Unbelievable Tips About Stock Investments On Balance Sheet

For example, if company a acquires a 40% stake in company b by buying 8,000,000.

Stock investments on balance sheet. But there's another, clearer way to suss out a company's. Nike stock has appreciated well with an 18.3% cagr, providing a very nice roi to investors over t. raising. Financials are provided by nasdaq data link and sourced from the.

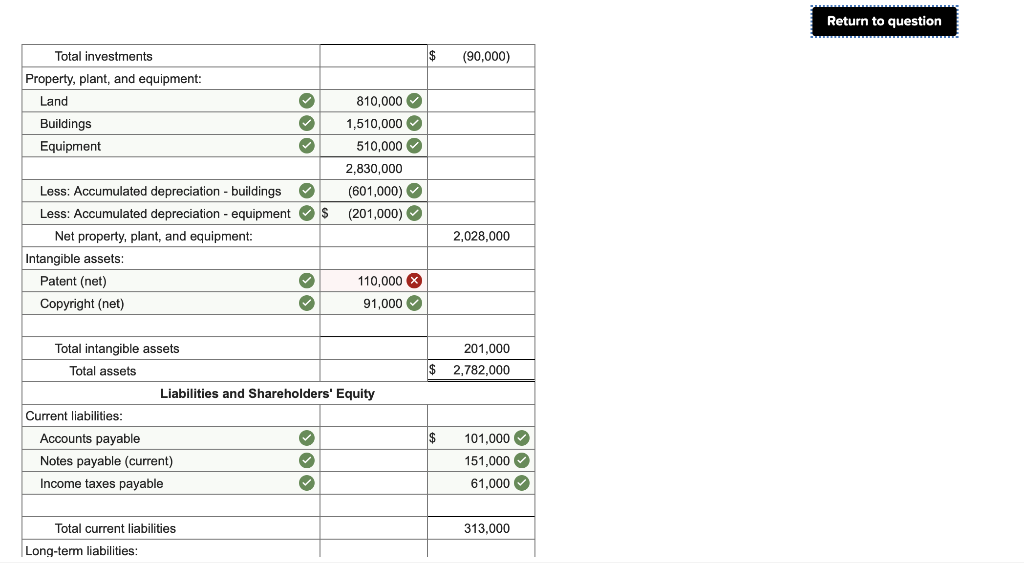

The balance sheet is split into two columns, with each column. A company’s balance sheet is important for stock investors because it gives you a financial snapshot of what the company looks like in terms of the following. You can learn about the health.

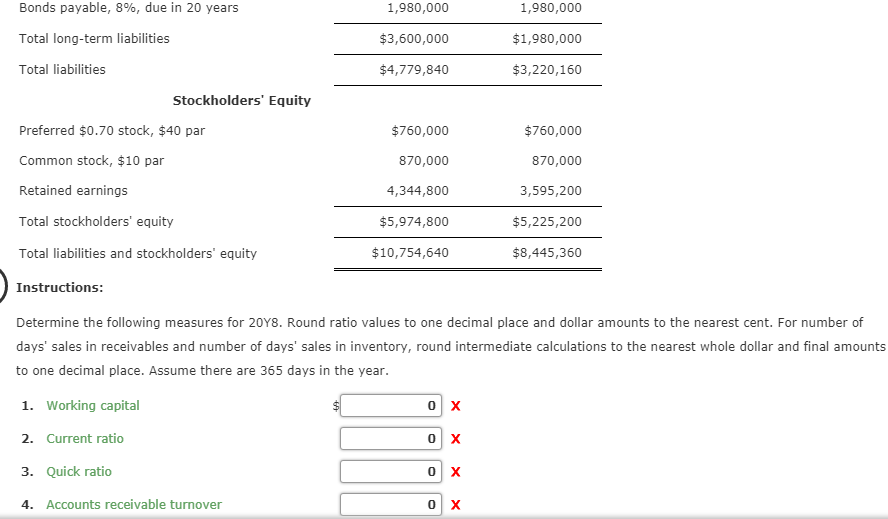

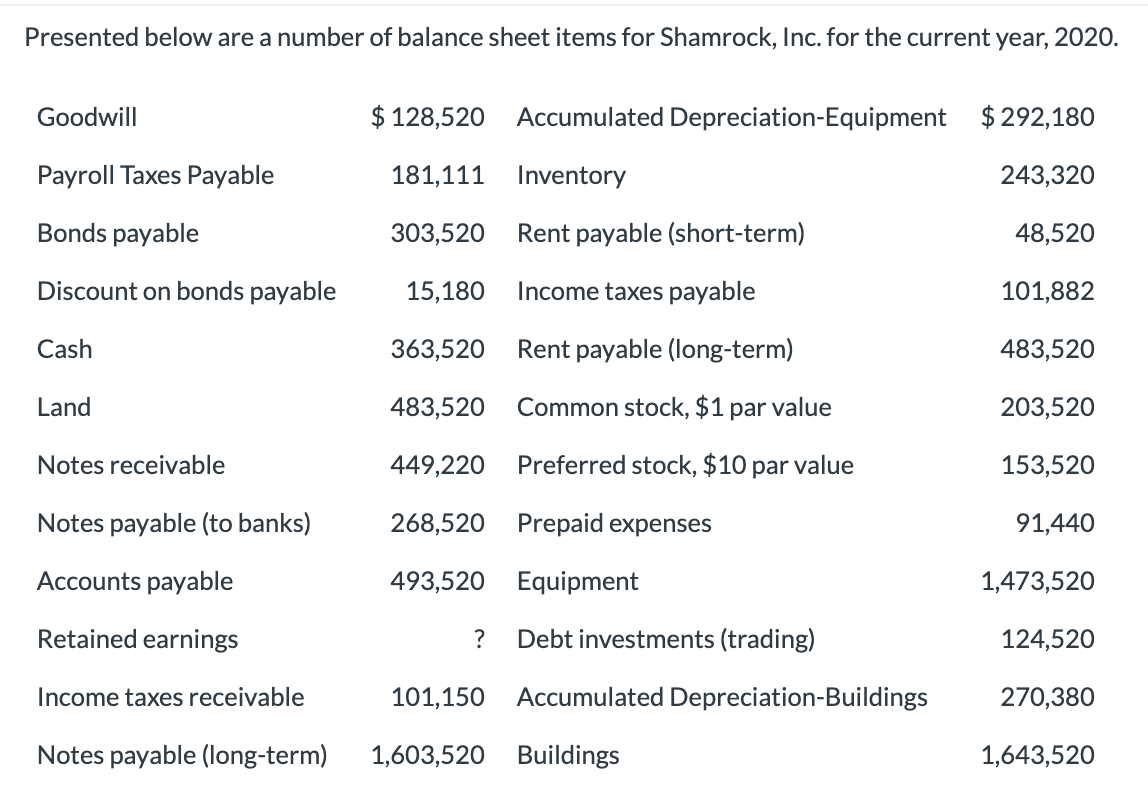

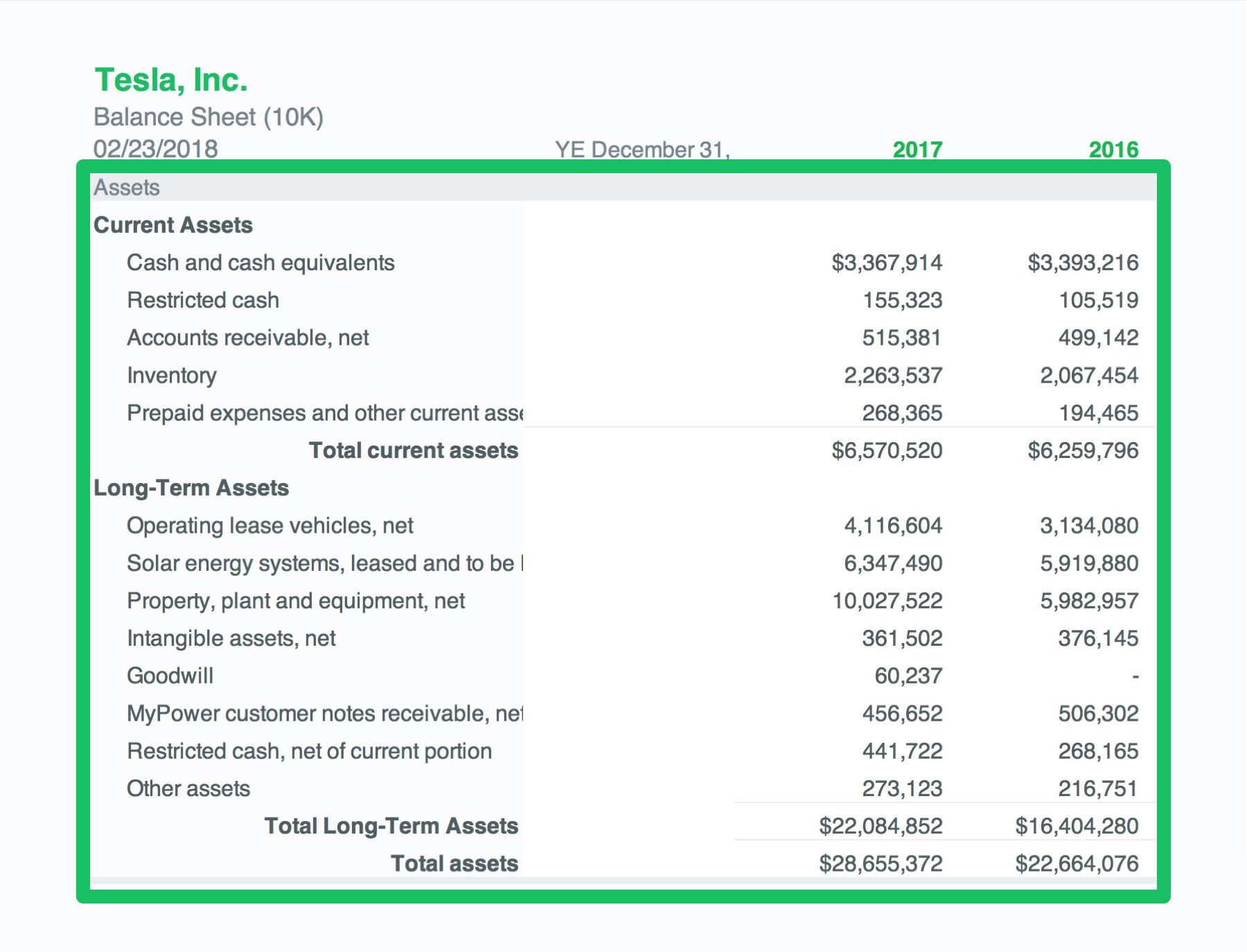

To create a stock balance sheet, we have to follow some specified rules. The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that. (for a complete guide to working capital, read our “working capital 101”.

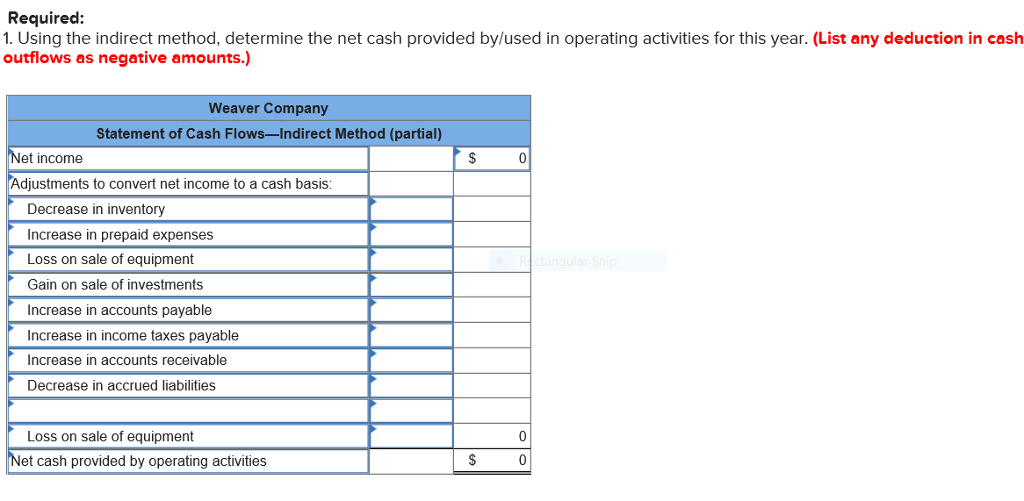

We start the balance sheet forecast by forecasting working capital items. All the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: Recording and disclosing investments in another company on the balance sheet is a crucial aspect of financial reporting.

Balance sheet ( annual) financials in millions usd. Dividends are accounted for as return on investment and reduce the listed value of shares. To do this we have to.

Investors use it to assess a company’s potential. The balance sheet is a key financial statement that provides a snapshot of a company's finances. A company's financial statements—balance sheet, income, and cash flow statements—are a key source of data for analyzing the investment value of its stock.

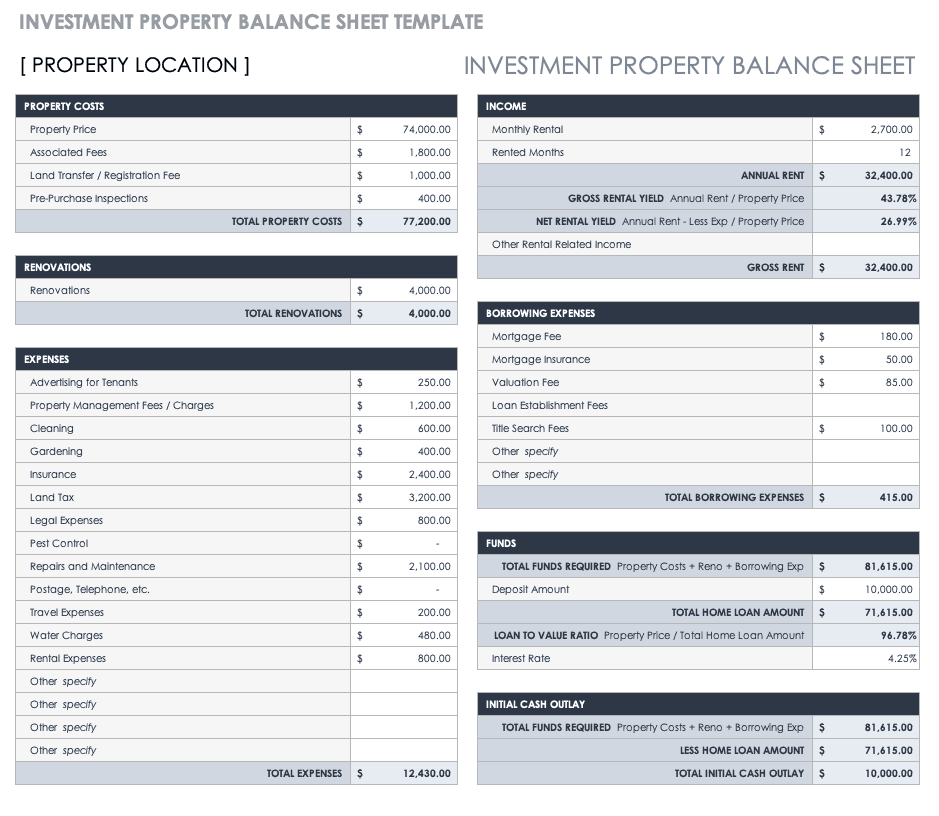

Investment is a crucial item in the balance sheet of the business. Fqvlf ), listed on the toronto stock exchange under. At first, we want to make a dataset.

A firm invests for the long term to help them sustain profits now and into the future. Qs) stock price has remained in a consolidation phase in the past few weeks as investors assess the company’s prospects. A company's balance sheet should be interpreted when considering an investment as it reflects their assets and liabilities at a certain point in time.

Assets minus liabilities equals owners’ equity. On thursday, jefferies made a notable change to its rating for first quantum minerals (otc: The business can decide to invest in a range of financial assets, including equity securities, debt securities, or.

To find successful stocks, most investors examine a company's ability to grow its various types of earnings. The balance sheet includes things owned (assets) and things owed (liabilities). We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)