Best Of The Best Info About T2125 Form 2018

Get started with the basics of preparing a t2125 business statement in taxcycle t1.

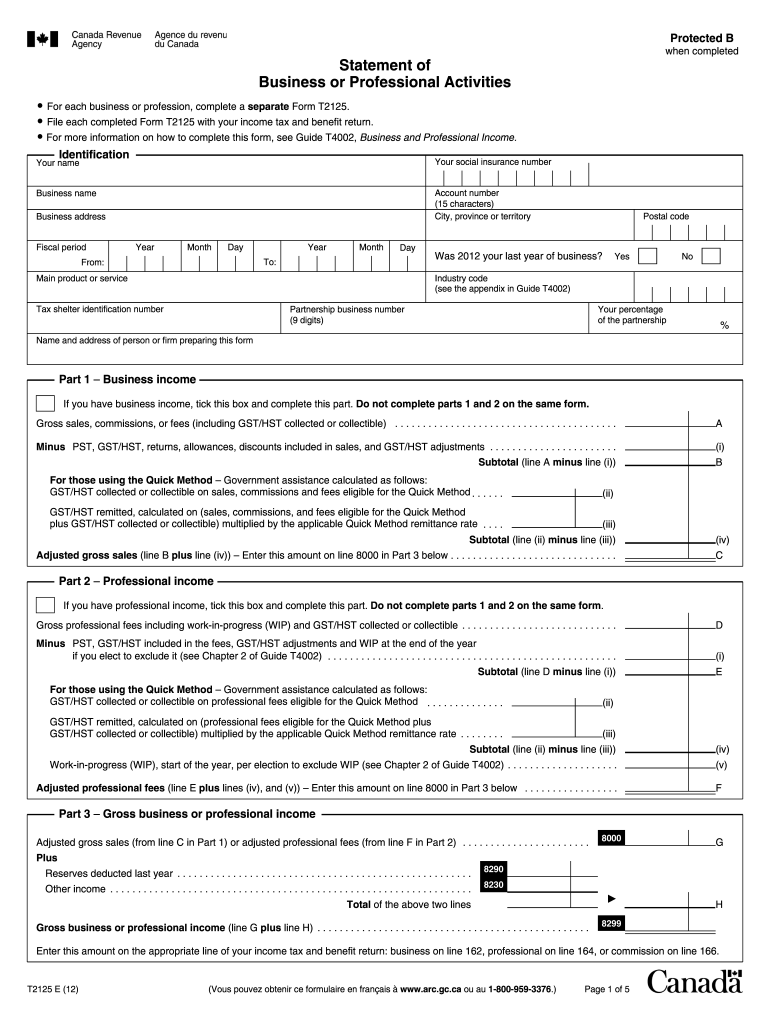

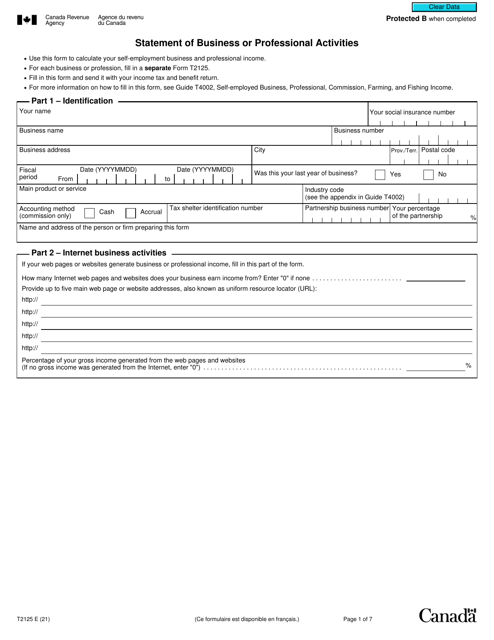

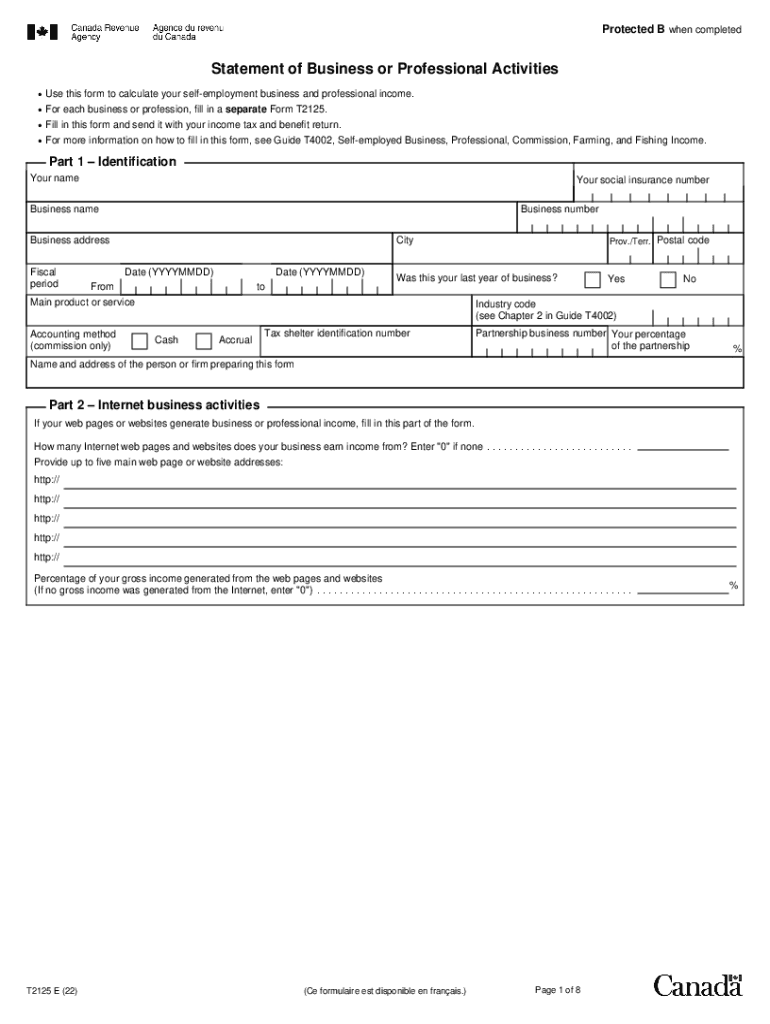

T2125 form 2018. A t2125 form is a schedule that goes along with a tax return, and it lists income, and expenses where taxpayers operate certain types of businesses. As the title says, i have income i need to claim using the t2125 form. 7 rows t2125 breakdown.

Enter the identifying information for your business (if relevant) in this tab. For each business or profession, fill in a separate form t2125. Use the t2125 form to report either business or professional income and expenses.

Statement of business or professional activities form to report your income and expenses for the year. Form t2125, statement of business or professional activities. General business, professional or commission to activate the review messages.

When completing form t2125, statement of business or professional activities, form t2121, statement of fishing activities, or form t2042, statement of farming activities,. Fill in this form and send it with your income tax and benefit return. Start a t2125.

This includes sole proprietors, members of a. This form can help you calculate your income and expenses for income tax purposes. Use this form to report either business or professional income and expenses.

Create a t2125 form set ; For the first time since 2018, a wwe premium live event will take place in australia in the form of elimination chamber on saturday elimination chamber is the. Form t2125, statement of business or professional activities date modified:

Anyone who has business income of any kind is required to fill out a t2125. Basic information about the t2125 form. Since 2018, saudi authorities have arbitrarily detained saudi women’s rights activists who campaigned for the end of the male guardianship system and the right to.

The statement of business or professional activity form must be completed and filed by june 15 each year. I used studiotax last year for my 2017. Who needs to file a t2125 form?

Get started with the basics of preparing a t2125 business statement in taxcycle t1. For more information on how to fill in this form,. This form can help you calculate your.

You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses. For an example of the. The t2125 form is available online via the canada revenue agency (cra) website.

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)

/delipaperworktax-56a82fab3df78cf7729ce02e.jpg)