Heartwarming Info About Statement Of Cash Flows In Accounting

Quickbooks online offers a range of features designed to streamline bookkeeping processes for bus.

Statement of cash flows in accounting. Information about the cash flows of an entity is useful in providing users [refer: Statement of cash flows is one of the four financial statements which shows the cash movement, cash inflow and cash outflow of the business, and the overall change of cash balance of the company during the accounting period which. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

One is called the indirect method. The purpose of this statement is to provide a means to assess the enterprise’s capacity to generate cash and to enable stakeholders to compare cash flows of different entities (cpa canada, 2016). It helps identify the availability of liquid funds with the organization in a particular accounting period.

Preparing a statement of cash flow; You have one that is called the direct method. Accountants working internationally must report in accordance with international accounting standard (ias) 7 statement of cash flows.

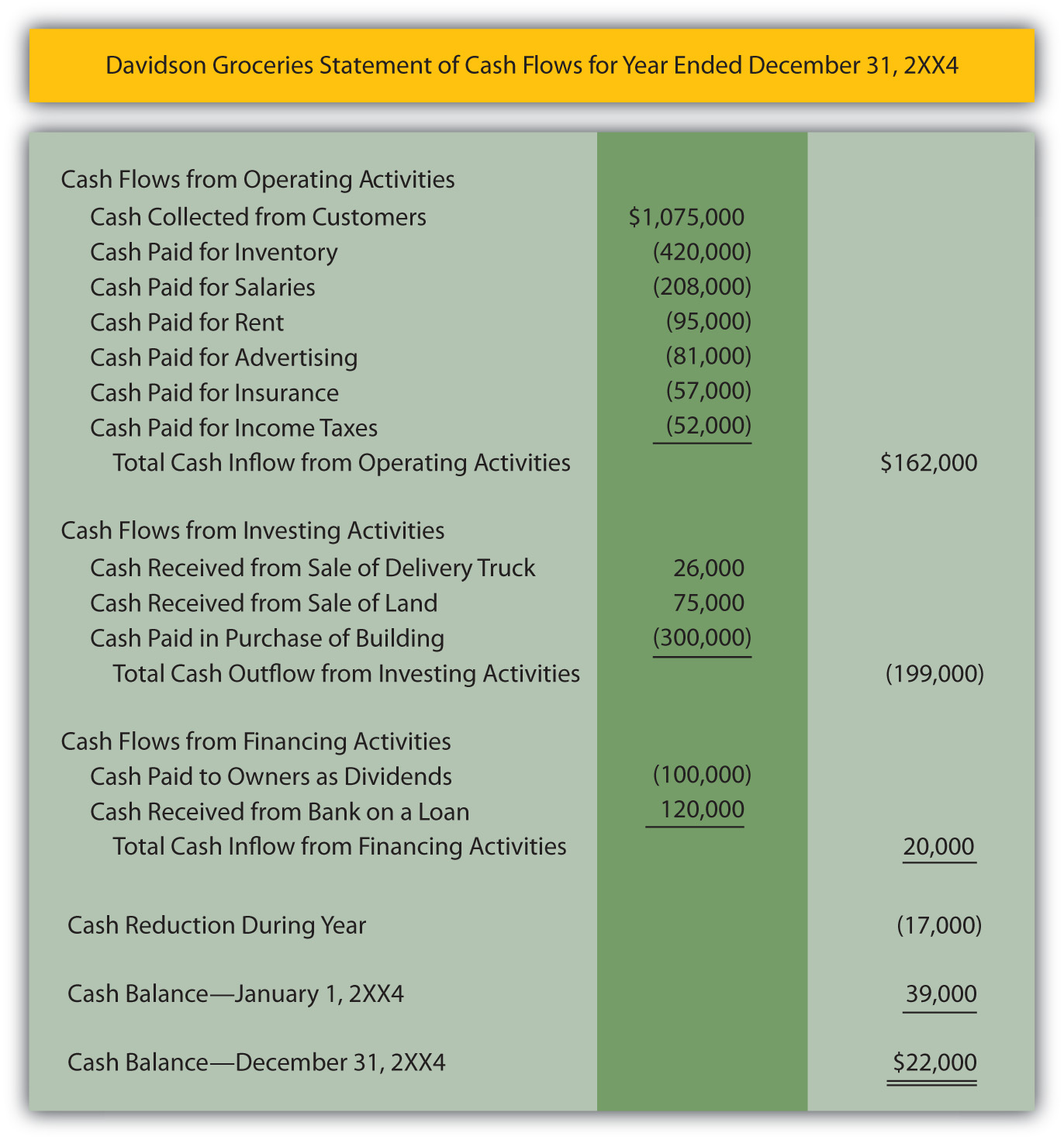

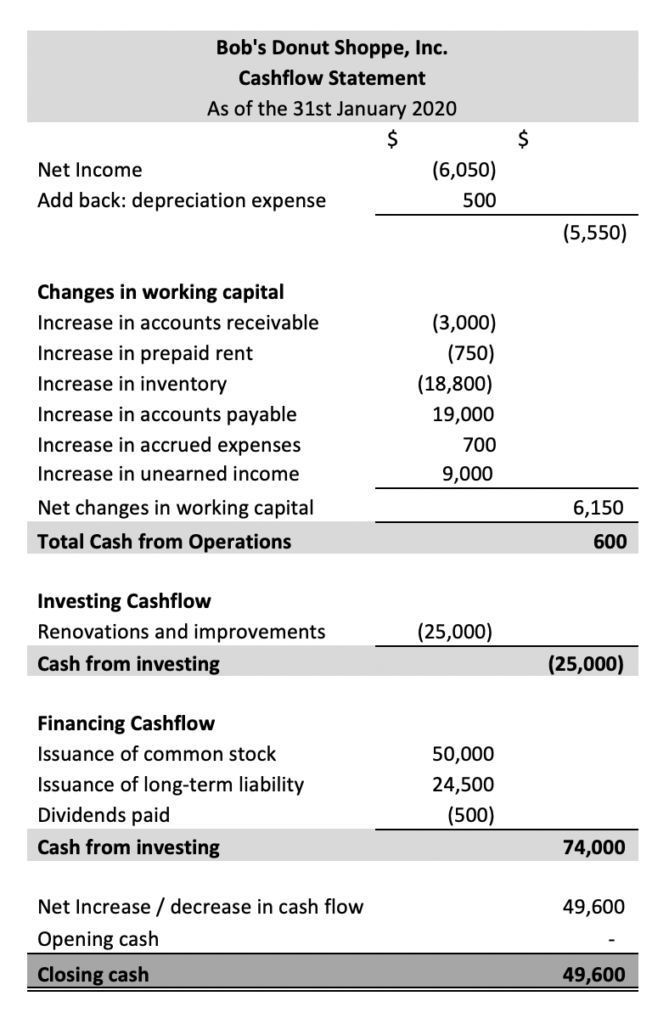

Look at exhibit 2 to see how activities can be classified to prepare a statement of cash flows. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. The cash flow statement is required for a complete set of financial statements.

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet. Introduction there are two accounting methods that are used in the recording of transactions by an organization—the cash method and the accrual method.

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Cash flow from operations, cash flows from investing, and cash flows from financing. The method used is determined by the needs of the organization and the way that revenue is received and inventory is tracked.

So these are the three main sections. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. The cfs highlights a company's cash management, including how well it generates.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. The cash flow statement in accounting is one of the four basic financial statements. We have the recording available for you!

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Additional information from dux’s accounting records is provided also.dux companycomparative balance. Reviewing it can give you information about your cash flow as opposed to net income.

The statement of cash flows classifies cash receipts and disbursements as operating, investing, and financing cash flows. Cash flows from investing and financing; Its particular focus is on the types of activities that create and use cash, which are.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)