Lessons I Learned From Tips About Dividends Received Cash Flow

Generated $910 million in q4 and $2.9 billion for the full year.

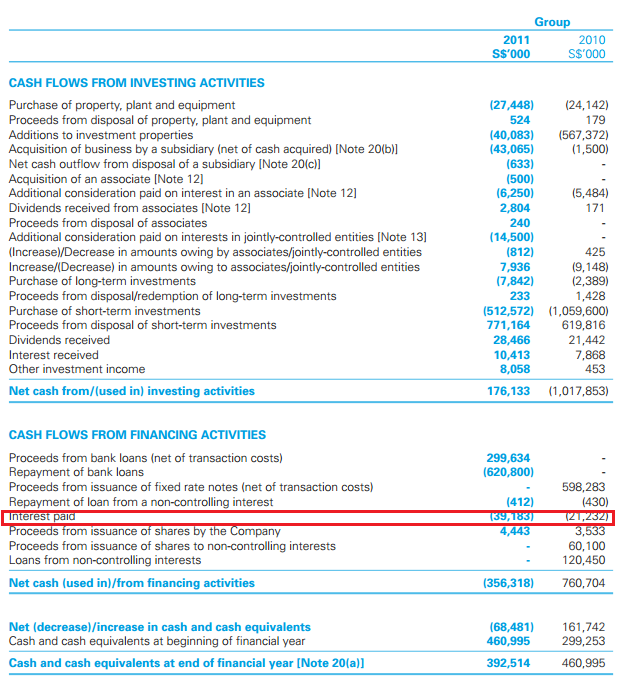

Dividends received cash flow. When added to the opening cash balance of $250,000, the resulting total of $307,500 is equal to the ending cash. Cash flows from interest and dividends received and paid shall each be disclosed separately. However, section 7 to frs 102 considers dividends as either operating or financing cash flows.

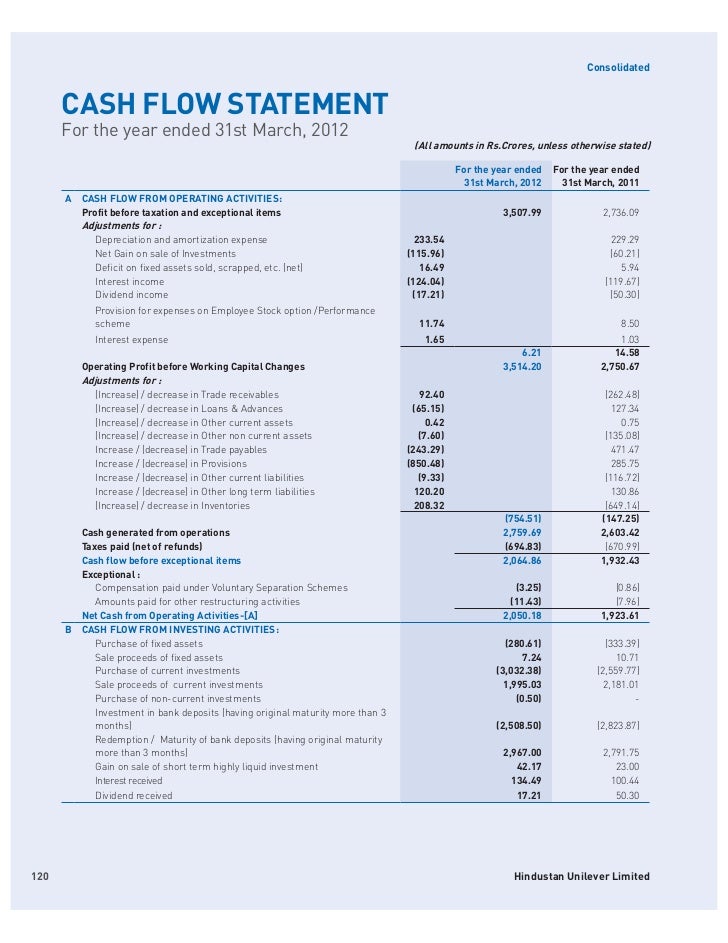

Increased annual base dividend by 7% to $3.60 per share, with a q4 base. From the above statement we can understand. In the cash flow statement under equity dividends paid.

Dividends are paid under financing activities since they (the financiers of the entity) provided finance for the business and this is not a daily or operating activity of the. Positive cash flow indicates that a company's liquid assets are. Over the last year, the s&p 500 has increased more.

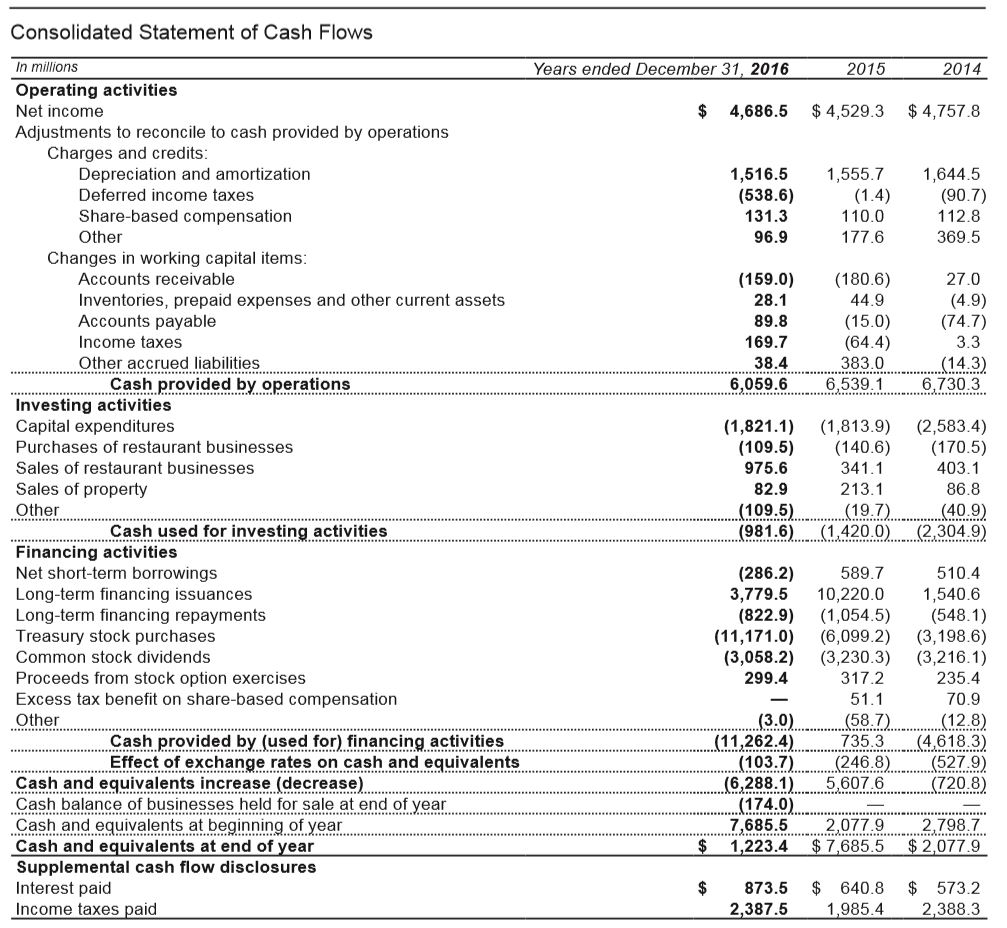

Interest and dividends received and paid may be classified as operating, investing, or financing cash flows, provided that they are classified consistently from. To determine how much outward cash flow results from a dividend payment, you have to know the amount of the dividend and the number of shares.

Interest and dividends received and paid may be classified as operating, investing, or financing cash flows, provided that they are classified consistently from period to period. Require companies, other than those for which investing and financing are main business activities, to classify interest and dividends paid as cash flows arising. The three activities total a net increase in cash of $57,500.

Pepsico generates plenty of cash flow to support dividends. Each shall be classified in a consistent manner from period to period as either operating, investing or financing activities. Free cash flow:

About 3% of the sample classifies dividends received as a financing cash flow, inconsistent with guidance in ias 7, statement of cash flows, paragraph 33. Cash received as interest on loans or investments, as well as cash received as dividends from other companies, is. The stock market has been doing well lately.

Dividends paid are required to be classified in the financing section of the cash flow statement and interest paid (and expensed), interest received, and dividends received. Interest and dividend receipts: Strong free cash flow of the industrial business up 39% at €11.3 billion (2022:

Exercise calculating the dividend paid at the start of the accounting period the company has retained earnings of $500 and at the reporting date retained earnings are $700. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating,.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)