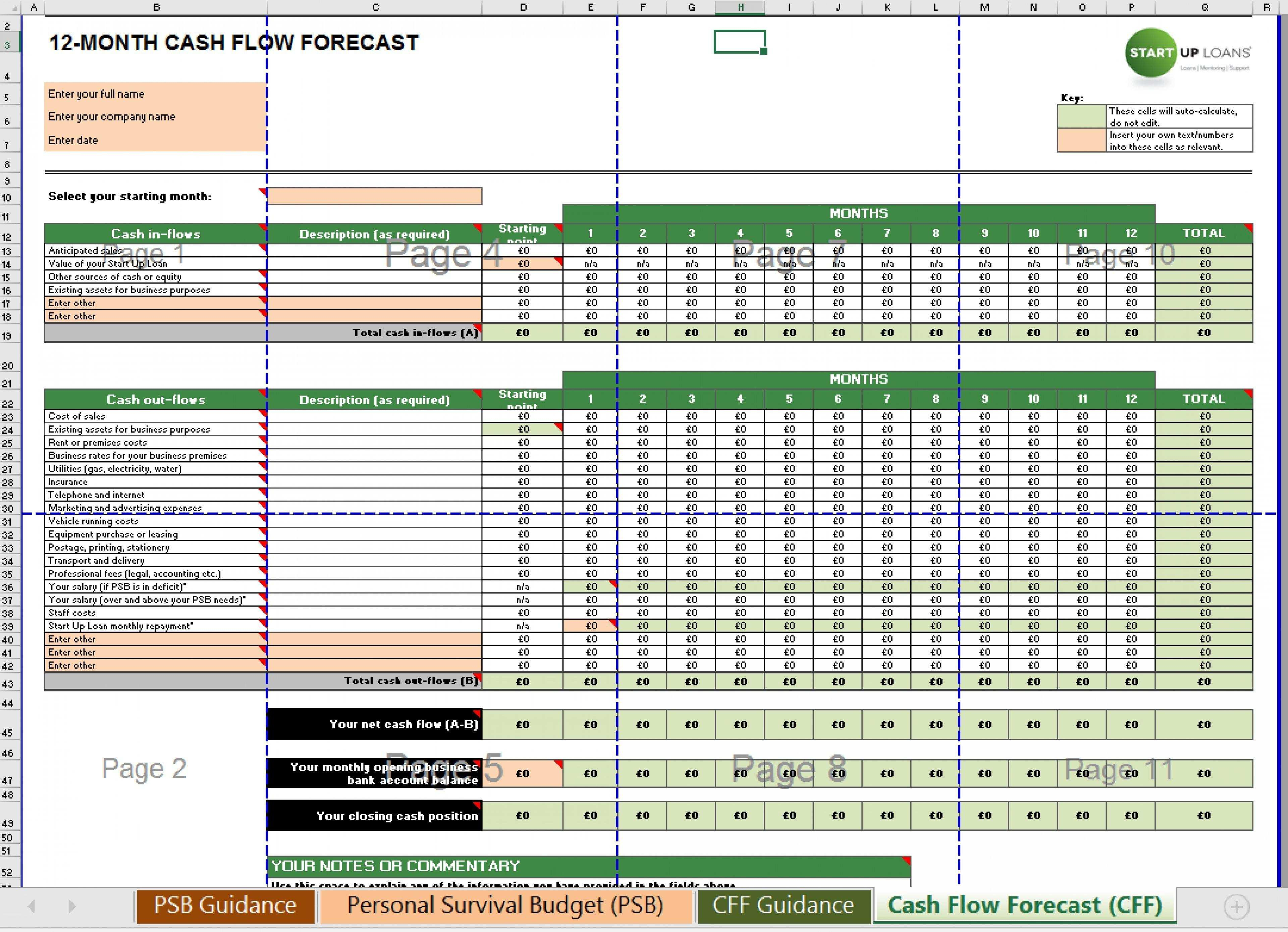

A good cash flow forecast might be the most important single piece of a business plan. A cash flow budget is an estimation of the flow of cash into and out of a business over a set period of time. Introduction a cash budget is a financial planning tool that forecasts a business’s cash inflows and outflows over a specific period.

All the strategy, tactics, and ongoing business activities mean nothing if. Its primary purpose is to. You can also use this method to project future cash flow.

This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame. Put the income and expenses in order by the date they. Often referred to as a cash budget or a cash flow, the cash flow budget allows a company to keep on top of cash income and outgoings over.

A cash flow budget estimates cash flows over a specific accounting period, whether it’s weekly, monthly, quarterly, or annually. A cash budget details a company's cash inflow and outflow during a specified budget period, such as a month, quarter or year. Cash flow budgeting is a way of determining the cash flow of a business over a period of time to gauge its sustainability.

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. You can use the information to see if you have enough cash coming in to maintain regular.