Marvelous Tips About Statement Of Cash Flows Cheat Sheet

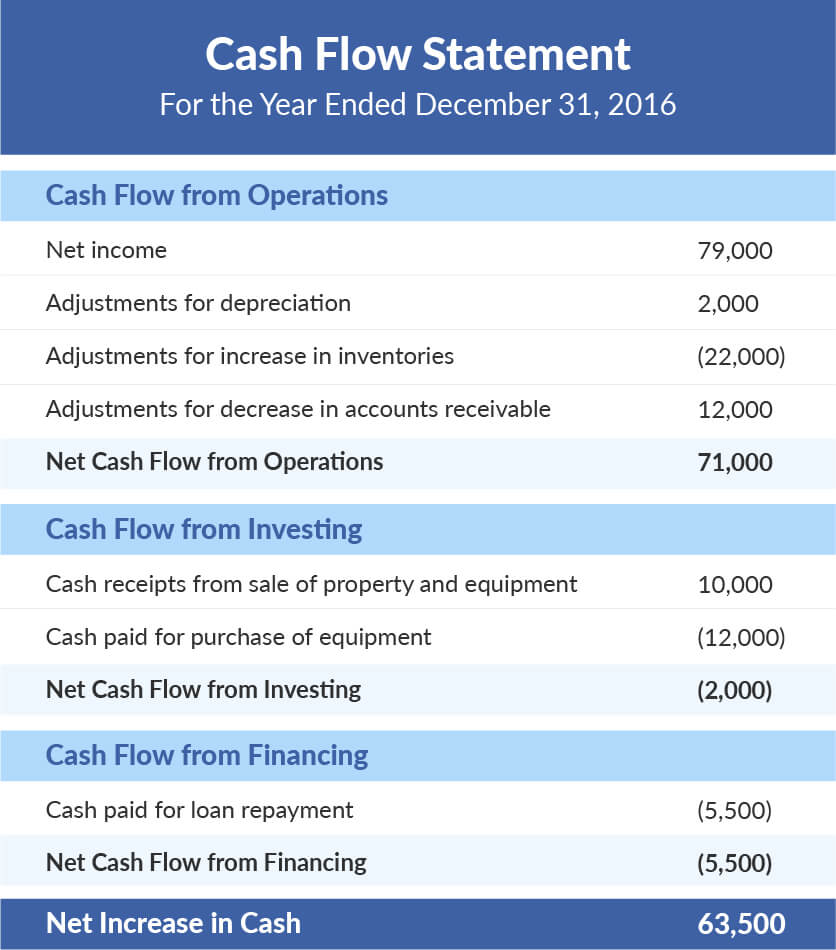

Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

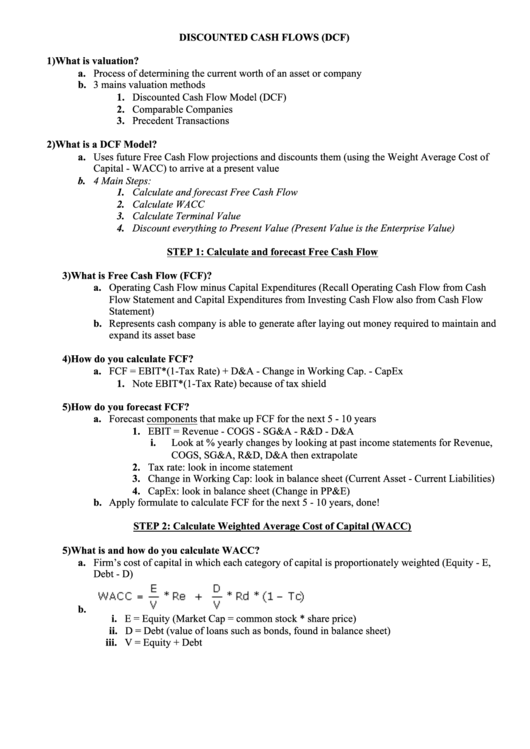

Statement of cash flows cheat sheet. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). A cash flow statement tells you how much cash is entering and leaving your business in a given period. The statement of cash flows is prepared by following these steps:

The worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. Understand all the various types of cash flow. Managing cash flows is essential to the successful operation of your business.

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Statement of cash flows is one of the four financial statements which shows the cash movement, cash inflow and cash outflow of the business, and the overall change of cash balance of the company during the accounting period which could be monthly, quarterly, or annually. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities. Recall that financing activities are those used to provide funds to run the business.

Summary of investing and financing transactions on the cash flow statement; Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. How to create a cash flow statement

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established. Accounting closing dates as starting and ending periods An entity presents its cash flows from operating, investing and financing activities in a manner which is most appropriate to its business.

Cash flow from investing activities; What is a cash flow statement? Cash flow statements always show the movement of cash over a period of time.

Common items in this section of the statement include the payment of dividends, issuance of common or preferred stock, and issuance or payment of notes payable (see figure 5.18). Simply enter the financial data for your business, and the template completes the calculations. The statement of cash flows is prepared by following these steps:

You should think of cash flow as the lifeblood of your business, and you must keep that blood circulating at all times in order avoid failure. Add back noncash expenses, such as depreciation, amortization, and depletion. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Begin with net income from the income statement. The main purpose of the.