Here’s A Quick Way To Solve A Info About Gross Profit In Trial Balance

(2) the motor van was sold on 31august 20x5 and traded in against the cost of a new van.

Gross profit in trial balance. A trial balance allows you to check for mathematical errors (is the sum of the debits equal to the sum of the credits), and check account balances versus expectations (if you usually have a. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. How do you find the gross profit on a trial balance?

This statement comprises two columns: Trump ordered to pay over $355m for fraudulent business practices in new york. This will sum the income, expenditure and payroll sections (g,h & i) once loaded and any changes will dynamically update the total.

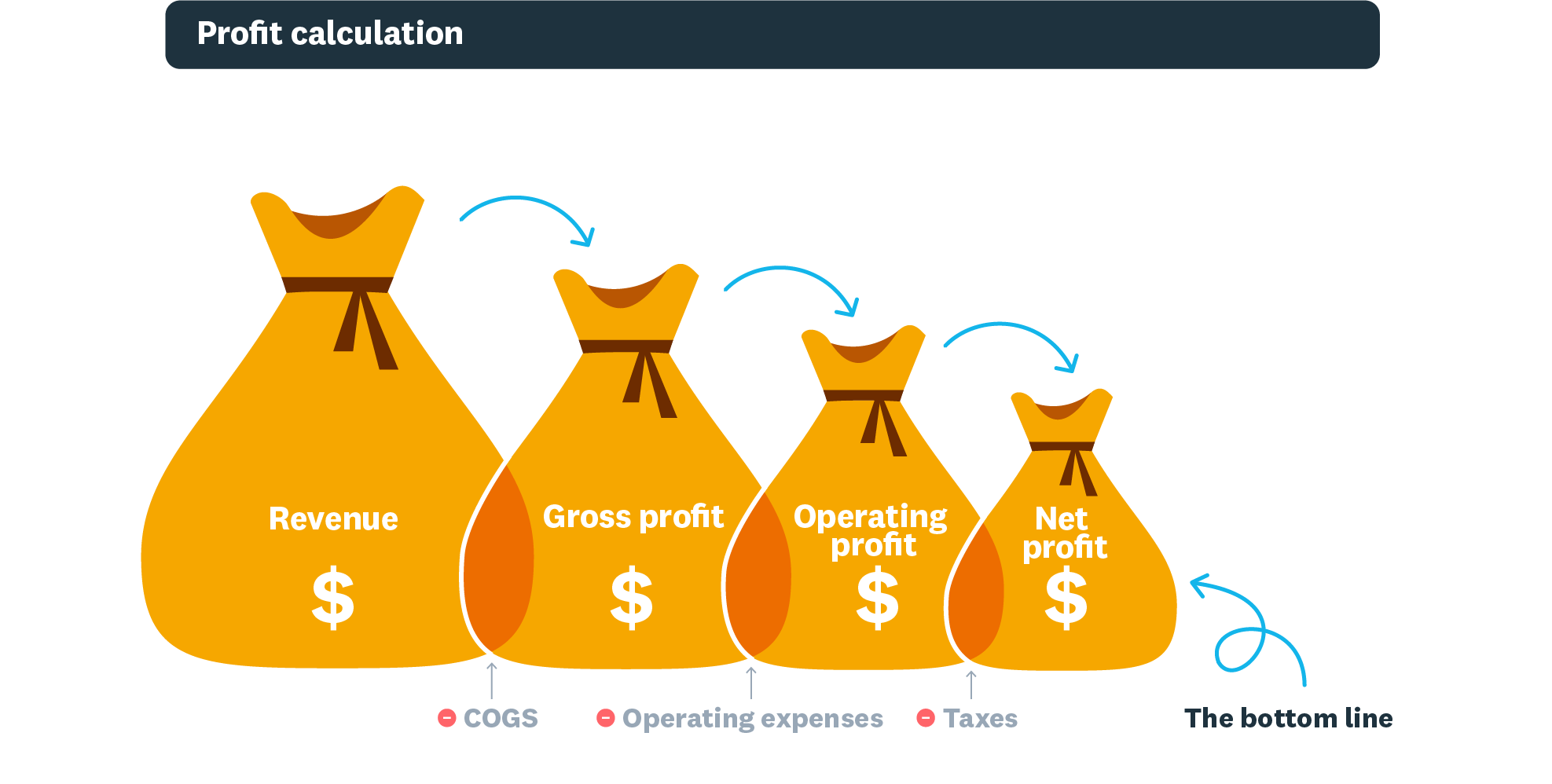

Profit calculation in trial balance 4 years ago updated for new trial balances a line will be automatically added to the v (equity) section of the trial balance: Total revenues are $10,240, while total expenses are $5,575. The trial balance of tyndall at 31 may 20x6 is as follows:

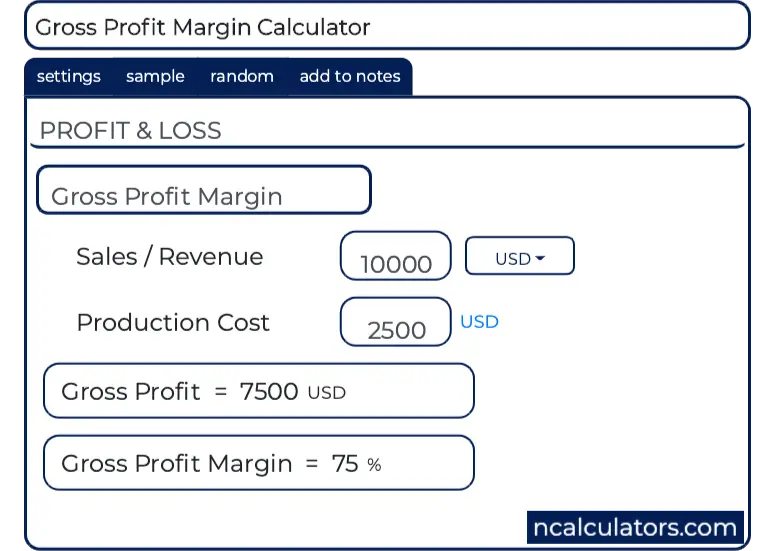

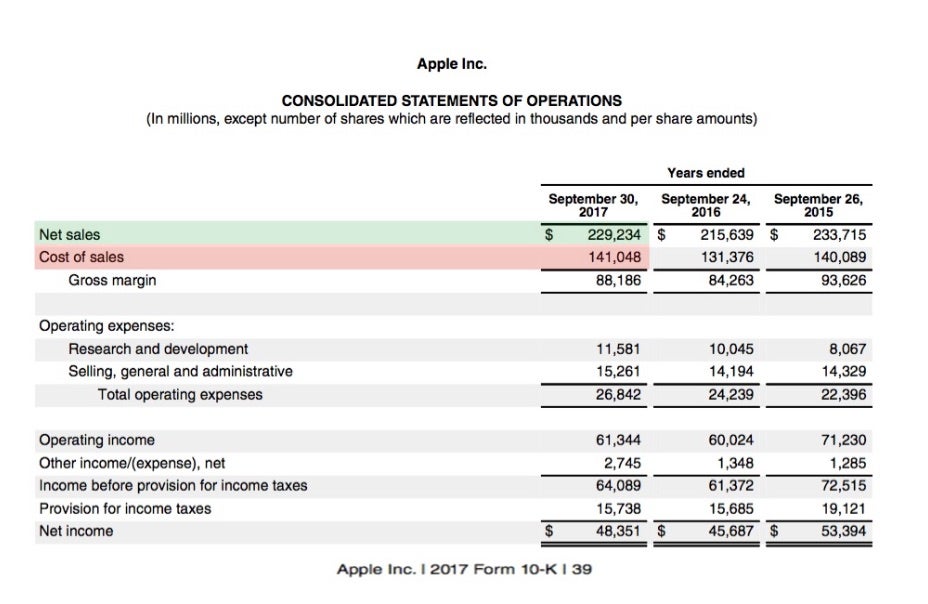

Profitability ratios are calculated to see how much profit is being generated from a company’s sales. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Is profit included in trial balance?

The balances are usually listed to achieve equal. This formula gives a business an indication of how much money it has made after accounting for the cost of producing and selling its products or services. The cardinal rule of the trial balance is that the total of the trial balance debit and credit accounts and ba lances taken from the ledgers should be the same or tallied.

The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. Total expenses are subtracted from total revenues to get a net income of $4,665. The balance in the profit & loss appropriation a/c as shown in the trial balance represents the balance carried forward from the previous accounting period (i.e.

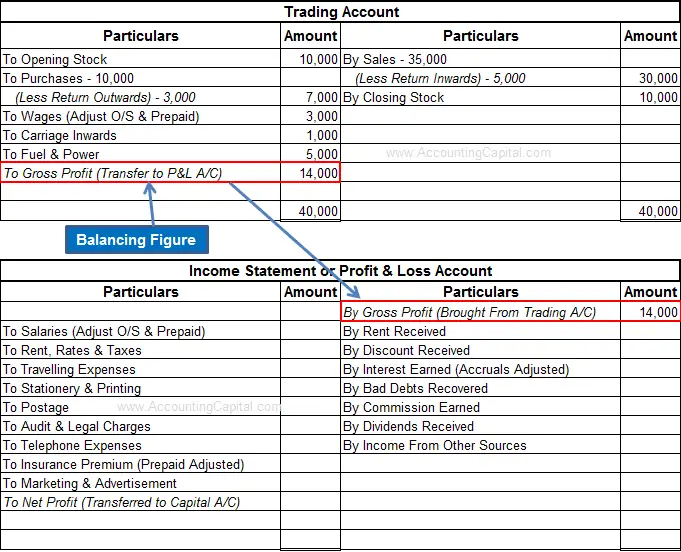

(iv) trial balance does not show the gross profit and net profit. (a) treating revenue expenditure as capital expenditure or vice versa. The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc.

Revenue and expense information is taken from the adjusted trial balance as follows: A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. This number tells you how efficient.

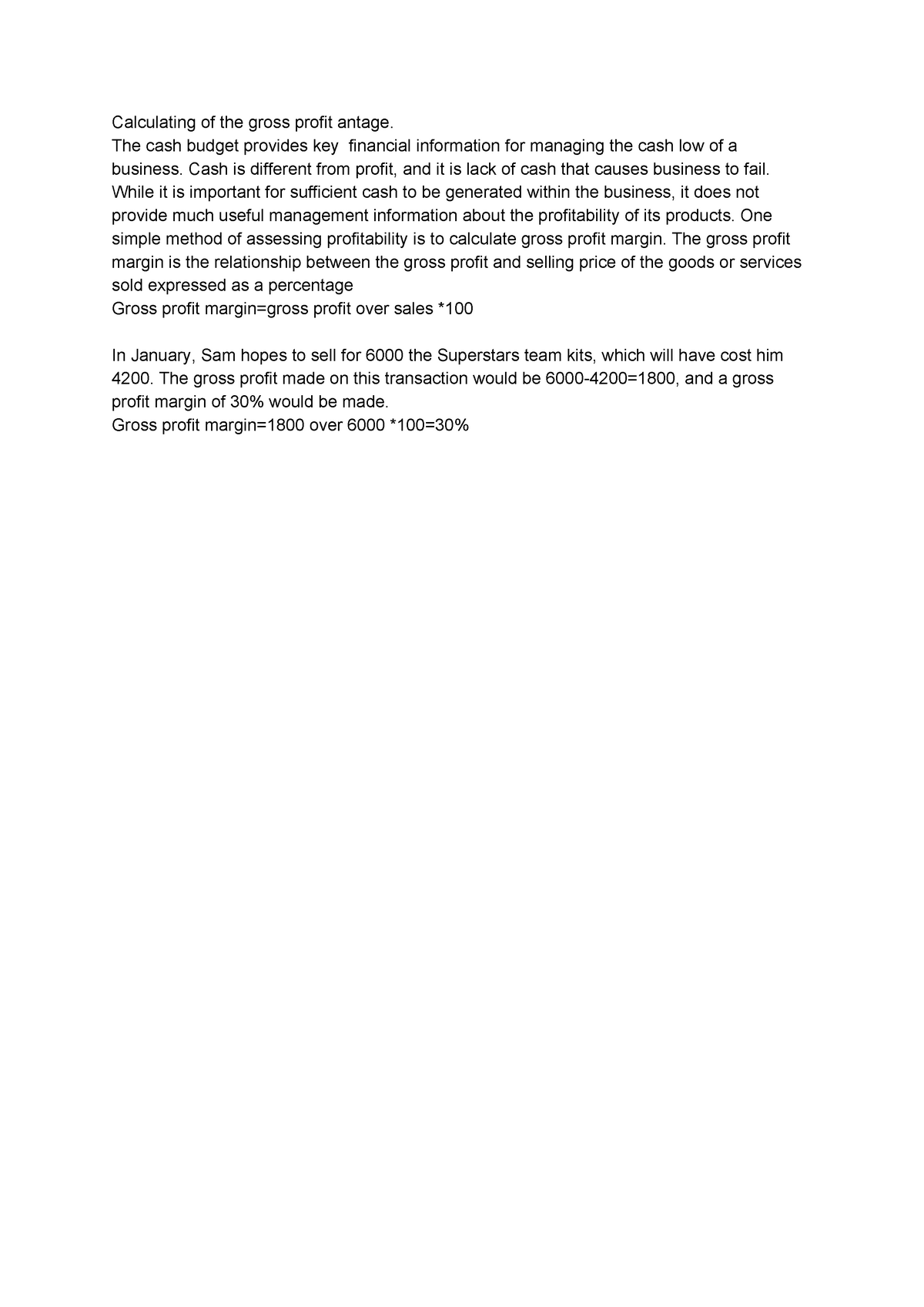

Year ending 31 st march 20_5). Gross profit % = gross profit / revenue gross profit % = 128,571 / 428,571 = 30%. Gross profit is the profit a company makes after deducting the costs associated with producing and selling its products or the costs associated with its services.

A trial balance summarises the closing balance of the different general ledgers of the company, while a balance sheet summarises the total liabilities, assets, and shareholder’s equity in the company. Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance. The net profit of the current period is transferred to the profit & loss appropriation a/c.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)