Painstaking Lessons Of Info About Financial Statements Of A Partnership

Partnerships are a legal form of business organization where two or more partners come together to form a business.

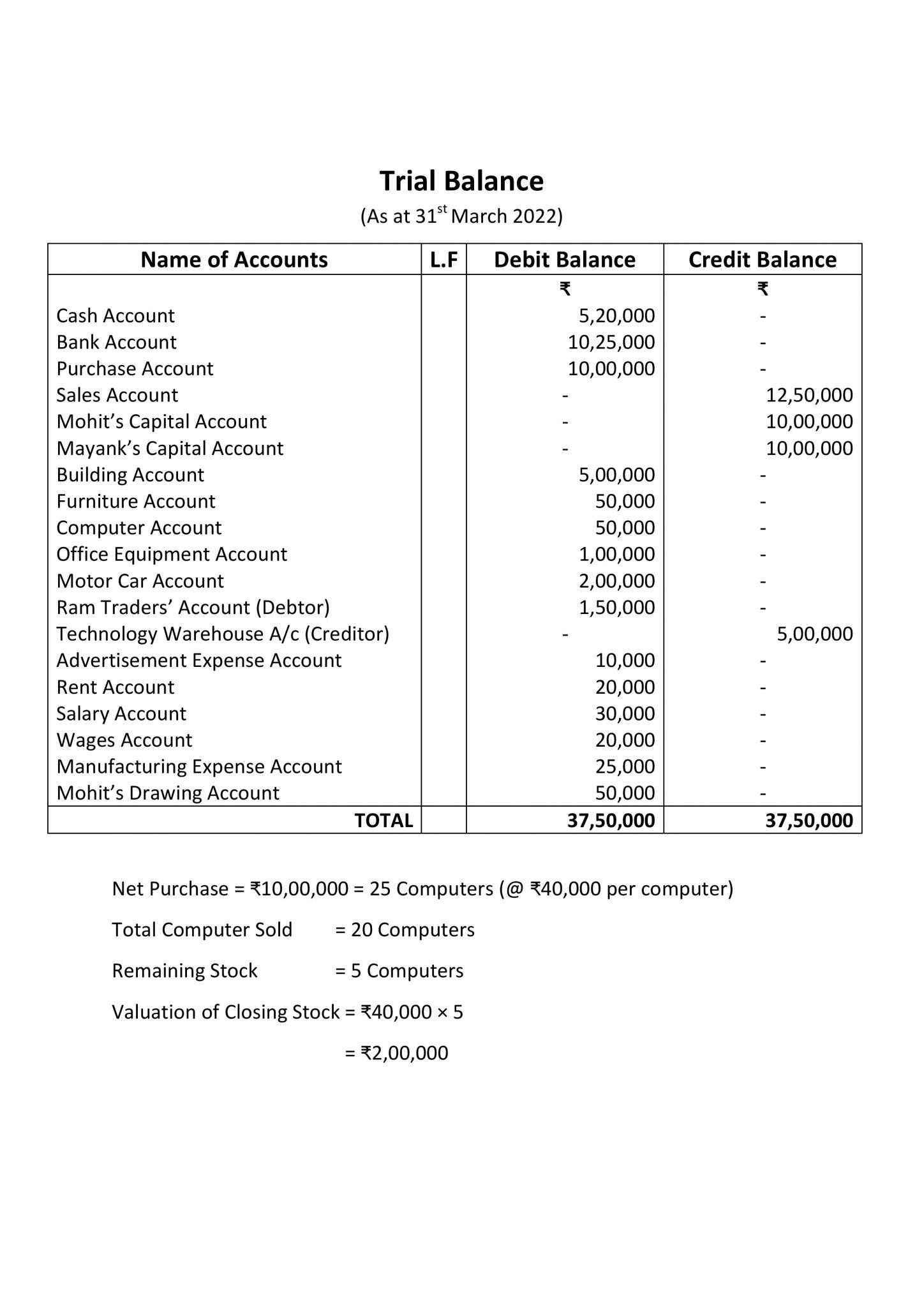

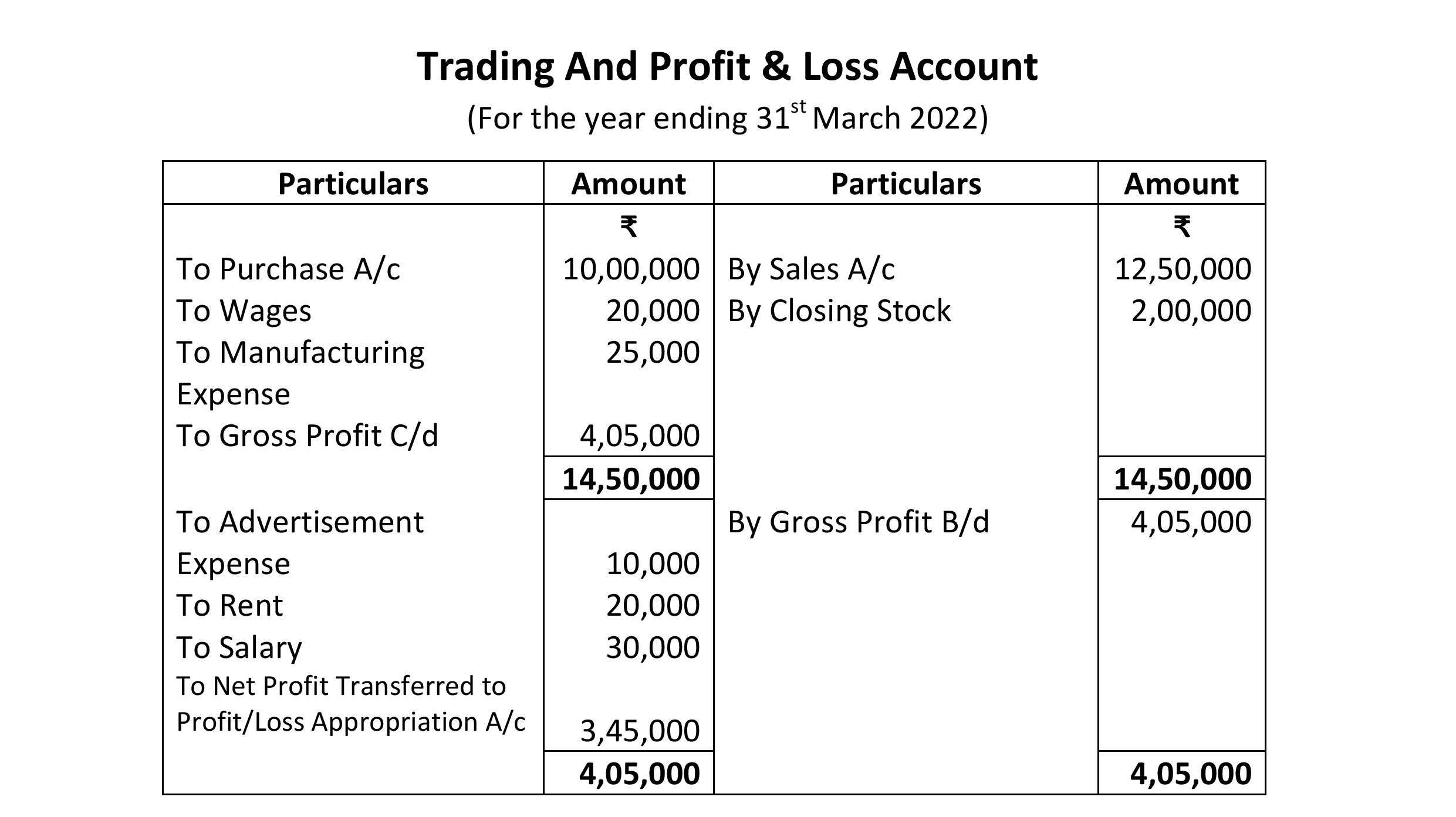

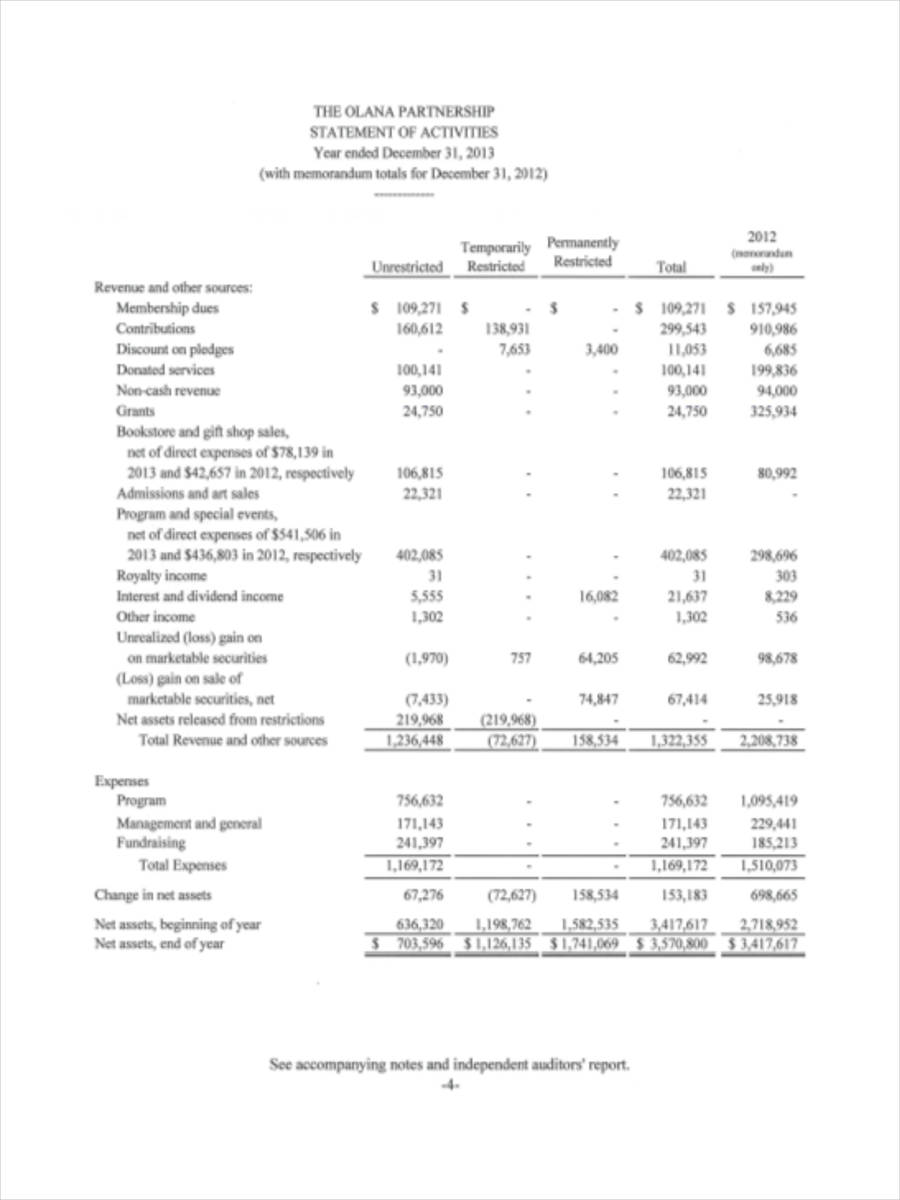

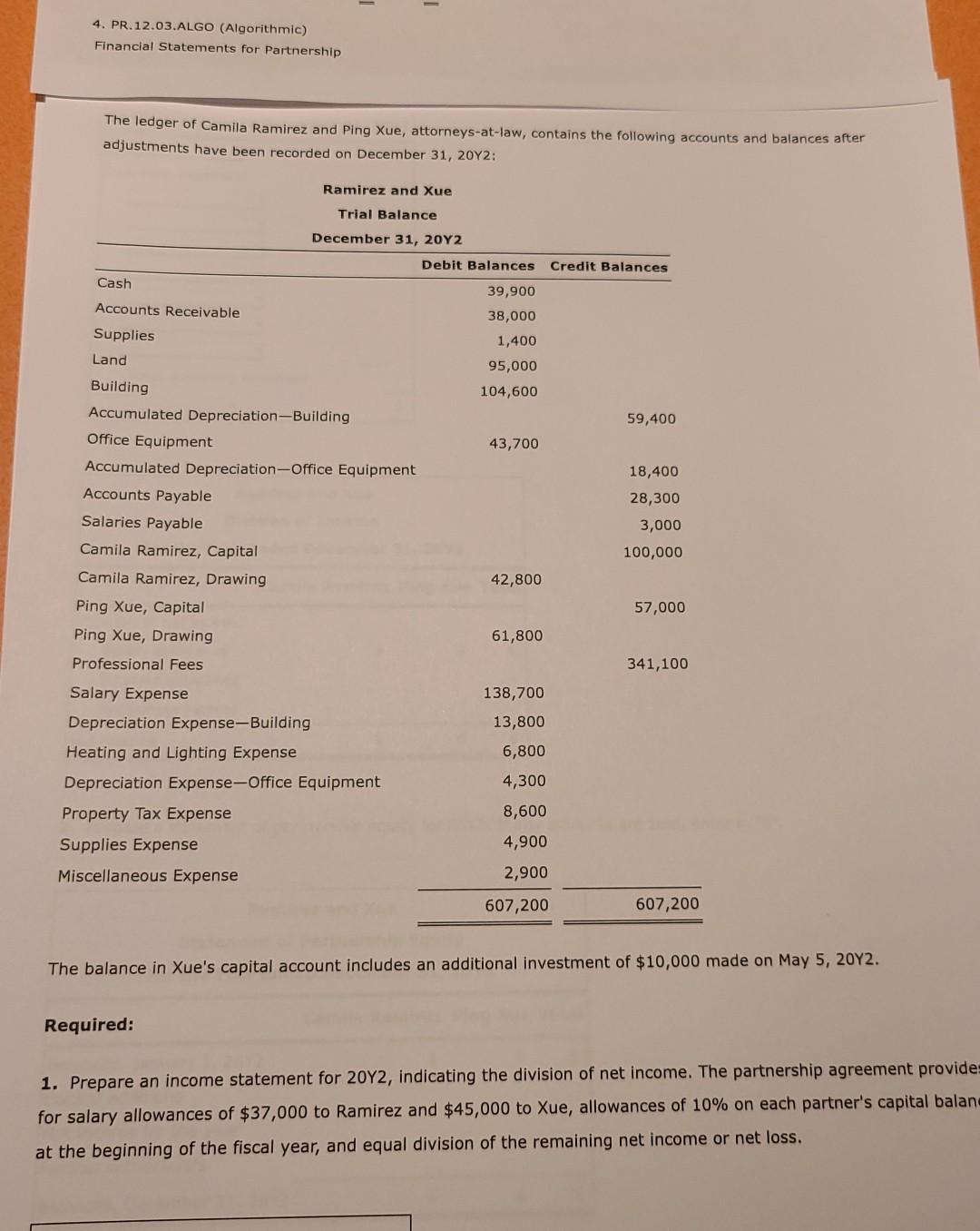

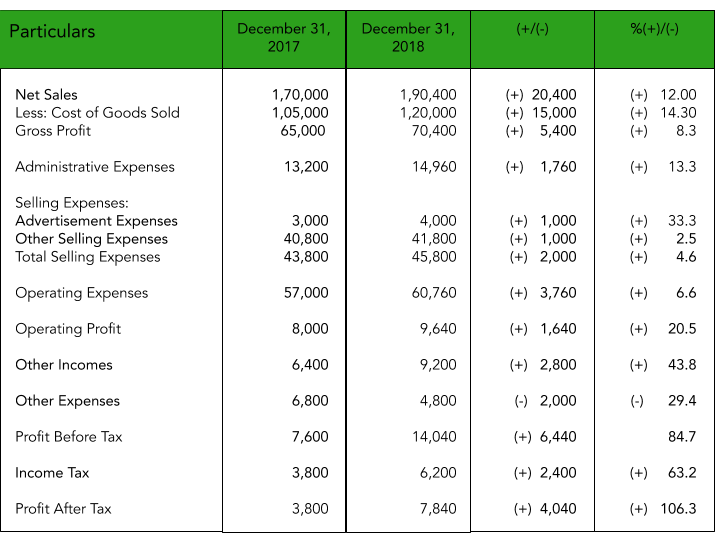

Financial statements of a partnership. The partnership records and tracks all contributions from and distributions to each. Net income for the year equalled $15,000, allocated as a: Partnership accounting except for the number of partners' equity accounts, accounting for a partnership is the same as accounting for a sole proprietor.

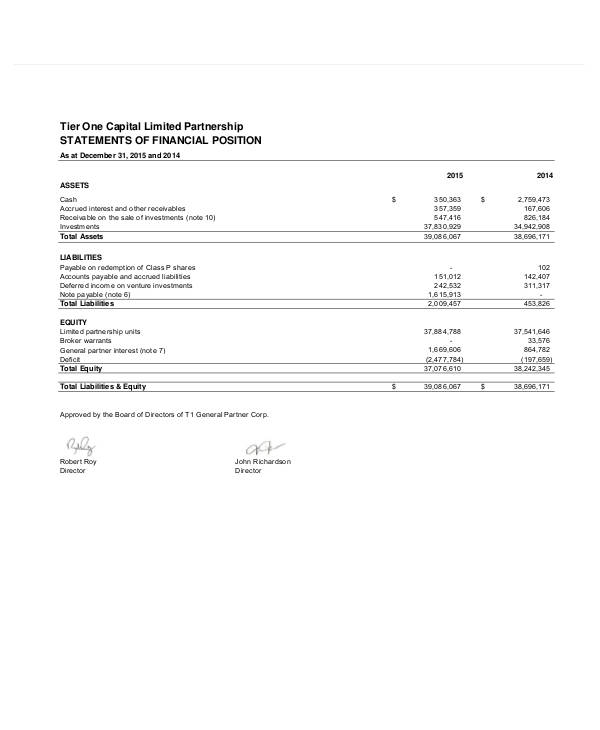

The financial statements of the trading company, including the condensed schedule of investments, are contained elsewhere in this report and, should. A statement of financial position as at at the last day of the period; The difference lies stylish the allocations of the earnings after fiscal activities.

In 2023, this strategy culminated in the distribution of dividends to common unitholders, affirming the partnership's robust financial health and its dedication to. While the average deal size increased 14. Accounting for partnerships the purpose of this article is to assist candidates to develop their understanding of the topic of accounting for partnerships.

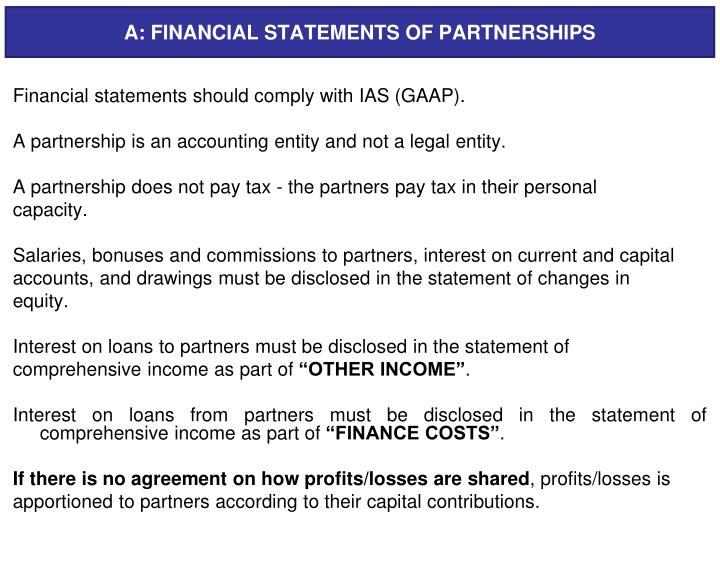

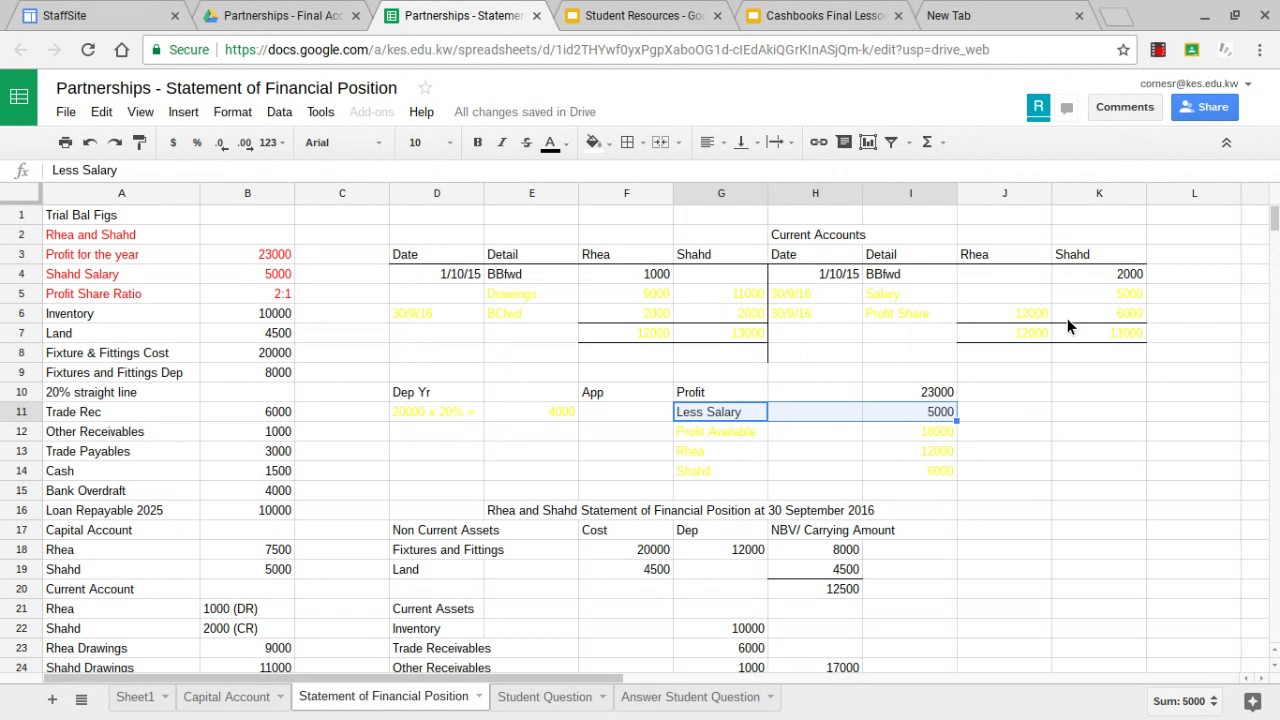

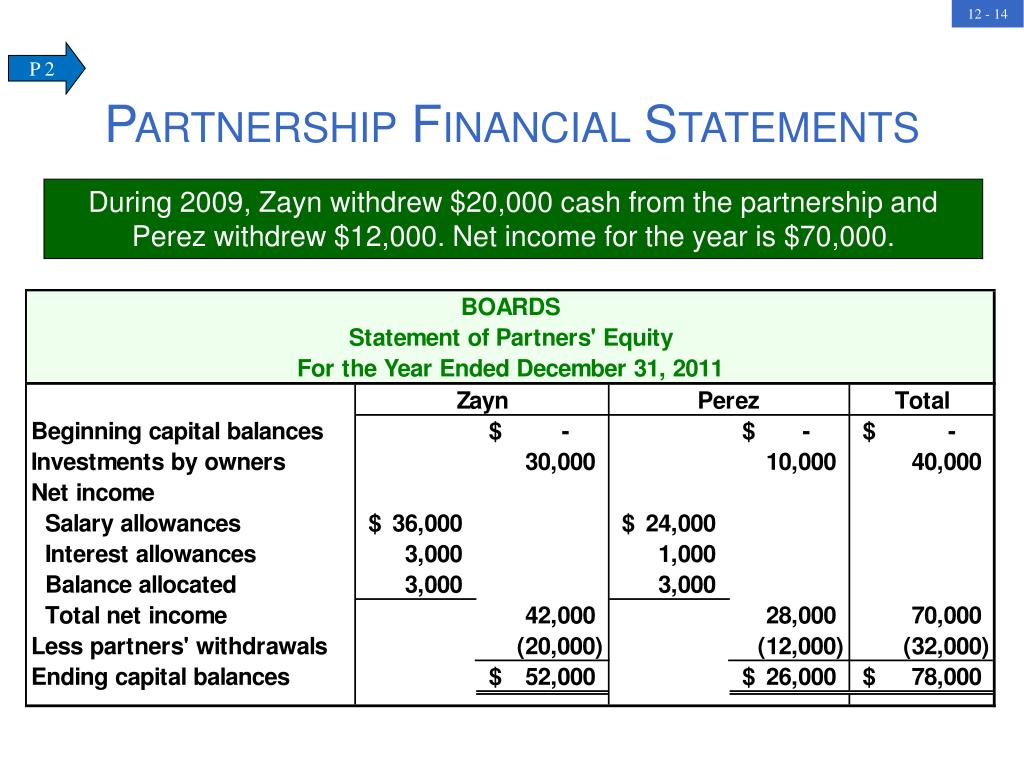

If the partnership business is involved in manufacturing a manufacturing account is also. Statement of changes in partners’ capital year ended. The income statements of partnerships should be presented in a manner which clearly shows the aggregate amount of net income (loss) allocated to the general partners and.

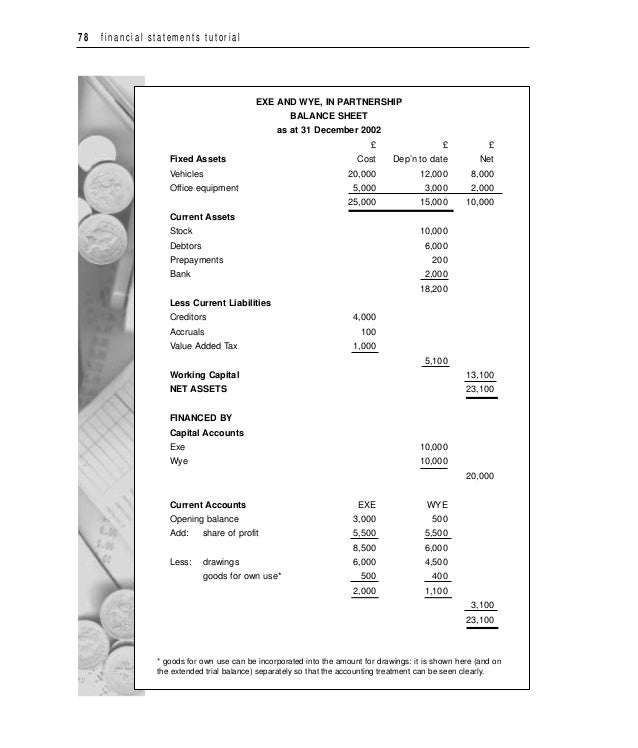

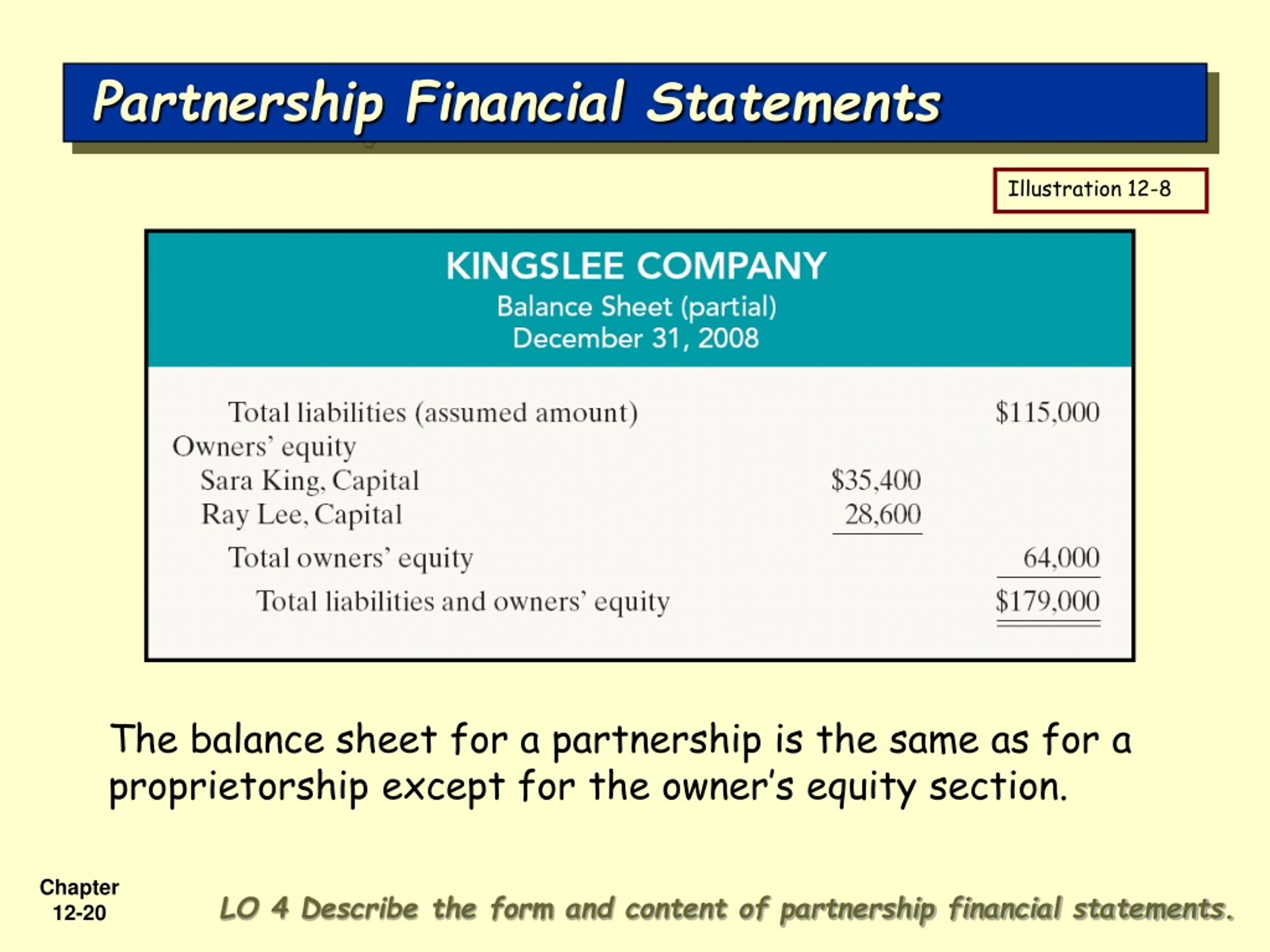

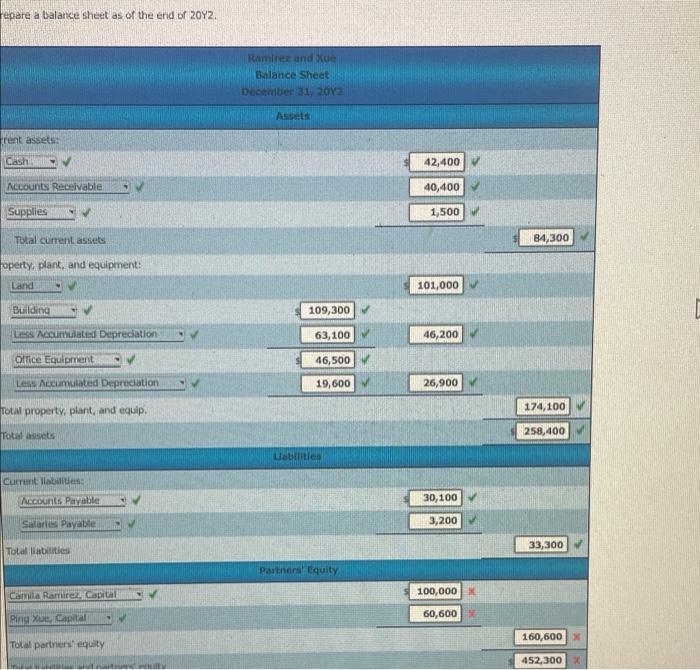

The three financial statements for a partnership are the income statement, capital statement (or statement of owner's equity ), and balance sheet. The balance sheet the balance sheet is a record of a business's assets, liabilities and owners' (or partners') equity. Cost 1 accumulated depreciation, 1 april 20x2 inventory, 1 april 20x2 2 trade receivables 3 allowances for receivables, 3 1 april 20x2 sales revenue purchases rent paid 4.

Partnerships must provide information on how net income was distributed among partners. General partnership financial statements should include disclosure of any unusual commitments undertaken by the general partner or sponsor. The capital account statement is the one financial statement totally unique to partnerships.

The financial statements of bepc and the partnership (excluding any pro forma financial statements) included or incorporated by reference in the supplemented prospectus and. This form, which shows income,. 7 / financial statements see accompanying notes to financial statements.

(a) do not put partners' salaries or interest on capital into the main income statement. Partnership financial statements are similar to those used by limits legal companies. Each contributed $5,000 to the partnership during the fiscal year.

Income statement the main part of the income statement is prepared exactly as for a sole trader. Preparing partnership financial statements. Technology company cisco announced wednesday that it plans to lay off 5% of its global workforce, amounting to thousands of employees, as part of a company.

These three statements together show. This information can be combined with the balance sheet or the. Return of partnership income” using irs form 1065.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)