Peerless Info About Profit And Loss Account On Balance Sheet

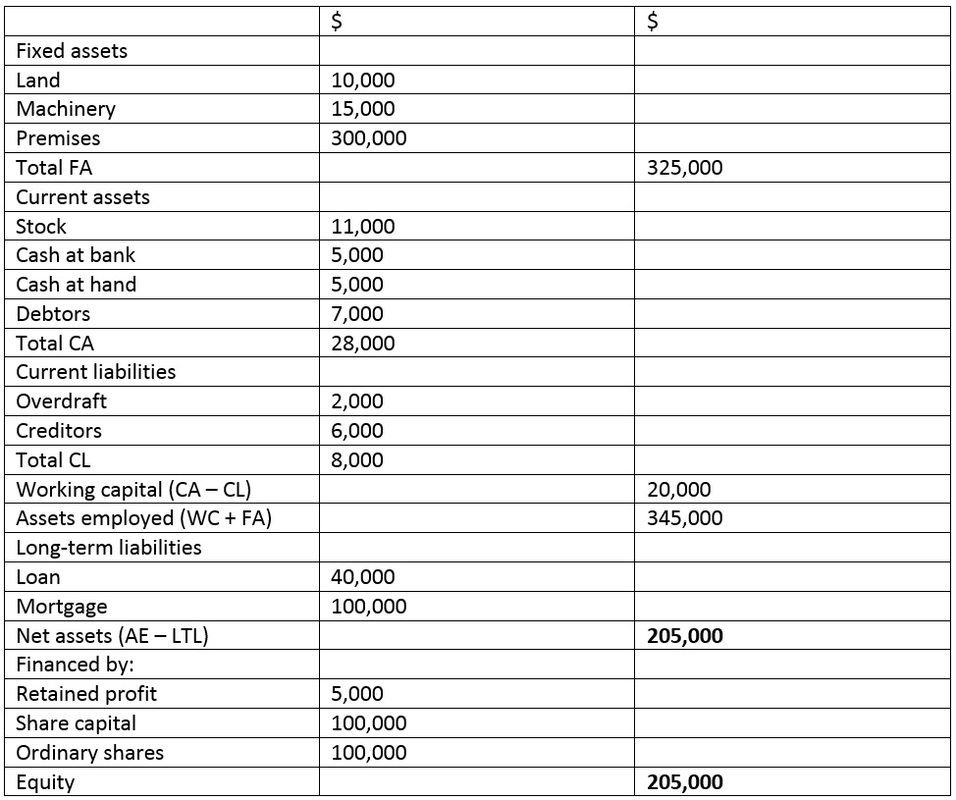

A balance sheet is a statement that discloses the financial position of its assets,.

Profit and loss account on balance sheet. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement. Your balance sheet and profit and loss account explained by: A p&l statement provides information about whether a company can.

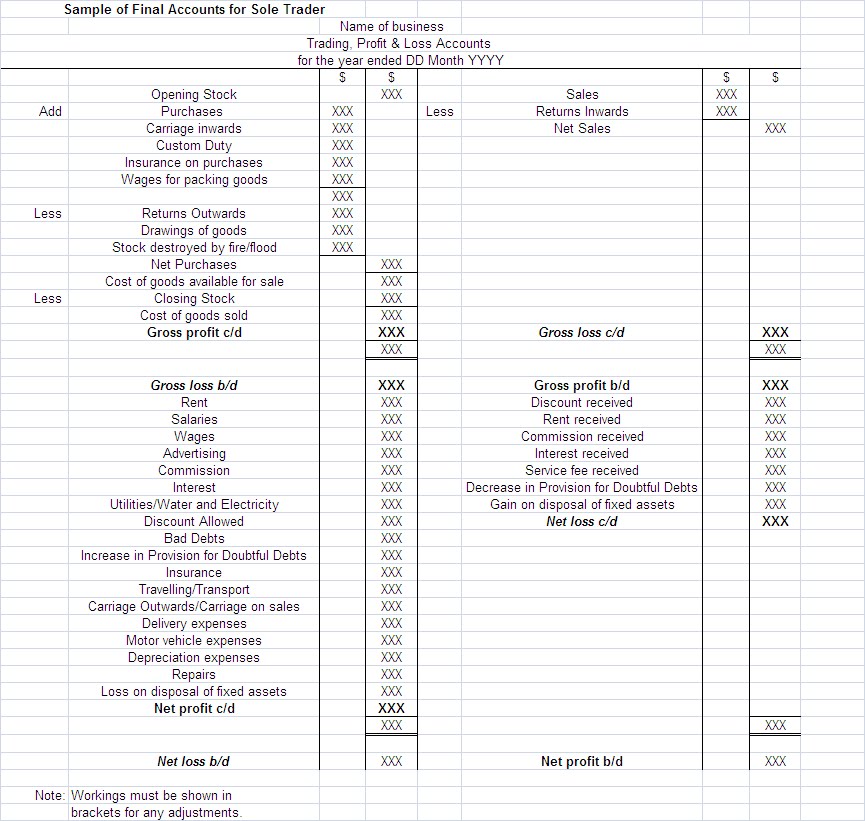

The p&l account is a component of final accounts. July 13, 2022 when looking at your financial statements, there are three main types that you will issue on a regular basis: The profit and loss account shows the profit or loss of a business over a given period of time e.g.

A balance sheet reports your assets/liabilities at a point in time. Profit & loss account means a concept that summarizes the revenues, expenses, gains, and losses of a company over a specific time period (year or quarter). This contrasts with the balance sheet, which is a snapshot of a company’s overall.

Profit and loss account vs balance sheet vs cash flow statement. What do these terms mean, and what information can these documents provide you about your company? It is prepared to determine the net profit or net loss of a trader.

Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the. Profit and loss statement vs. The p&l summarizes the company’s performance over a specific period, while the balance sheet reflects the company’s value at a specific.

A profit and loss account (p&l) reports the true financial position of the business, i.e. The balance sheet and profit & loss account (p&l) are two of the most important financial statements for a business. Difference between balance sheet and profit & loss account commerce diff.

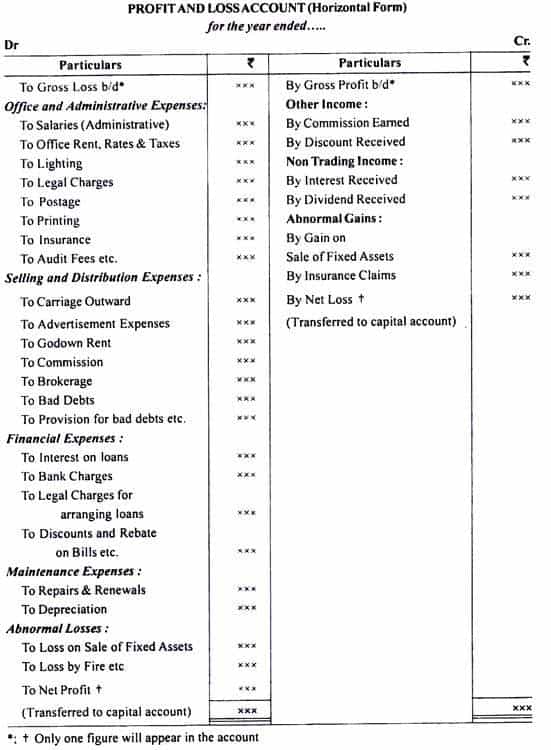

A profit and loss (p&l) account shows the annual net profit or net loss of a business. Key difference between a balance sheet and a profit and loss account (p&l) balance sheet vs profit & loss explained in the world of finance and accounting, understanding financial statements is crucial for any business. A typical profit and loss account would look as shown in fig.

Profit and loss account is made to ascertain annual profit or loss of business. Profit and loss account. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Key differences between profit and loss statement vs balance sheet. Financial statements are important for analyzing the performance of a business and making informed financial decisions. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement.

7.1 the profit and loss account the profit and loss account is a very useful statement. It’s a snapshot of your whole business as it stands at a. The balance sheet is a snapshot of a company’s assets, liabilities, and equity at a specific point in time.