Unique Info About Negative Accounts Receivable On Cash Flow Statement

And yet a negative cash flow statement is not in itself cause for alarm.

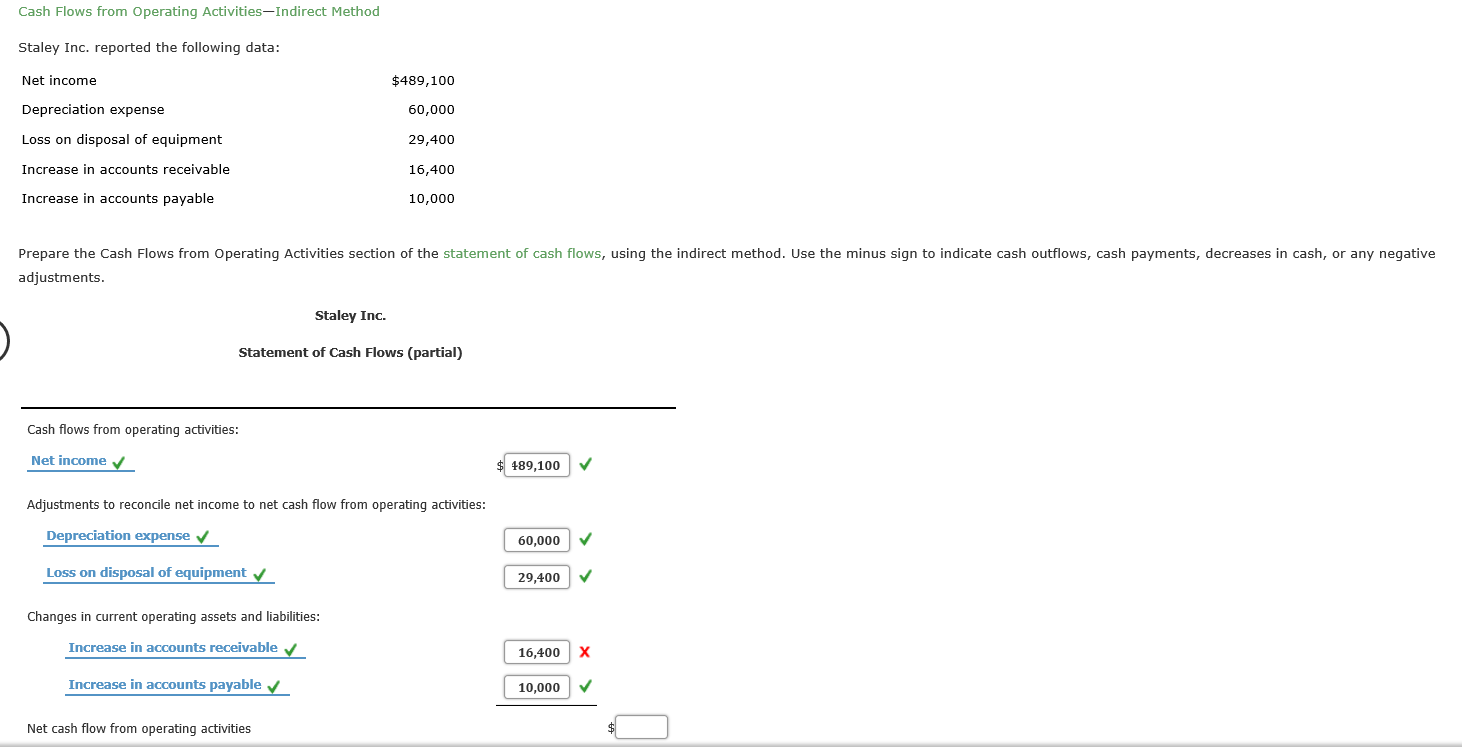

Negative accounts receivable on cash flow statement. Collected more than you billed collected a payment after writing off an accounts receivable issued a credit memo larger than the accounts receivable balance posted an incorrect journal entry How does the account receivable present in the cash flow statement? When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow.

It may mean a business is new and has spent a lot of money on property or equipment. The cfs measures how well a. This journal entry will decrease the accounts payable (debit) as a result of paying our debt.

Using this information, an investor might decide that a company with uneven cash flow is too risky to. As a result, it will decrease the cash flow for the business in the current period. Positive cash flow vs.

Paystand integrates with major erp and order management systems to provide robust payment functionality directly within your system of record. Instead, a customer overpayment may be the root of the problem. How can accounts receivable be negative?

Even with an optimal rhythm, some remain. It can also reveal whether a company is going through transition or in a state of decline. Or, it could mean the business is in growth mode.

Yes, accounts receivable can have a negative balance, and here are 5 reasons why you may occasionally see a negative balance. Similarly, accounts receivable, money yet to be received from customers, is accounted as negative cash flow in the cash flow statement. A negative amount on the statement of cash flows (scf) indicates that the amount described was:

It should show up as a positive accounts payable. Create your account view this answer the accounts receivable is negative on a statement of cash flow when. Negative cash flow does not always result from a negative accounts receivable balance.

You may see a net negative on a statement of cash flows when looking at accounts receivable or operating activities. Within the cash flow statement, the cash receipts or cash inflows are reported as positive amounts. This has a negative effect on cash flow as the increase in accounts receivable will result in less cash inflow to the business since the cash is built up in the accounts receivable.

Whether it’s a rapidly growing startup or a mature and profitable company. It doesn’t always mean you have negative cash flow. Negative cash flow vs.

This means that the decrease in accounts payable has a negative effect on cash flows. The following table provides various ways for you to think of the positive and negative amounts that are shown on the cash flow statement: With that said, an increase in accounts receivable represents a reduction in cash on the cash flow statement, whereas a decrease reflects an increase in cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)