Build A Tips About Is Profit Loss Statement An Income

Yes, they’re the same thing.

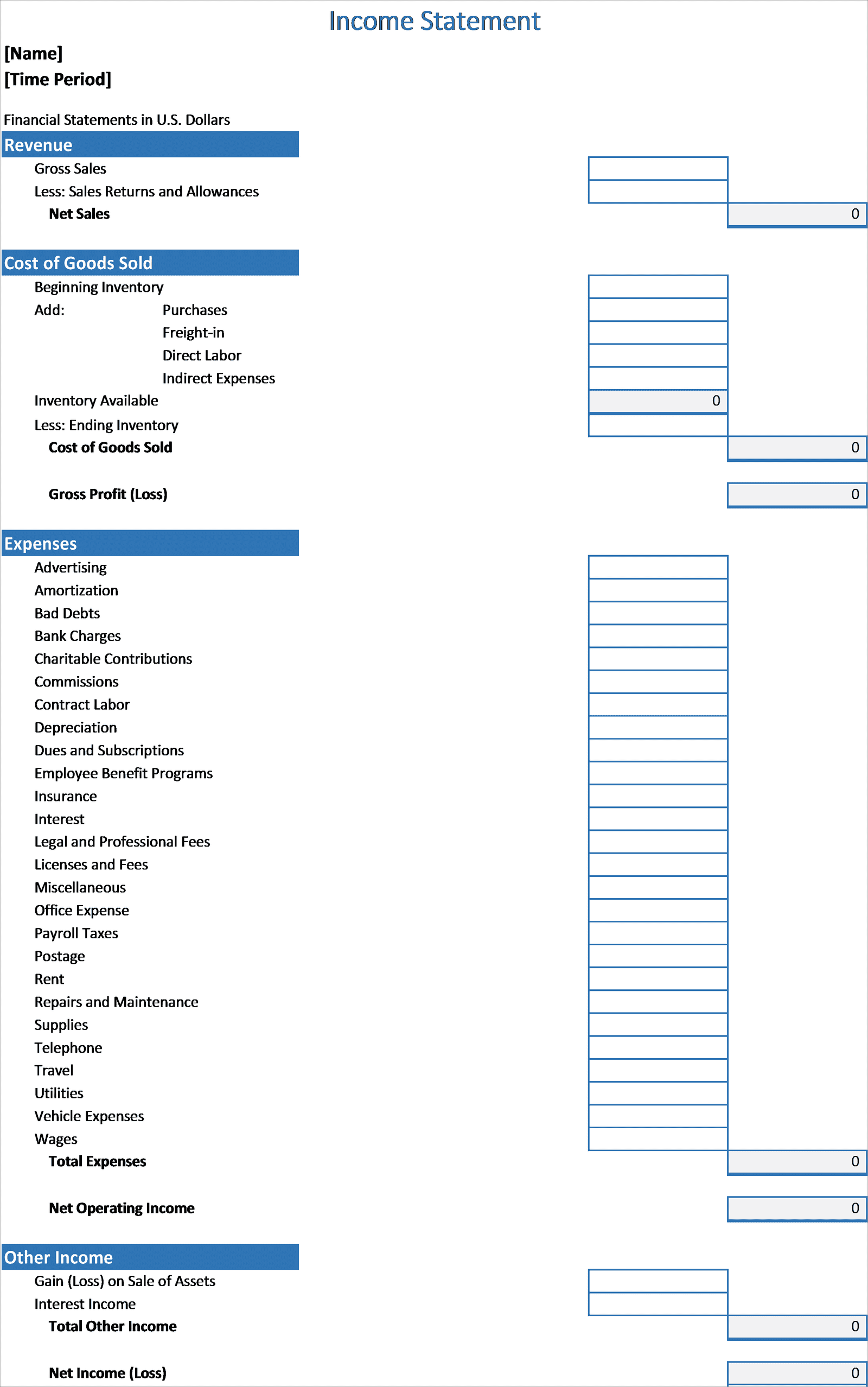

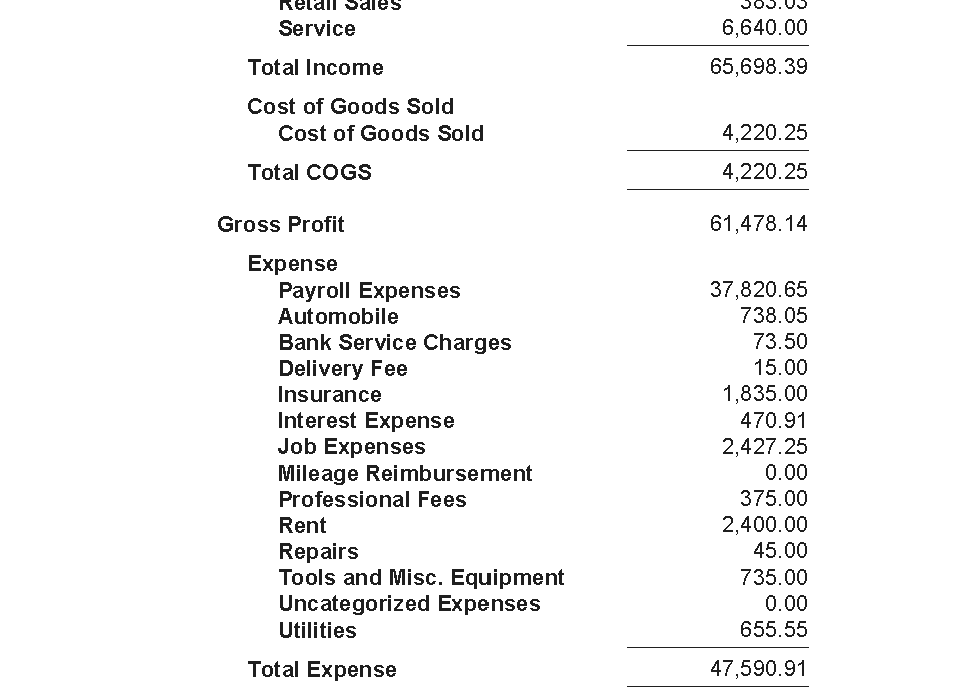

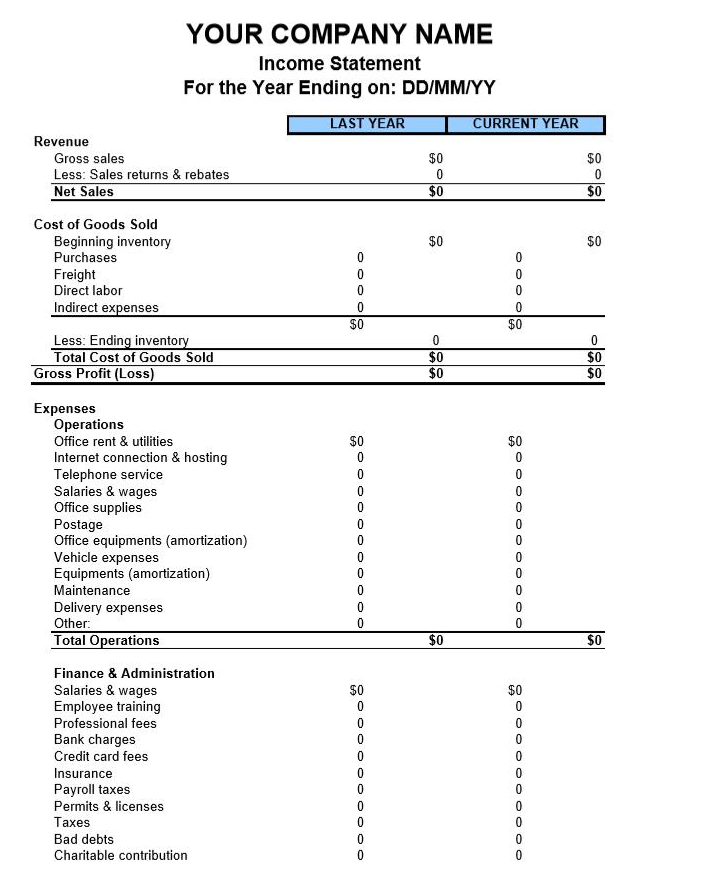

Is profit loss statement an income statement. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. In this article, we explain the meanings of income statement vs profit and loss, compare them to one another and provide some statement examples. It’s essentially a snapshot of how much money the company made (or lost) during that time frame.

Then, it subtracts the costs of making those goods or providing those services, like. Unrealised gains are not recognised as income in the profit and loss account but are recorded directly under the liability item “revaluation accounts”. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

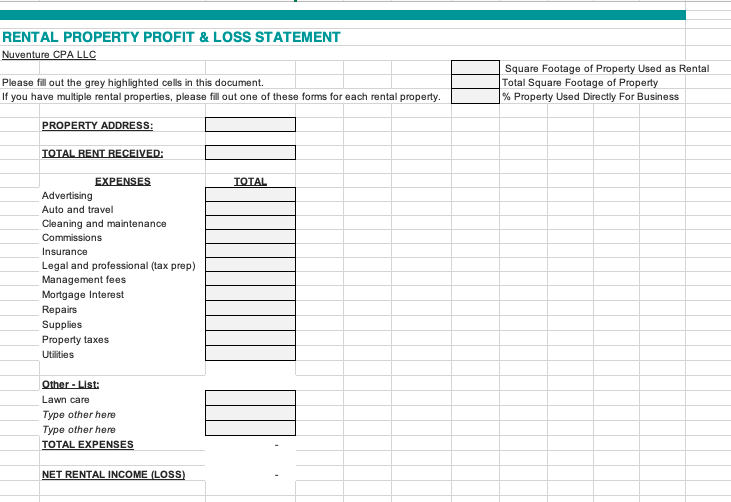

The income statement, also known as the profit and loss statement, is an important tool as it calculates the profitability or loss of a business. In this article, we define income statement vs. Yes, profit and loss statements and income statements can be used for tax purposes.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The profit & loss statement, also known as an income statement or p&l statement, is a financial document that shows the revenues and expenses of a business over a specific period. The financial statements summarize a company’s revenues, costs, and expenses incurred during a specific period.

Also known as the profit and loss (p&l) statement or the statement of revenue and expense, an income statement provides valuable insights into a company’s operations, the efficiency of. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. A profit and loss statement, also known as an income statement or p&l, is a financial report that shows the revenues and expenses of a business over a defined period of time.

In short, the profit and loss statement reports a company's revenues, expenses, and most of the gains and losses which occurred during the period of time shown in the statement's. Many key fundamental ratios use information from the income statement. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

Accounting & taxes. It provides insight into how much money a company has made and spent during that period, revealing its profitability. You are free to use this image on your website, templates, etc, please provide us with an attribution link.

Profit and loss and when and how to use them. An income statement, also known as a profit and loss statement (p&l statement), summarizes a business’s revenues and expenses over a period of time. You can learn about the health of a business—up and down, and across time—by looking at its income statement.

It shows both turnover and profitability for. The profit and loss statement, or p&l, is sometimes used to mean a company's income statement, statement of income, statement of operations, or statement of earnings. Definition a profit and loss (p&l) statement is a summary of an organization’s income and expenses over a period of time.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. It’s one of the most important financial statements for small business owners, so it’s key to understand what an income statement is, what its purpose is, and.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)