Brilliant Strategies Of Info About Increase In Accounts Payable Statement Of Cash Flows

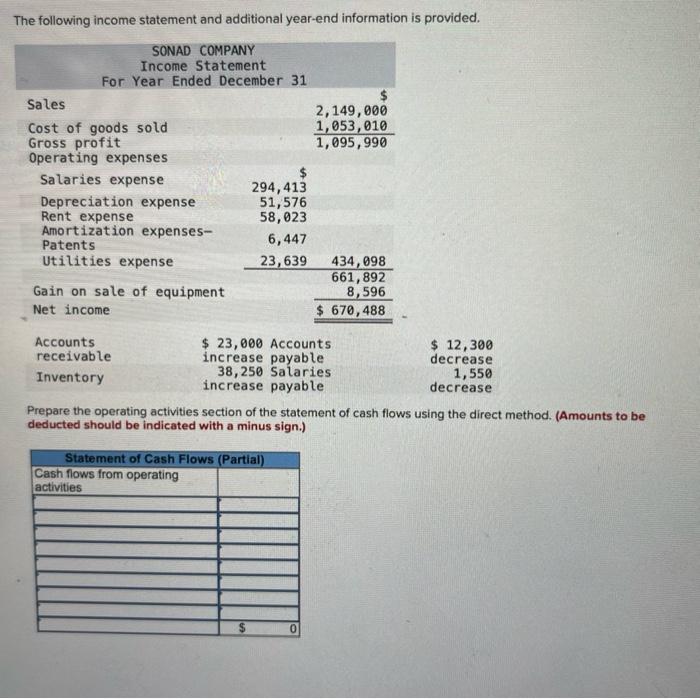

Asc 230 allows a reporting entity to prepare and present its statement of cash flows using either the direct or indirect method (see fsp 6.4.2), though asc.

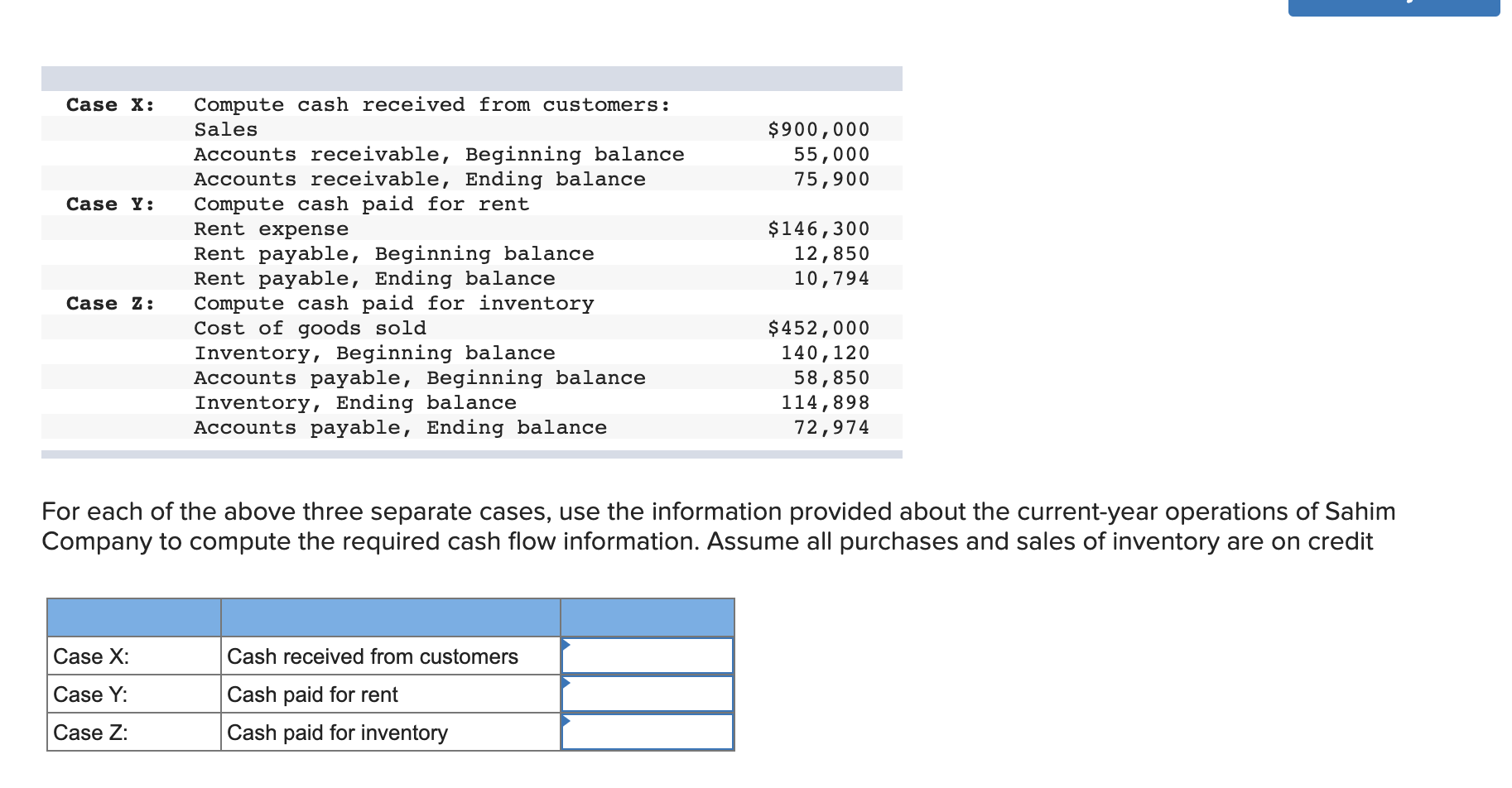

Increase in accounts payable statement of cash flows. A negative number means cash flow. Transactions that show a decrease in assets result in an increase in cash flow. Where do notes payable go on a cash flow statement?

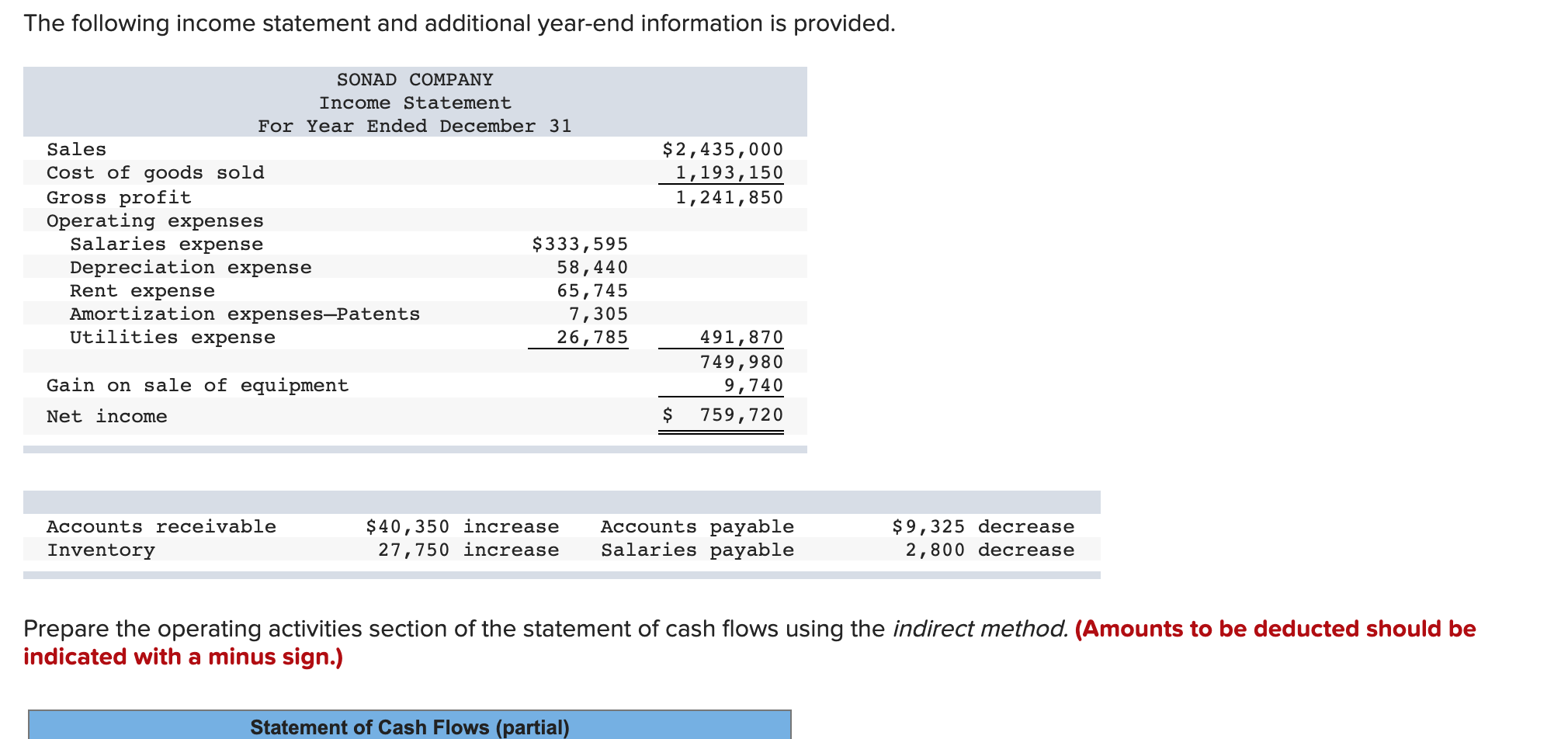

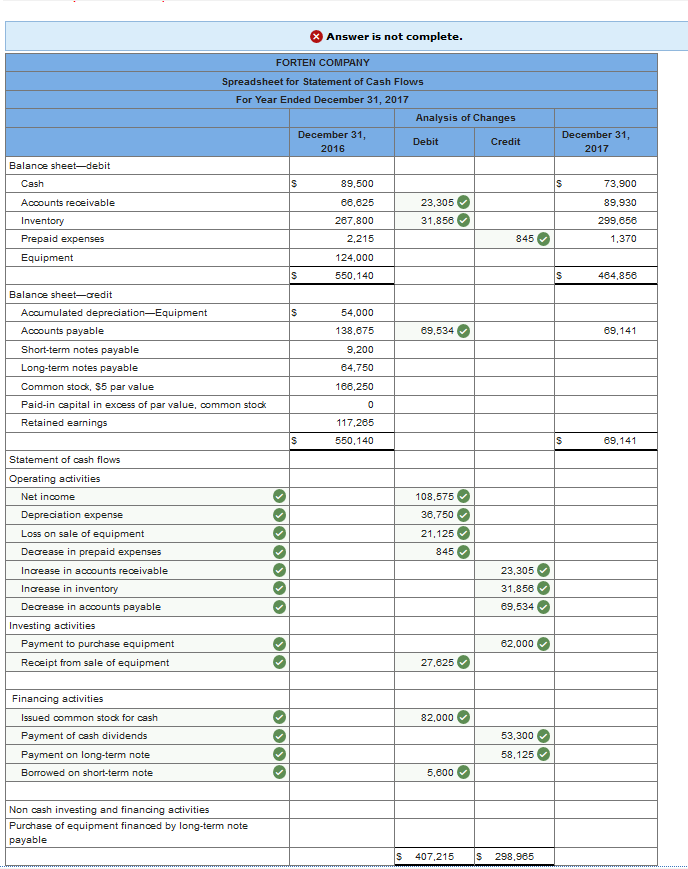

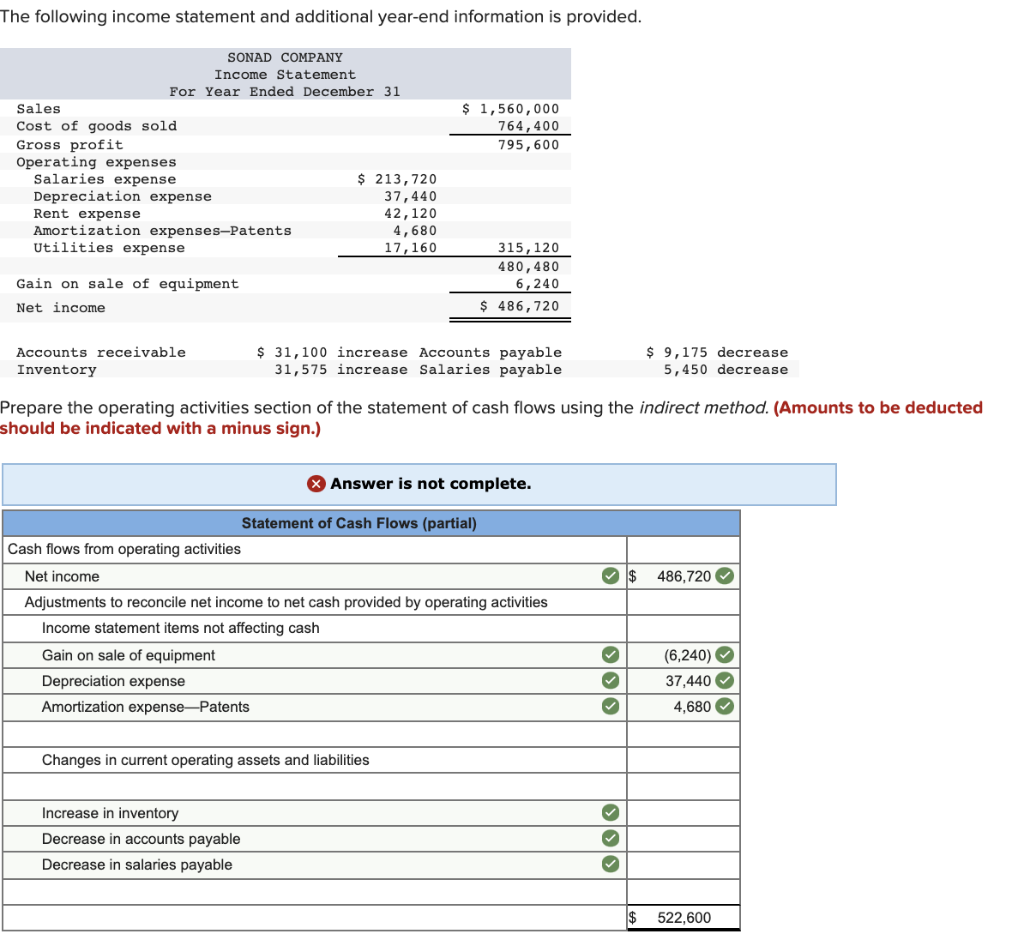

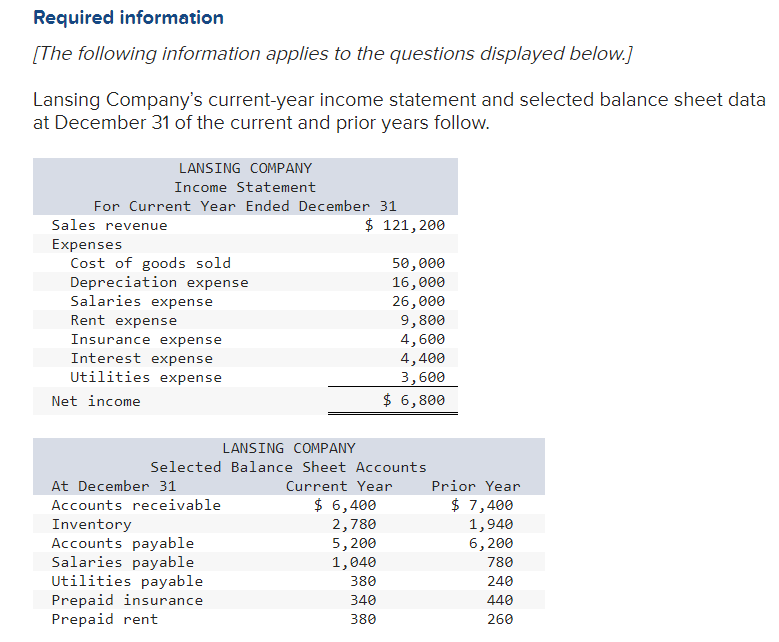

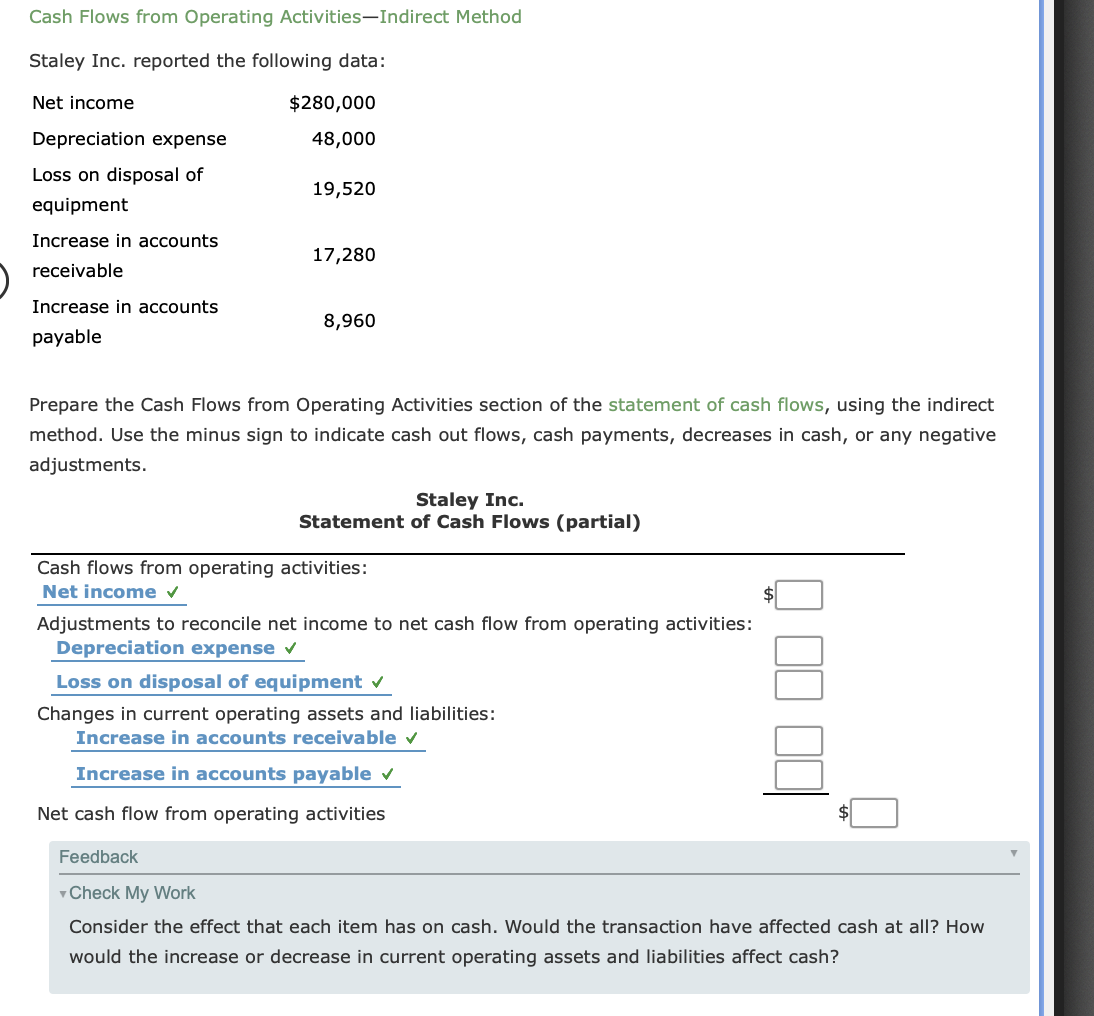

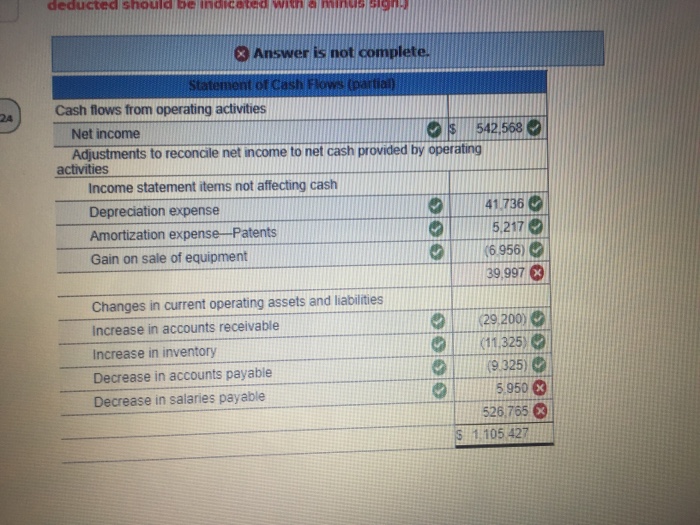

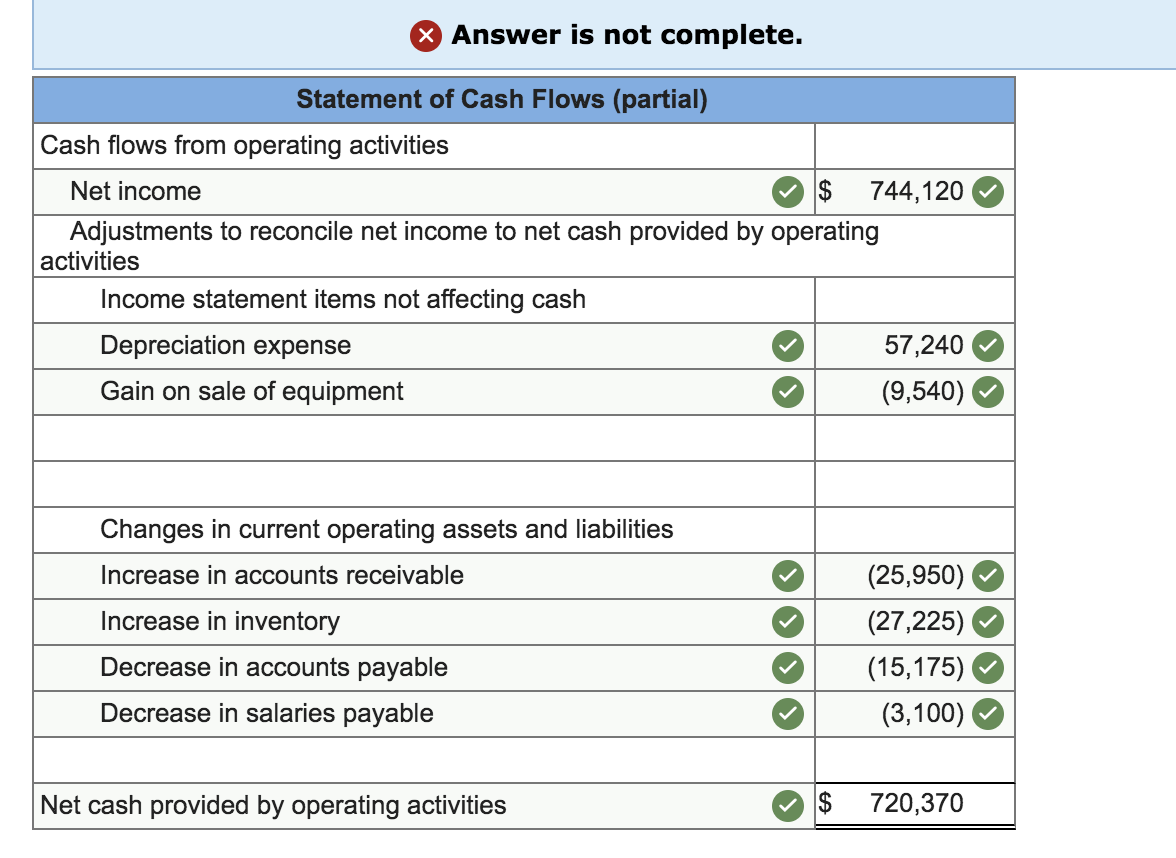

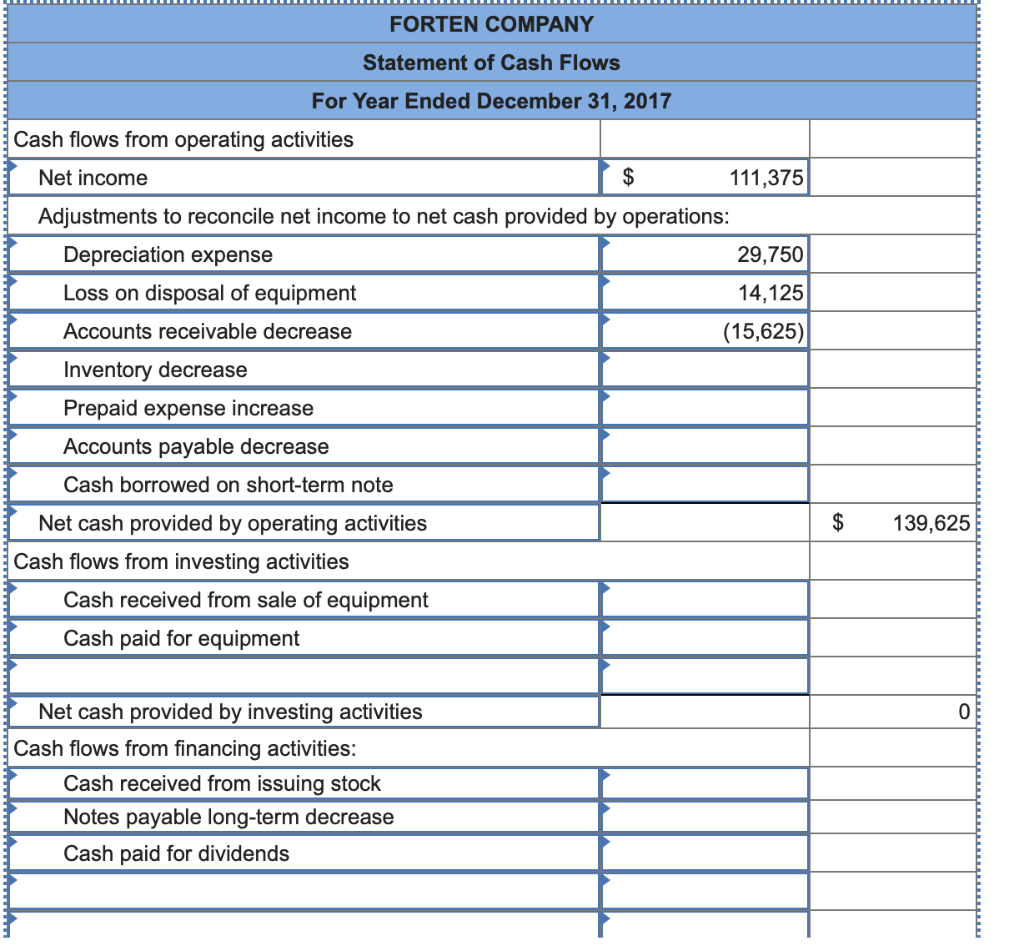

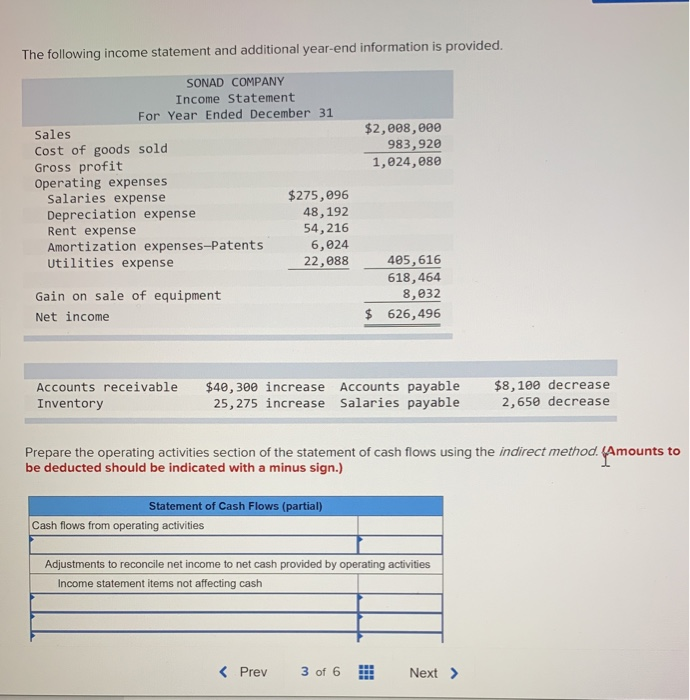

The statement of cash flows is prepared by following these steps: Begin with net income from the income statement. This transaction of the credit purchase has saved us from spending cash for the time being.

Add back noncash expenses, such as depreciation, amortization, and depletion. Calculation companies need to calculate the increase of decrease in accounts payable prior to including it on the statement of cash flows. Begin with net income from the income statement.

Accounts payable increases means cash not spent. Cash flow statements (cfs) provide a summary of the cash that a company brings in and spends in a given time period, also called cash inflow and cash outflow. Therefore, an increase in payables is added to the amount of net income.

Thus, an increase in the accounts payable will increase the cash flow. In this journal entry, there is an increase in accounts payable increase (credit) as a result of making the purchase on credit. The reason for this is that ap is actually an accounting term, and this indicates that a company has not immediately spent cash.

Therefore, when a company does not pay its creditors and suppliers, it is keeping cash. The economic decisions that are taken by users require an. Impact of a decrease in current liabilities.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. Paying out less cash is good/favorable for the company's cash balance. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

A decrease in accounts payable represents that cash has actually been paid to vendors/suppliers. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. The spot rate for euros was $1.20 per €1.

Transactions that show an increase in liabilities result in an increase in cash flow. Information about the cash flows of an entity is useful in providing users [refer: Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Increasing the frequency of paying back vendors affects cash flow negatively, while decreasing it affects cash flow positively. Increasing accounts payable is a source of cash, so cash flow increased by that exact amount.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)