Amazing Info About Note Payable In Cash Flow Statement

A common error when preparing the cash flow statement is to present the repayment of €40,000 of the note payable as an outflow of $48,000 (the amount of the debt repayment remeasured to us dollars at the beginning of the period).

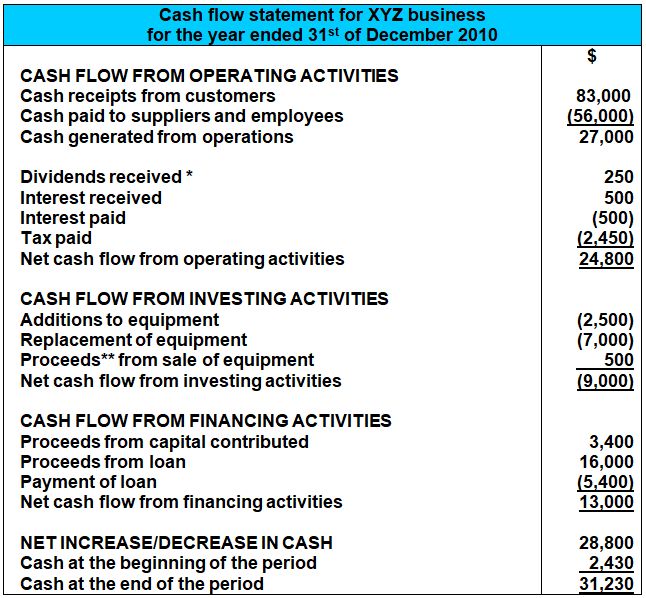

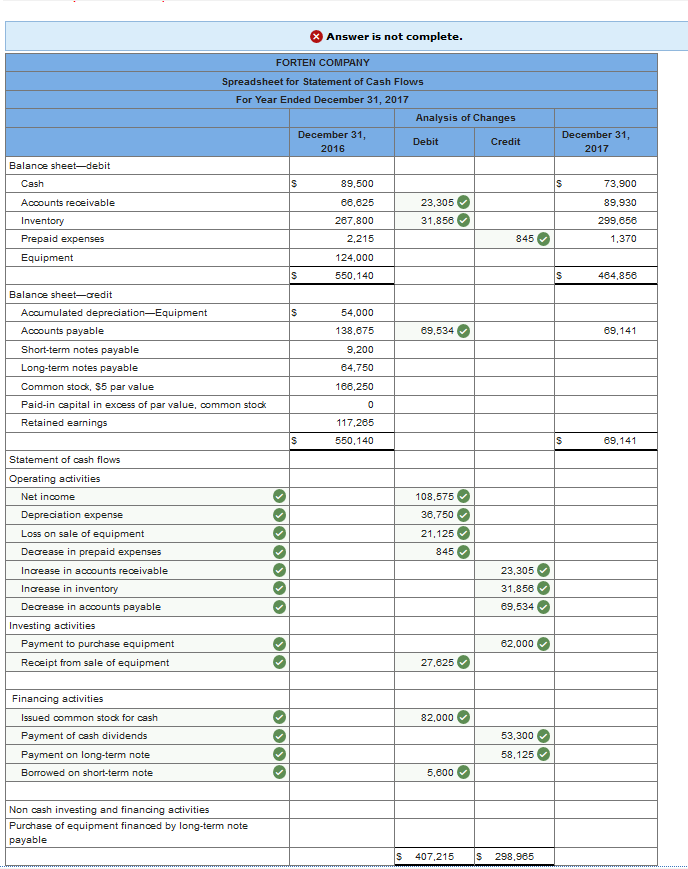

Note payable in cash flow statement. How does accounts payable increase? Cash flow definitions cash flow: Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Cash flows related to notes payable affect the financing and operating activities sections of the statement. A cash flow statement is a financial statement that presents total data.

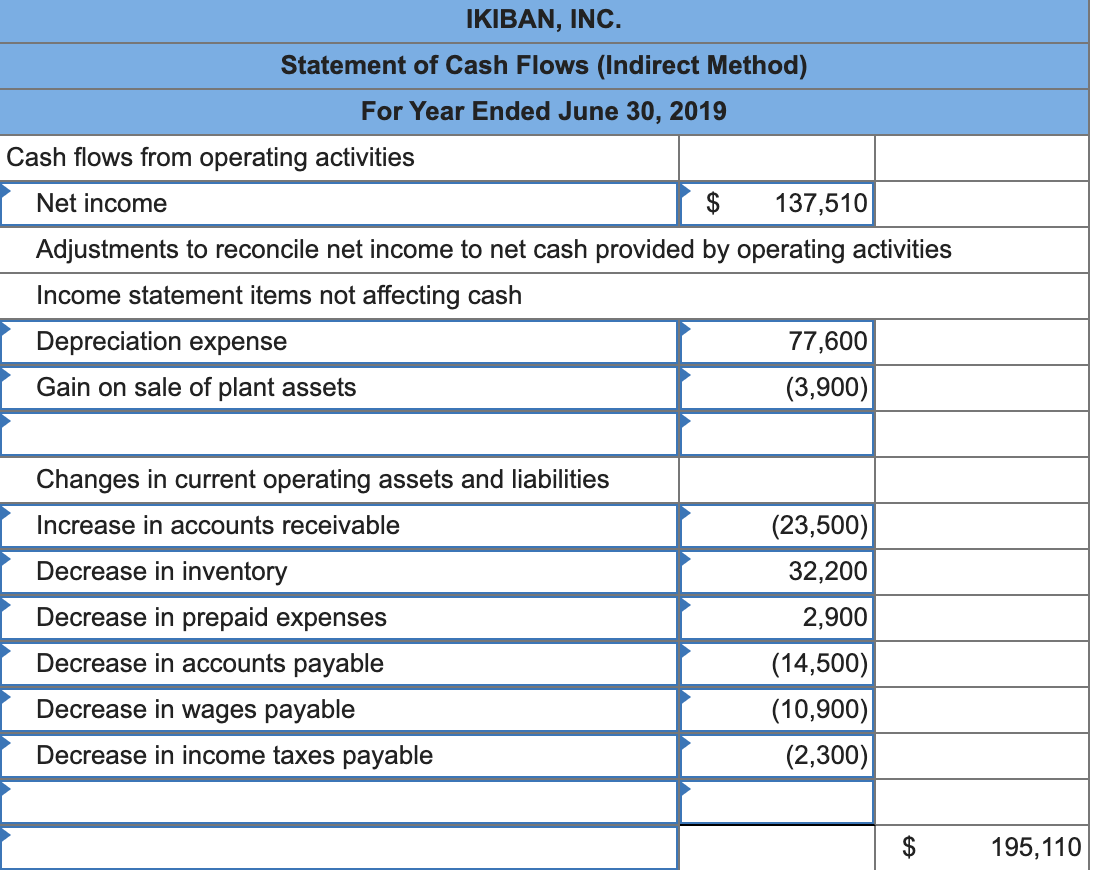

Notes payable cash flow statement definition. Preparing a statement of cash flows is made much easier if specific steps in a sequence are followed. The cash flow statement reflects the actual amount of cash the company receives from its operations.

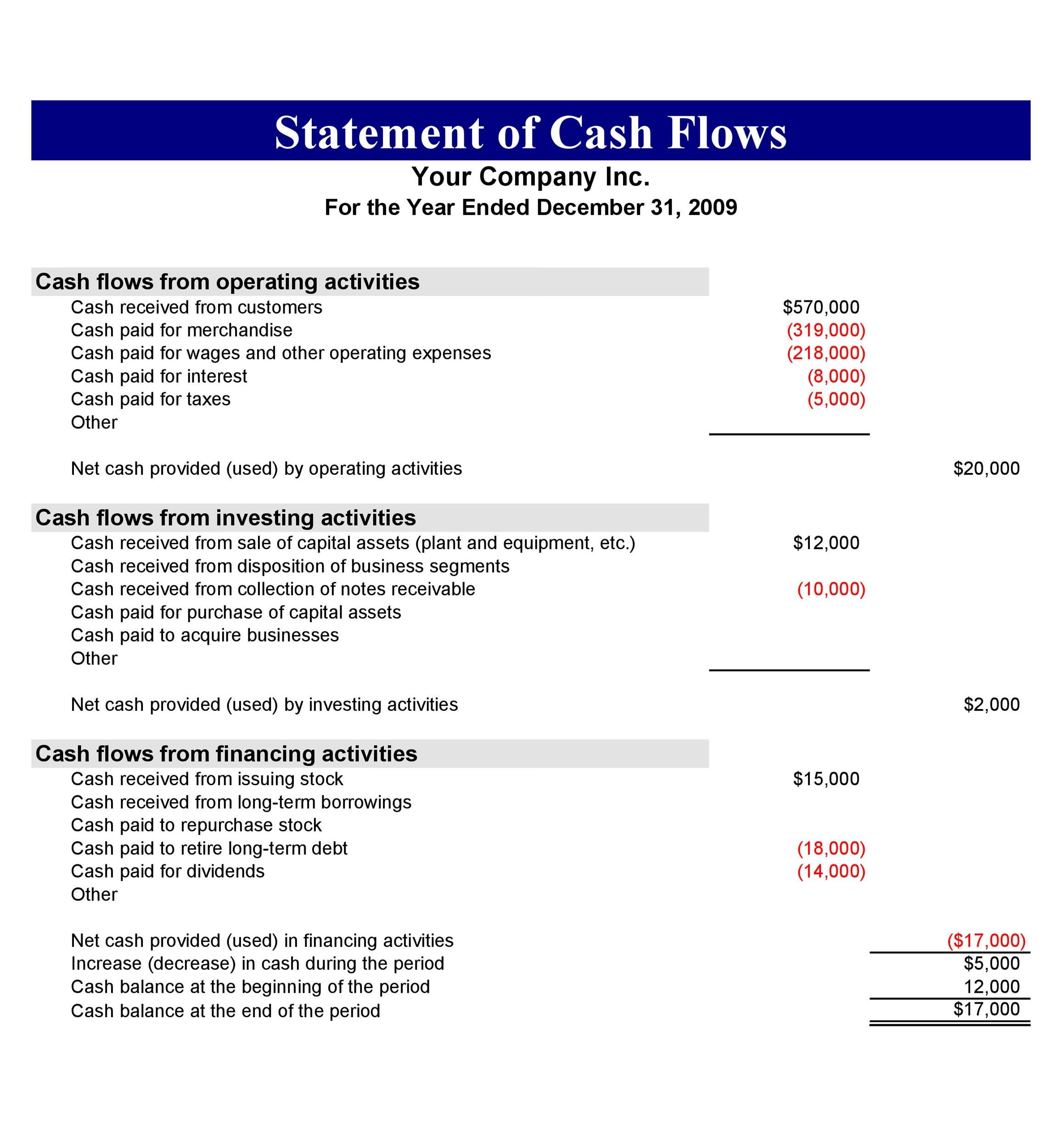

Common items in this section of the statement include the payment of dividends, issuance of common or preferred stock, and issuance or payment of notes payable (see figure 5.18). A cash flow statement tells you how much cash is entering and leaving your business in a given period. Add back noncash expenses, such as depreciation, amortization, and depletion.

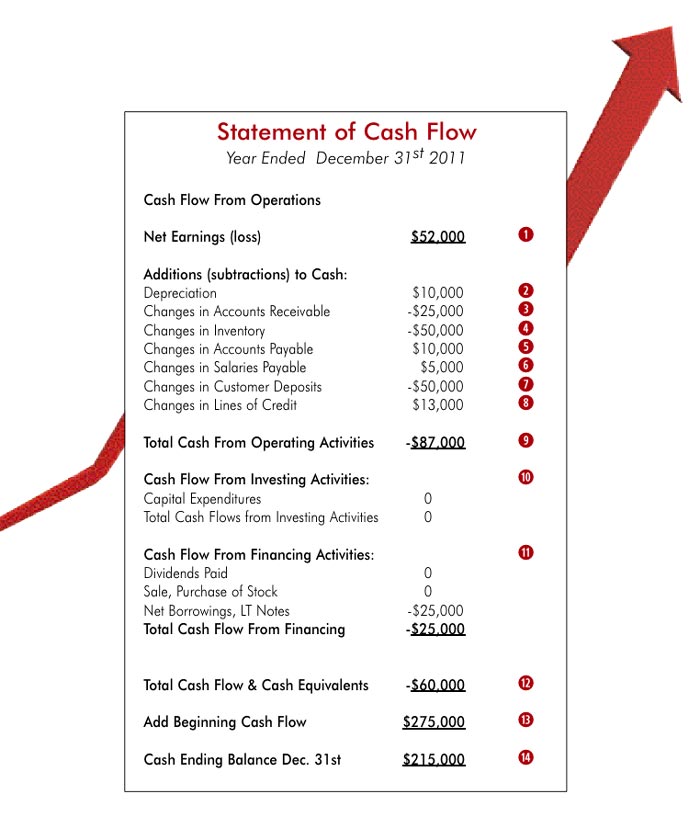

Notes payable have an effect on cash flow when a company receives or pays back the proceeds and when it makes regular interest payments. Increase in notes payable when a business takes on a new loan or note, it. In this article, we discuss what notes payable are, whether notes payable should appear on cash flow statements, where to record notes payable on cash flow statements and how notes payable impact cash flow statements.

Borrowing when a company receives the note proceeds, it debits cash and credits notes payable. On the cash flow statement, you start out with the $95,000. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections:

An inflow occurs when cash is paid to a business. In the current year, clear lake took out additional notes payable (a cash inflow). This statement can be used to assess a company’s financial health and liquidity.

A note payable affects the cash flow statement by reducing the amount of cash that a company has available, as payments must be made to repay the loan. The cash flow statement is required for a complete set of financial statements. On the cash flow statement, the accounts payable is a line item under the operating activities section.

Begin with net income from the income statement. Notes payable appear as liabilities on a balance sheet. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

Additionally, they are classified as current liabilities when the amounts are due within a year. The statement of cash flows can be challenging to prepare. At the same time, it also increases a company’s liabilities, as they are required to.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)