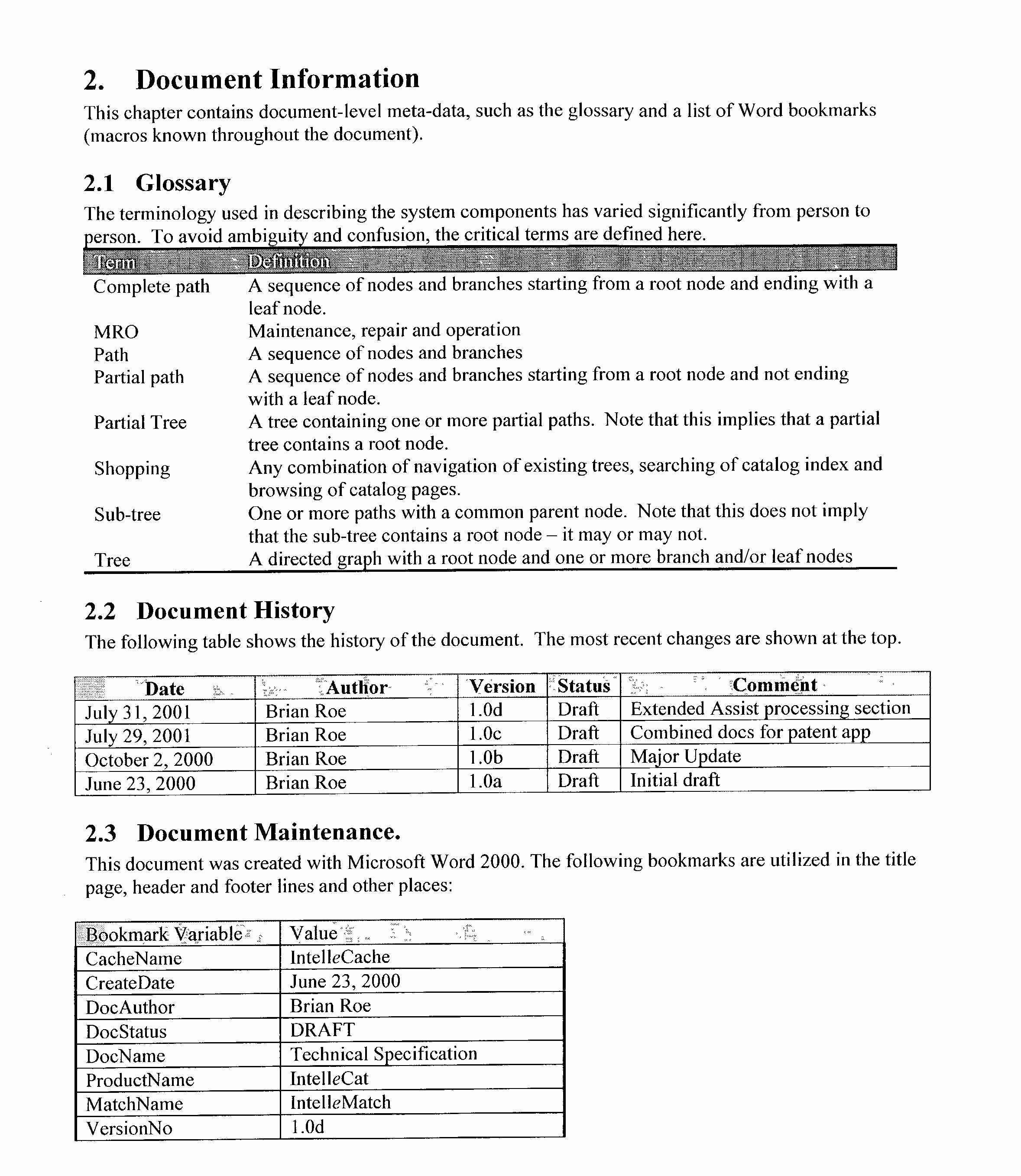

Ideal Tips About Profit Loss Statement Definition

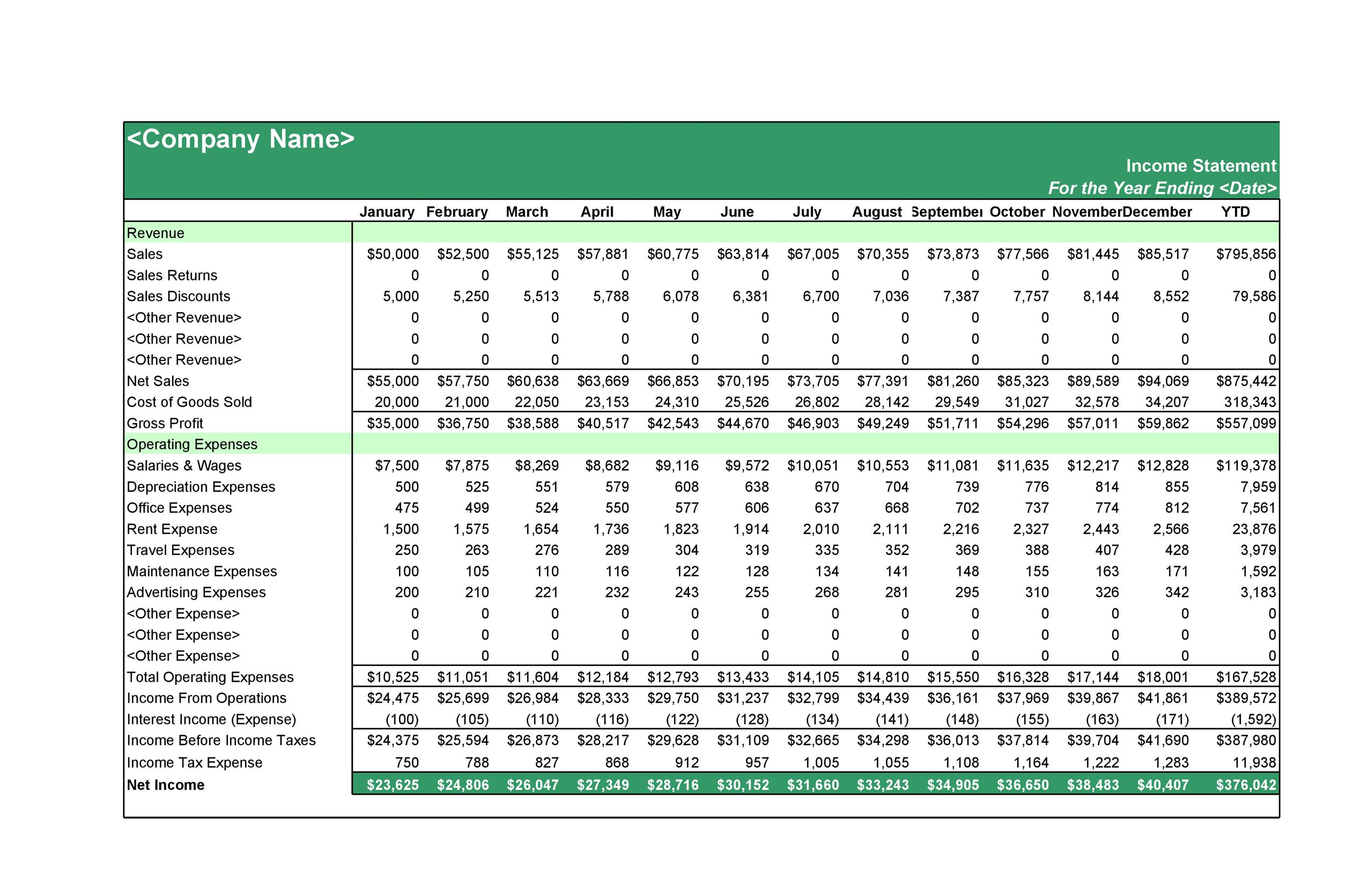

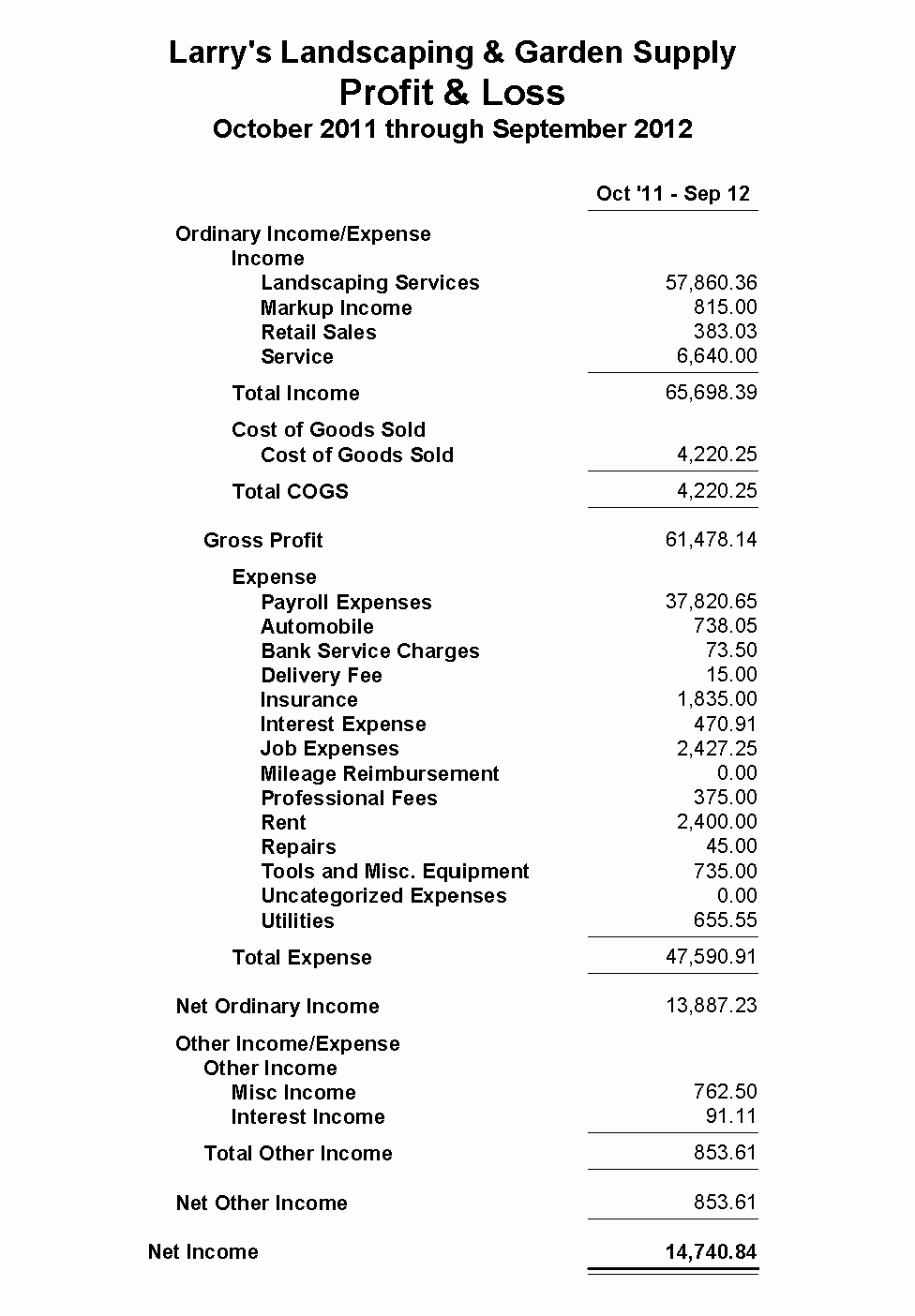

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

Profit loss statement definition. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. The bottom line on a p&l will be net income, also known as profit or loss.

This summary provides a net income (or bottom line) for a reporting period. Key takeaways a p&l statement explains the income and expenses that lead to a company’s profits (or losses). A profit and loss statement aggregates the revenues, expenses, and profits or losses of a business.

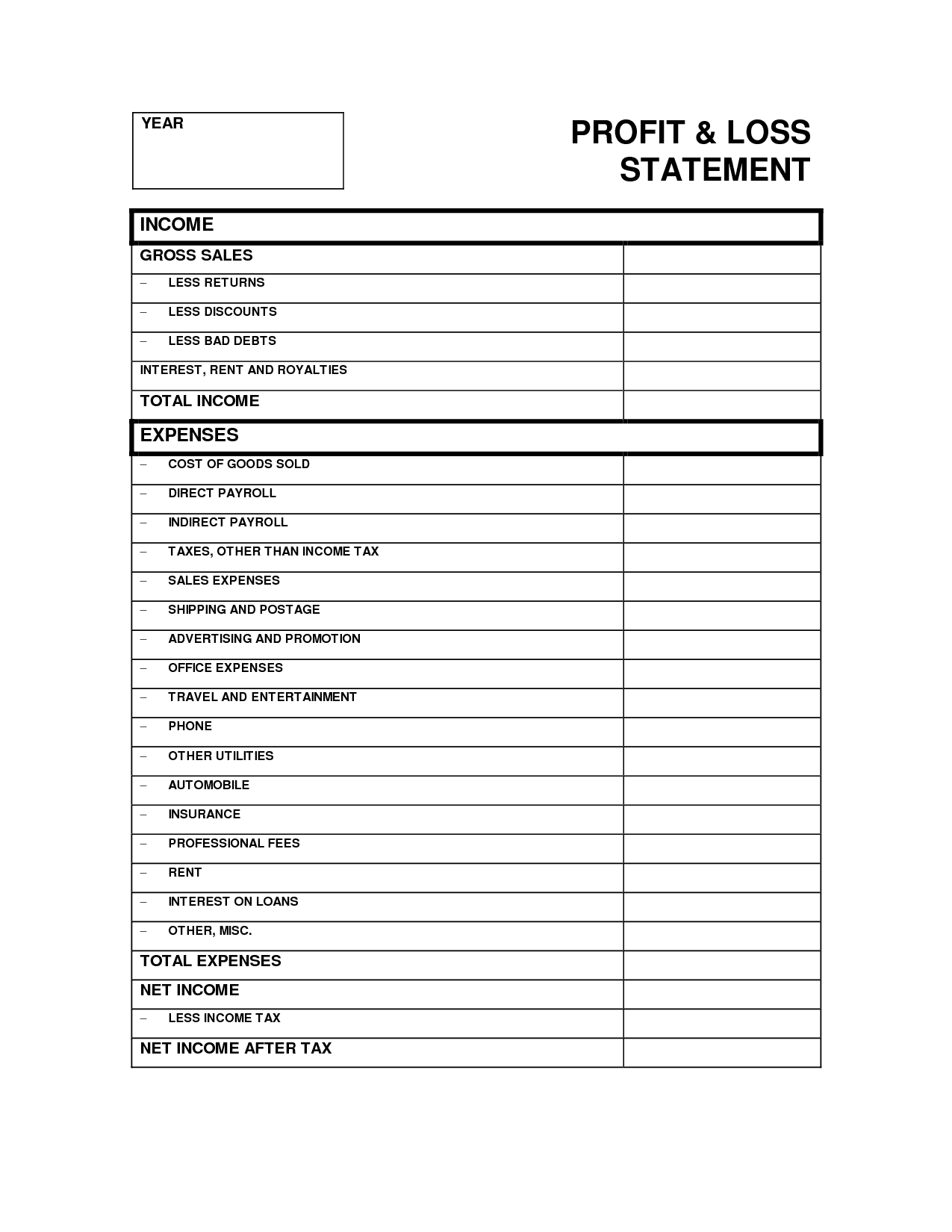

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specified period. The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually.

Definition a profit and loss (p&l) statement is a summary of an organization’s income and expenses over a period of time. It shows company revenues, expenses, and net income over that period. The profit and loss formula is:

A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year. It portrays financial results for a specific period of time. How to read a profit and loss statement

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)