Brilliant Strategies Of Tips About Cash Flow Statement Means

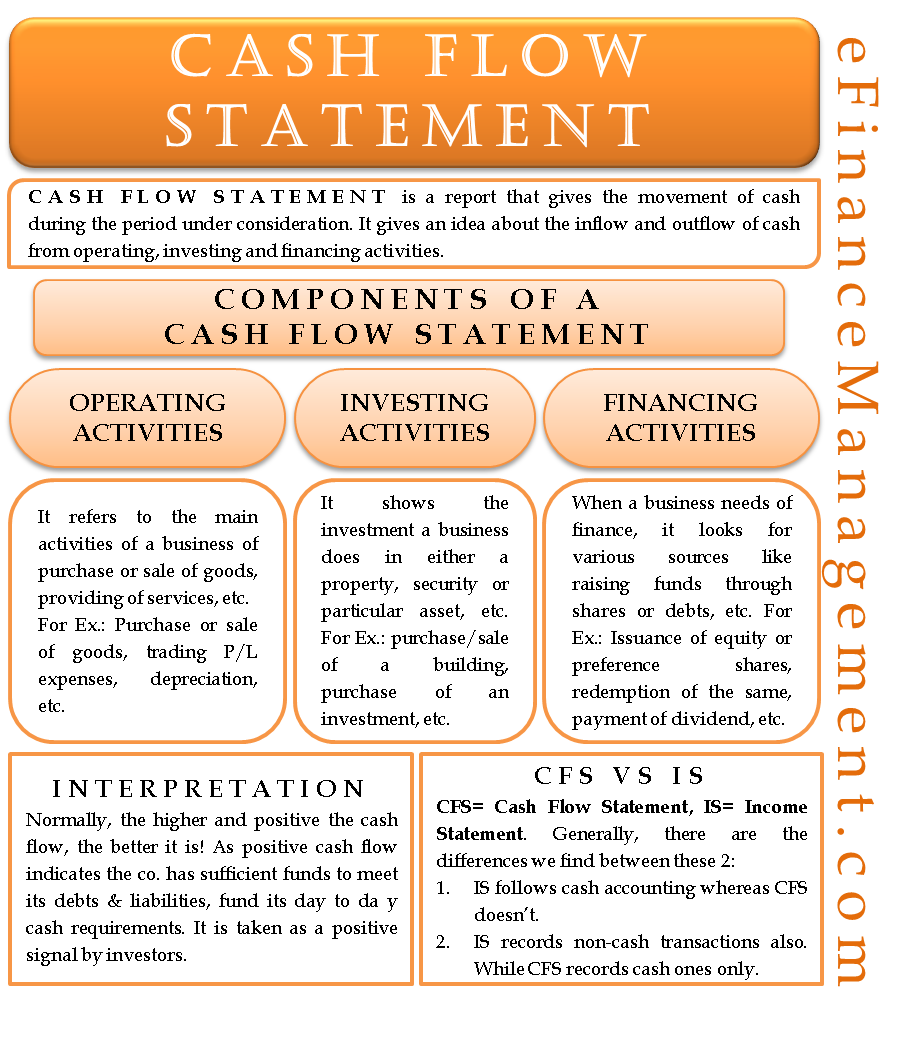

Statement of cash flows definition a statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

Cash flow statement means. Cash received signifies inflows, and cash spent is outflows. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back.

The cash flow statement includes cash made by the business through operations, investment, and financing—the sum of. It helps identify the availability of liquid funds with the organization in a particular accounting period. A cash flow statement is a financial statement that shows how cash entered and exited a company during an accounting period.

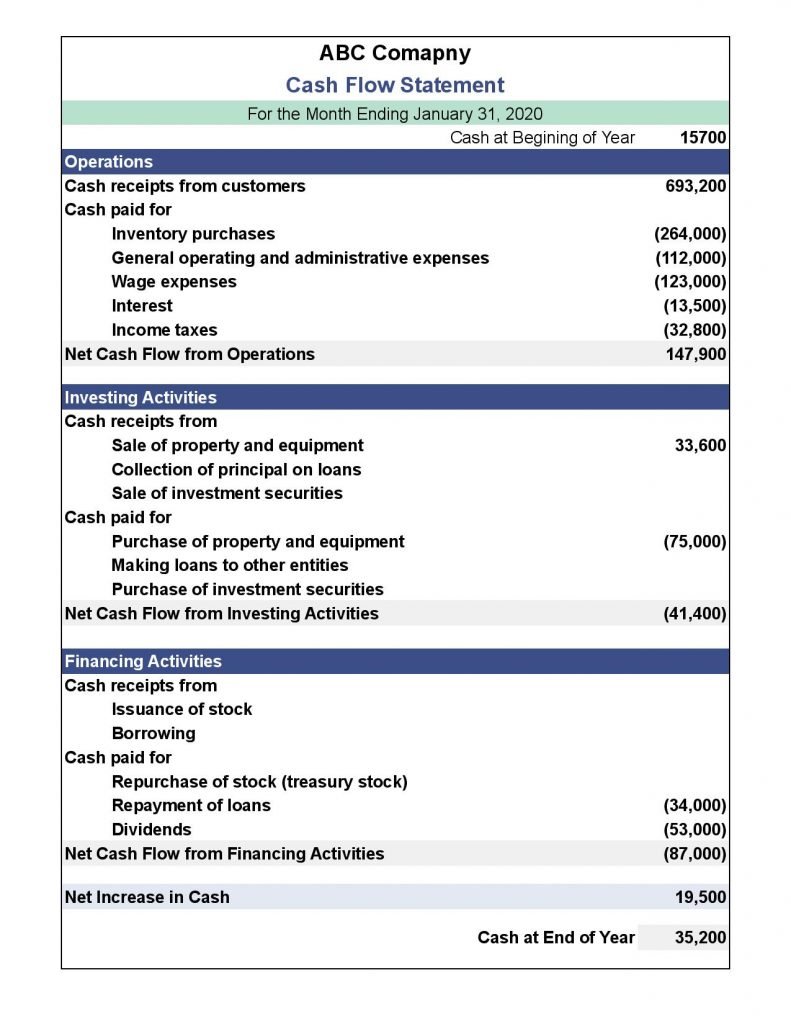

The cash flow statement formula The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories:

A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. The cash flow statement has three main parts:

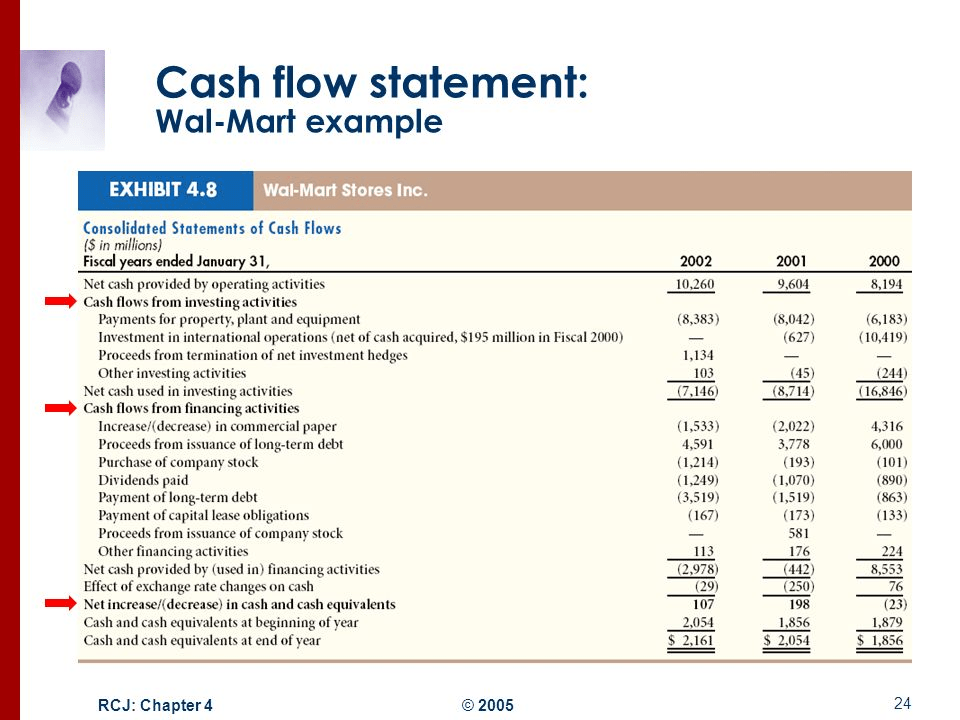

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. Key takeaways a cash flow statement provides data regarding all cash inflows that a company receives from its ongoing operations and. The cash flow statement is the third main financial statement, together with income statement and the balance sheet.

What is a cash flow statement? Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. The first section of the cash flow statement.

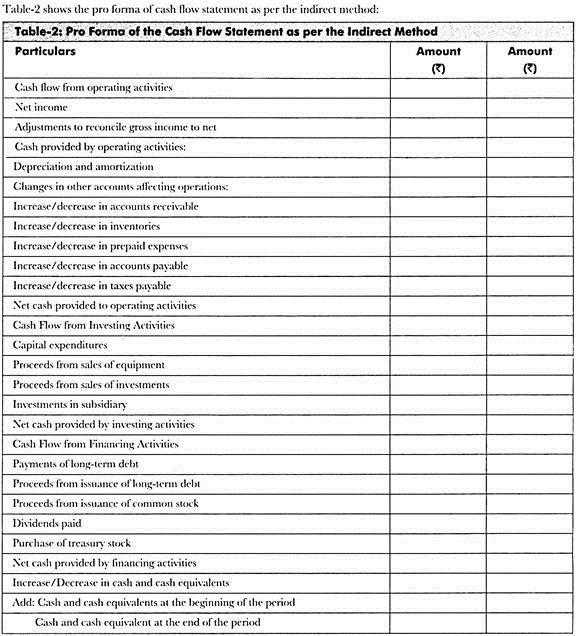

Thus, all the profits are. The cash flow statement can be prepared with two separate methods: The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

It also breaks down where you've spent that money so you can see if your business is making more money than it spends. What is a cash flow statement? It provides an overview of how much cash the business generates and where it’s being spent.

The cash flow statement is required for a complete set of financial statements. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The main components of the cash flow statement are:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)