Perfect Tips About Accounting Statement Of Retained Earnings Revised Schedule Vi Companies Act 2013

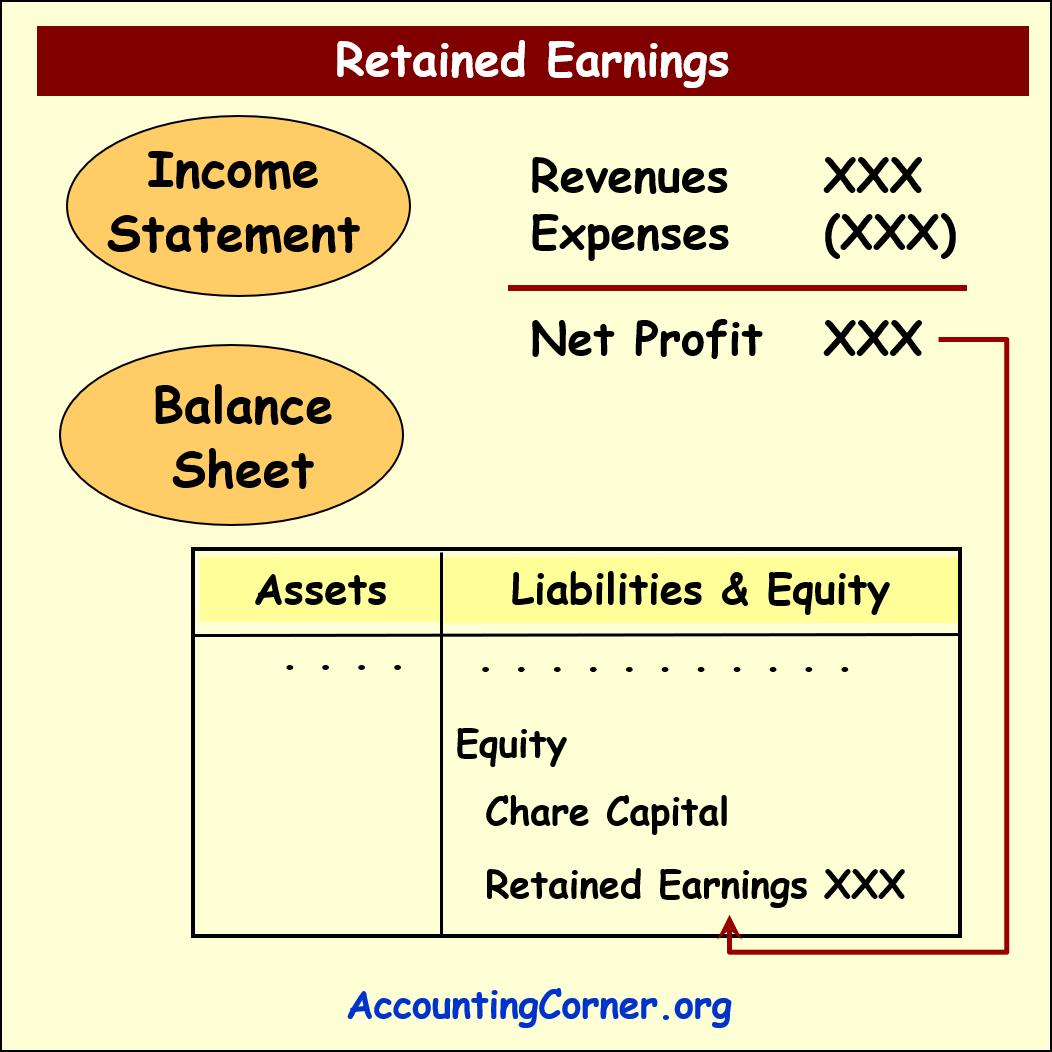

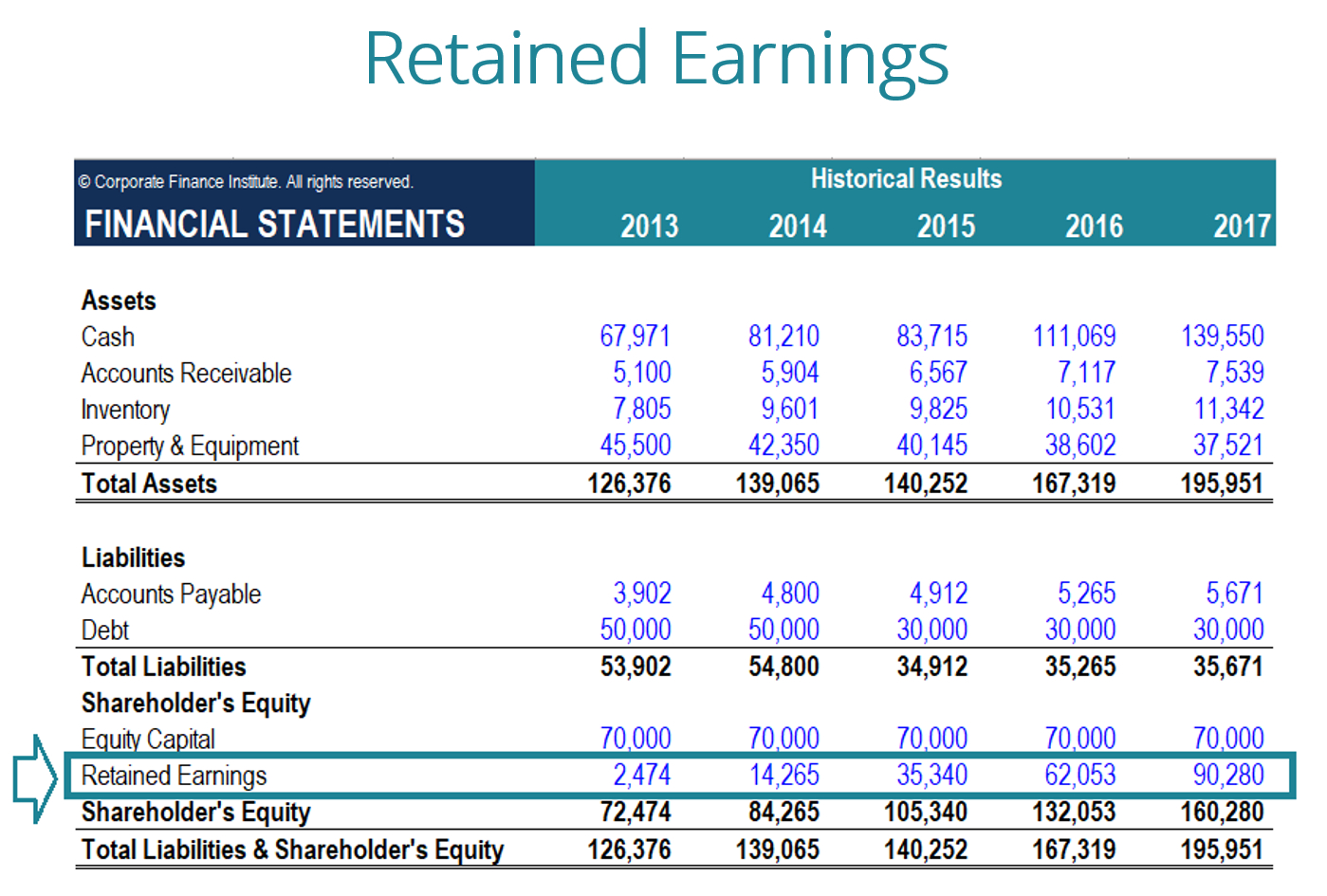

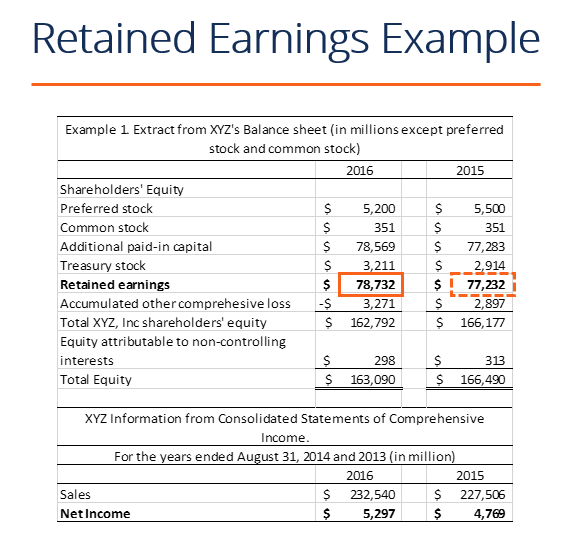

Expansion the company may use the retained earnings to fund an expansion of its operations.

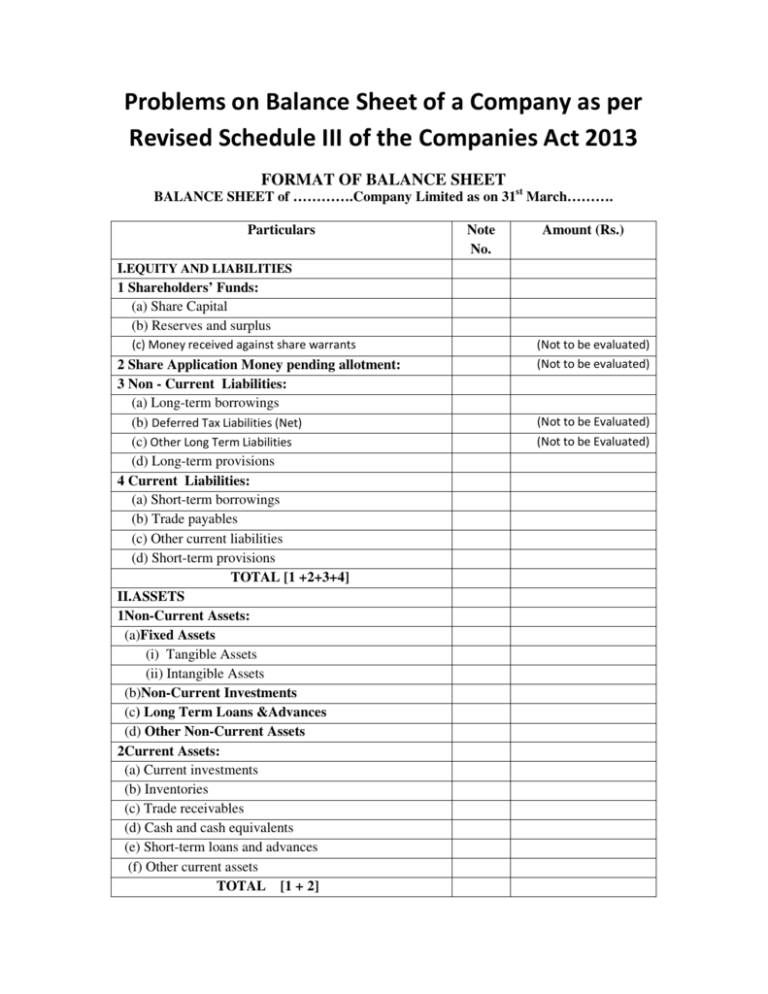

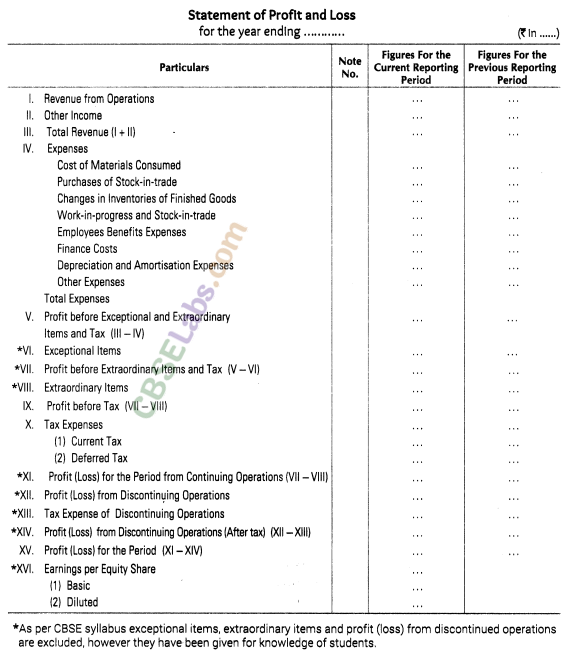

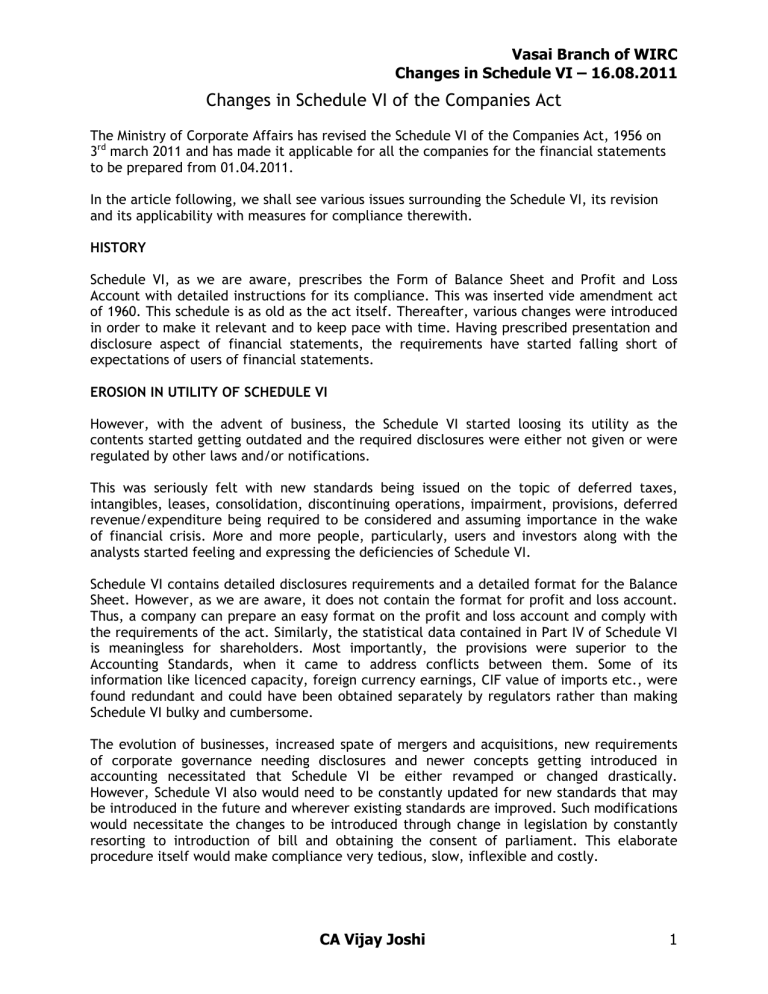

Accounting statement of retained earnings revised schedule vi of companies act 2013. 653(e) dated 30th march 2011 made applicable the revised schedule vi for the balance sheet and profit and loss account to be prepared. Taking cognizance of imperative situation and need, the ministry of corporate affairs revised the existing schedule vi to the companies act, 1956 and made it applicable to. Where compliance with the requirements of the act including accounting standards as applicable to the companies require any change in treatment or disclosure including.

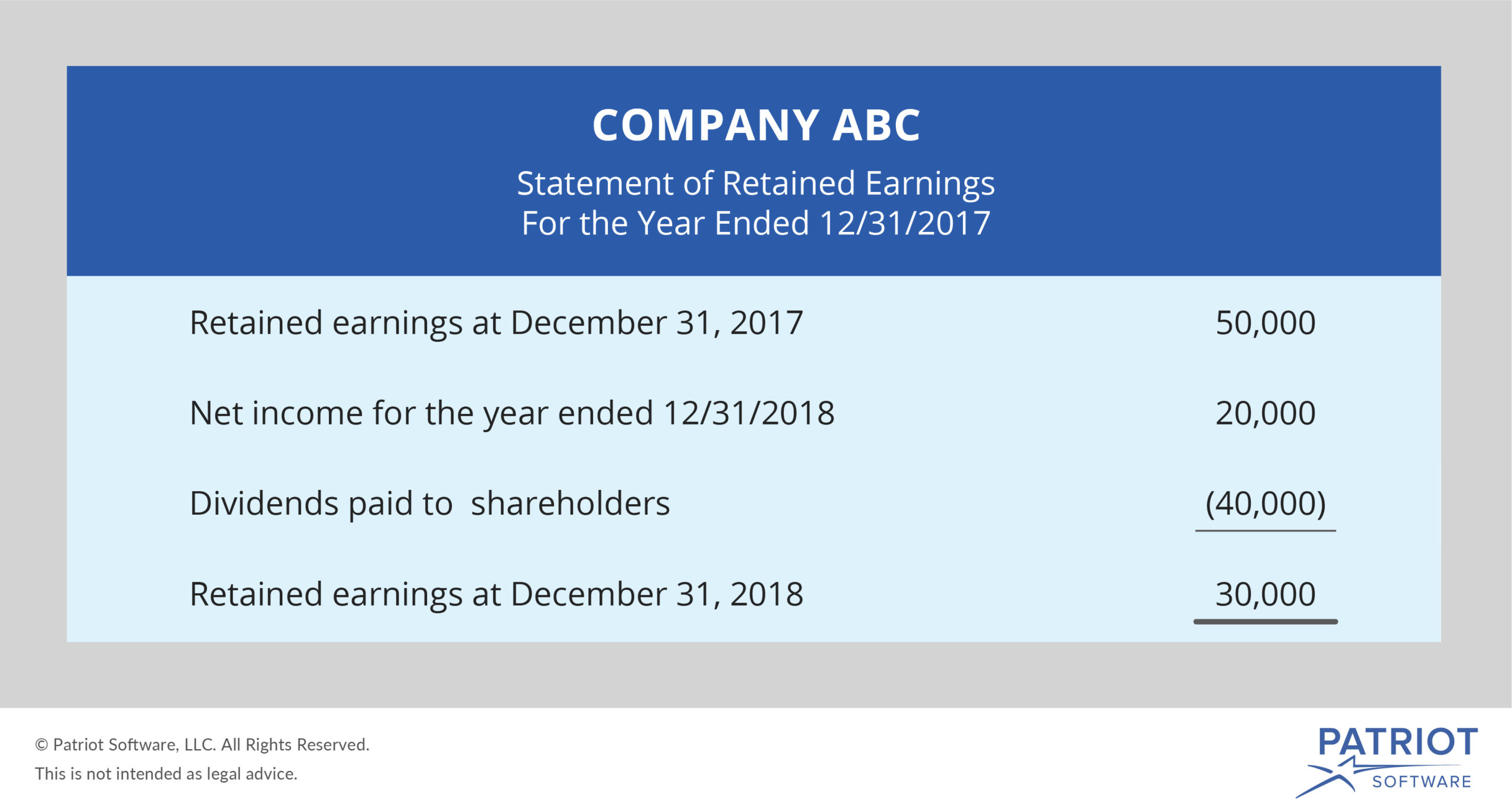

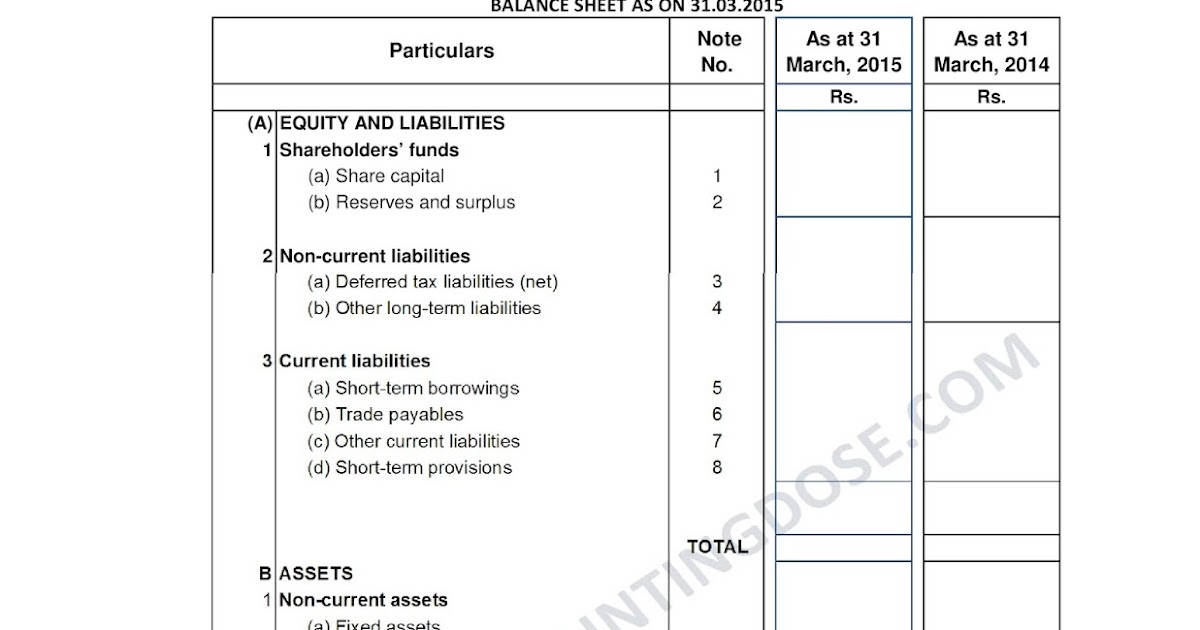

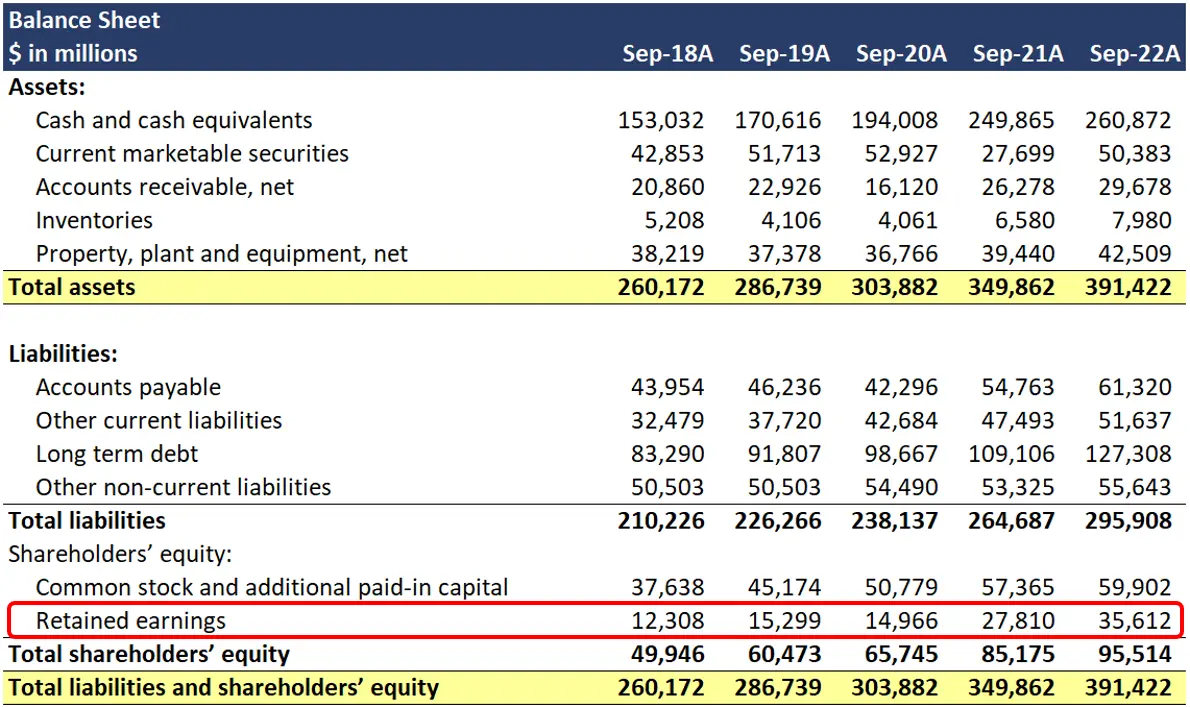

The revised reconciliation of retained earnings available for dividend declaration following the format as prescribed under annex a of this circular shall. Balance sheet and statement of profit &. The guidance note on revised schedule vi to the companies act, 1956 to the extent of amendments in the schedule iii to the companies act, 2013.

Taking cognizance of imperative situation and need, the ministry of corporate affairs revised the existing schedule vi to the companies act, 1956 and made it applicable to. Schedule iii of the companies act, 2013 provides guidelines and instructions for the preparation of financial statements, which include the balance. Trade receivables”, for item (i), the following shall be substituted, namely:— “(i) trade.

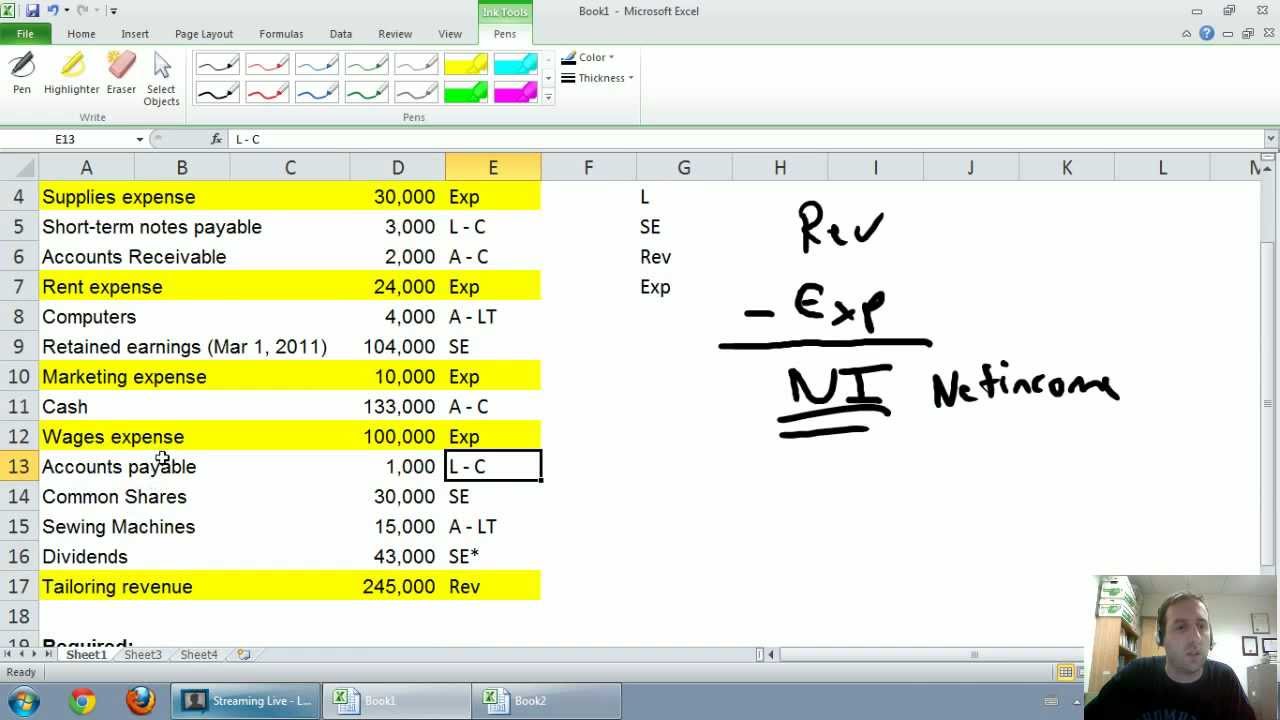

Normally, these funds are used for working capital and fixed asset purchases (capital expenditures) or allotted for paying off debt obligations. The draft revised schedule iii to the companies act, 2013 for a company whose financial statements are drawn up in compliance of companies (indian accounting standards). Para 4.1.1 of the revised schedule vi necessitates that if compliance with the requirements of the act and/or accounting standards requires a change in the treatment.

The revised schedule gives prominence to accounting standards (as) i.e. The funds may go into building a new plant, upgrading the current. Schedule vi to the companies act, 1956 (‘the act’) provides the format in which companies registered under the act prepare and present their financial statements.

The ministry of corporate affairs (mca) has amended schedule iii of companies act 2013 (“act”) on 24 march 2021 to increase transparency and provide additional disclosures to. Schedule iii[1] (see section 129) [effective from 1st april, 2014] [2][division i financial statements for a company whose financial statements are required to comply with the. The statement of retained earnings is one of four main financial statements, along with the balance sheet, income statement, and statement of cash.

As ‘accounting standards’ including “ind as” as applicable have become mandatory, schedule iii to the companies act, 2013 became an important piece of document with. Mandatory, schedule iii to the companies act, 2013 became an important piece of document with a format aligned with that of accounting standards. In case of any conflict between the as and the schedule, as shall prevail.

Looking at the advancements in accounting principles coupled with.