Best Of The Best Info About High Current Ratio Interpretation

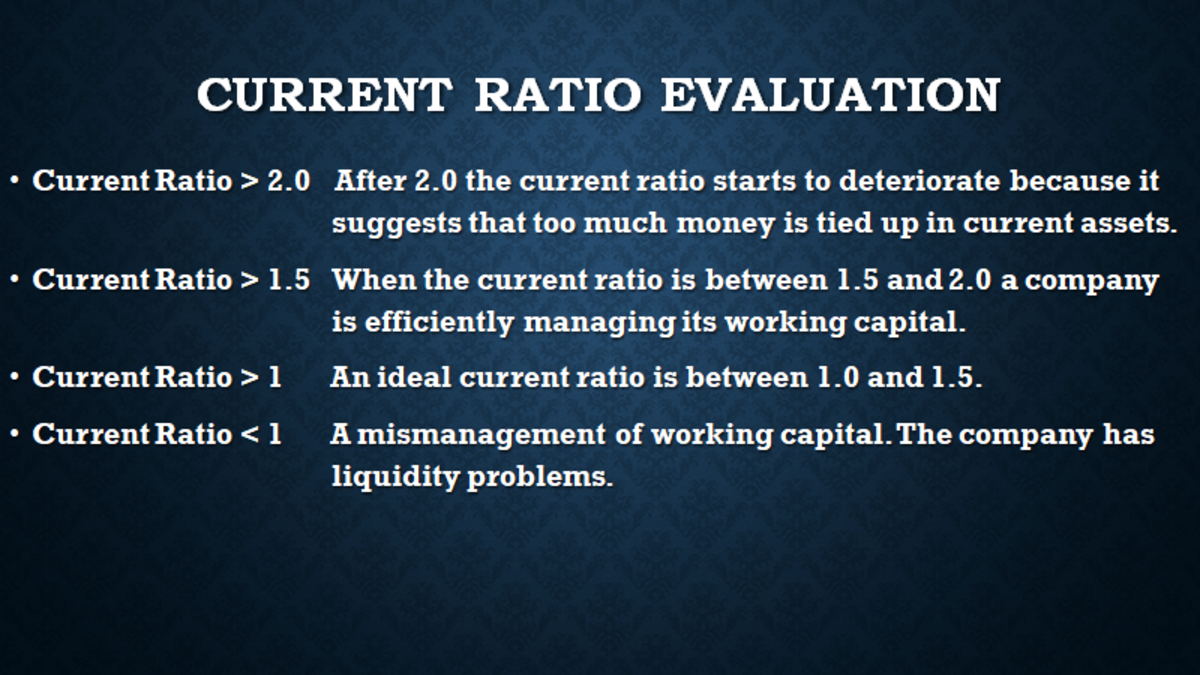

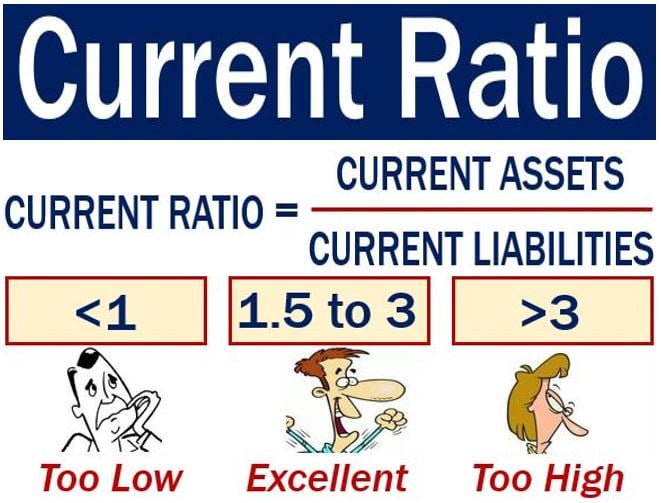

However, a ratio that is too high may indicate that the company is not using its resources efficiently, as it has more cash than it needs, or.

High current ratio interpretation. Written by tim vipond what is the current ratio? A very high current ratio may indicate existence of idle or underutilized resources in the company. A very high current ratio indicates that the business is not able to manage its capital in an efficient manner to produce profits.

The current ratio describes the relationship between a company’s assets and liabilities. In that case, the company has a current ratio of 1.5 = $1.5 million / $1.0 million. Above 2), it might be that the company is unable to use its.

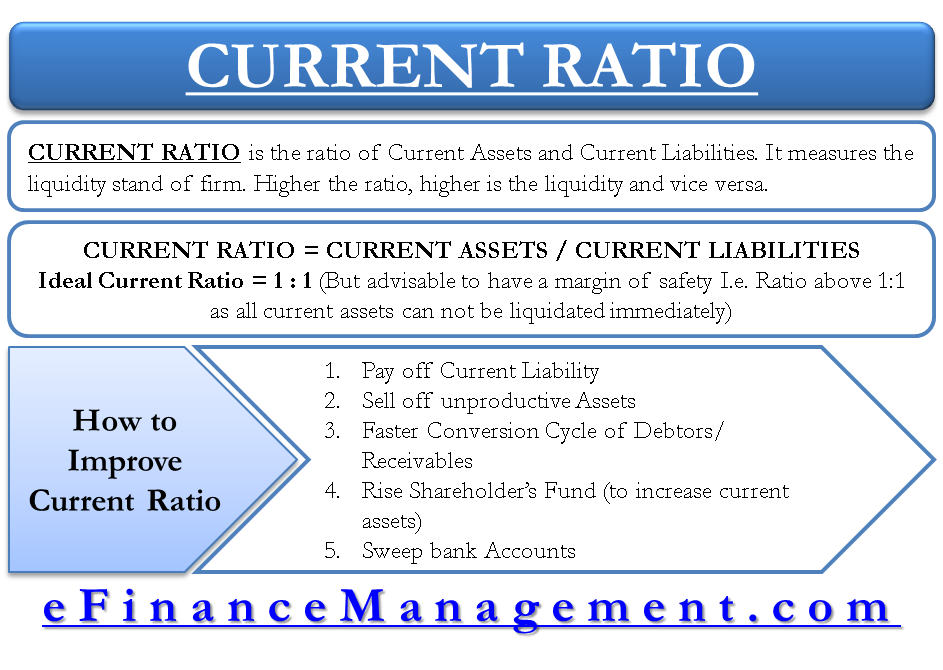

The current ratio needs to be high enough to provide financial stability and basic liquidity for the firm. Creditors are more willing to extend credit to those who can show that they have the resources to pay. A higher ratio is desirable because it.

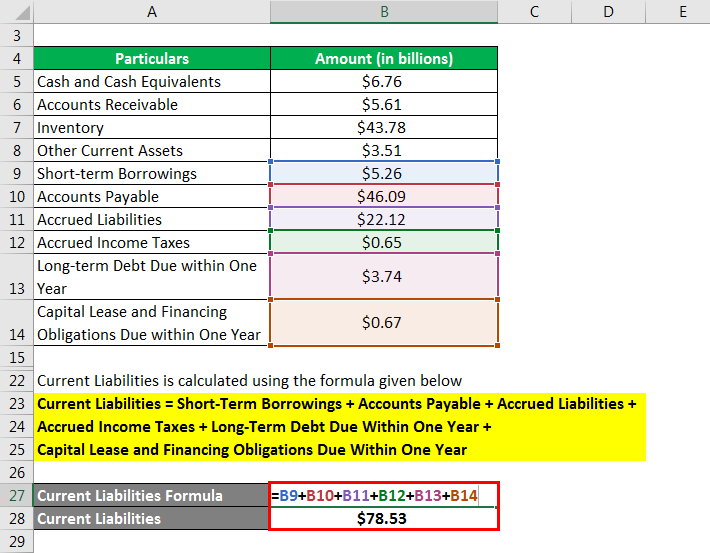

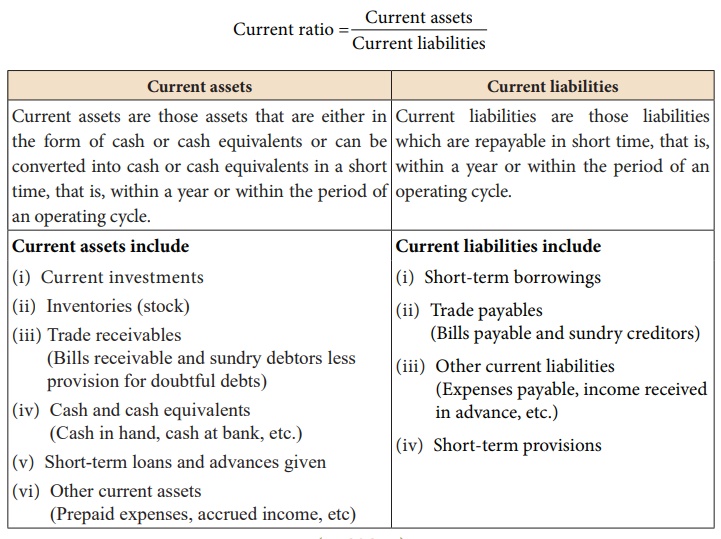

An excessively high current ratio, above 3, could indicate that the company can pay its existing debts three times. The value of the current ratio is calculated by dividing current assets by current liabilities. 1.00 is generally considered the minimum acceptable value.

A low current ratio of less than 1 indicates that the. That means that the current ratio for your business would be 0.68. More precisely, the general formula for the current ratio is:.

Analysis of current ratio high vs low current ratio. This ratio assesses a company’s capacity to meet its existing liabilities with current assets. Current ratio = $15,000 / $22,000 = 0.68.

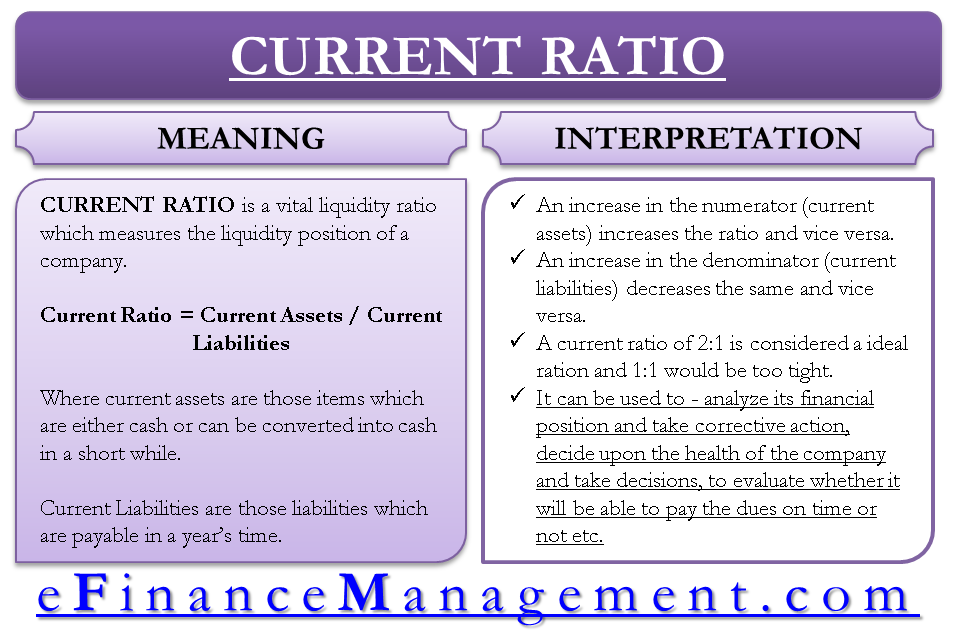

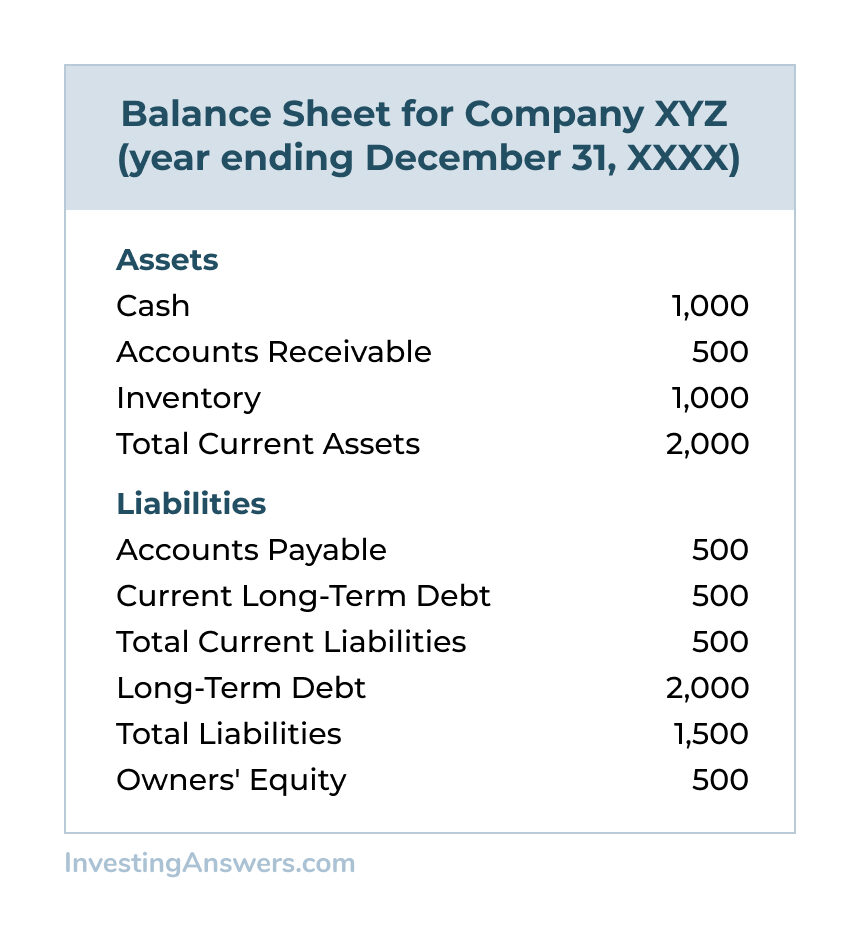

In other words, it is defined as the total current. The current ratio or working capital ratio is a ratio of current assets to current liabilities within a business. How to interpret the current ratio?

A company with a current ratio of less than one doesn’t have. A high current ratio is generally considered a favorable sign for the company. The higher the current ratio, the more liquid a company is.

Two frequently used liquidity ratios are the current ratio and the quick ratio. This is because most of the current assets earn low or no. Working capital ratio = current assets / current liabilities = 229,500 / 119,000 = 1.92857 ≈ 1.93.

However, if the current ratio is too high (i.e. The higher the current ratio, the better a company appears to be at paying its annual debts.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

![Current Ratio Formula + Calculator [Excel Template]](https://media.wallstreetprep.com/uploads/2021/11/27114755/Current-Ratio-Formula.jpg)