One Of The Best Info About Provisions Income Statement

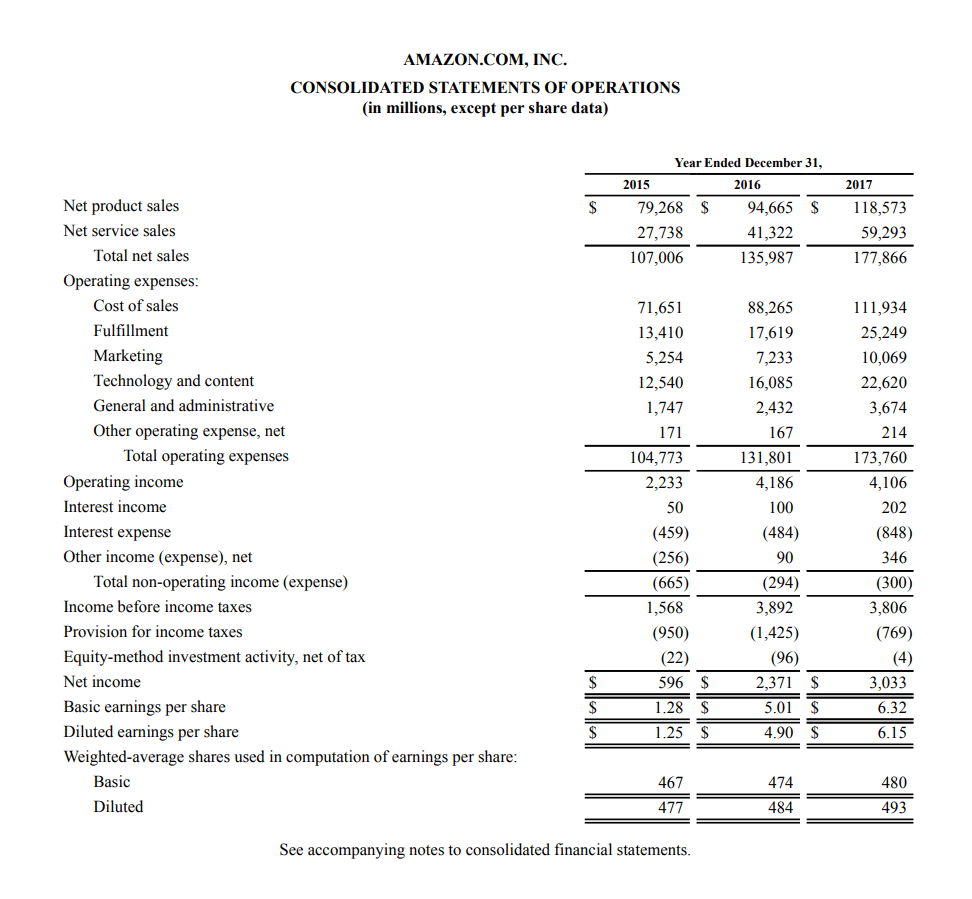

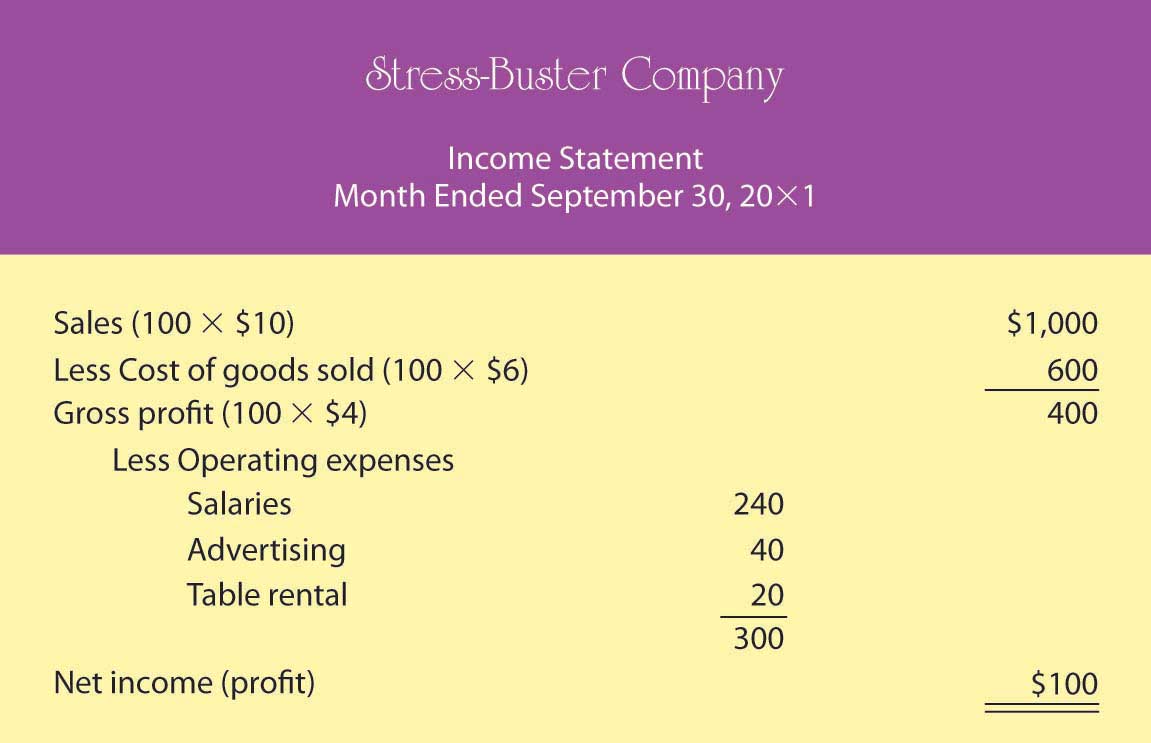

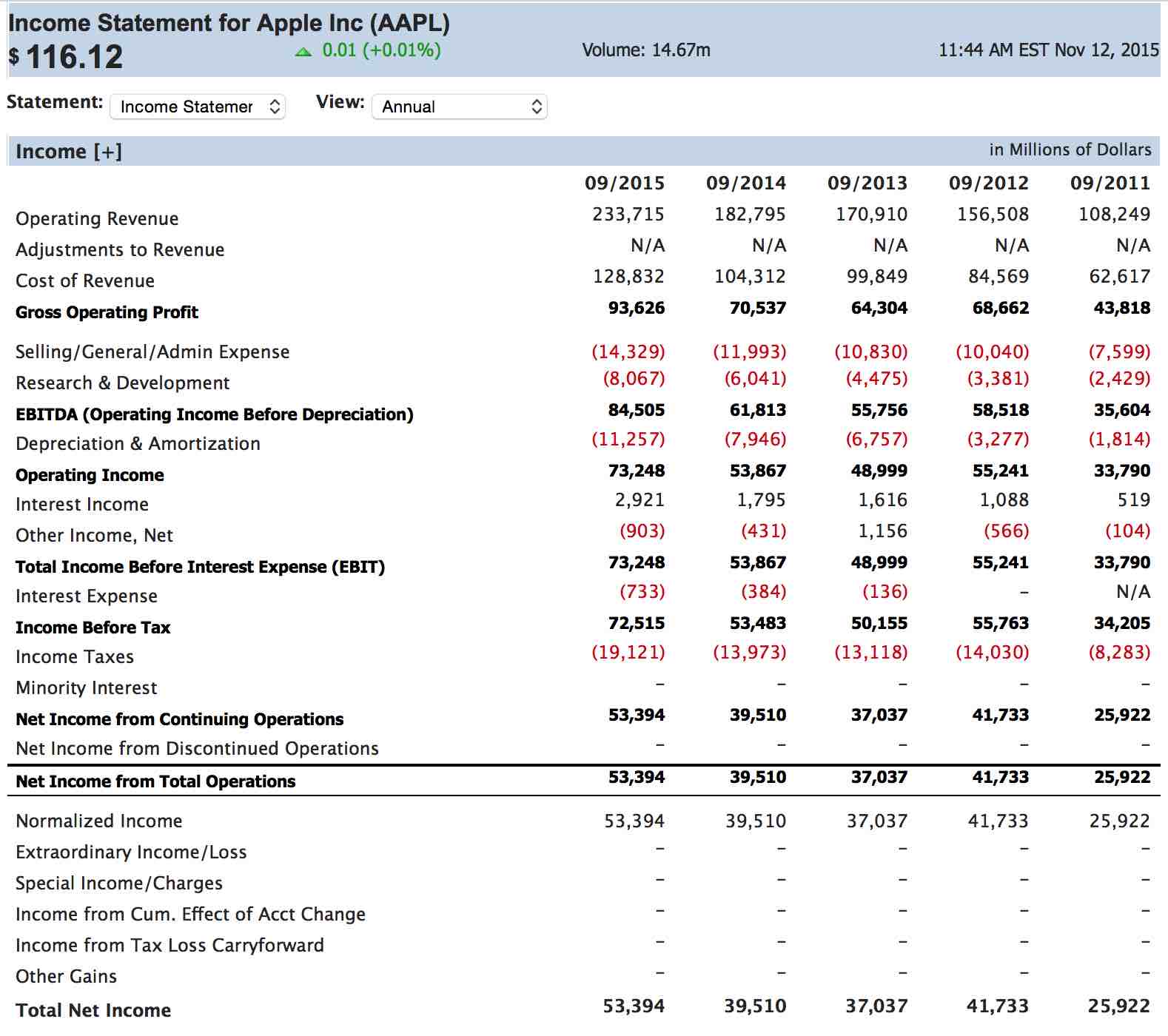

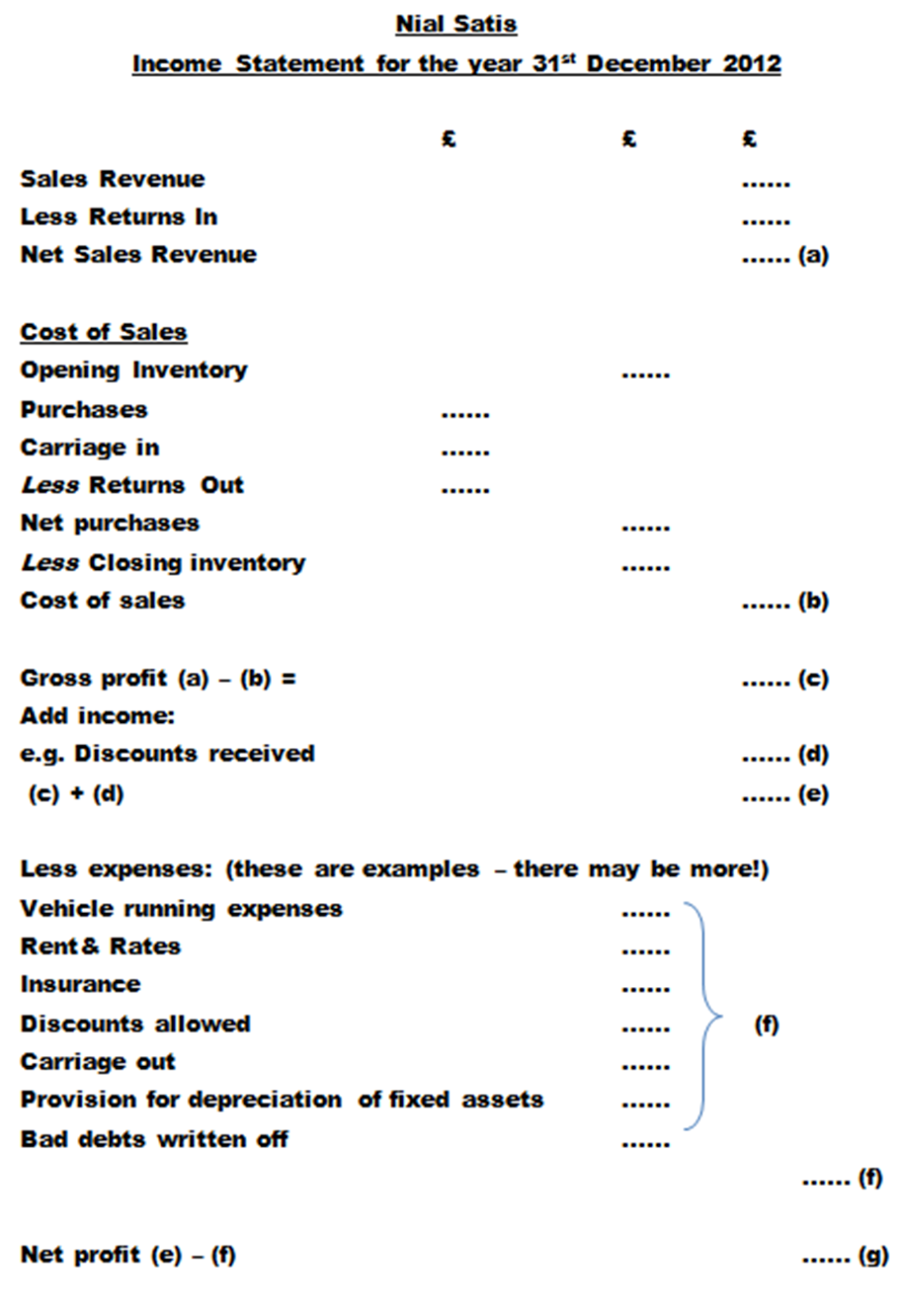

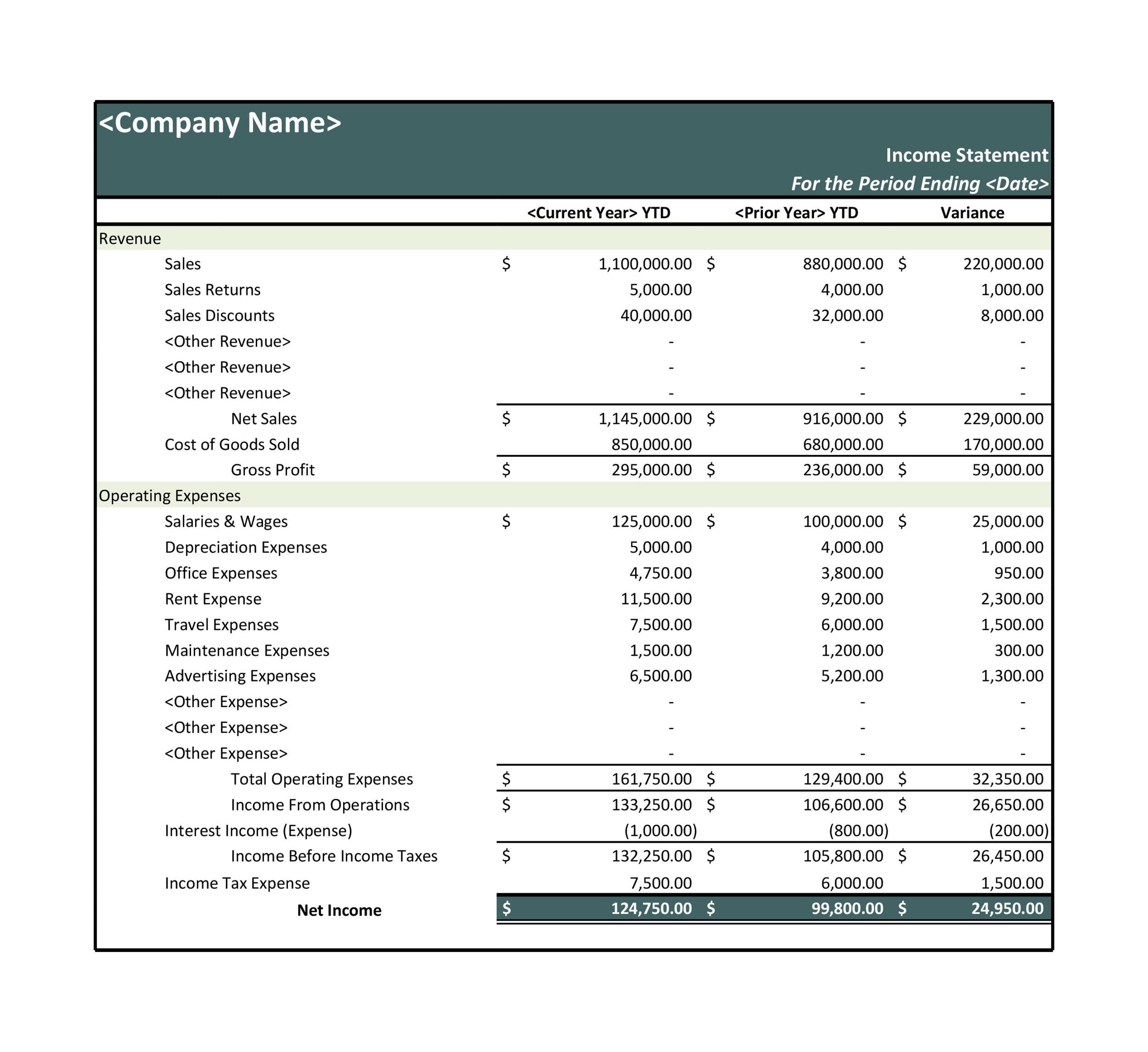

Accountants list provisions on an organization’s balance sheet as current liabilities and expenses on the income statement.

Provisions income statement. Once approved, these will be the world’s first rules on ai. Provision definition in bookkeeping. The recording of provisions occurs when a company files an expense in the income statement and, consequently, records a liability on the balance sheet.

Clause 5 inserts new part 3 into schedule 1aa of the principal act.new part 3 contains transitional provisions relating to claims for payment of legal aid that are in progress when the bill comes into force.new part 3 provides that if a grant of legal aid that includes a disbursement incurred in relation to a report or statement (whether oral or written) of a. Provisions are measured at the best estimate (including risks and uncertainties. Is a provision a reserve?

In income statements, the appearance of provision for income tax would refer to that expense. Provision for income tax meaning. It is just one type of provision that corporate finance departments set aside to cover a probable future expense.

, we examine some of the key amendments incorporated into this amended bill. Provisions in accounting are the money set aside to pay for expected future expenses. In april 2021, the european commission proposed the first eu regulatory framework for ai.

In financial reporting, provisions are recorded as a current liability on the balance sheet and then matched to the appropriate expense account on the income statement. Read along to learn about: A legal guarantee that a product will work as described and that any repairs, replacements, or refunds will be provided if needed.

The different risk levels will mean more or less regulation. The second tranche of the federal government's closing loopholes bill has passed both houses of parliament and is now awaiting royal assent. The provision in accounting refers to an amount or obligation set aside by the business for present and future liabilities belonging to specific categories.

Why are provisions important in accounting? The provision for credit losses (pcl) is an estimation of potential losses that a company might experience due to credit risk. The journal to record the provision would be as follows.

The provision for credit losses is treated as an expense on the. It says that ai systems that can be used in different applications are analysed and classified according to the risk they pose to users. This insight examines the new provisions and key amendments.

An allowance or reserve set aside to cover potential losses or liabilities that may arise in the future. Provisions are crucial in budgeting for various liabilities and obligations that arise during an accounting year. Examples of provisions what are tax provisions?

General provisions are balance sheet items representing funds set aside by a. Money owed by a customer or client that is unlikely to be paid. A tax provision is the estimated amount of income tax that a company is legally expected to pay to the irs for the current year.

:max_bytes(150000):strip_icc()/generalprovisions_final-e246d5a375ed4e56993b2e06cd1004cf.png)