Here’s A Quick Way To Solve A Info About Unearned Income On Balance Sheet

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed.

Unearned income on balance sheet. The company) is the party with. The same payment of unearned revenue would be treated differently if the company uses income method. Unearned revenue is money received from a customer for work that has not yet been performed.

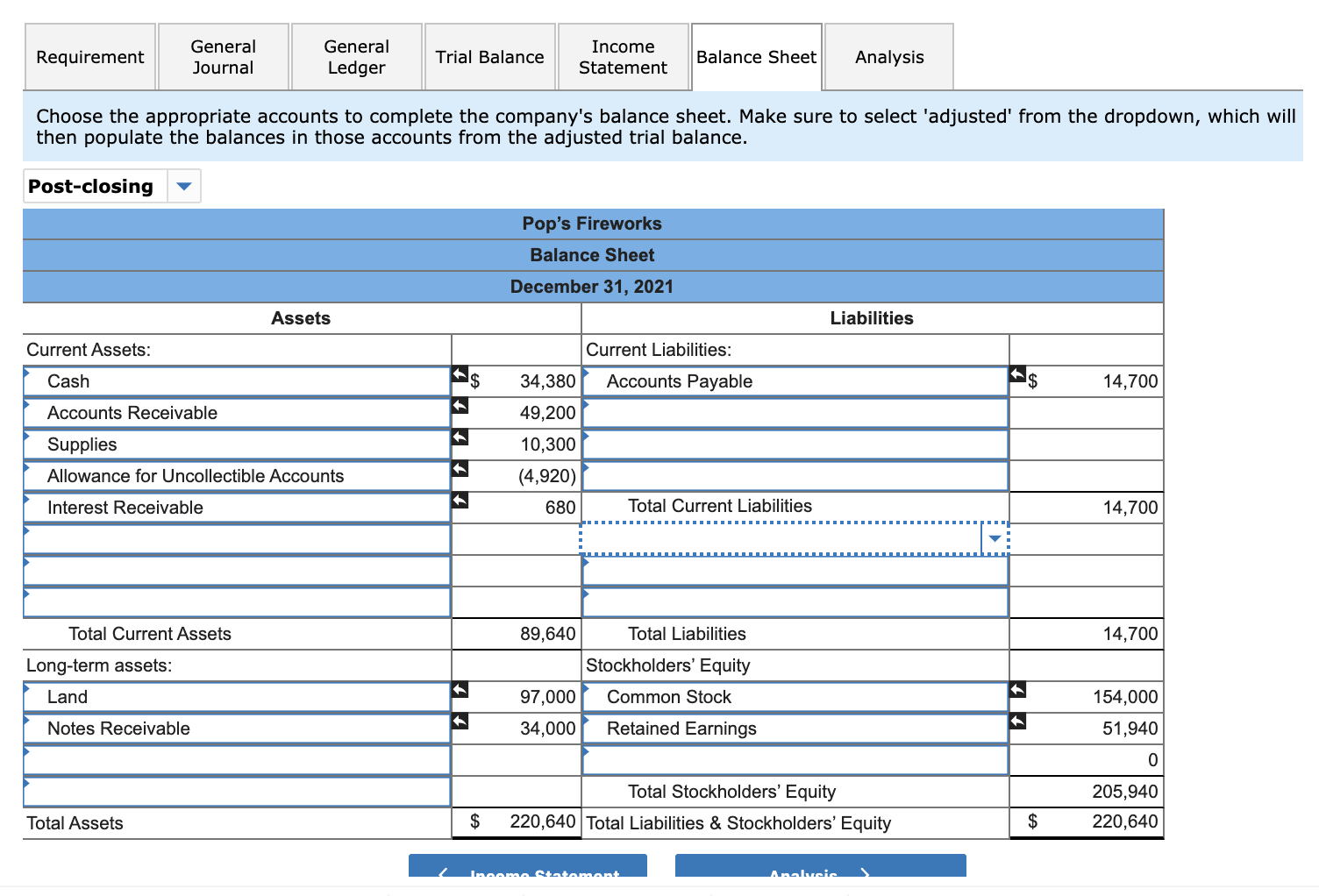

We are simply separating the earned part from the unearned portion. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. Unearned revenue is treated as a liability on the balance sheet because the transaction is incomplete.

More specifically, the seller (i.e. When a company initially receives unearned revenue and has not yet provided the agreed good. Unearned revenue or deferred revenue appears as a liability on the balance sheet.

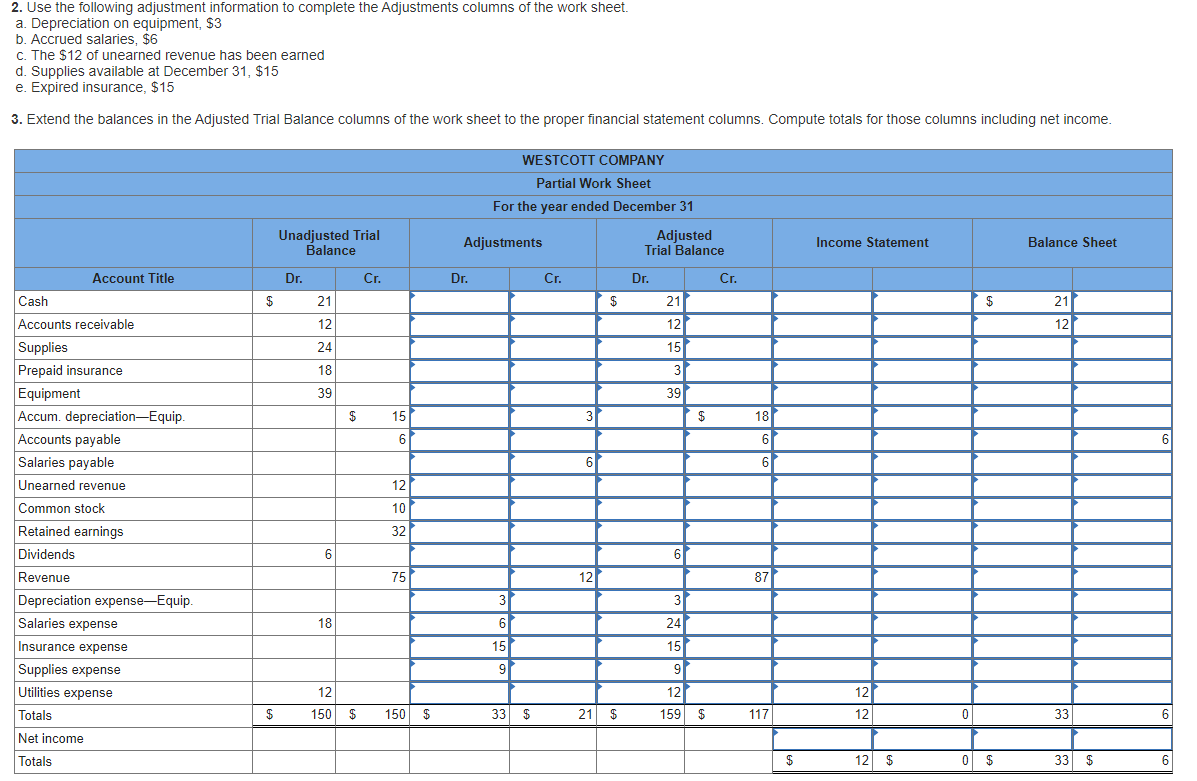

It represents the company’s obligation to provide goods or services in the future. On the balance sheet, unearned revenue is classified as a liability. Of the $30,000 unearned revenue, $6,000 is recognized as income.

This changes if advance payments are made for services or goods due. The income method approaches towards the unearned. Unearned income or deferred income is a receipt of money before it has been earned.

It is essentially a prepayment. Both accrued revenue and accounts receivable are considered assets on the balance sheet, but accounts receivable is listed separately from accrued revenue. The balance sheet, also known as the “statement of financial position,” presents a snapshot of a business's.

It does not initially appear on the income statement but is transferred to the. In denver, for example, a. Unearned revenue is usually disclosed as a current liability on a company’s balance sheet.

Unearned revenue refers to the money small businesses collect from customers for a or service that has not yet been provided. How does unearned revenue appear on the balance sheet? The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends.

This is also referred to as deferred revenues or customer deposits. The term “unearned income” (u.i.) refers to the income generated through sources other than the traditional source of employment. In the entry above, we removed.

Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. However, at the end of the first month, the monthly portion of the total amount ($79/12=$6.58) will be deducted from the unearned revenue figure and recorded as the revenue. Unearned revenue is recorded on a company’s balance sheet as a liability.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)