Divine Tips About Prepare An Income Statement For The Year

Home » how to prepare an income statement it’s a key metric used to determine financial health and forecast how businesses might perform in the future.

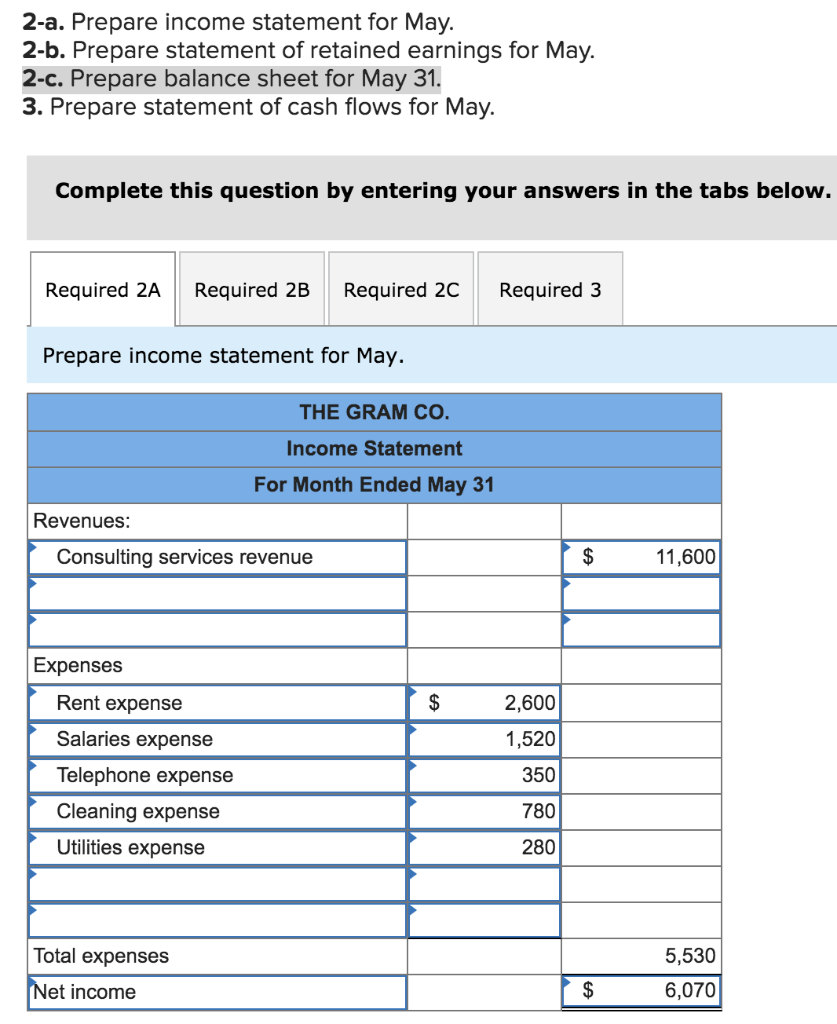

Prepare an income statement for the year. An income statement depicts a company’s financial performance by listing all of its expenses as well as how much money it has earned during the reporting period. Large companies/businesses report quarterly, but small companies do not need to apply restrictions while reporting. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york.

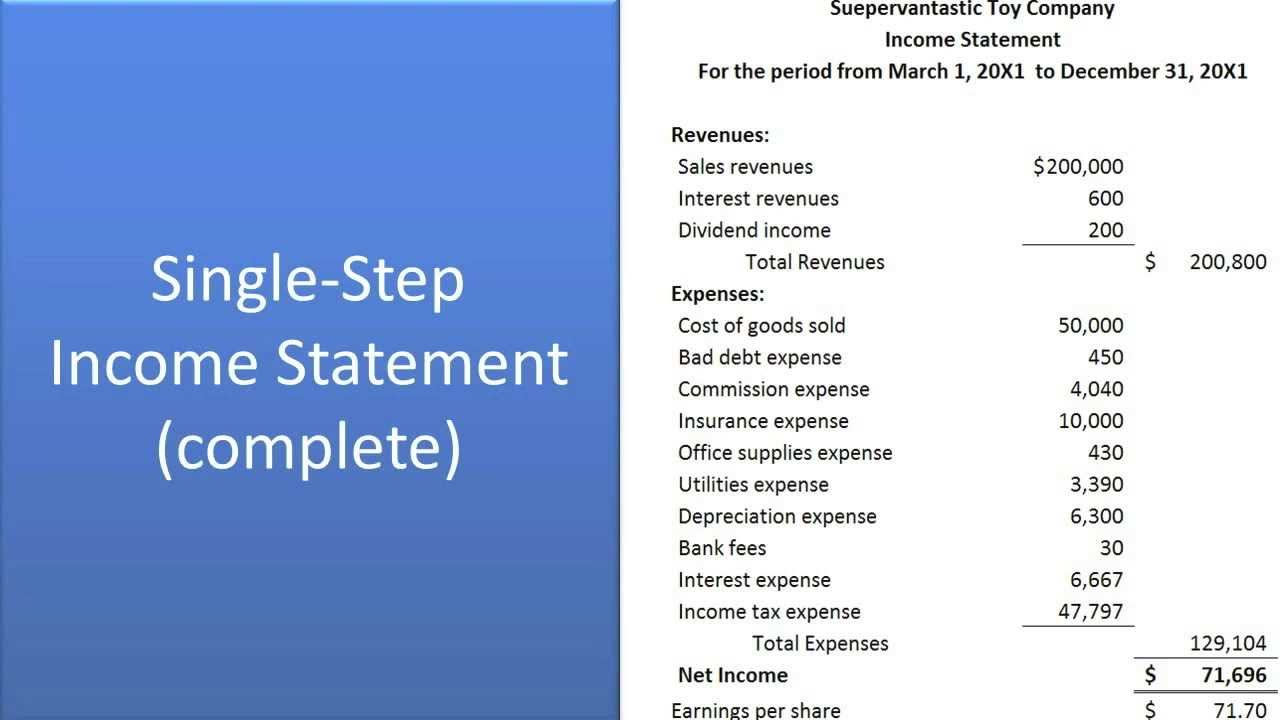

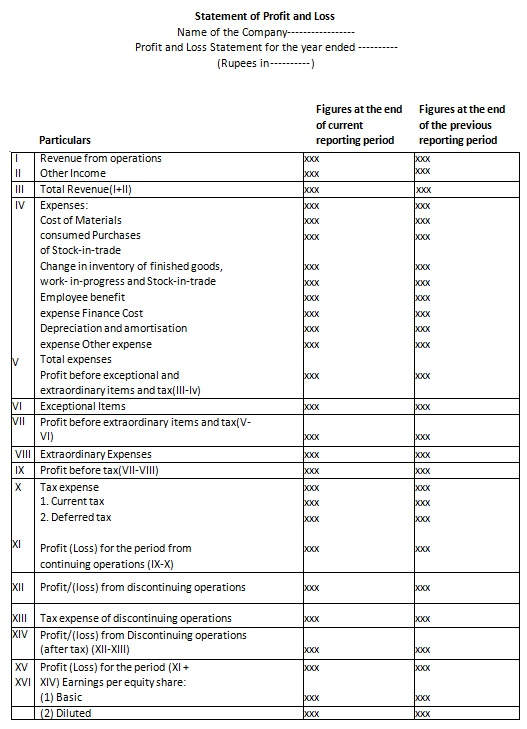

The civil fraud ruling on donald trump, annotated. An income statement, also known as a profit and loss statement (p&l statement), summarizes a business’s revenues and expenses over a period of time. The income statement may be presented in a separate report and another report for statement of comprehensive income can be prepared to show the additional other comprehensive.

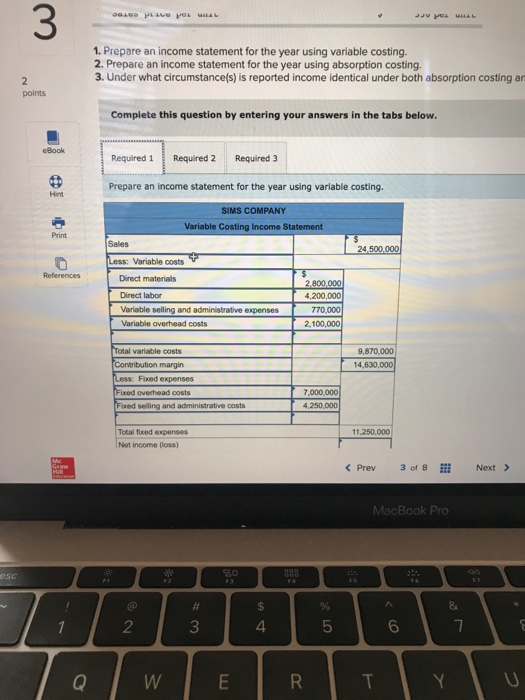

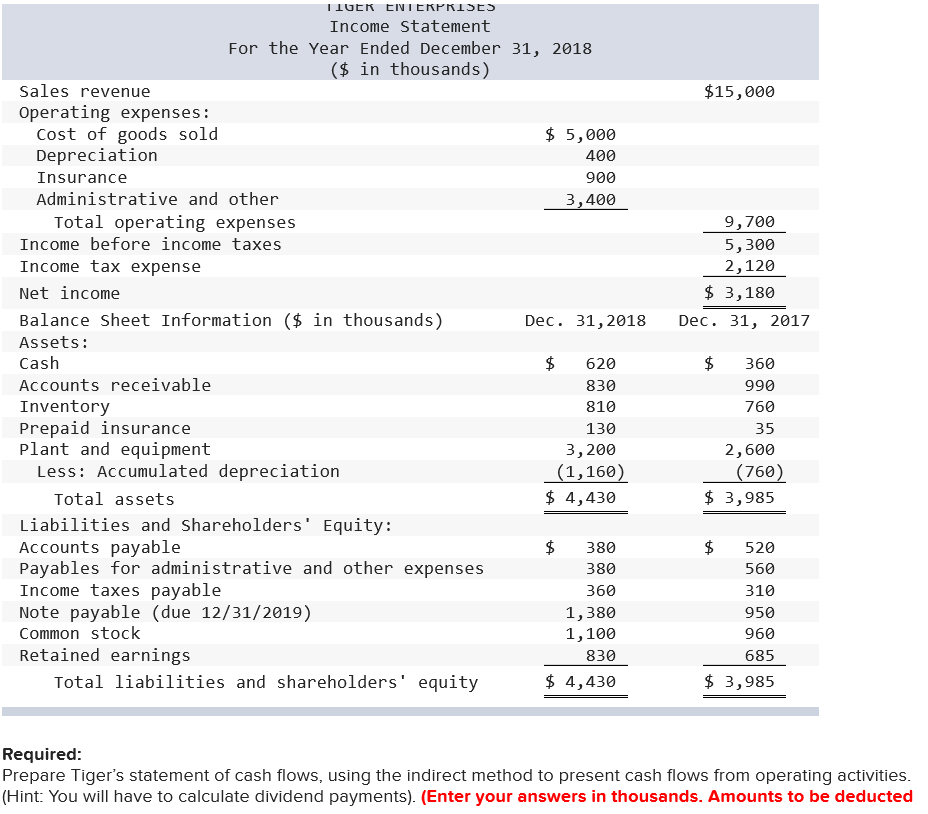

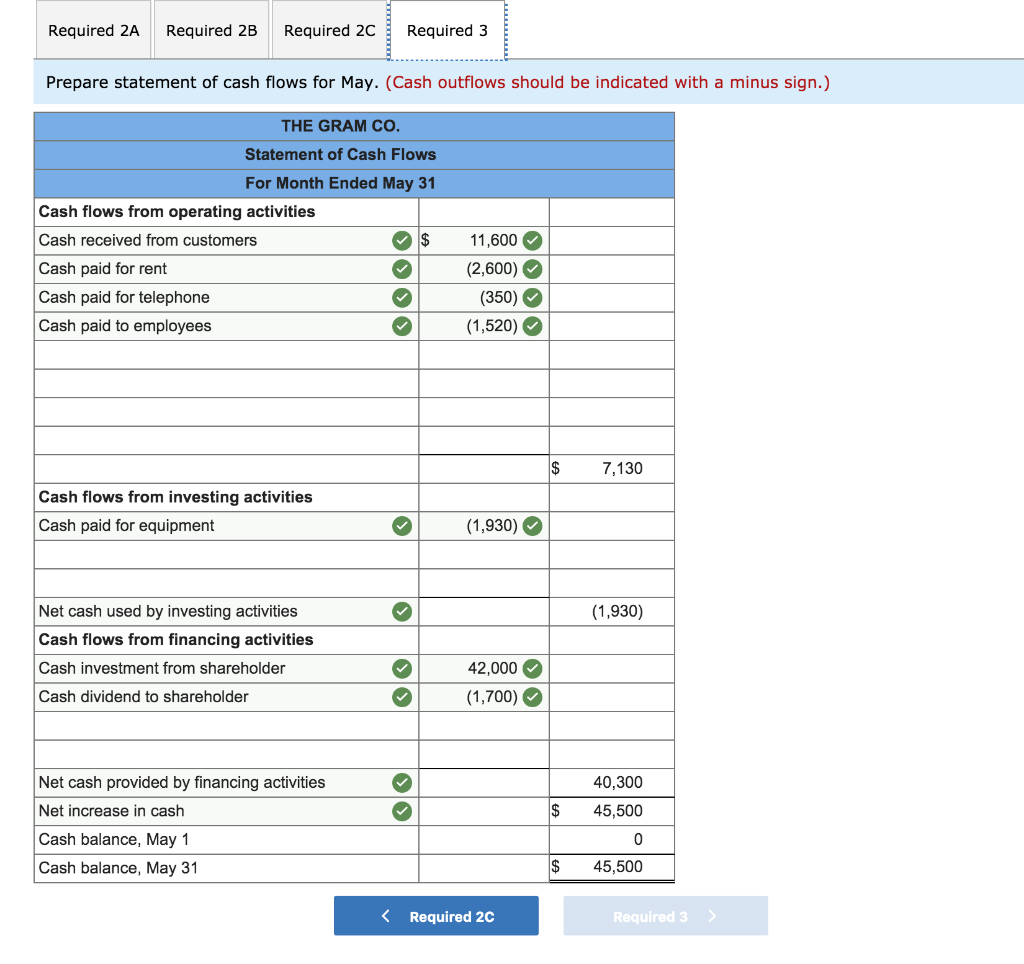

The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Revenue, gains, expenses, and losses. Put simply, an income statement follows this equation:

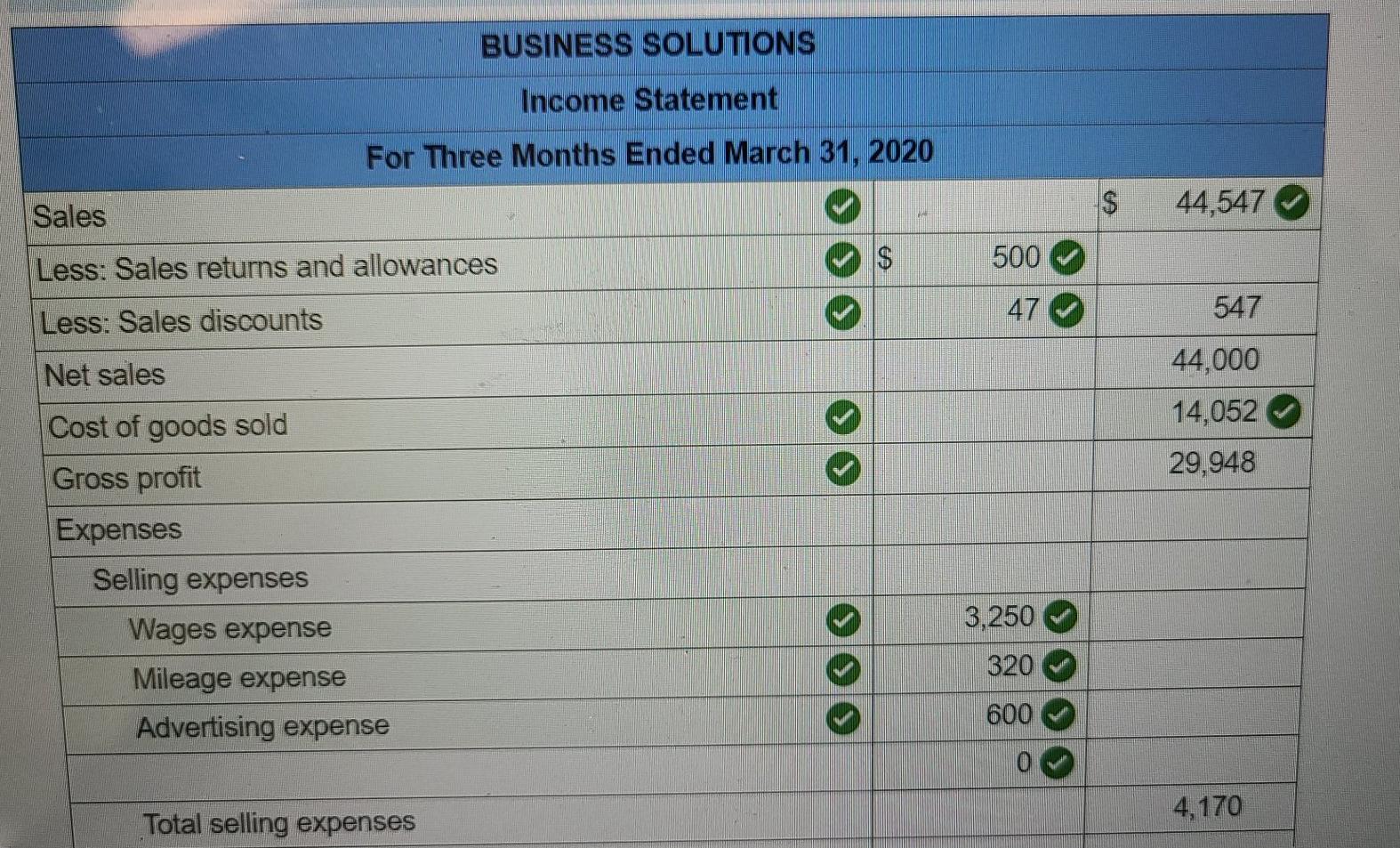

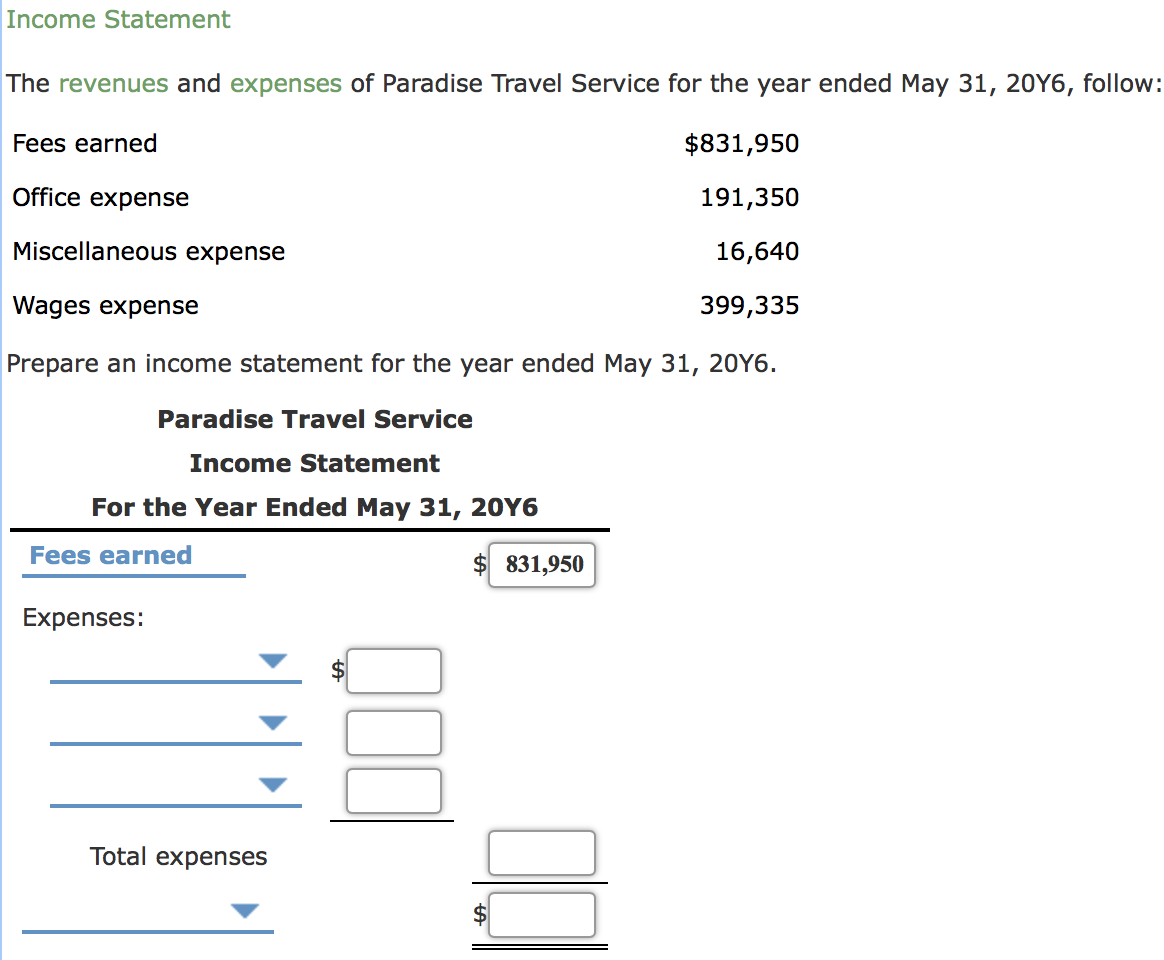

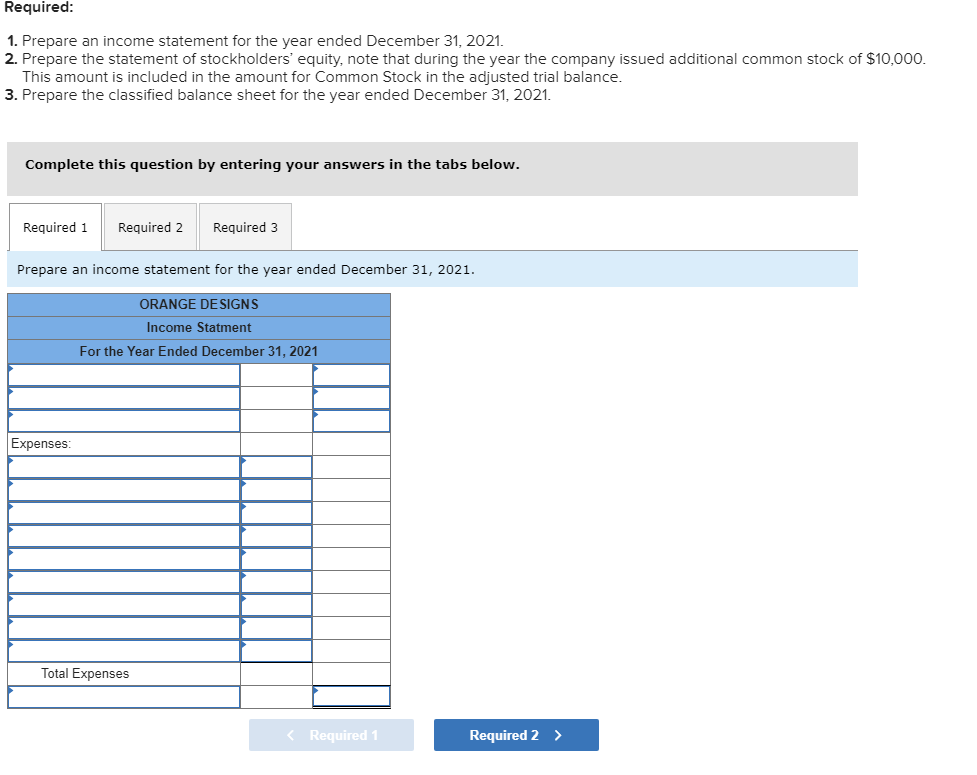

Subtract returns, discounts, and other allowances For this step, take some time to fully identify all operating expenses your business incurs to ensure you’re getting the full picture. When you prepare an income statement, there are four main categories to take into account:

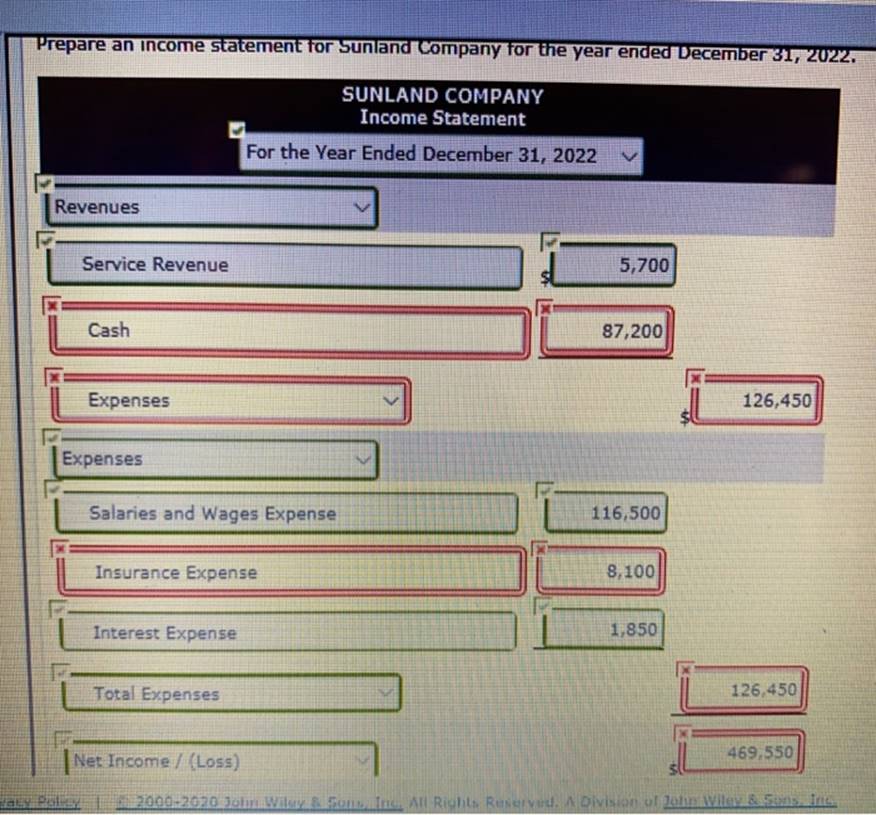

The income statement can either be prepared in report format or account format. Key takeaways an income statement demonstrates financial performance by showing all income and expenses your business incurs in a selected operating period. Start with revenue the first step is to add revenue figures for your reporting period.

To create an income statement for your business, you’ll need to print out a standard. An income statement is a document that tracks a business's revenue and expenses over a set period of time. It reports net income by detailing a business’s revenues, gains, expenses, and losses.

When preparing an income statement, revenues will always come before expenses in the presentation. Steps to prepare an income statement 1. Publicly traded companies like apple inc.

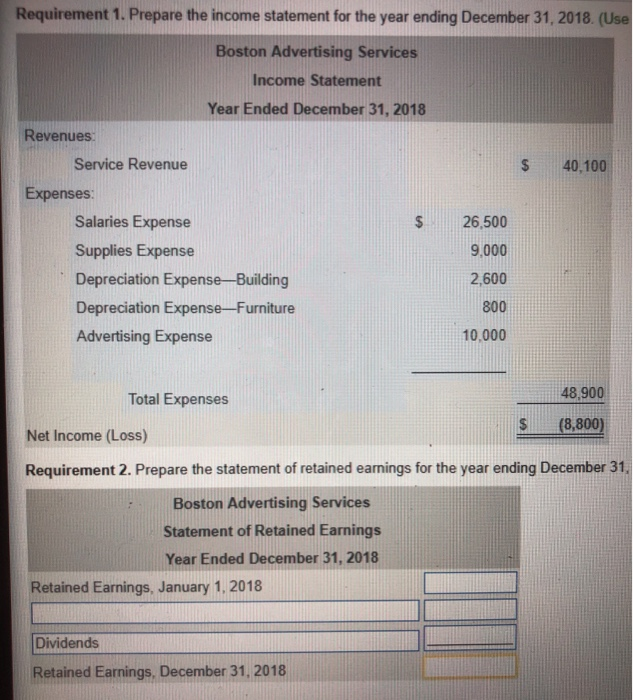

The income statement presents the revenues, expenses, and resulting profit or loss of a business. By rosemary carlson updated on april 13, 2020 the income statement is another name for the small business owner’s profit and loss statement. For printing plus, the following is its january 2019 income statement.

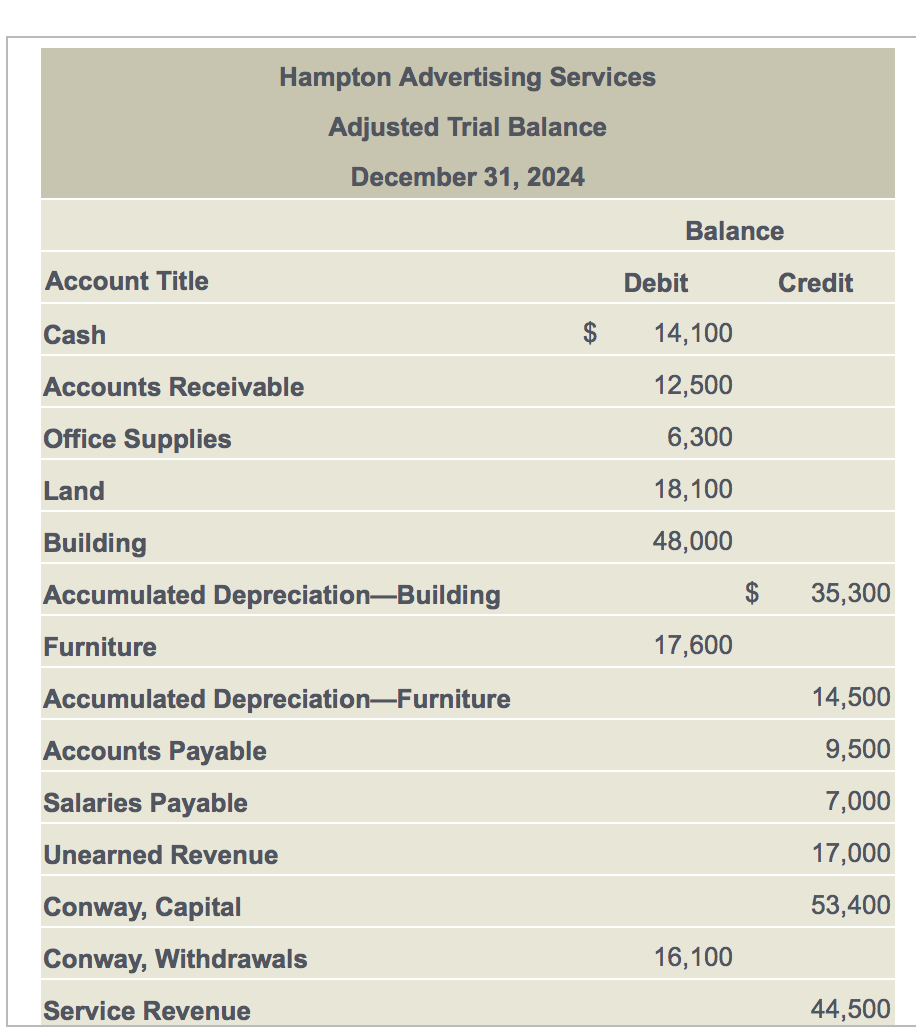

An income statement shows the organization’s financial performance for a given period of time. Identify sources of revenue, as well as gains (from investments, for example) identify company expenses and losses incurred over the same period. The heading of a financial statement is often made up of three lines.

In an accounting system, the best tool to take information from would be the. Businesses usually prepare their income statements monthly, quarterly, or yearly. Calculate total revenue once you know the reporting period, calculate the total revenue your business generated.

![[Solved] 1. Prepare an statement for the year usin](https://media.cheggcdn.com/media/7c9/7c9e8969-c124-4a98-b0a1-ce1c7a085e80/phpkWSkjR)