Cool Info About Income Statement Revenue Accounts

Income statements are used by managers, investors, lenders, and.

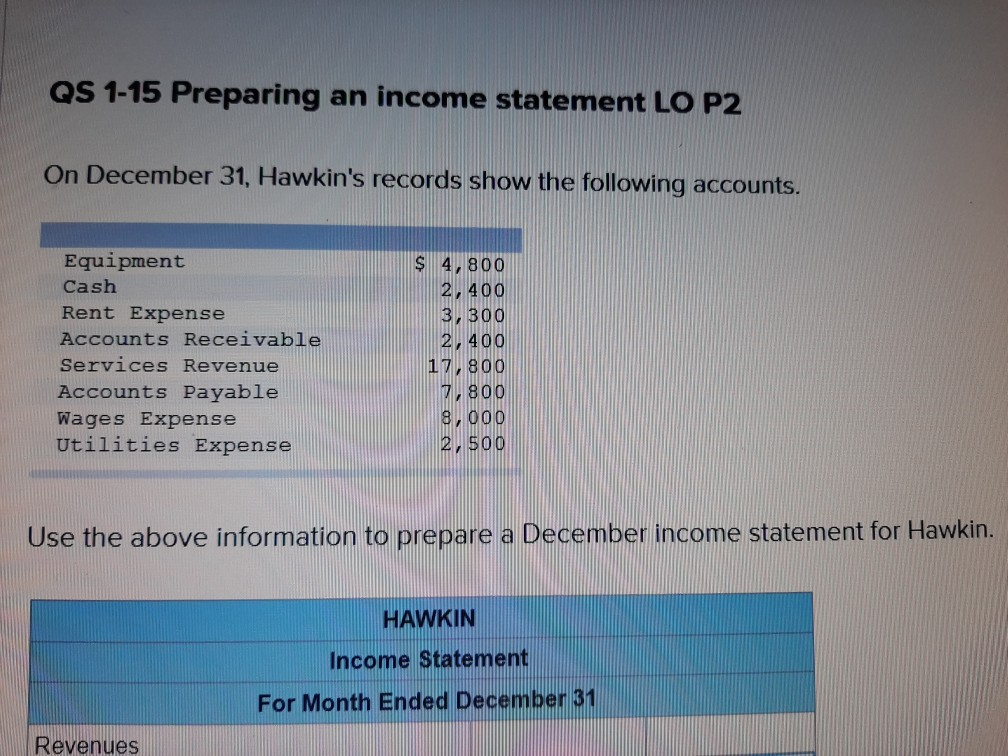

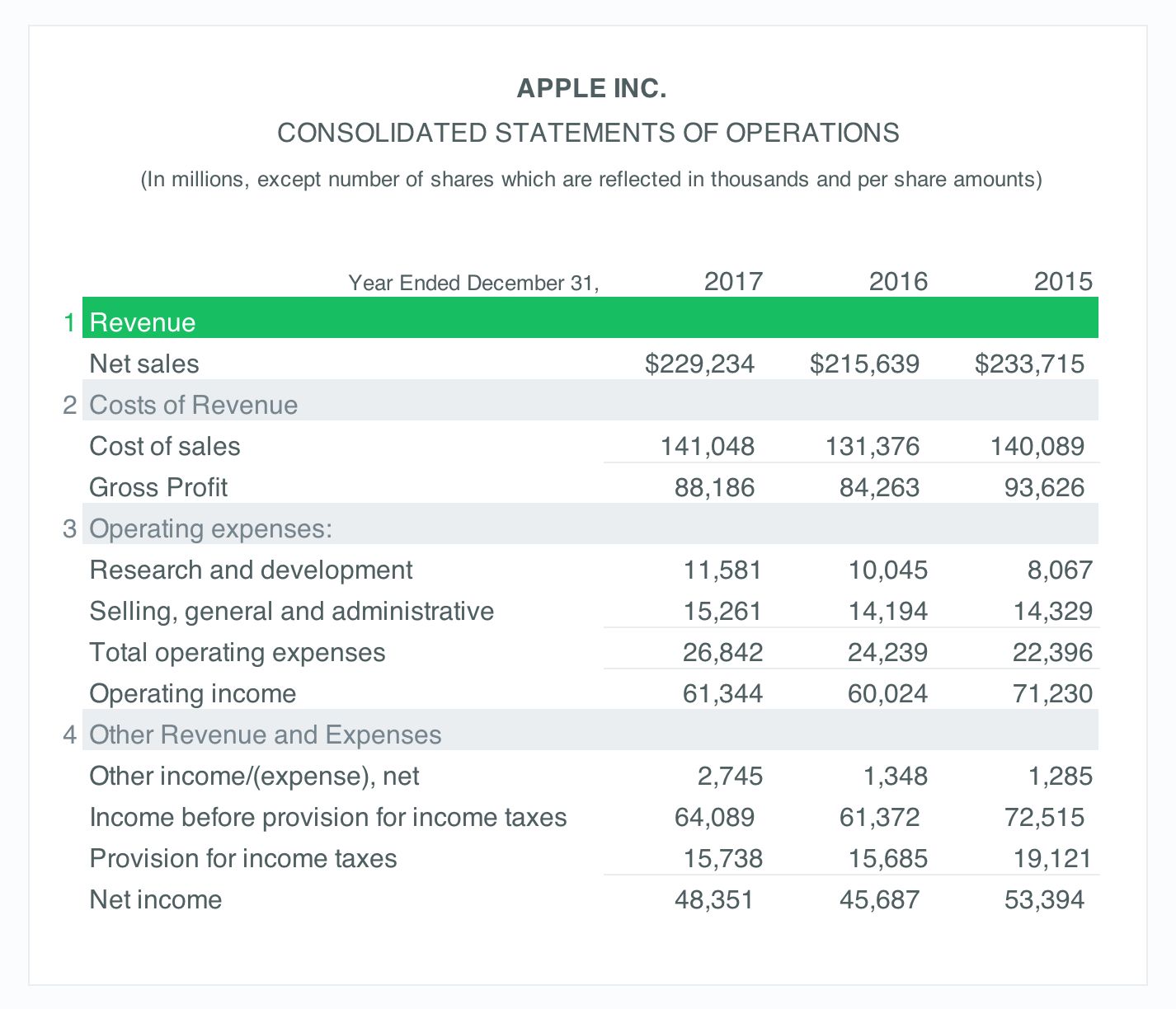

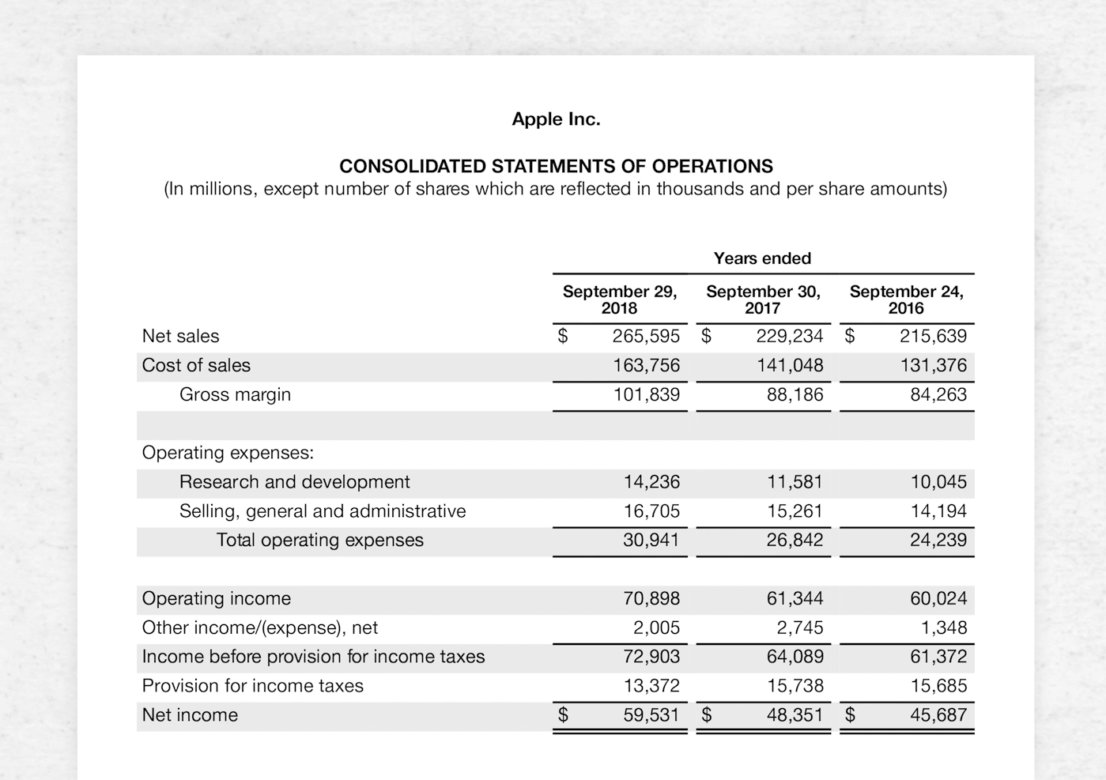

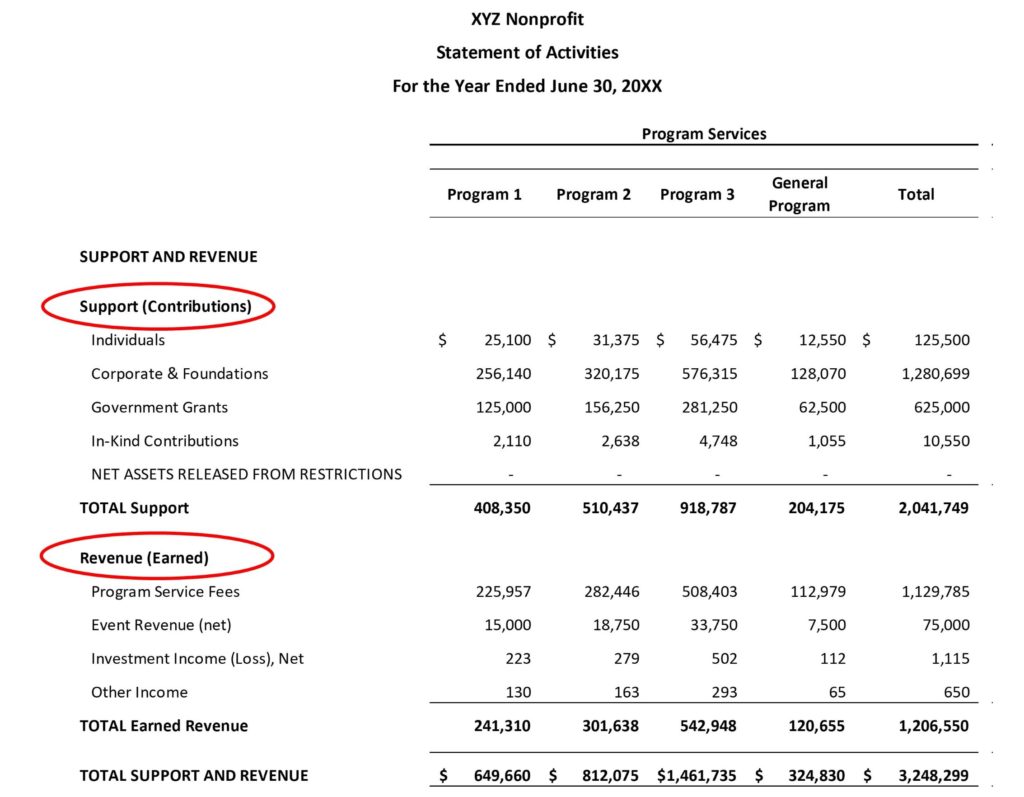

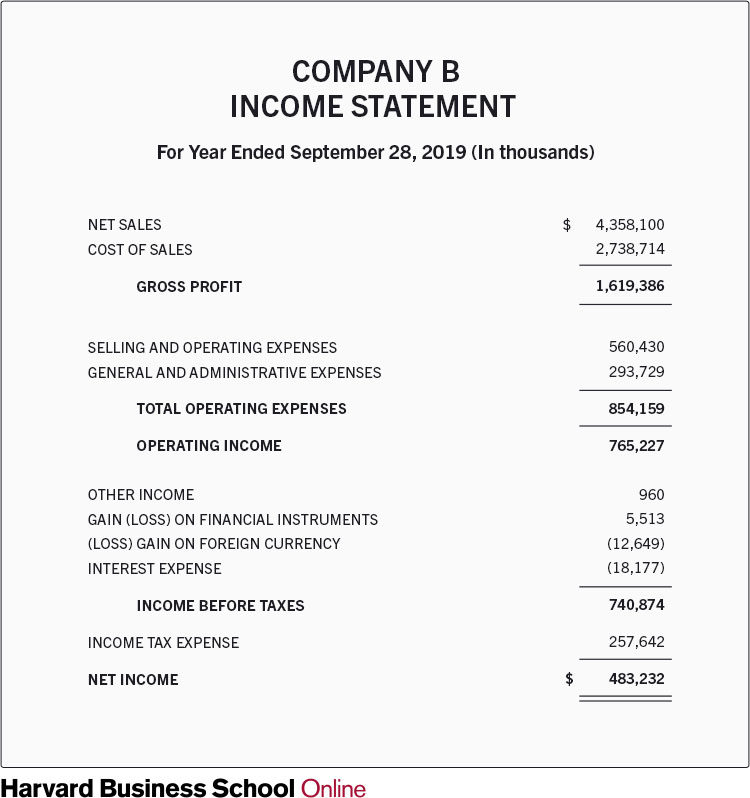

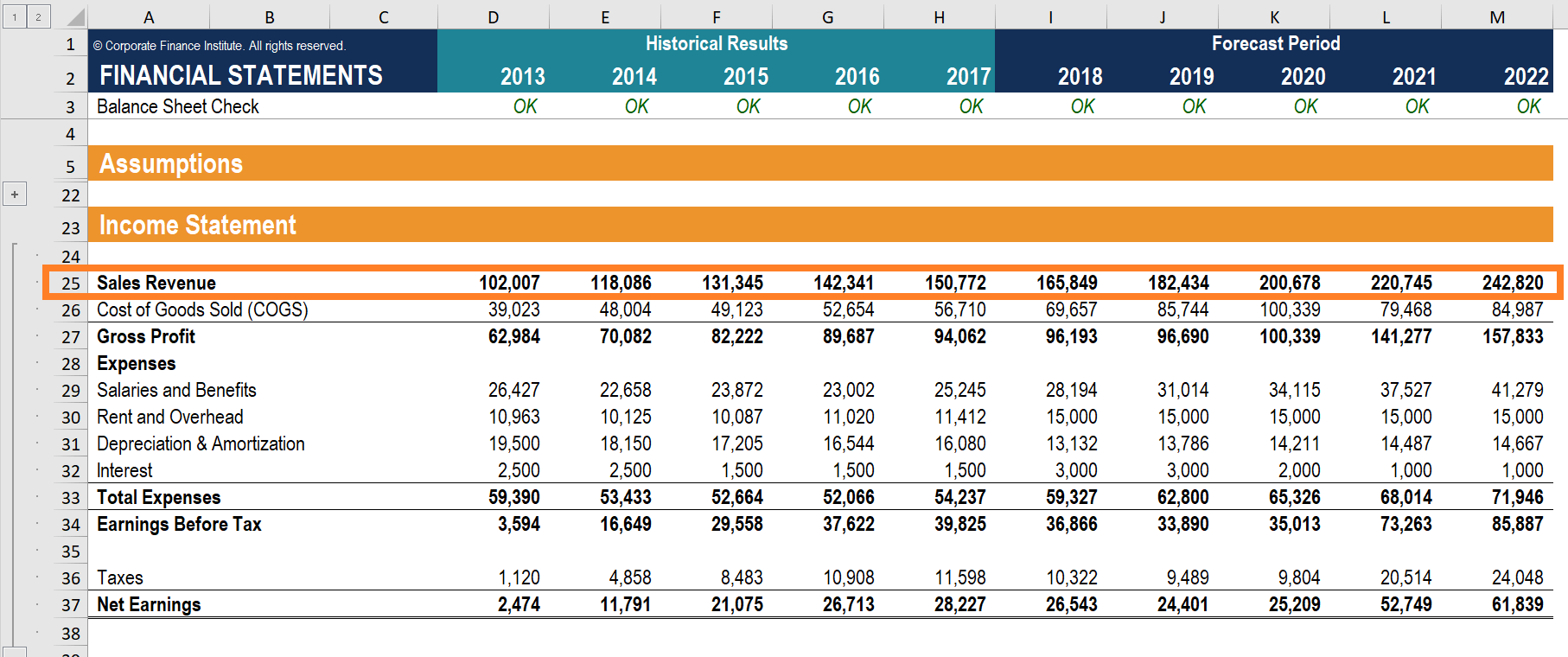

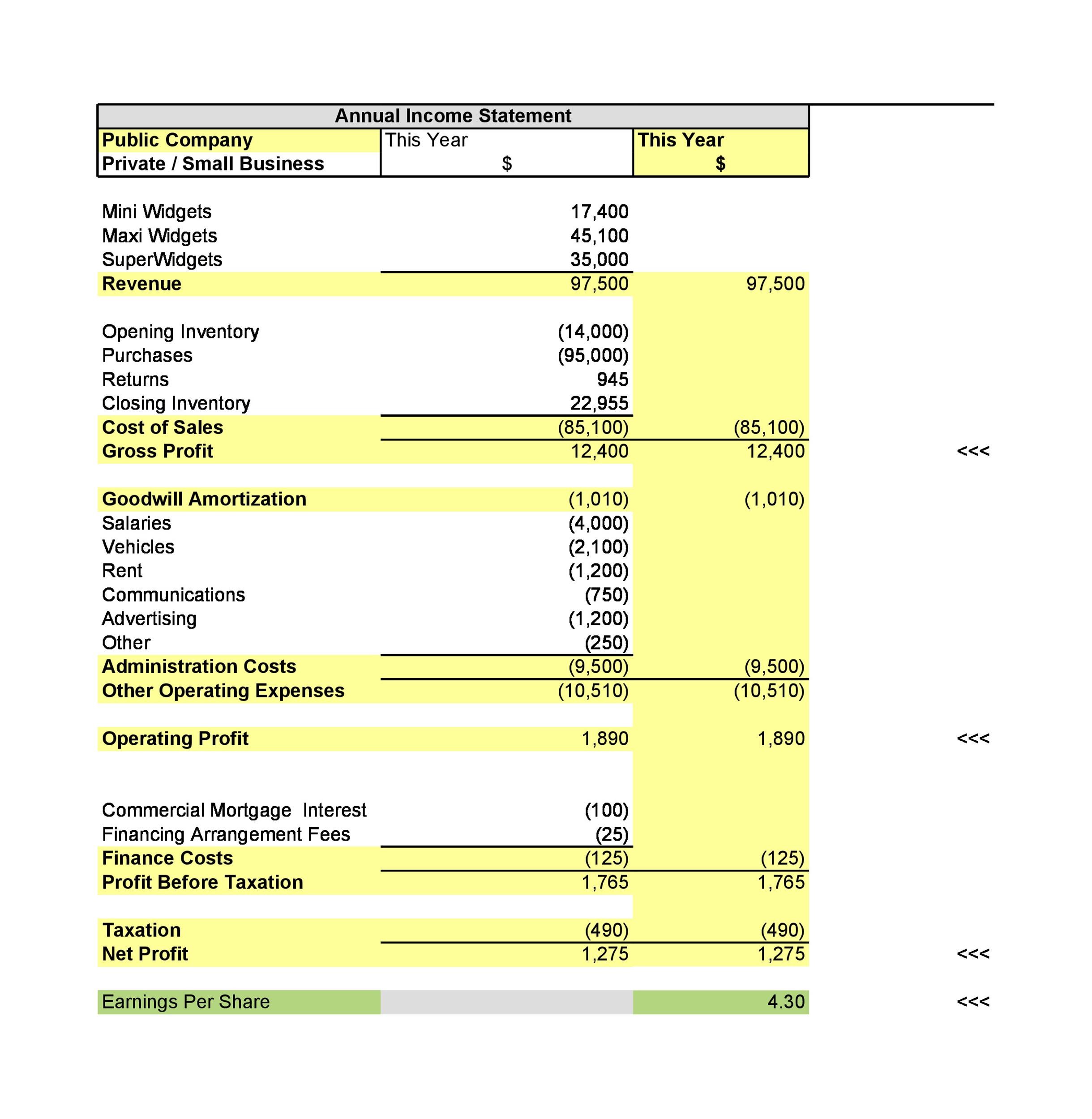

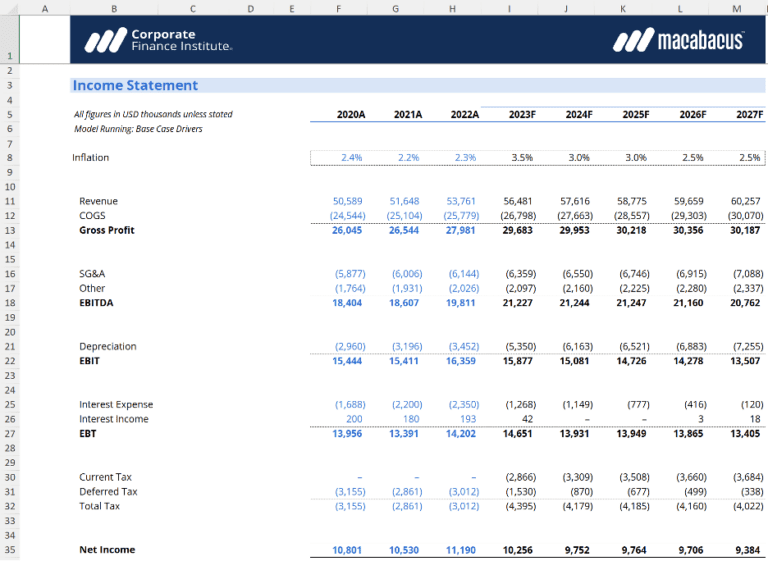

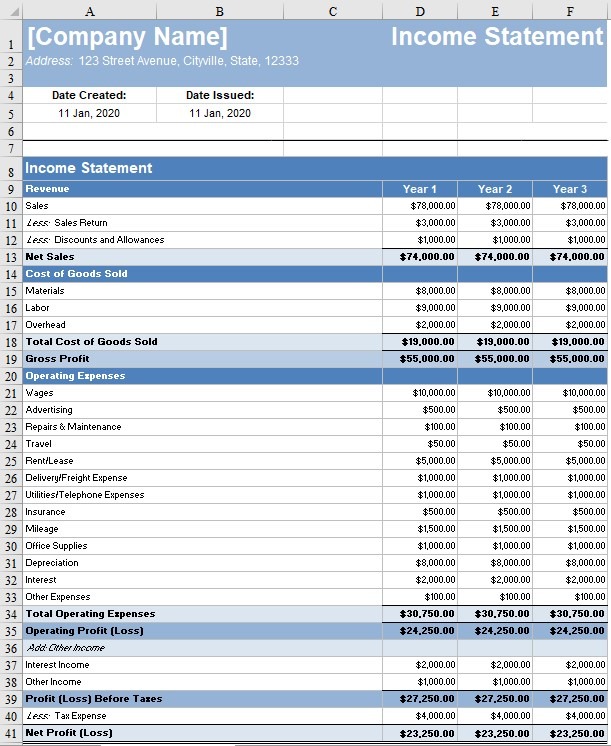

Income statement revenue accounts. It shows all revenues and expenses of the company over a specific period of time. It tells the financial story of a business’s operating activities. Year ended december 31, 2022 year ended june 30, 2022 nine months ended september 30, 2022

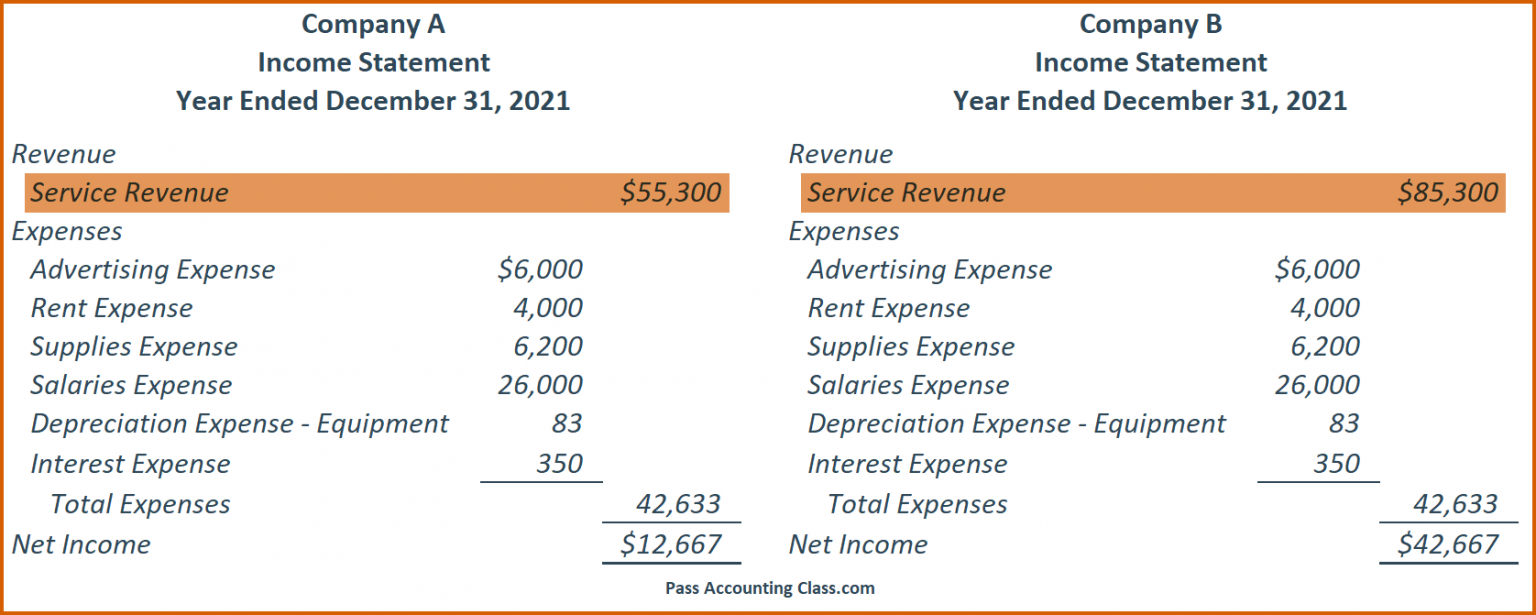

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income. Expenses include cost of sales;

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. When you earn revenue, you need to properly record it in your accounting books. Large companies may have thousands of income statement accounts in order to budget and report revenues and expenses by divisions, product.

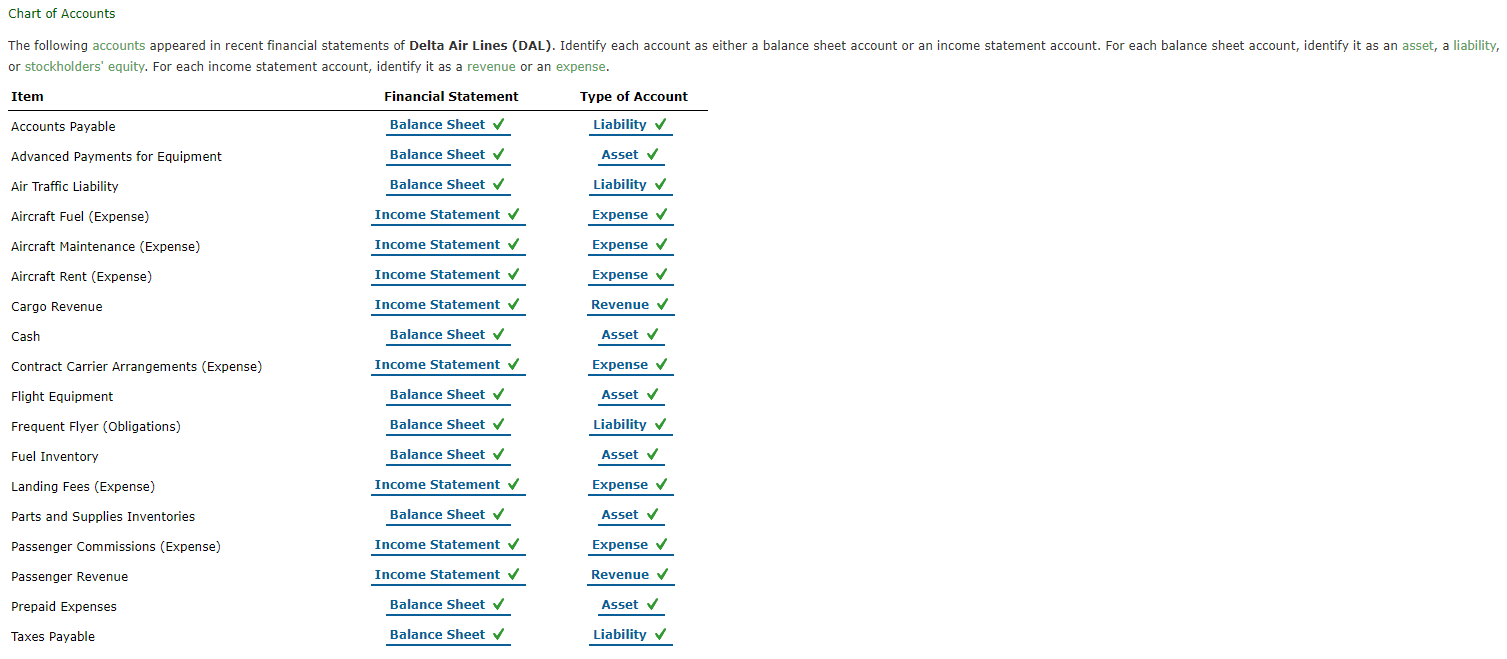

Contains revenue from the sale of products and services. What’s the purpose of an income statement? Revenue accounts include sales, service revenues, and other income such as rent income, royalty income, gain on sale of fixed asset, etc.

Salary as a revenue expenditure. The focus is not on when revenue is earned. This is a contra account, containing discounts granted.

In contrast, the cash basis accounting method accounts for revenue only after it has been paid by the customer and received by the company. These payments include regular wages, overtime pay, and bonuses. Types of revenue accounts.

The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. It shows your revenue, minus your expenses and losses. Income statement accounts are used to sort and store transactions involving:

An income statement is a financial report detailing a company’s income and expenses over a reporting period. Santa clara, calif., feb. The income statement reports revenues, expenses, gains, losses, and the resulting net income which occurred during the accounting period shown in its heading.

Within an income statement, you’ll find all revenue and expense accounts for a set period. Also sometimes called a “net income statement” or a “statement of earnings,” the income. How to read and understand income statements as a small business.

It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement. Gross profit refers to a company's profits after subtracting the costs of producing and distributing its products. Best high yield savings accounts.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)