Matchless Info About Cpa Prepared Financial Statements

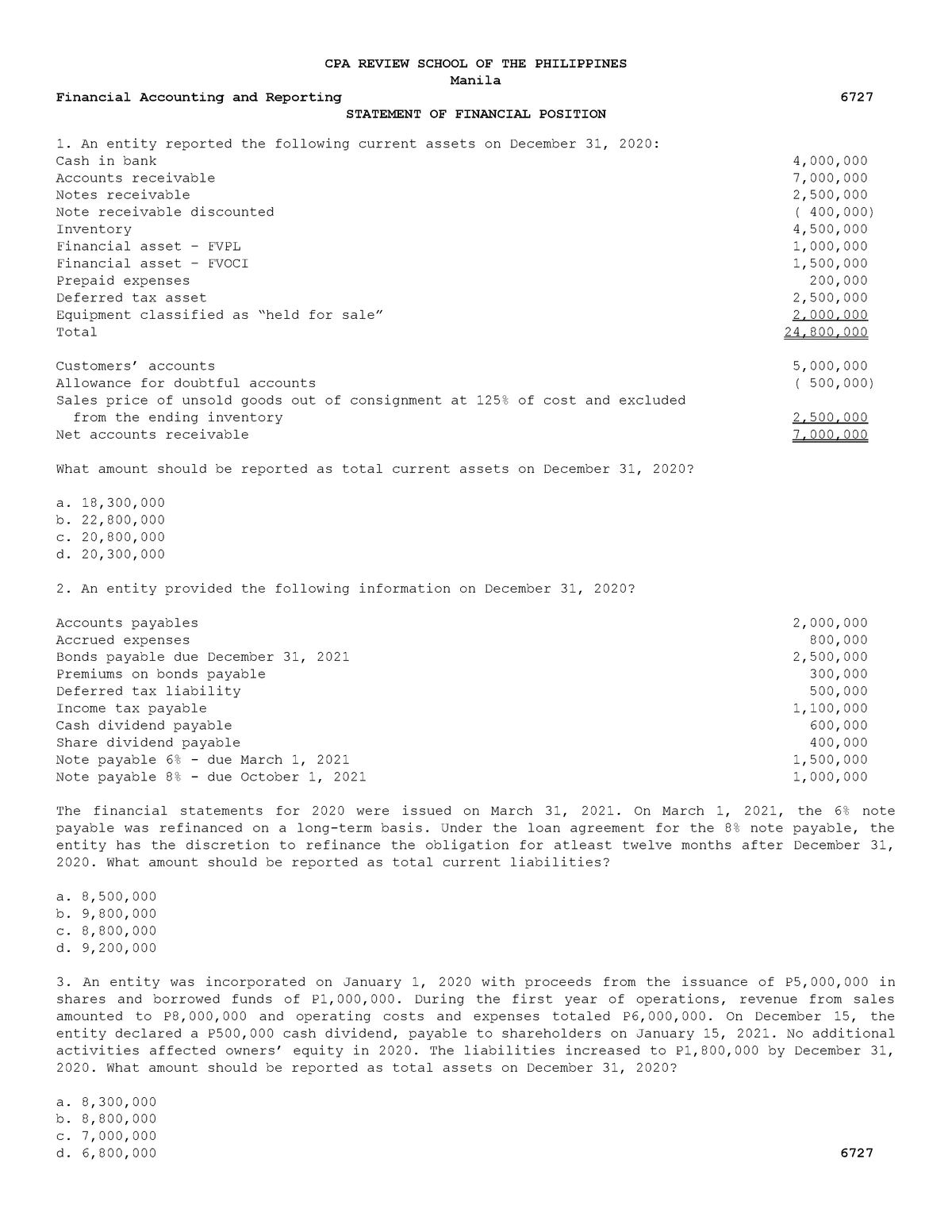

They prepare them mostly in accordance with (gaap), but not all (gaap) rules are precisely followed.

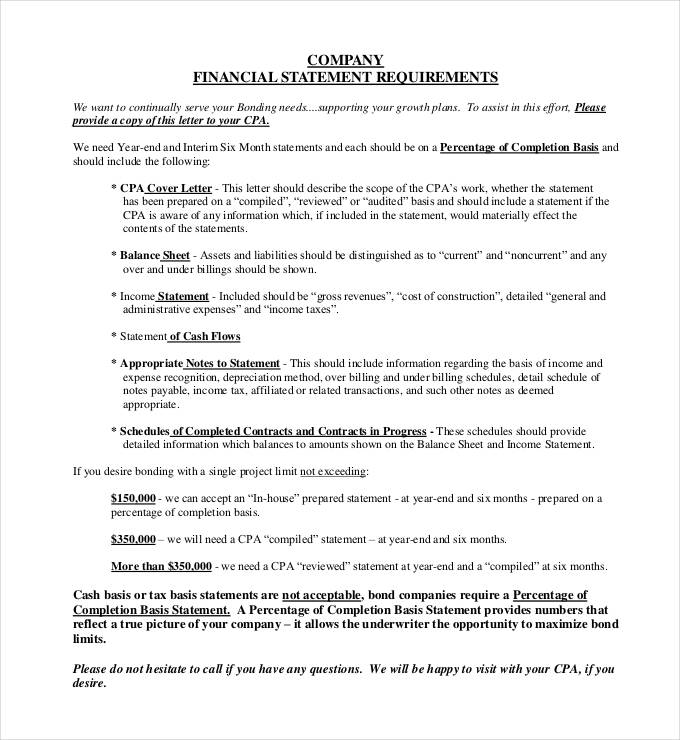

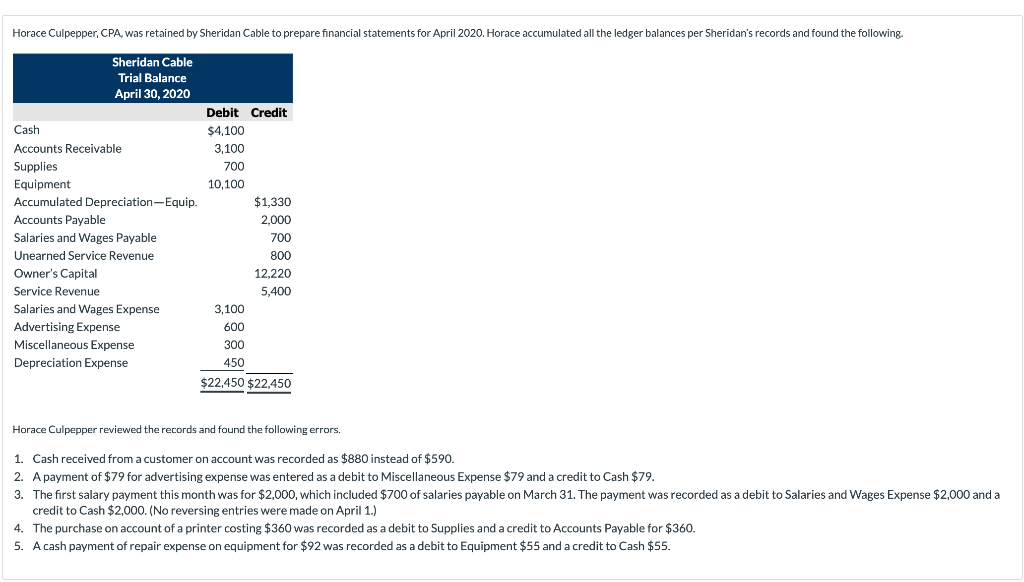

Cpa prepared financial statements. Management determines the financial statements to be prepared. A certified public accountant (cpa) will audit the contents of these statements using generally accepted accounting principles (gaap) to ensure the details are accurate. 1 see paragraph.29 of qc section 10, a firm's system of quality control.

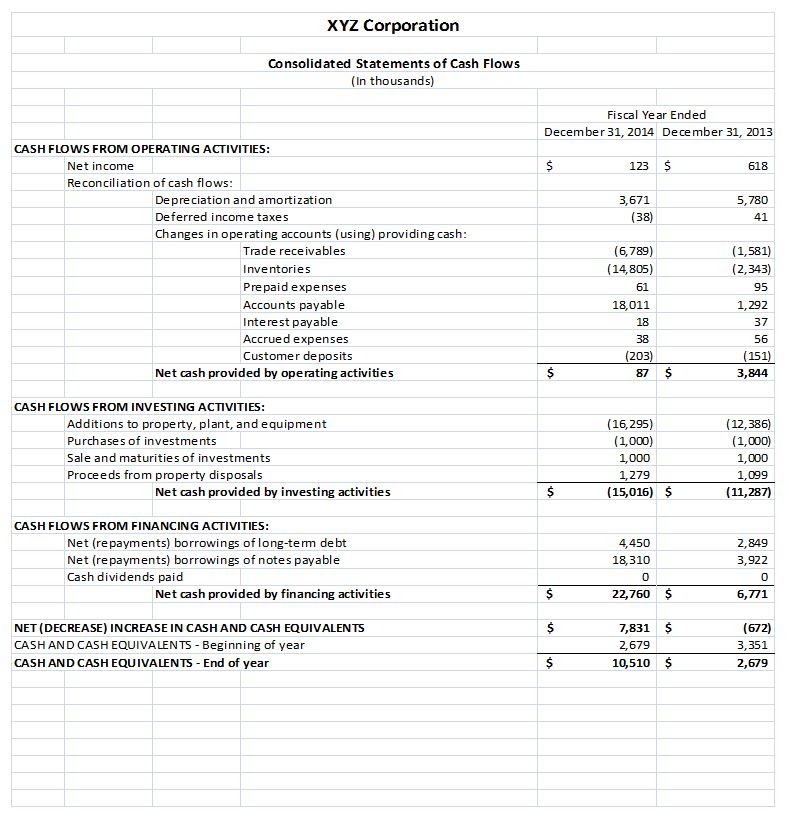

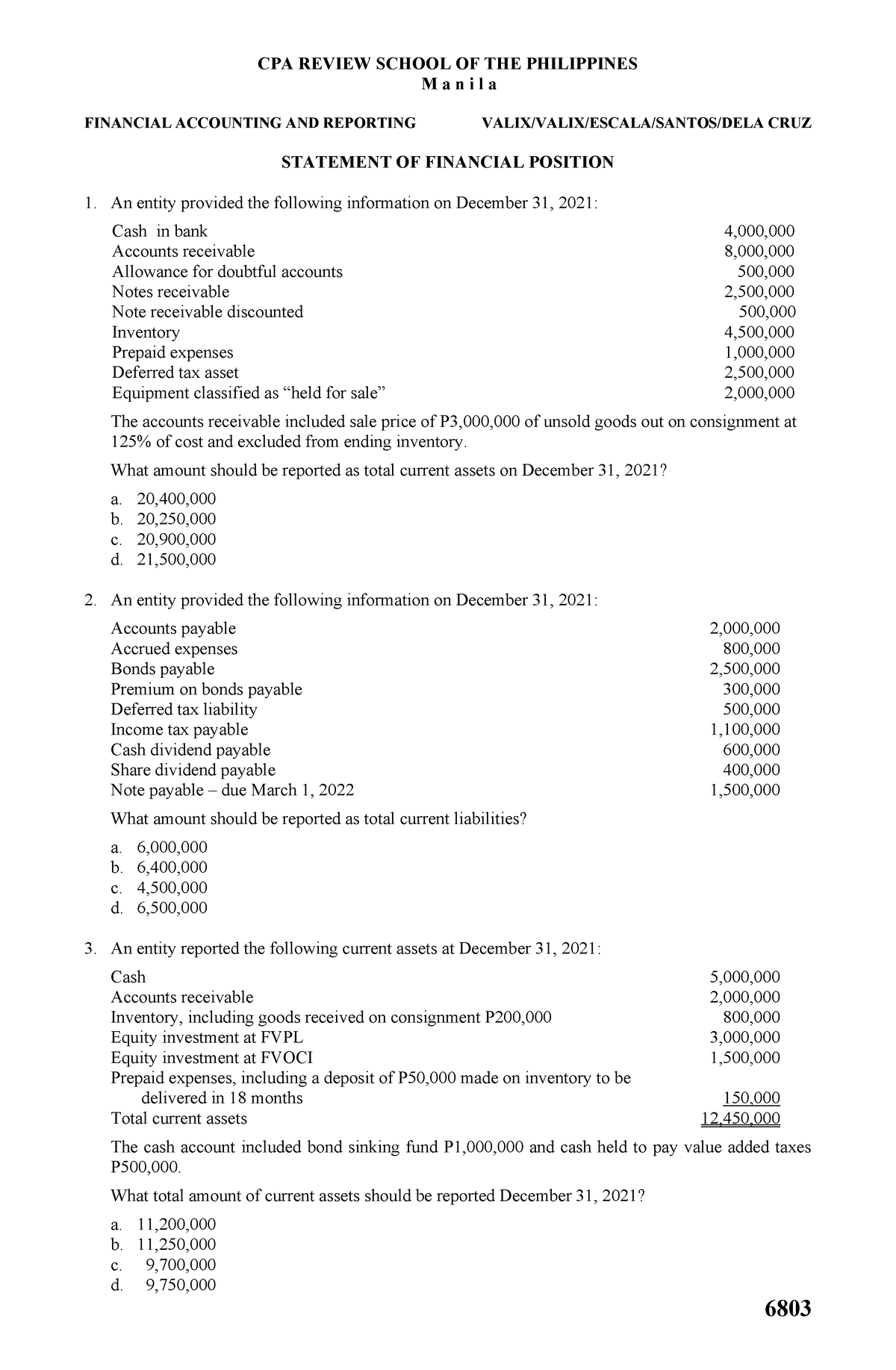

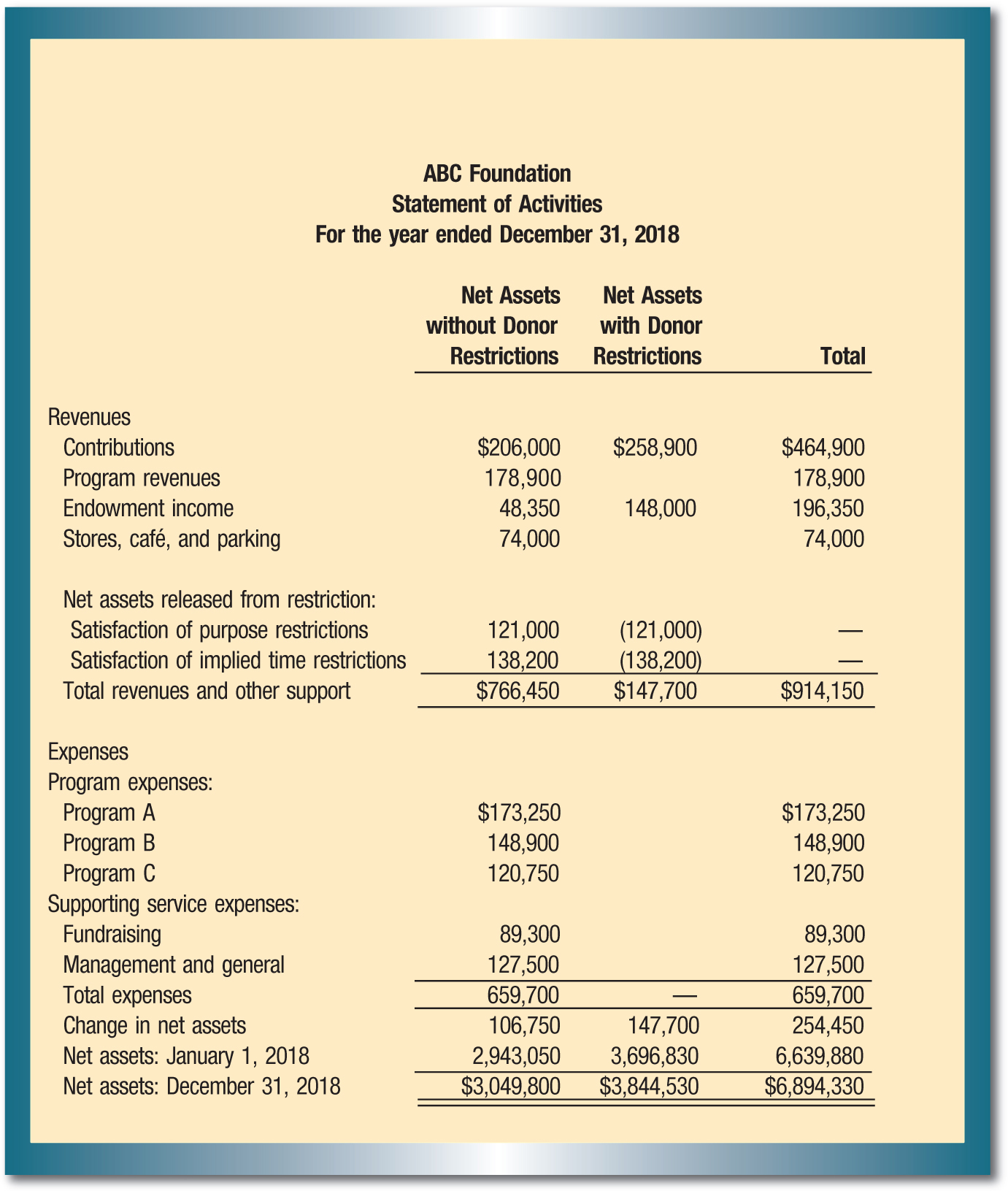

The cpa prepares these statements with information provided to them by the business client. Annual financial statements prepared for stakeholders are usually prepared in accordance with an applicable financial reporting framework specified in law or regulation. Financial statements normally include the following:

This type of financial statement may be collated, adjusted and prepared by any accountant, and does not require the use of gaap. The three general levels of financial statement service are audit, review and compilation. Cpas provide three other types of financial statements, which, in order of descending level of diligence, are:

Cpas provide three other types of financial statements, which, in order of descending level of diligence, are:. In a review of financial statements, the cpa analyzes the information provided by the client and enquires about any unusual trends. Those involved in the preparation of financial statements should find this guide useful, including directors, management, finance teams, professional advisors, and accounting students.

Changes made to the presentation of cpa canada’s financial statements. A cpa offers three levels of assurance when issuing financial statements. There are three levels of independent financial reporting that auditors provide on financial statements.

Preparation, compilation, review, and audit. The accountant can, if so directed by management, create and issue just one financial statement (e.g., income statement). Compilation compilation is when the cpa assists the client to present financial information in the form of financial statements.

Introduction scope of this section The goal is to compile and present the company’s financial information in a standard financial statement format, but the cpa provides no assurance that the financial statements are accurate or free from material misstatements, nor that. When do you need an audit?

Cpa’s are required to follow and use gaap when involved with audited or reviewed financial statements. The cpa is required to associate his or her name to the financial statements in a compilation report, but does not provide an opinion. While public companies are required to issue audited statements, smaller, privately held organizations have options.

1 preface because of the complexities of accounting principles generally accepted in the united states of america (gaap), many smaller entities have determined that financial statements prepared by applying the cash‐ or tax‐basis of accounting more appropriately suit their needs. The preparation of financial statements involves the process of aggregating accounting information into a standardized set of financials. The lowest level offers no assurance at all and is referred to as compiled financial statements.

Management is responsible to prevent and detect fraud. A cpa can provide different levels of service related to a company’s financial statements. Services of cpas to prepare financial statements on their behalf.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)