Breathtaking Tips About Finance Balance Sheet

Assets = liabilities + equity.

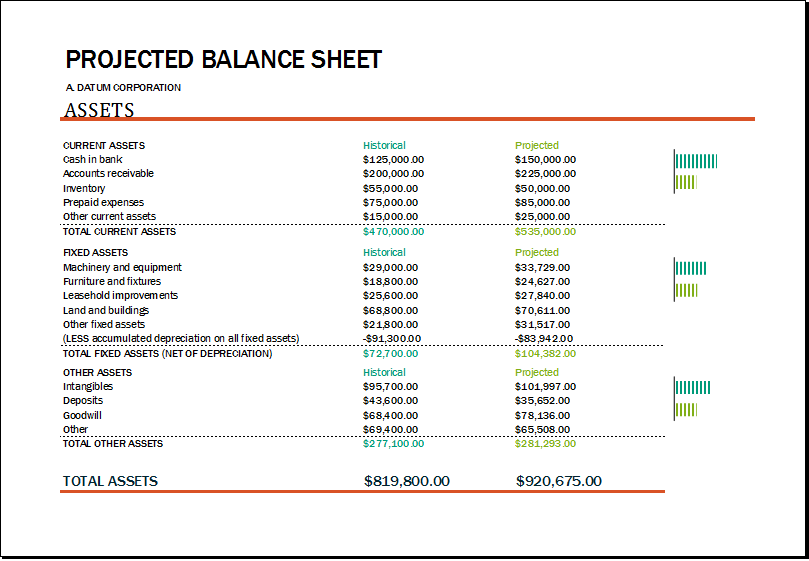

Finance balance sheet. Zero) which will be carried forward on the ecb’s balance sheet to be offset against future profits. European markets heidelberg materials balance sheet improves as building sector recovers. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors.

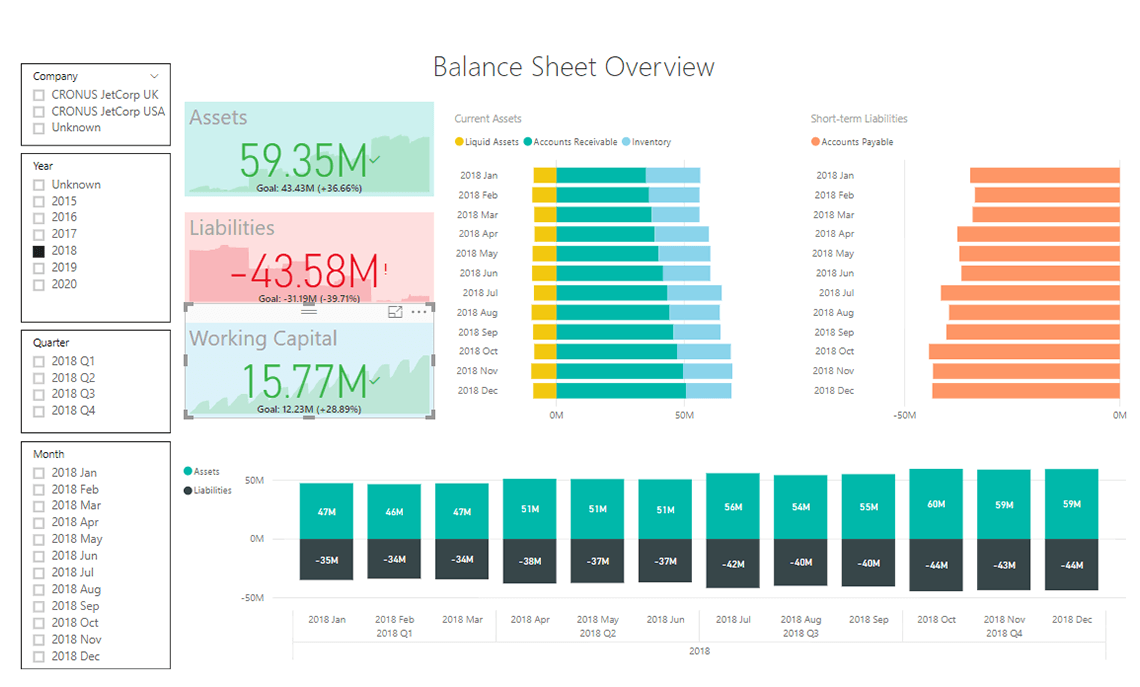

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Assets = liabilities + equity. What’s the difference between a cash flow statement and an income statement?

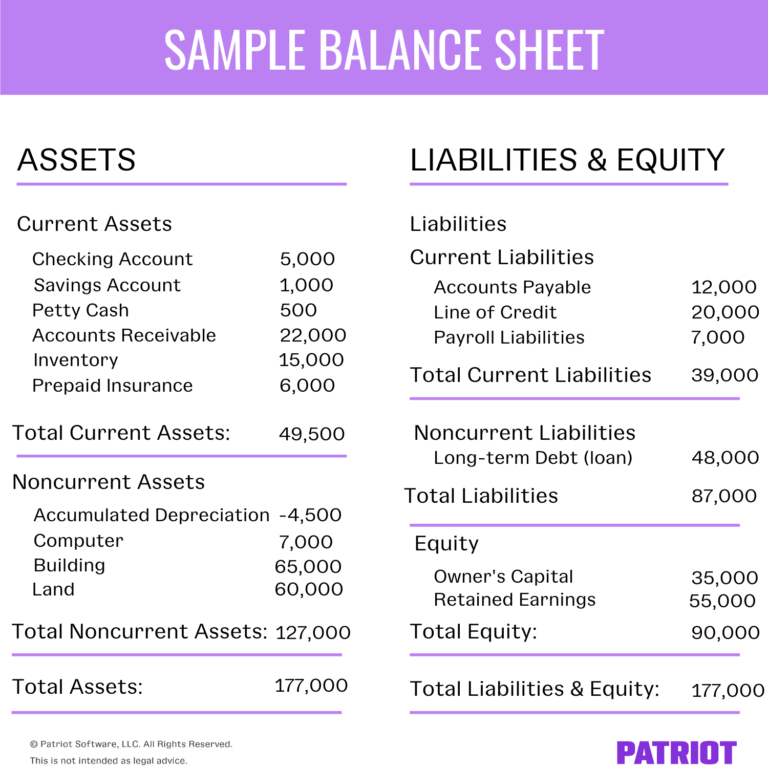

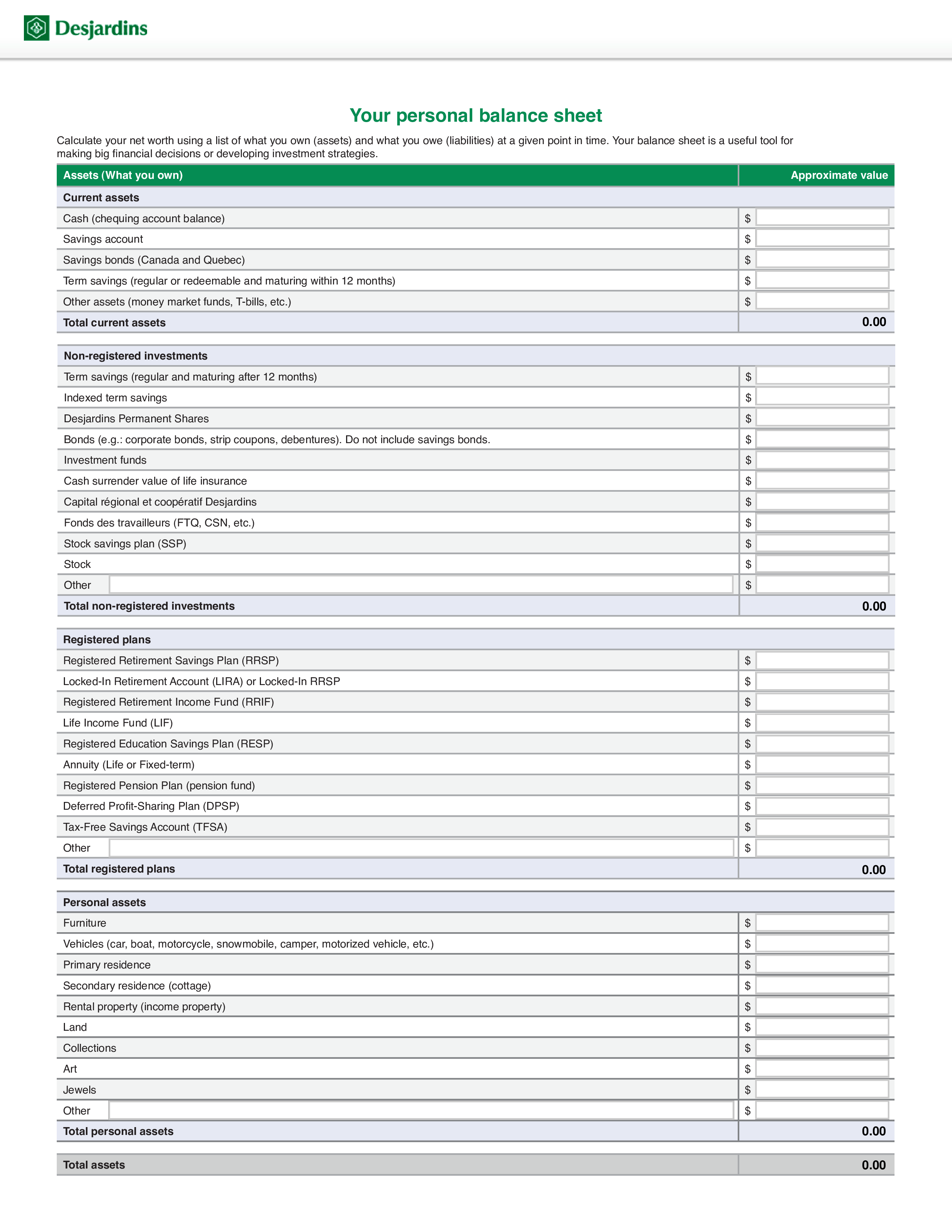

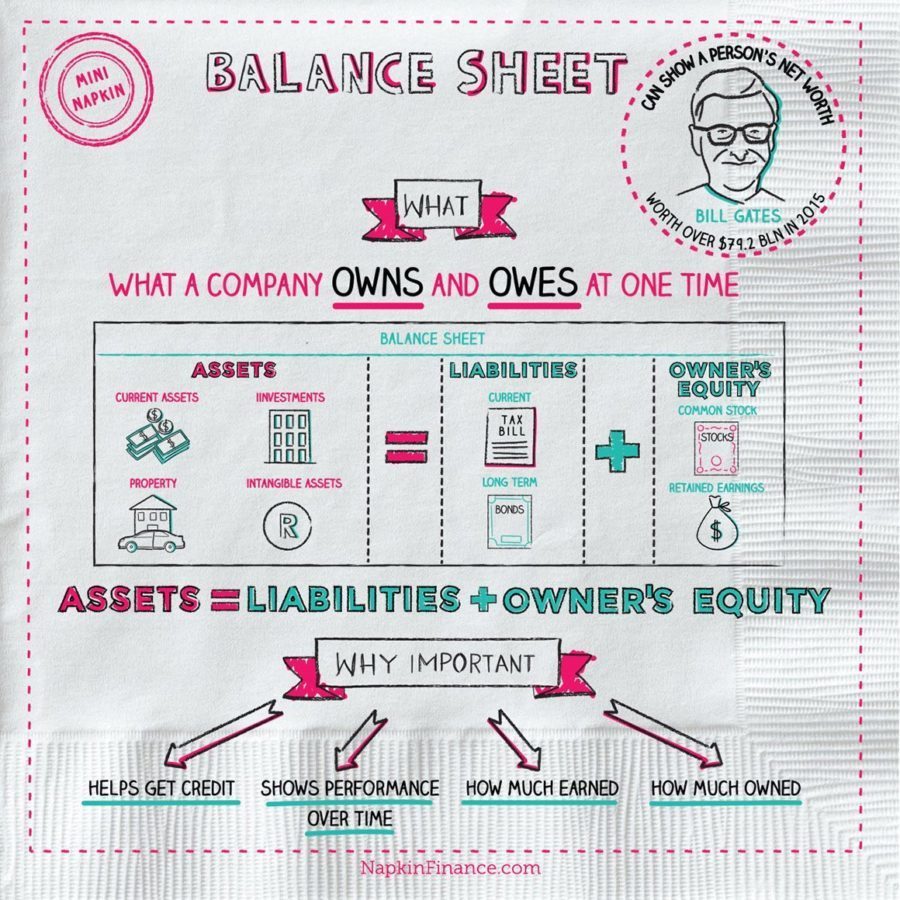

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation:

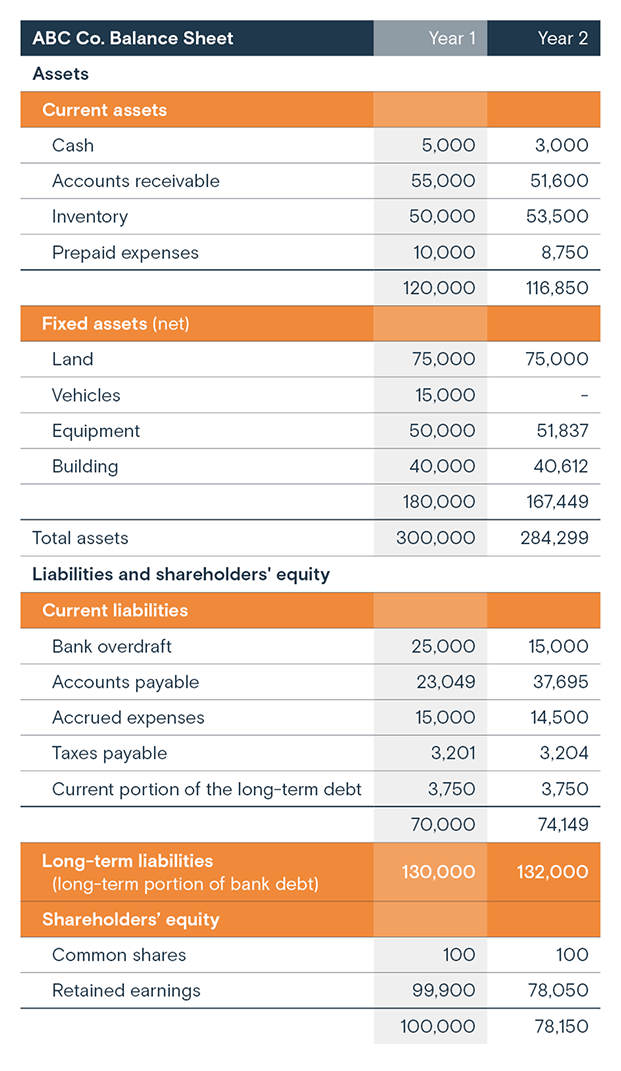

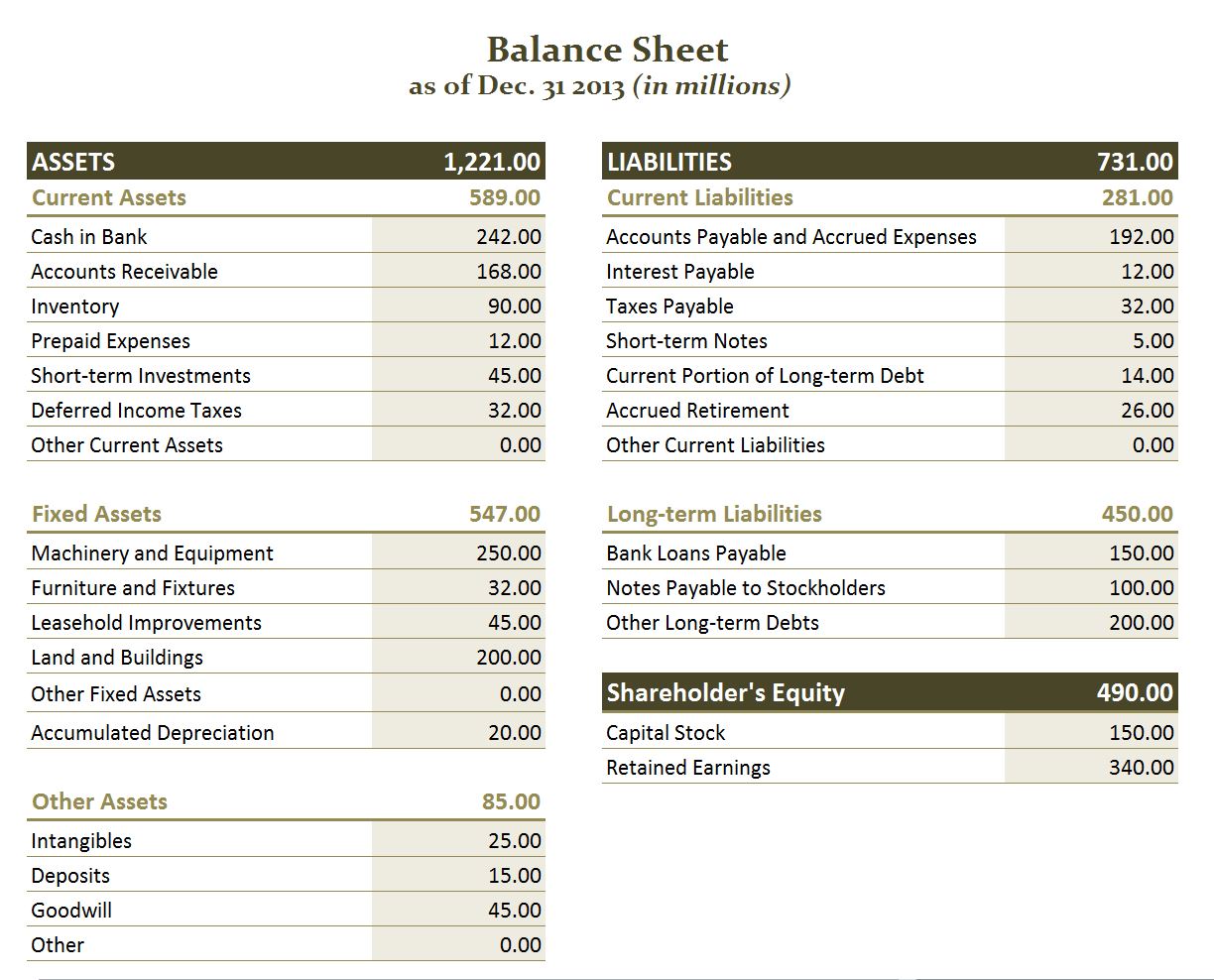

At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader. Liabilities include debt financing and other obligations, including accounts payable, accrued payroll. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

Succursale française, 28 avenue victor hugo, 75116, paris. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). The report replaces the existing sme balance sheet securitisation rating criteria, dated 19 october 2021.

James chen updated dec 15, 2023 frequently asked questions how are financial statements connected to each other? What are some examples of assets? Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday.

Fed likely to keep shrinking balance sheet while liquidity drain persists. The fed has been reducing the size of its holdings since 2022. Some fed officials said at the january meeting that amid uncertainty over how much liquidity the financial system needs, slowing the.

Balance sheets provide the basis for. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. It’s usually thought of as the second most important financial statement.

What are the three financial statements? The notes section contains detailed qualitative information and assumptions made during the preparation of the balance sheet. The balance sheet is split into two columns, with each column balancing out the other to net.

A balance sheet lists a company’s assets, liabilities, and owner’s equity at a specific point in time. It reports a company’s assets, liabilities, and equity at a single moment in time. Assets minus liabilities equals owners’ equity.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)