Painstaking Lessons Of Tips About Company Consolidation Accounting

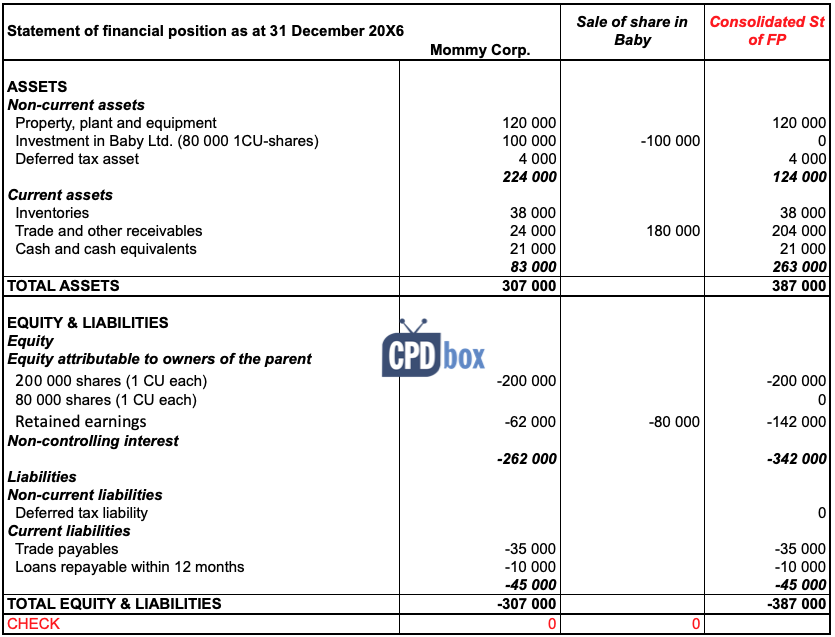

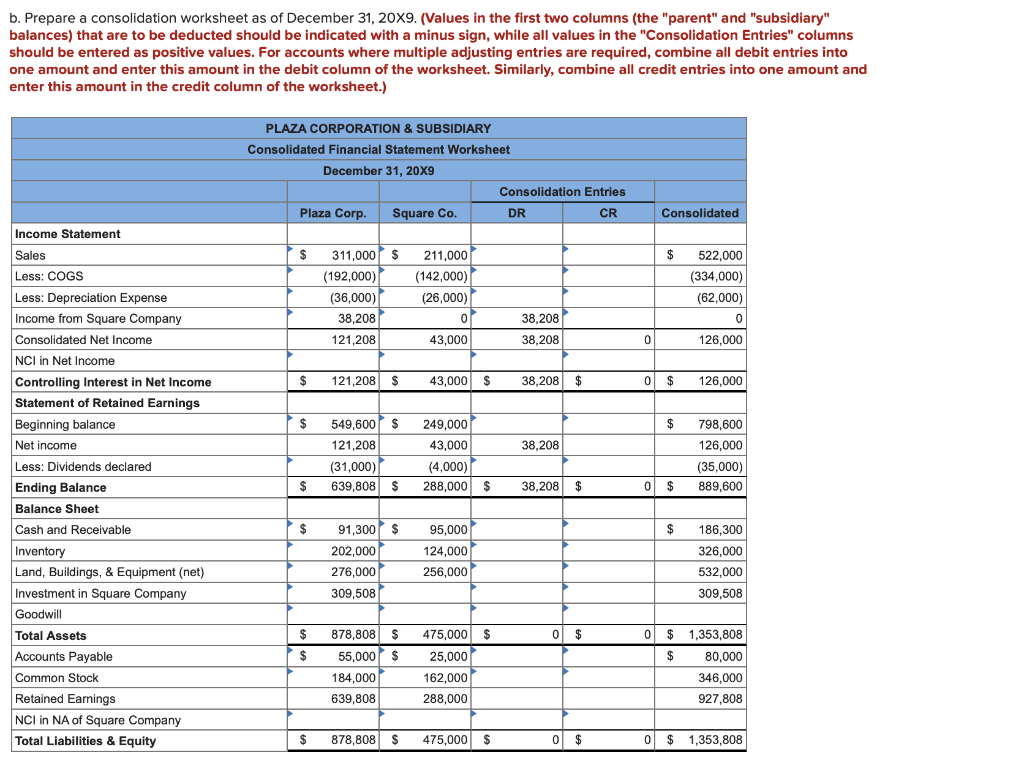

Preparing a consolidated statement of financial position.

Company consolidation accounting. It can refer to various activities, including merging two or more corporations, asset transfers between businesses, and debt repayment strategies. Telecom italia spa ’s chief executive officer said he welcomes a possible new approach by european regulators that would favor mergers in the telecommunications industry to help fund the rollout. In addition, this guide discusses the accounting for intercompany transactions in consolidation and other related matters.

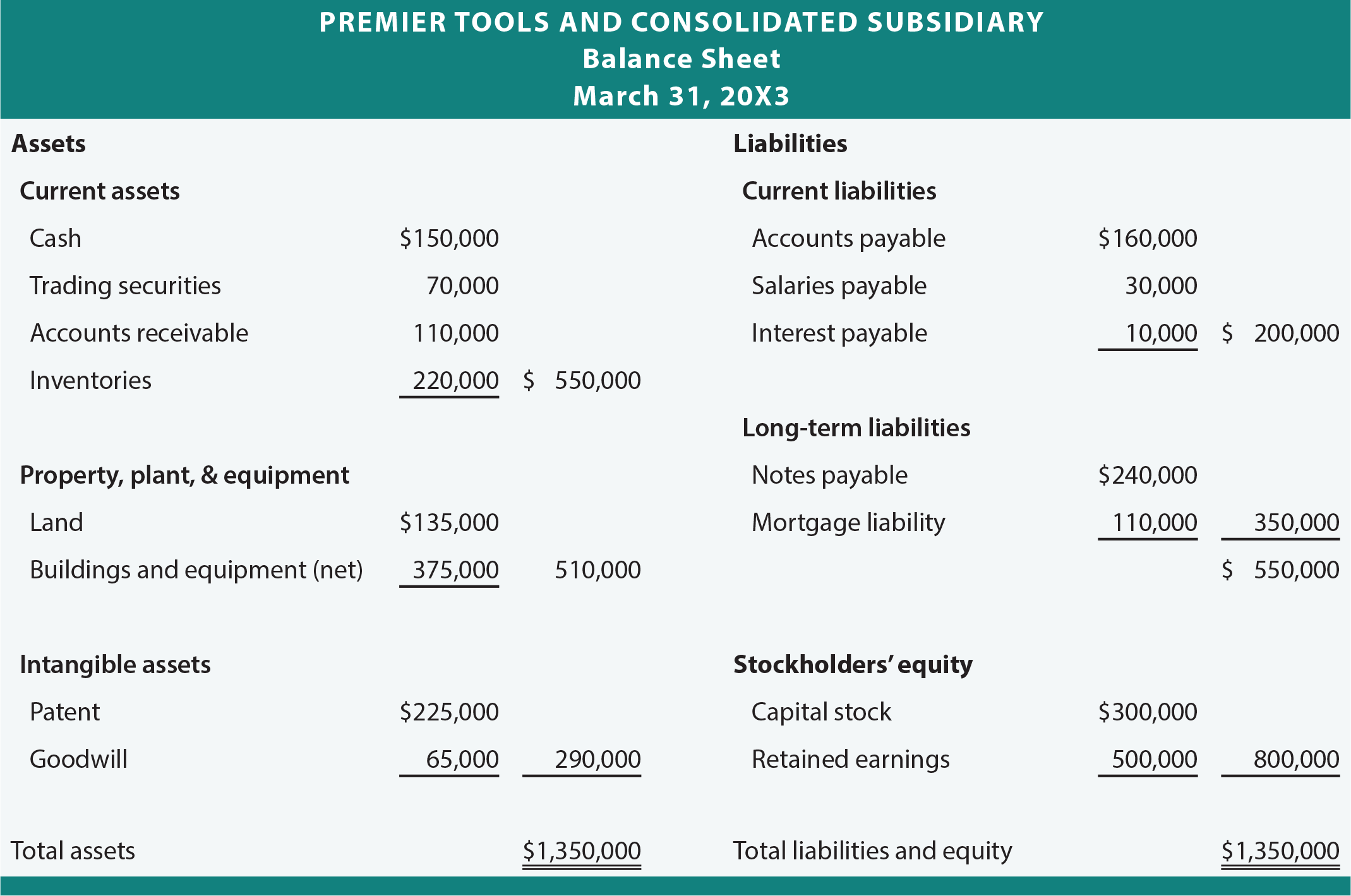

This november 2023 edition incorporates updated guidance and interpretations. Aurora also announces the completion of its previously announced consolidation of the common shares of the company (the common shares) on a 10 to 1 basis (the consolidation). Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’.

Applicability companies that present consolidated financial statements Consolidated financial statements are often referred to as ‘group accounts’. This guide begins with a summary of the overall consolidation framework.

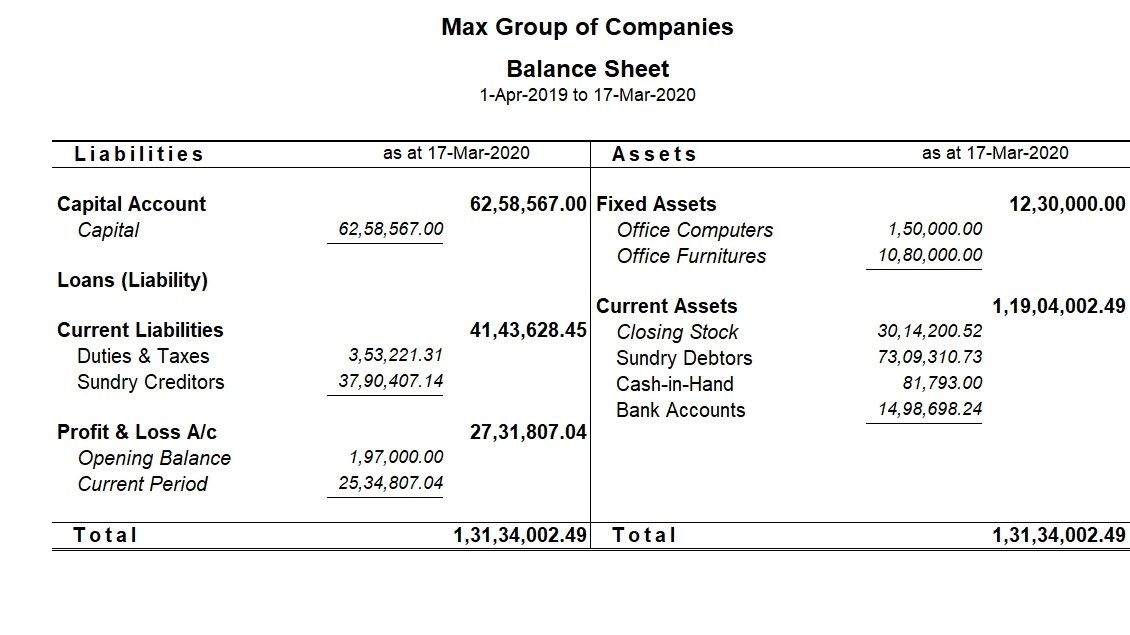

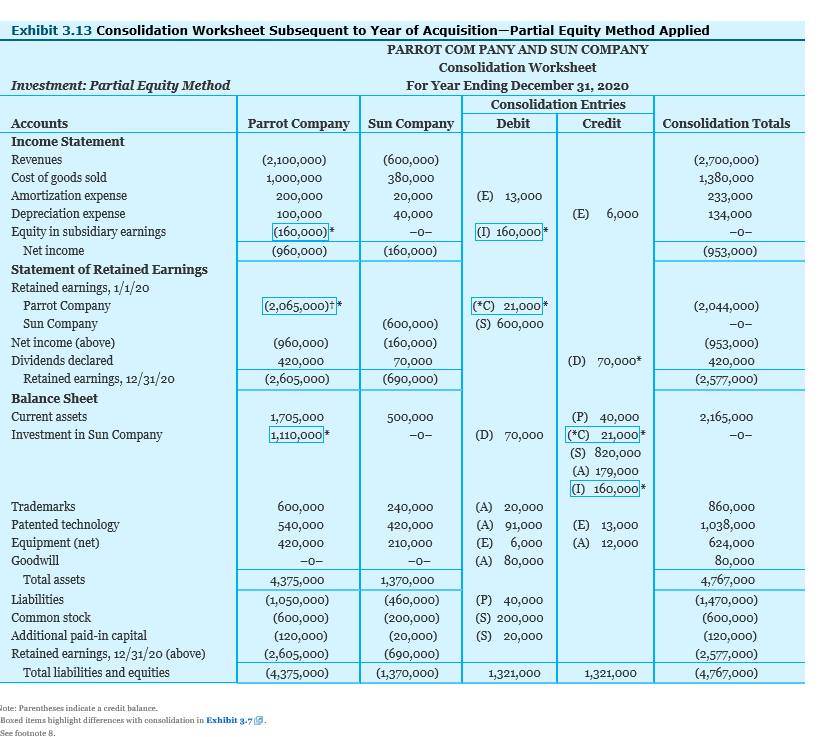

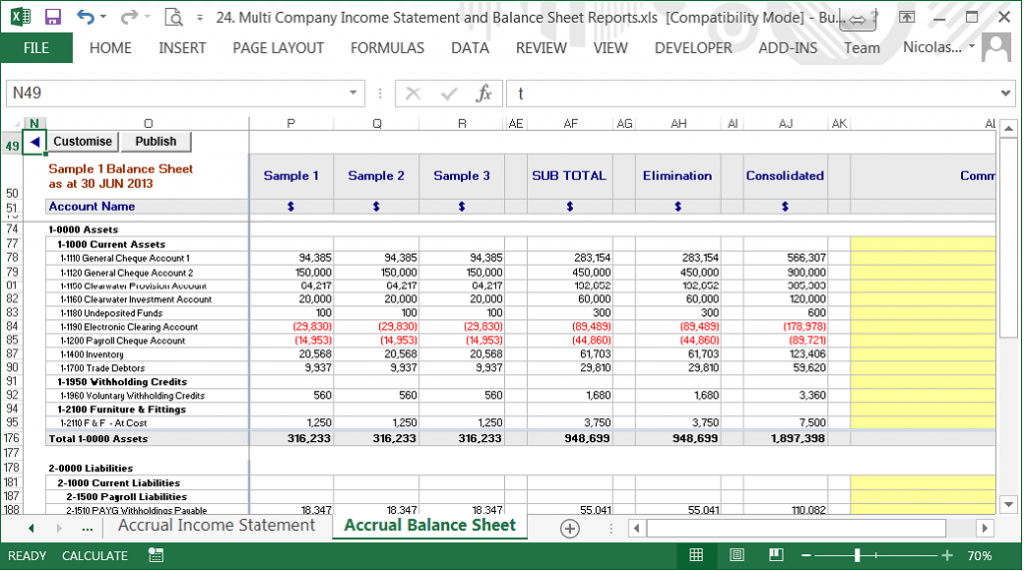

In the process, a balance sheet is prepared in which all the results of the subsidiaries and the parent company are included. Consolidation is the process of combining multiple entities or assets into one. More than just joining together, consolidation in accounting is a list of precise processes fundamentally rooted in accounting’s best practices.

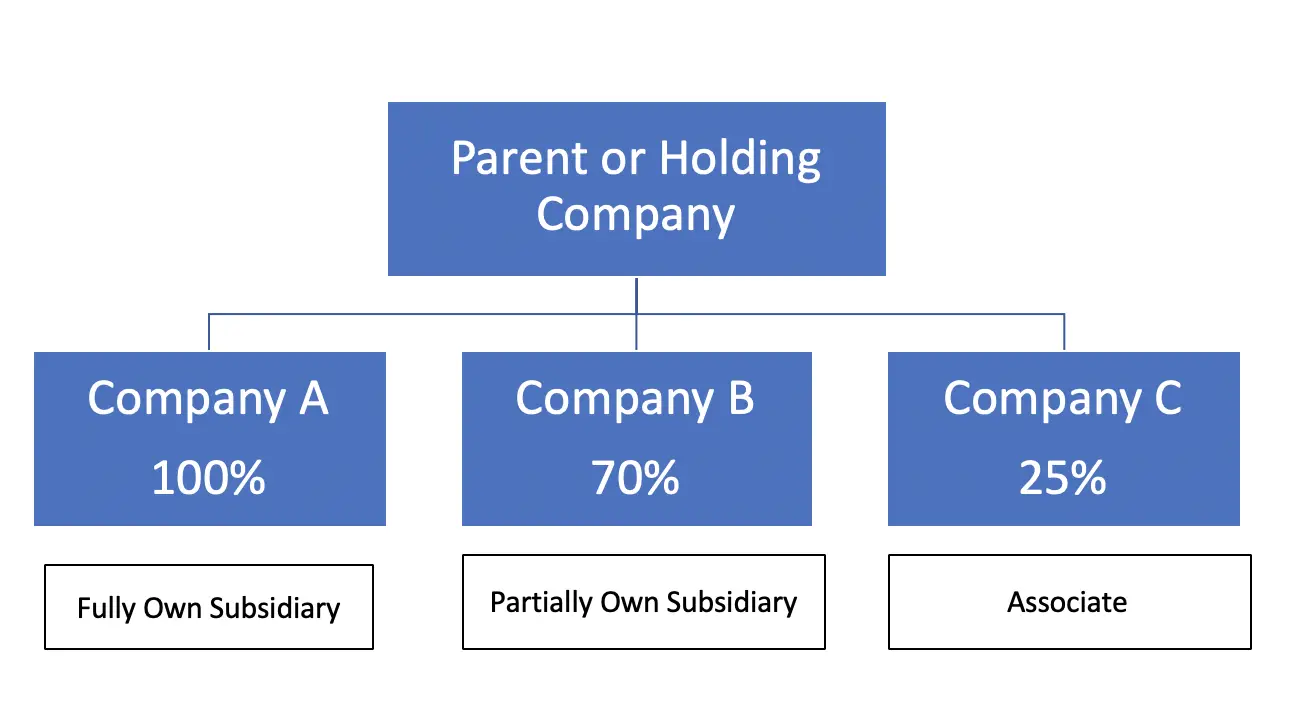

Consolidation accounting is a method of accounting used when a parent company owns subsidiaries (from 20% to upward of 50%). Financial statements, including consolidated financial statements, must report the substance of transactions and arrangements. 20 dec 2023 us consolidation guide this section addresses practical application issues after a reporting entity concludes.

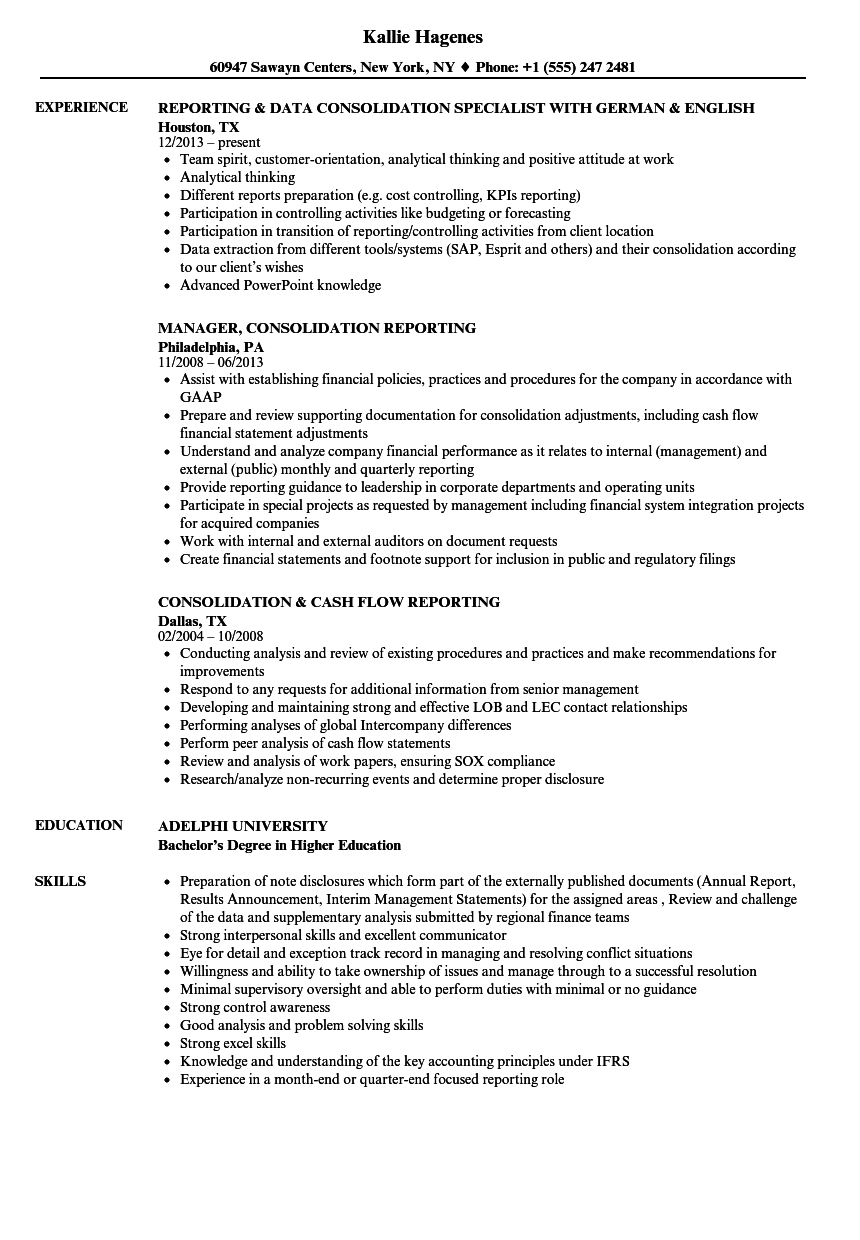

Group accountants play a vital role in some of the largest and most complex companies in the world, making sure that the group follows the right accounting procedures and helping. They are responsible for drawing up the group's consolidated accounts, supporting the. Under the consolidation method, a parent company combines its own revenue with 100% of the revenue of the subsidiary.

30 jun 2023 us ifrs & us gaap guide in relation to certain specialized industries, us gaap allows more flexibility for use of different accounting policies within a single set of consolidated financial statements. Italy’s government is considering selling a stake of up to 10% in lender banca monte dei paschi di siena spa in a bid to cut debt and facilitate consolidation in the banking sector. Consolidation accounting is the process of combining the financial results of several subsidiary companies into the combined financial results of the parent company.

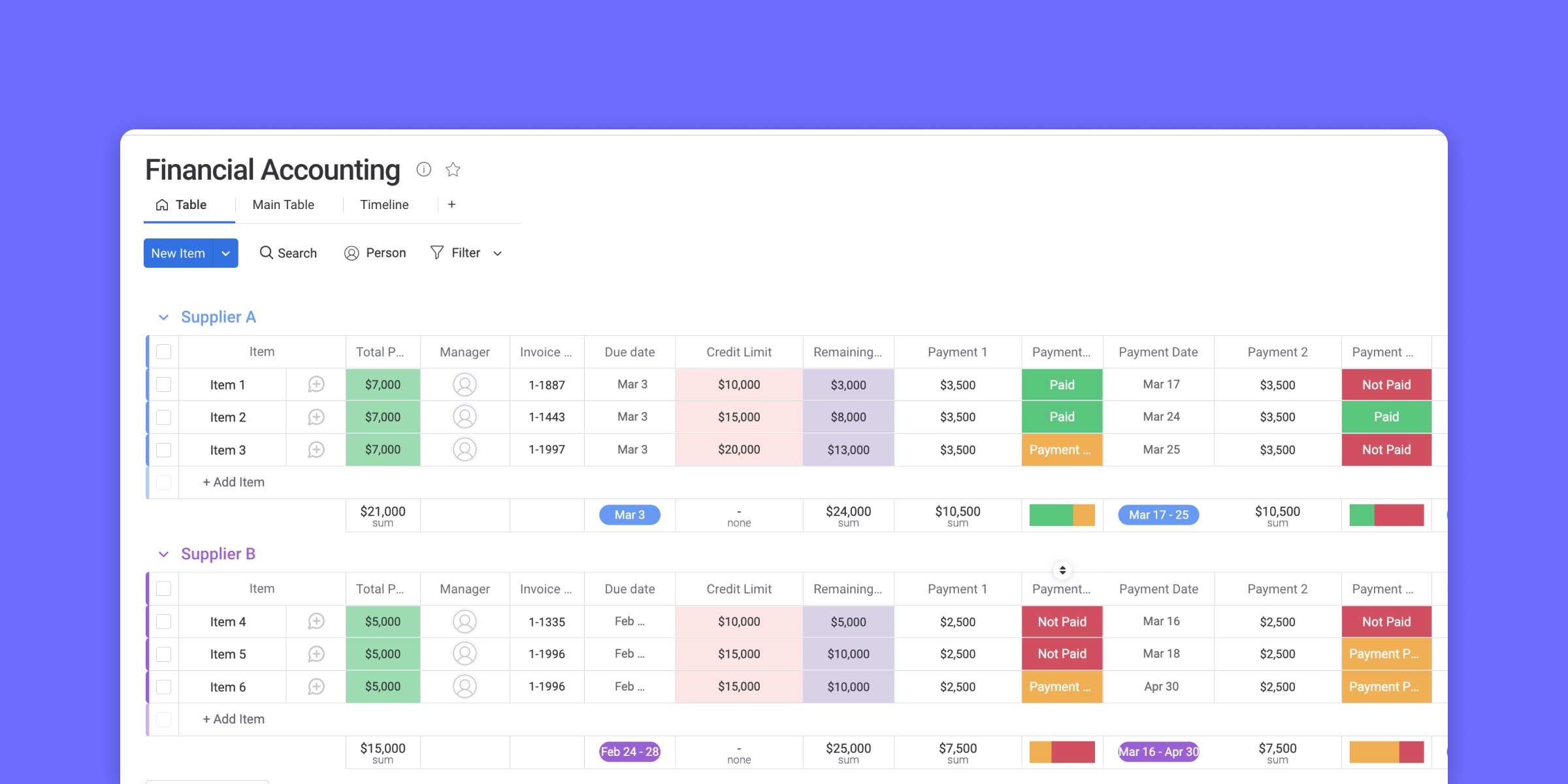

Just recently, general atlantic grabbed the spotlight in both the private equity and infrastructure sectors by strategically acquiring actis (1).in a similar vein, last month, blackrock (2) sealed a substantial $12.5 billion cash and share deal with global infrastructure partners. In the accounting world, financial consolidation is the process of combining financial data from several subsidiaries or business entities within an organization, and rolling it up to a parent company for reporting purposes. So in summary, consolidated financial statements give investors and stakeholders a complete picture of a parent company and its subsidiaries as a single reporting entity.

Under us gaap, there are two primary consolidation models: A specialist in this field is known as a group accountant or consolidation accountant. This method is typically used when a parent entity owns more than.

Finance teams must apply the same standards throughout the reporting process. The consolidation process helps users of financial statements (such as investors and lenders) to better assess the financial results of a group of companies. The ensuing chapters discuss the variable interest entity and the voting interest entity models.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)