Recommendation Info About Cash Flow Statement And Equivalents

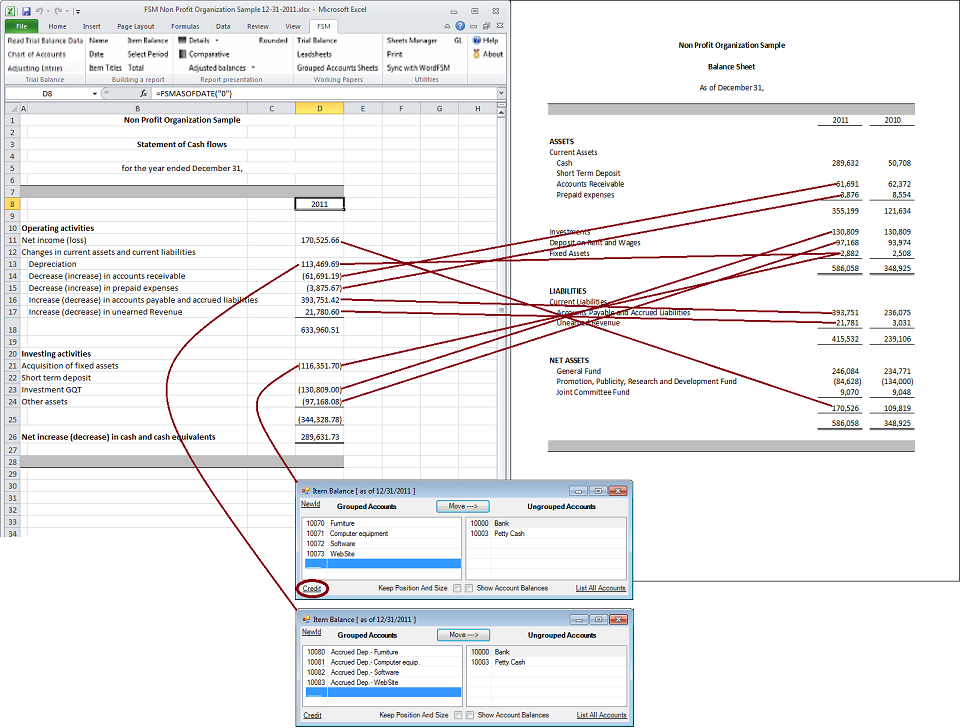

Cash and cash equivalents reported in the statement of cash flows may not always align with the corresponding line in the statement of financial position.

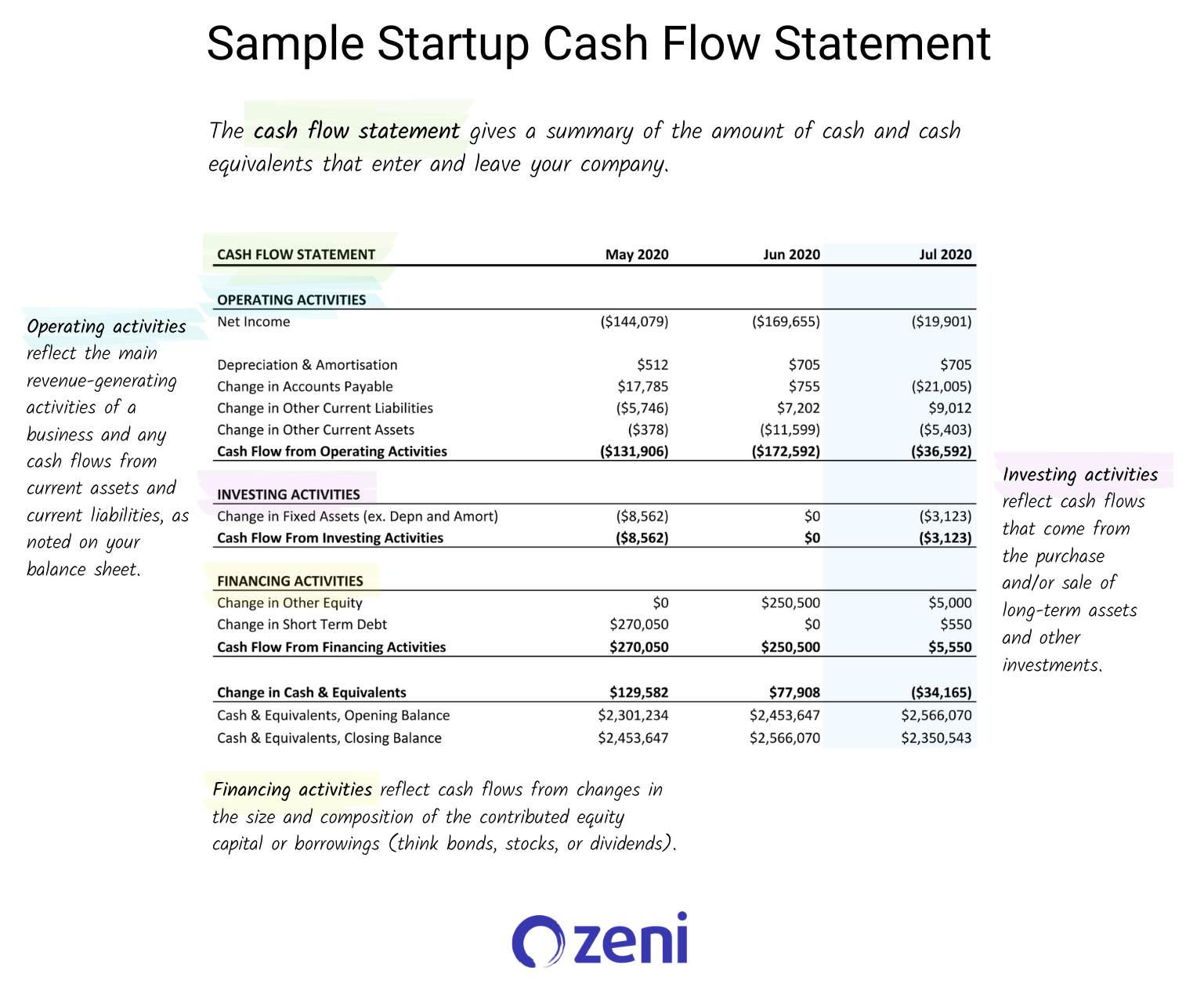

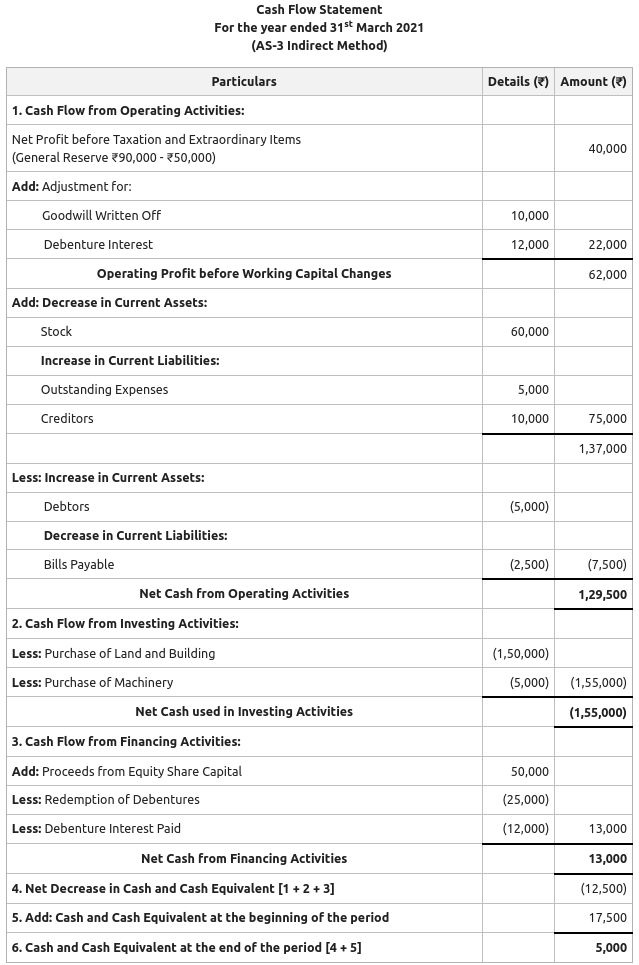

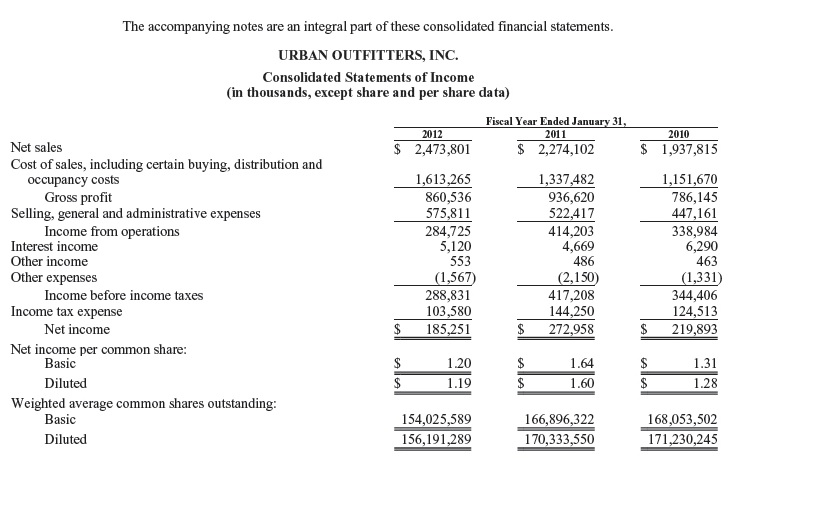

Cash flow statement cash and cash equivalents. These are few formulas that are used by analysts to calculate transactions related to cash and cash equivalents: It accounts for three major business activities in which cash is exchanged, i.e., operating, investing, and financing. In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income.

Currency and cash equivalents are business assets that can either cash or can be converted into cash straight. Cash and cash equivalents (cce) are assets that are immediately available as cash, meaning they can be converted into cash within fewer than 90 days. A cash flow statement records the overall cash movement in and out of business throughout an accounting period.

Cash and cash equivalents comprise cash on hand and. Ias 7 prescribes how to present information in a statement of cash flows about how an entity’s cash and cash equivalents changed during the period. The statement of cash flows must detail changes in the total of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and.

Cash flow statement mainly focuses on cash transactions and cash equivalents. The statement of cash flows analyses changes in cash and cash equivalents during a period. Cash and cash equivalents:

It ascertains the closing balance of cash and cash equivalents at the end of the year. What does a cash flow statement indicate about cash and cash equivalents? Cash and cash equivalents are balance sheet details that summarize the worth of a company's assets that are cash or may be converted into cash instantly.

Pay and cash equivalents are company assets that are either metal oder can be converted into cash immediately. Investing and financing transactions that do not require the use of cash or cash equivalents are excluded from an entity’s statement of cash flows ( paragraph 43 of. Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

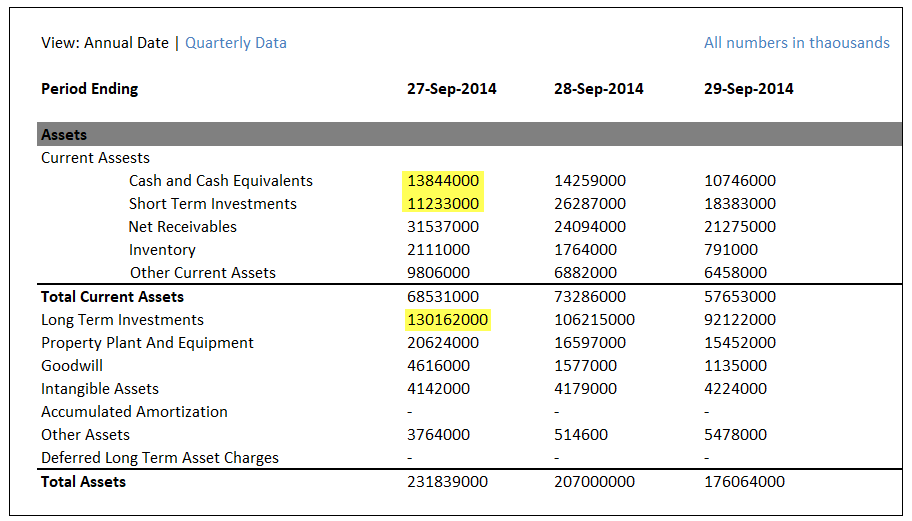

Cash and cash equivalents presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows. Cash and cash equivalents refers to the line item on the balance sheetthat reports the value of a company's assets that are cash or can be converted into cash immediately.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)