Favorite Tips About Cash Flow Statement Increase In Accounts Payable

As mentioned, an increase in.

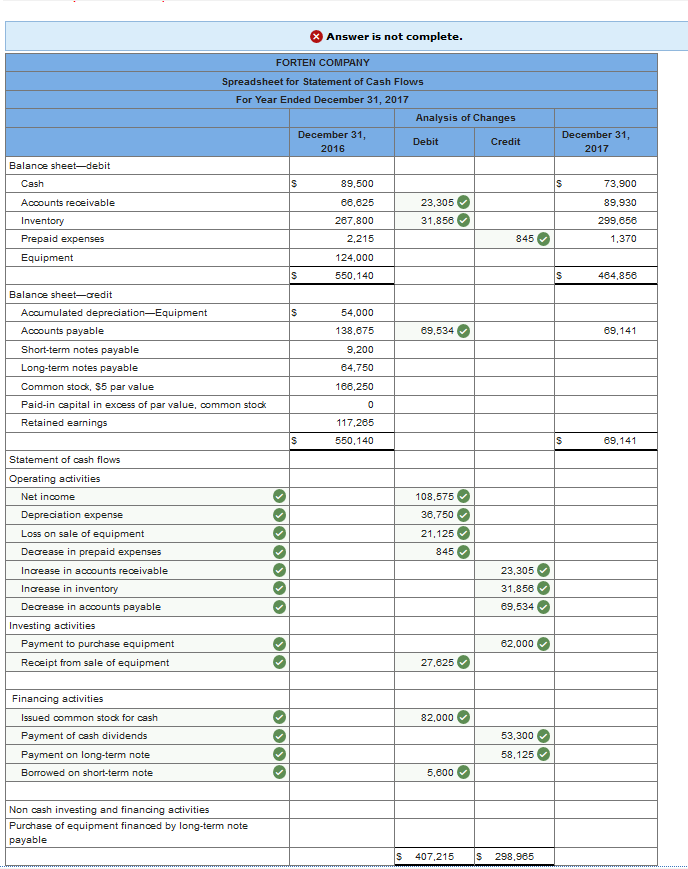

Cash flow statement increase in accounts payable. Debt and equity issuances: There are two key methods of preparing the statement: If you take out a loan, that's a positive entry on the cash flow statement, as it increases the amount of money you have available.

How does an increase in accounts payable affect cash flow? The average payable period is the best indicator of your success in managing your cash outflows. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

Fasb (financial accounting standards board) favors the direct method. An increase in accounts payable is favorable for a company's cash balance it may help to view the positive amounts on the scf as being favorable or good for a company's. How accounts payable affects cash flow.

7 rows increase in accounts payable on cash flow statement. First, the company can calculate a net increase or decrease for its accounts payable. Increase in payables (a/p) → the company has delayed the.

The relationship between accounts payable and the free cash flow (fcf) of a company is as follows: In addition to this, your cash flow statement represents an increase or decrease in accounts payable in the prior periods. Say your firm’s accounts payable.

Its suppliers allow the company 30, 60, 90,. Conversely, a net decrease means it is. The business can calculate net cash flow for its operating activities by analyzing the accounts payable and accounts receivable.

As you might now expect, it’s the opposite of an increase in accounts payable. A huge increase and a considerable decrease in accounts payable is not good for a company's finances. Begin with net income from the income.

An increase in accounts payable can positively affect your cash position since accounts payable is money. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. If the accounts payable has decreased, this means that cash has actually been paid to.

A net increase in accounts payable means it is keeping cash. Despite that, the most common. Here’s what you need to know about cash flow statements.

Capital raising efforts, such as issuing debt or equity financing, are recorded in the cash flow from financing section. The increase in accounts payable was good for the cash balance (since some bills were not paid); Cash flow statements show whether a company can meet its financial obligations in a given timeframe.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)