Fantastic Info About Withholding Tax Disclosure In Financial Statements

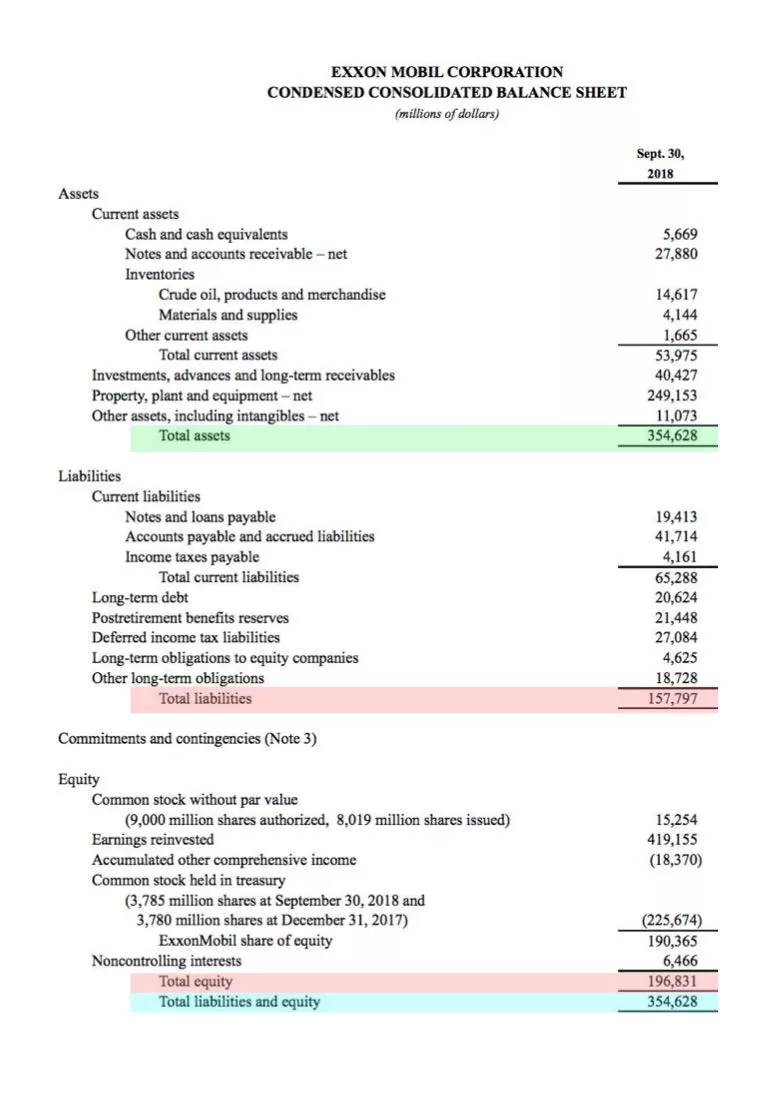

Examples of such risks include situations in which (1) the registrant may have to repatriate foreign earnings to meet current liquidity demands, resulting in a tax payment (e.g.,.

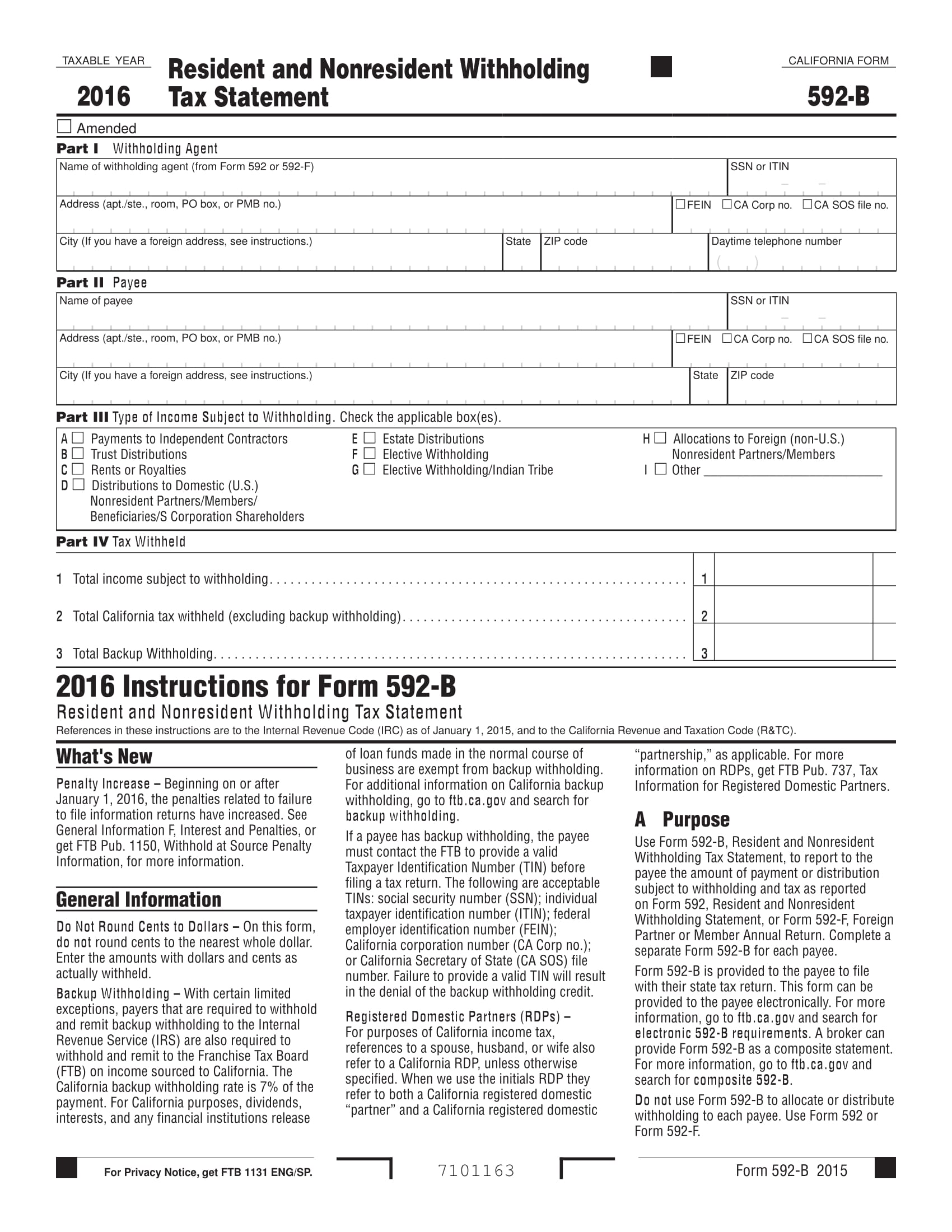

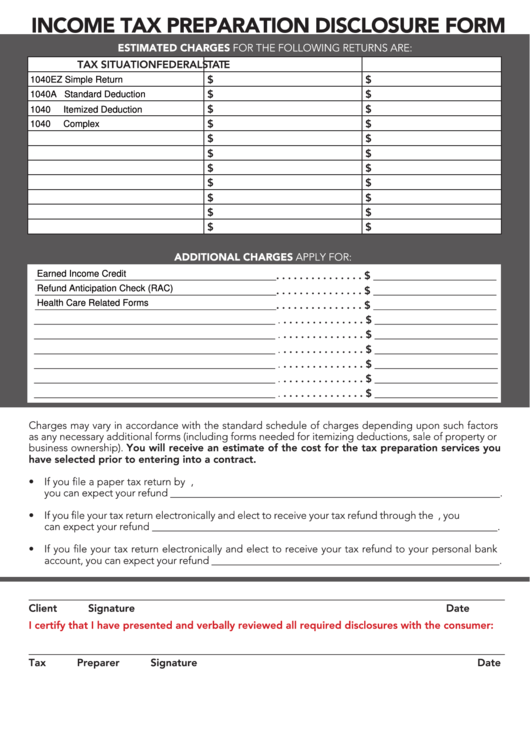

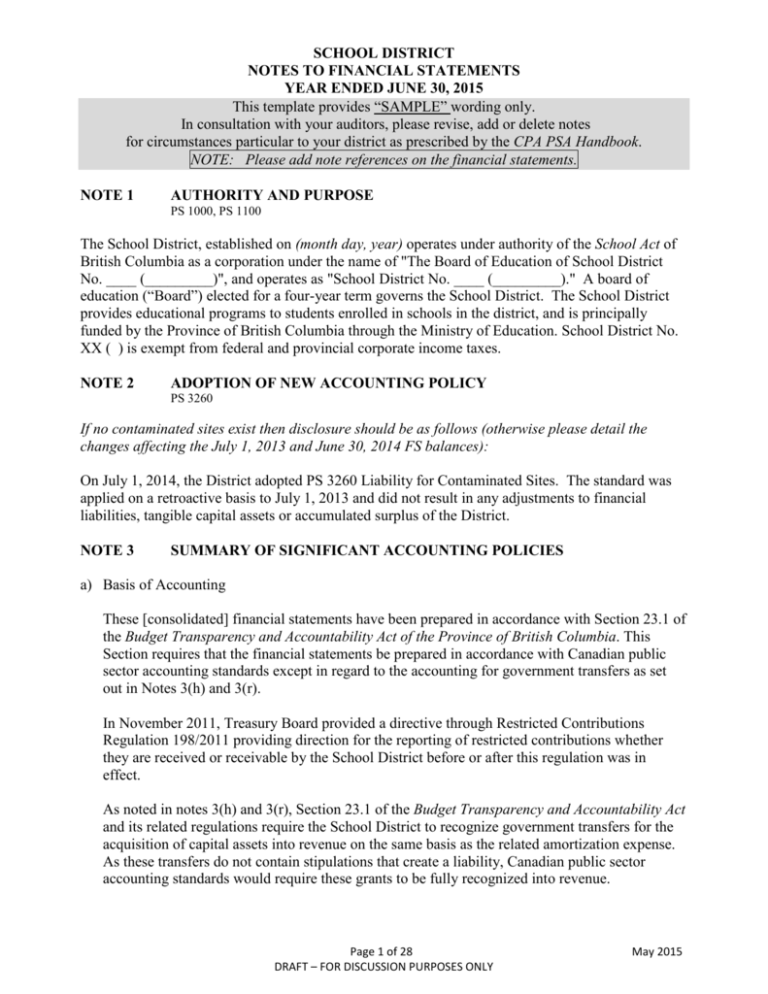

Withholding tax disclosure in financial statements. The disclosure of taxes in financial statements is still deemed unusual, especially for public companies. Losses or unused tax credits, the presentation of income taxes in the financial statements and the disclosure of information relating to income taxes. Although there are differing views on tax disclosure, the practice is.

Prior research relating to tax disclosure in financial statements is also minimal. The results reveal a negative relationship between tax avoidance and tax disclosure, with lower tax avoidance leading to higher tax disclosure; This study contributes to an explanation of the variables that influence the tax disclosure level and.

Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. While tax information on the financial statements presented under fasb accounting standards codification (asc). Ifrs and its interpret ation c hange o ver time.

Annette nellen, esq., cpa, cgma. Withholding tax is efficient in that tax authorities can collect tax as taxable. Income tax (expense) and reconciliations.

Tax losses or unused tax credits, the presentation of income taxes in the financial statements and the disclosure of information relating to income taxes. Notes to the financial statements for the financial year ended 31 december 2010 illustrative annual report 2010 121 reference notes to the financial statements 3.1. Portions of certain sample disclosures in this document are based on actual disclosures from public filings.

In addition to the disclosures required by ias 12, some disclosures relating to income taxes are required by ias 1 presentation of financial statements, as follows:. For the year ended december 31, 2019, the respective. Details that would identify the registrants have been removed,.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

![[TOPIC 16] WITHHOLDING TAX SYSTEM Final and Creditable (Expanded](https://i.ytimg.com/vi/afPgHThPH-E/maxresdefault.jpg)