Beautiful Work Tips About Income Tax Expense On Statement Elements Of Accounting Equation And Examples

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

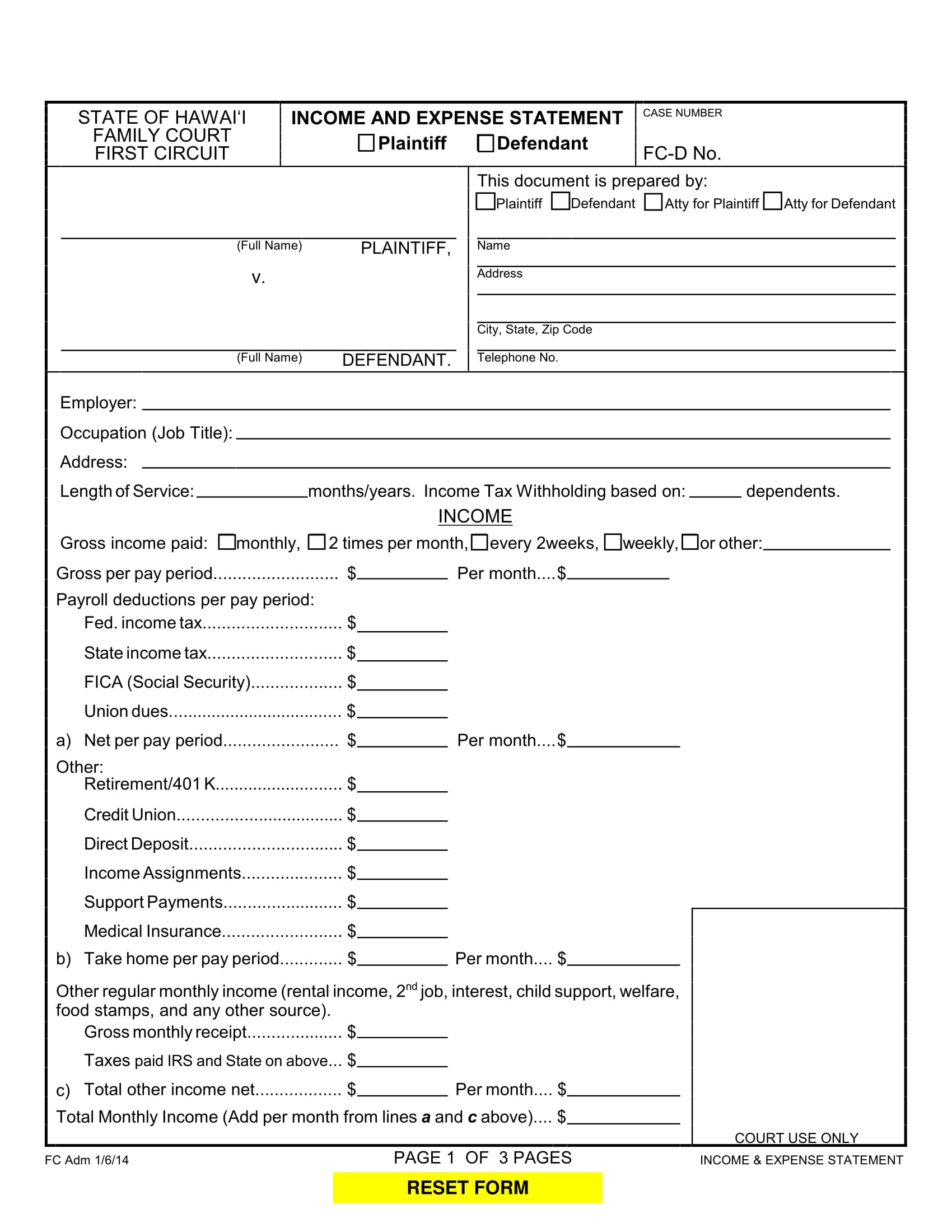

Current tax expense (income) any adjustments of taxes of prior periods;

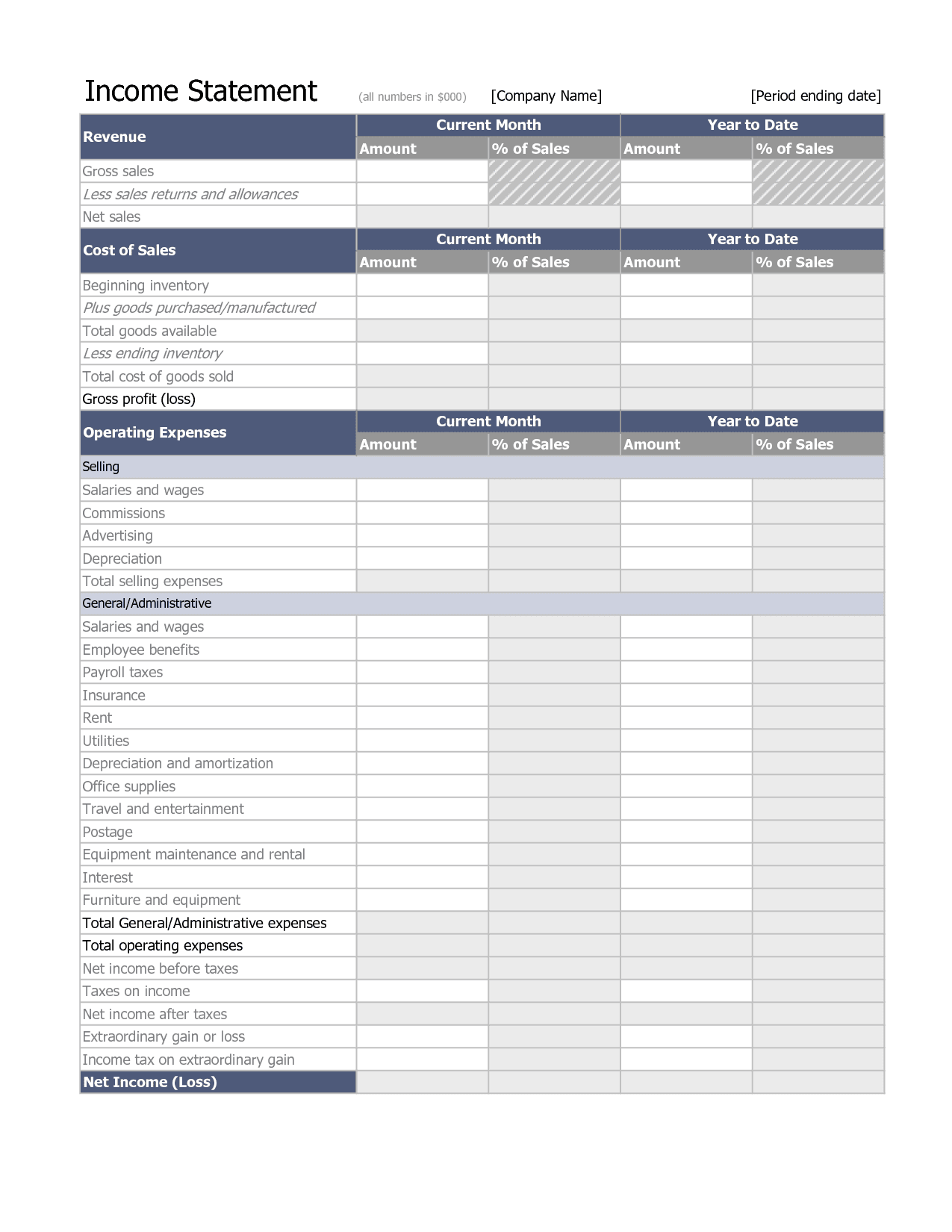

Income tax expense on income statement elements of accounting equation and examples. The business also gained $1,500 from the sale of. It results in cash outflow as income tax liability is paid out through bank transfers to the income tax department. Calculate the income tax expense and the business’s net income (earnings).

The amount of income tax that is associated with (matches) the net income reported on the company's income statement. Add up all your gains then deduct your losses. If the expenses are smaller than the sales, the net result is profitability, or net income, rather than a net loss.

Service revenue, professional fees, rent income, commission income, interest income, royalty income, and sales. Sales on credit) or cash. Income tax is a type of expense that is to be paid by every person or organization on the income earned by them in each financial year as per the norms prescribed in the income tax laws.

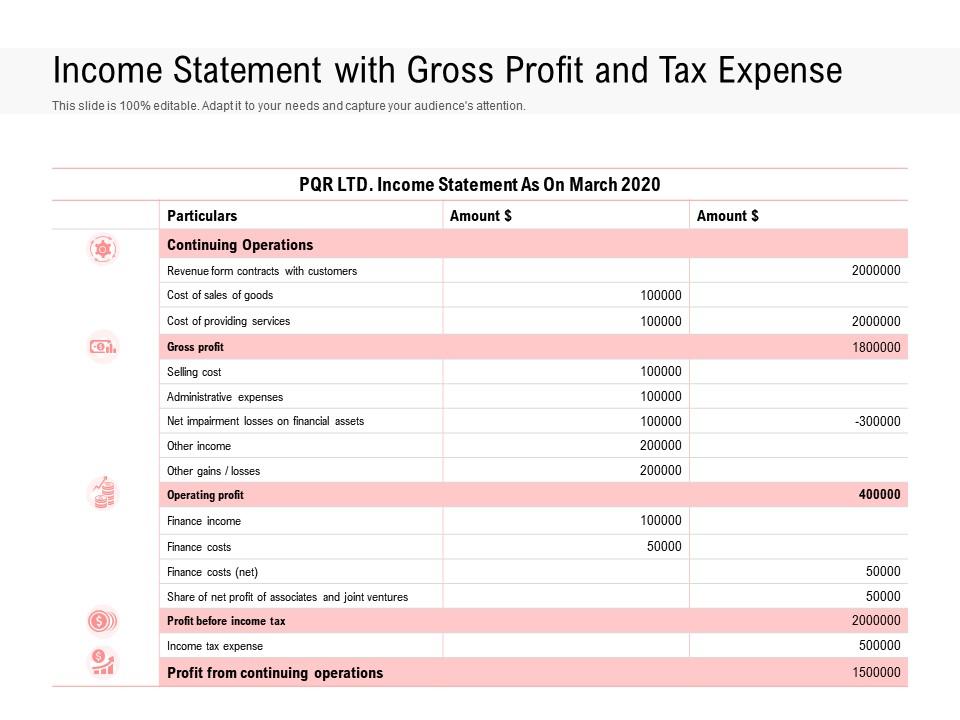

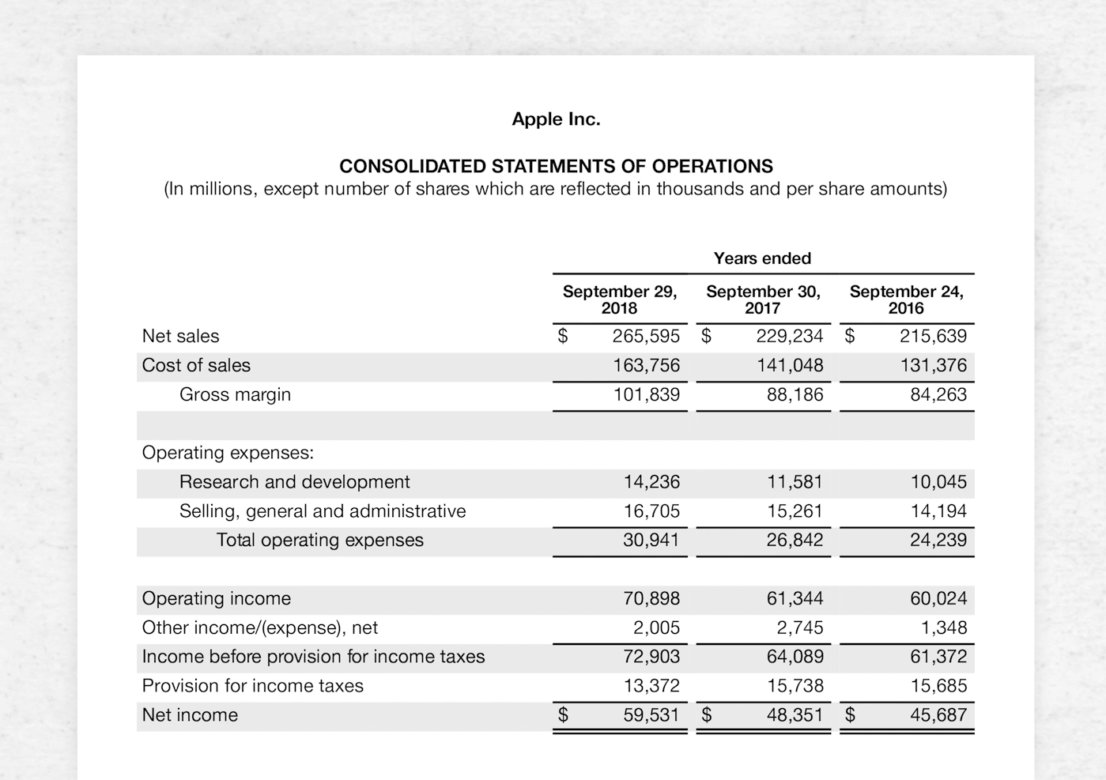

3 elements of income statement Major components of tax expense (tax income) [ias 12.79] examples include: Revenue revenue includes income earned from the principal activities of an entity.

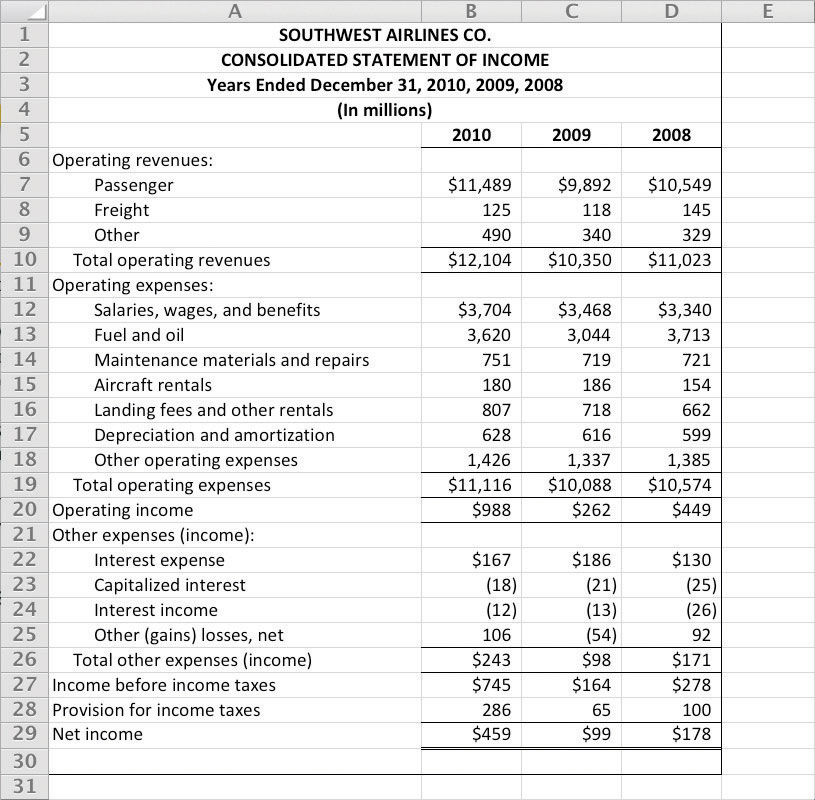

The income statement is a useful way to see how a company makes money and how it spends it. Input the appropriate numbers in this formula: The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

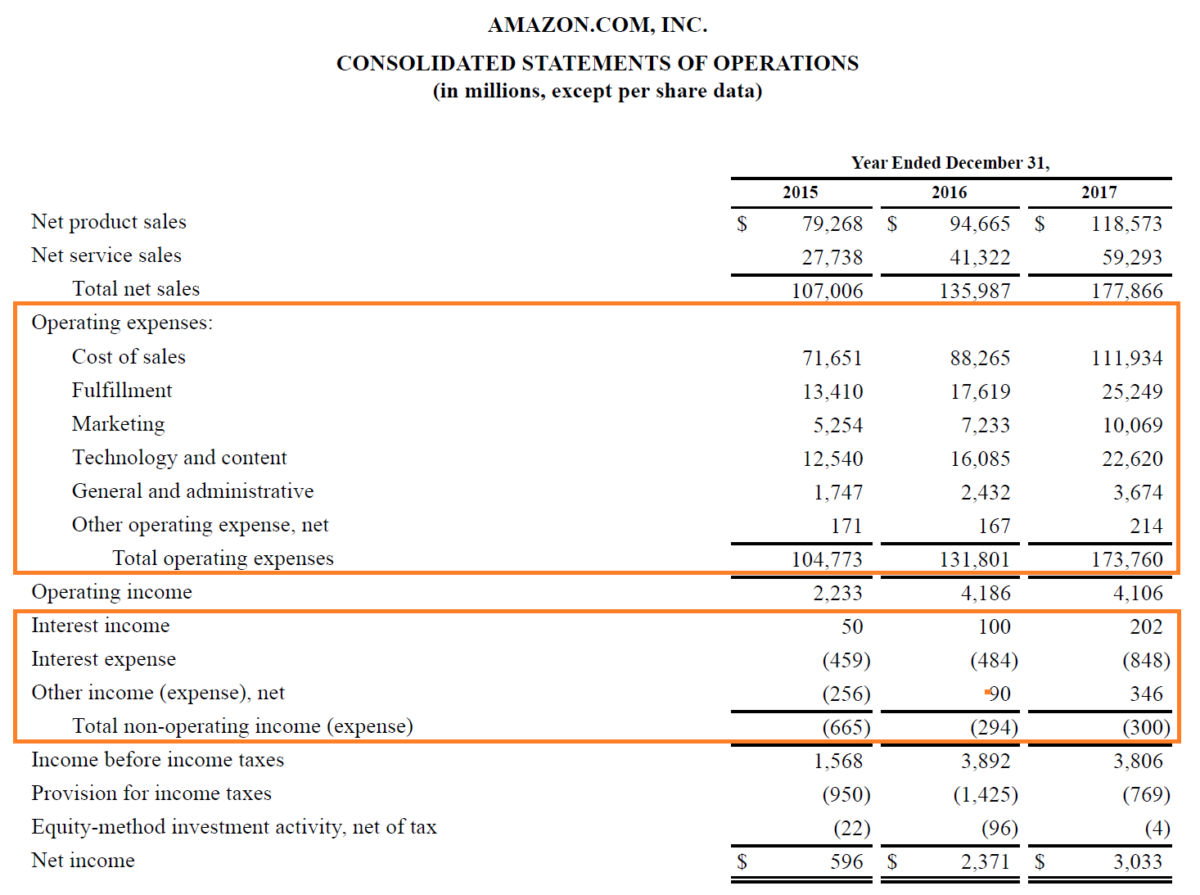

Types of income tax individual income tax, also called personal income tax, is placed on a person's wages, salary. Year ended december 31, 2022. An income statement might use the cash basis or the accrual basis.

The statement helps financial statement users understand the sales generated during the period and the expenses incurred to generate those sales. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; Example anushka began a sole trade business on 1 january 20x1.

The difference between net sales and the cost of goods sold. Expense like income, expenses are also measured every period and then closed as part of capital. You can look at an income statement for just one day or over a month, a quarter, a year, or several years.

Income tax expense is calculated by multiplying taxable income by the effective tax rate. Amount of deferred tax expense (income) relating to the origination and reversal of temporary differences; Examples of income tax expenses.

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Amount of deferred tax expense (income) relating to changes in tax rates. Total income tax expense = $952.5 + $3501 + $9,636 = $14,090.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)