Casual Info About Net Receivables On Balance Sheet

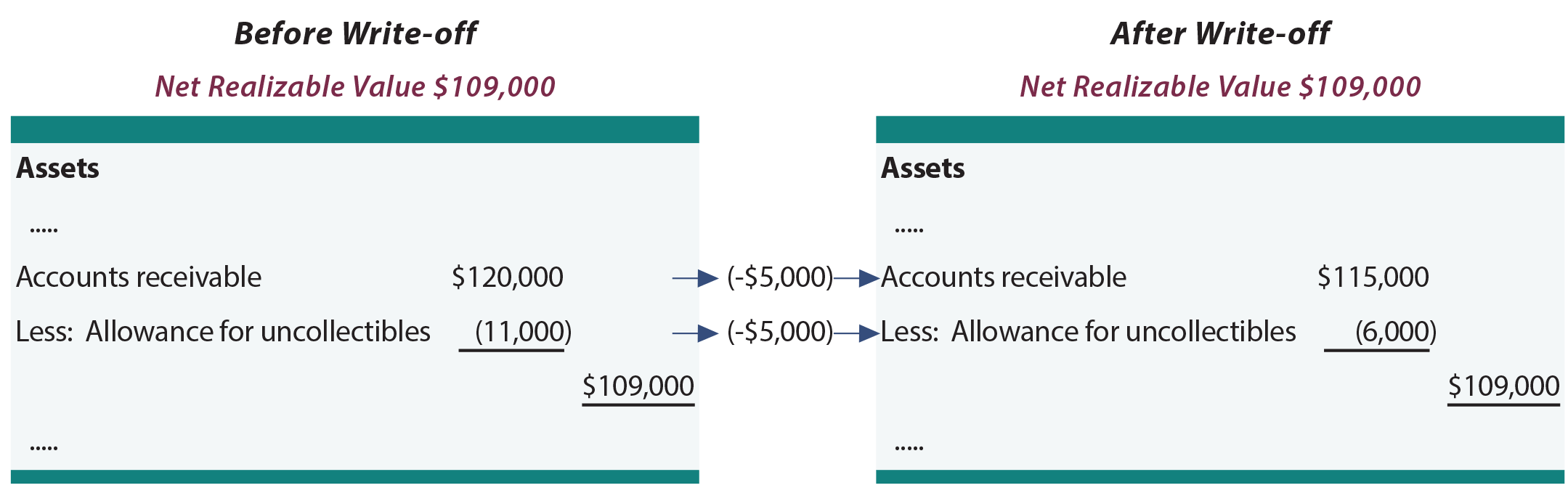

Allowance for doubtful accounts is a credit on the balance sheet as it reduces the accounts.

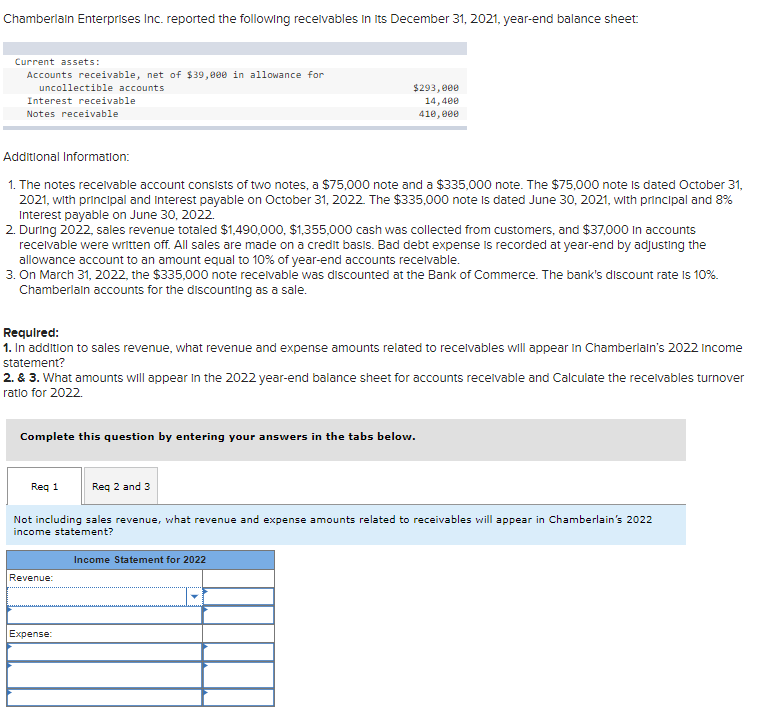

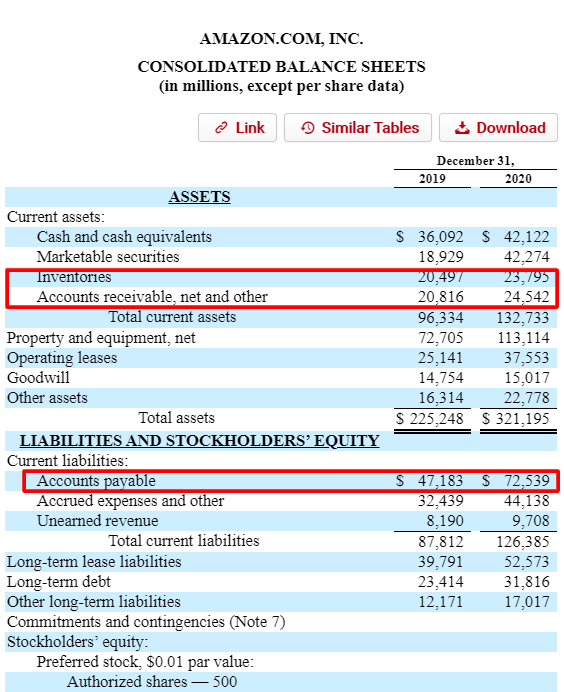

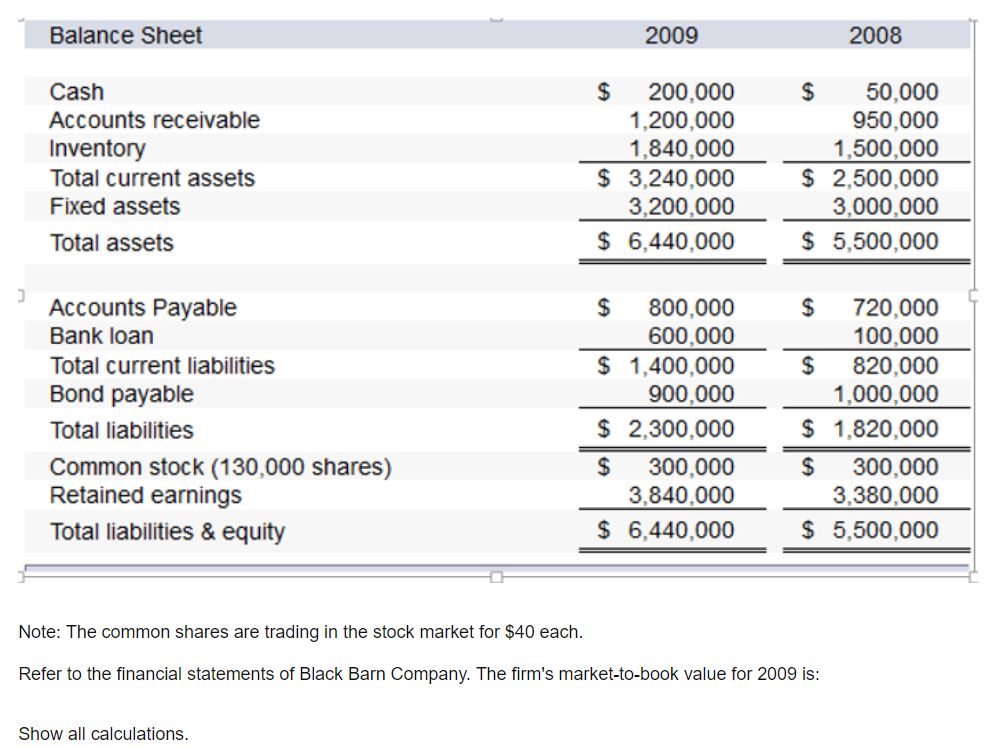

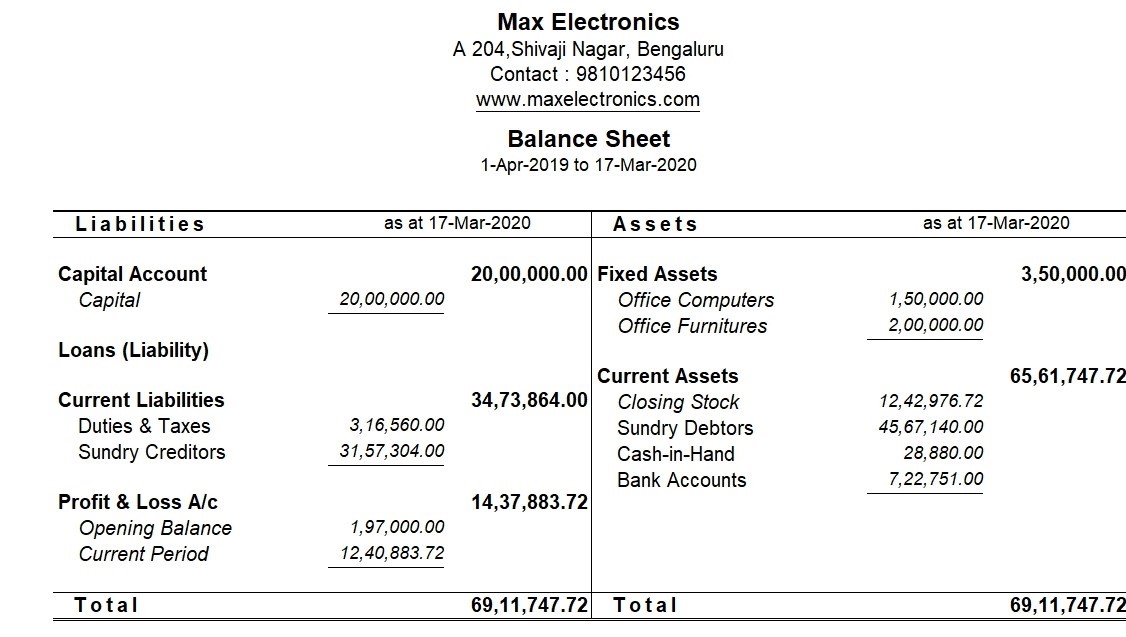

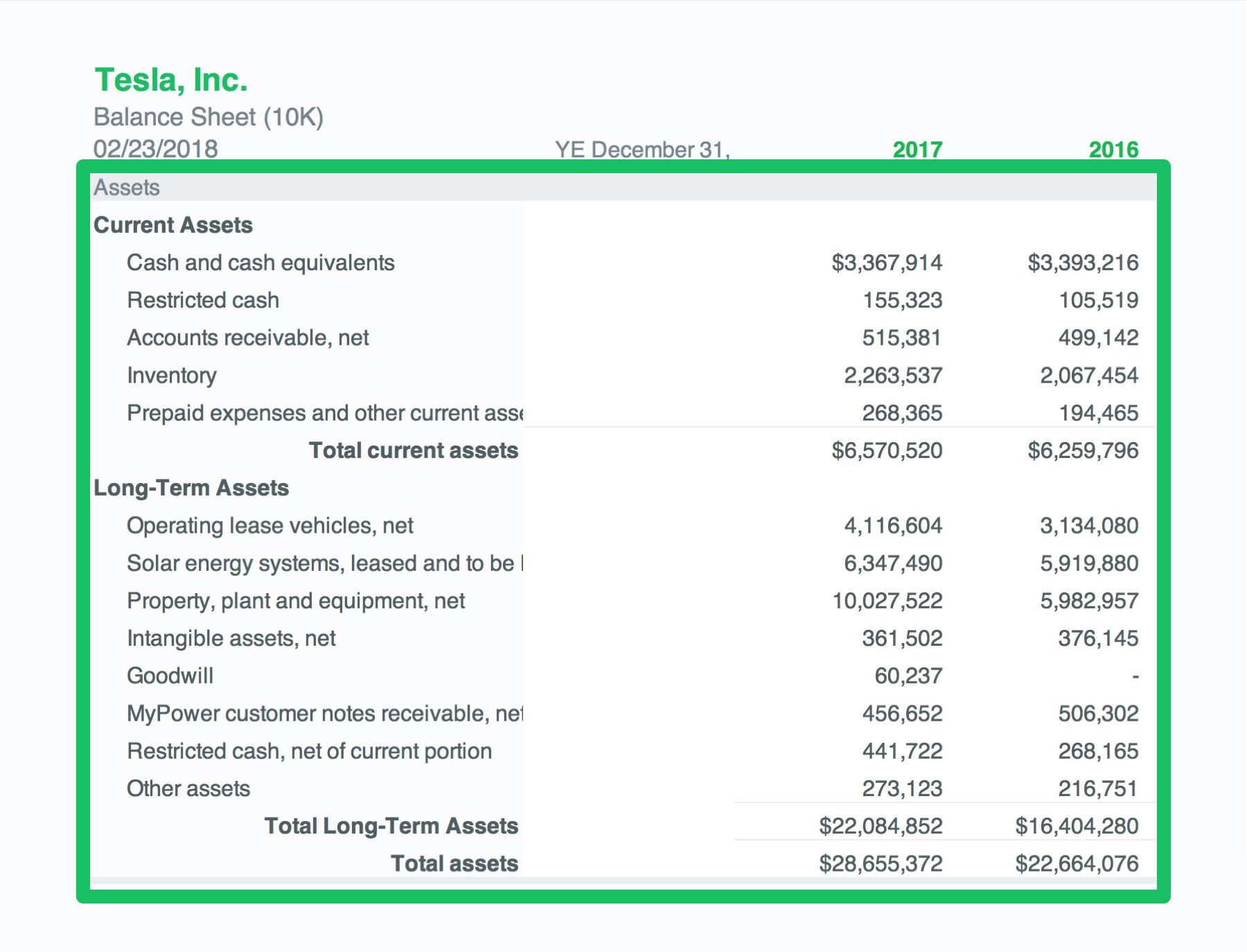

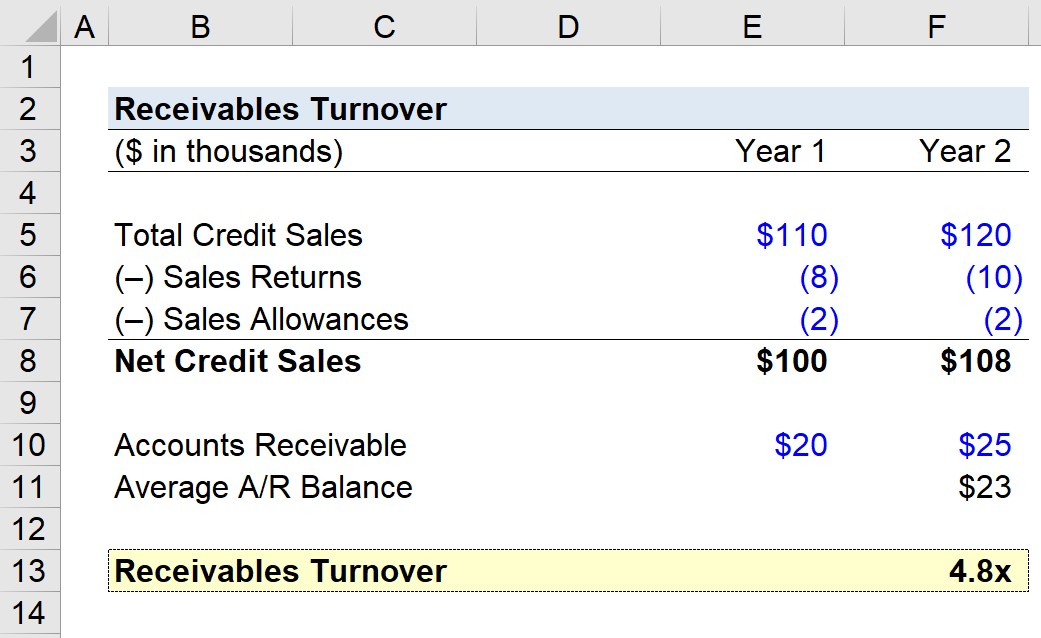

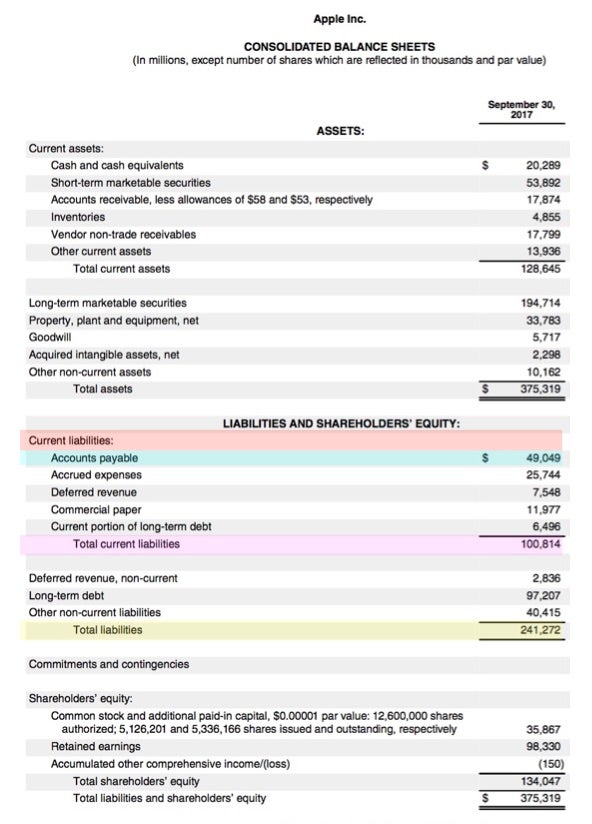

Net receivables on balance sheet. Updated march 28, 2022. Net accounts receivable is the total amount of money customers owe a company. The notes section contains detailed qualitative information and assumptions made during the preparation of the balance sheet.

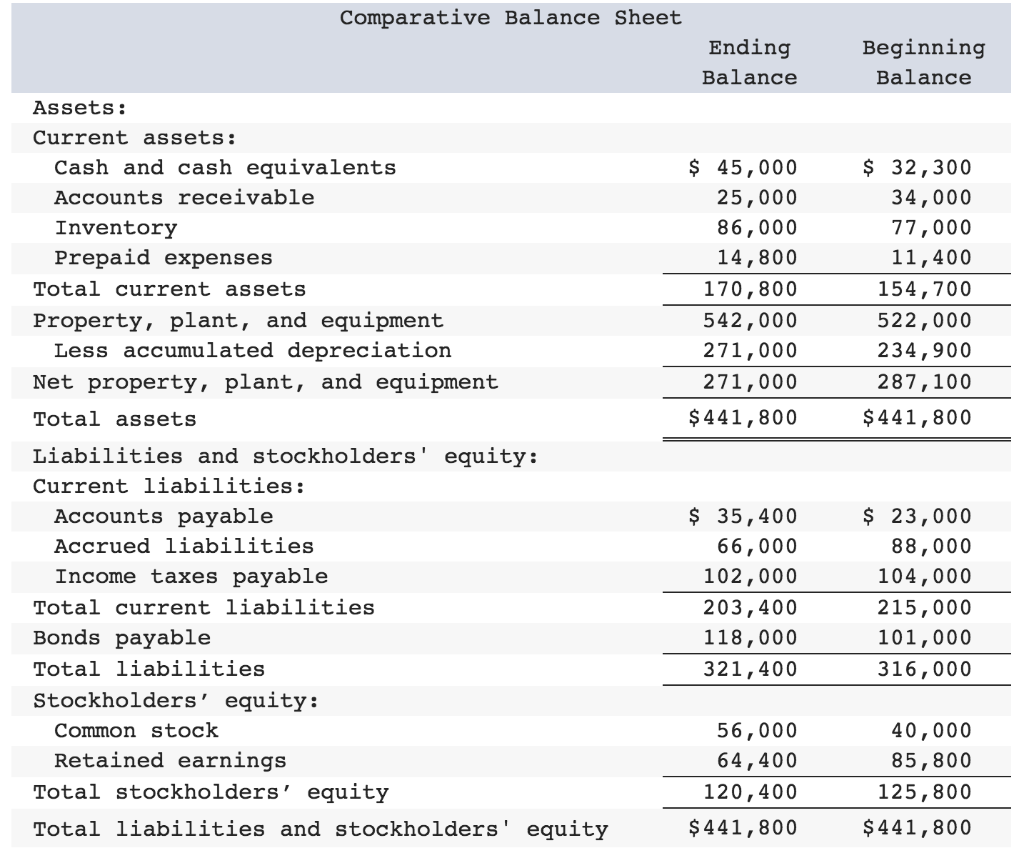

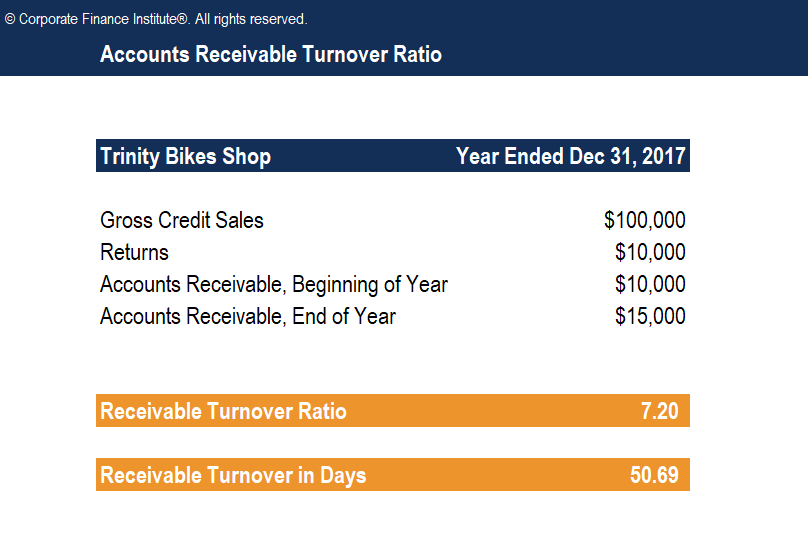

Companies that use accrual accounting estimate the allowance each period. The balance sheet should reflect the value of inventory as the cost to replace it. The net receivables amount is calculated by subtracting the allowance for doubtful accounts from the gross amount of accounts receivable outstanding.

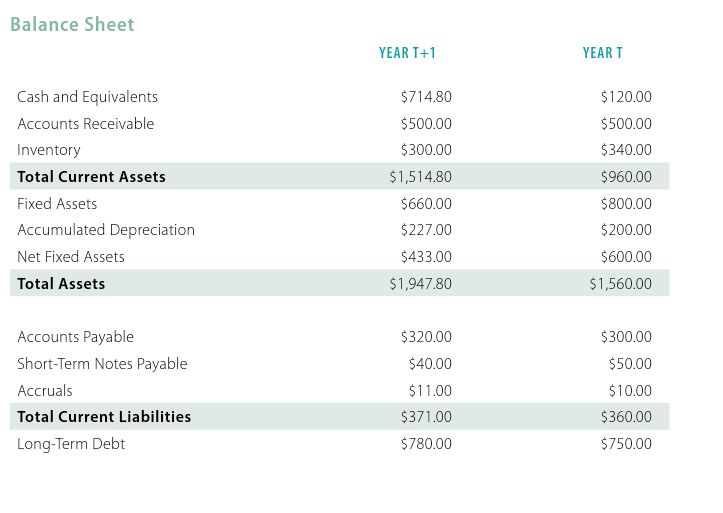

Notes receivable —more formal, unconditional written promises to pay a specified amount of money on a specified future date or on demand. On a company’s balance sheet, net receivables are presented as an aggregated total. After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value of $32,000.

The $1,500 is also calculated as 5 months of unexpired insurance x $300 per month.) Net receivables (or net realizable value) are equal to the accounts receivable amount less any allowance for doubtful accounts (discussed later in this chapter). Net receivables are often expressed as a percentage, and a higher percentage indicates a business has a greater ability to collect from its customers.one way that accounts receivable can become negative is if prepaid income is recorded incorrectly.

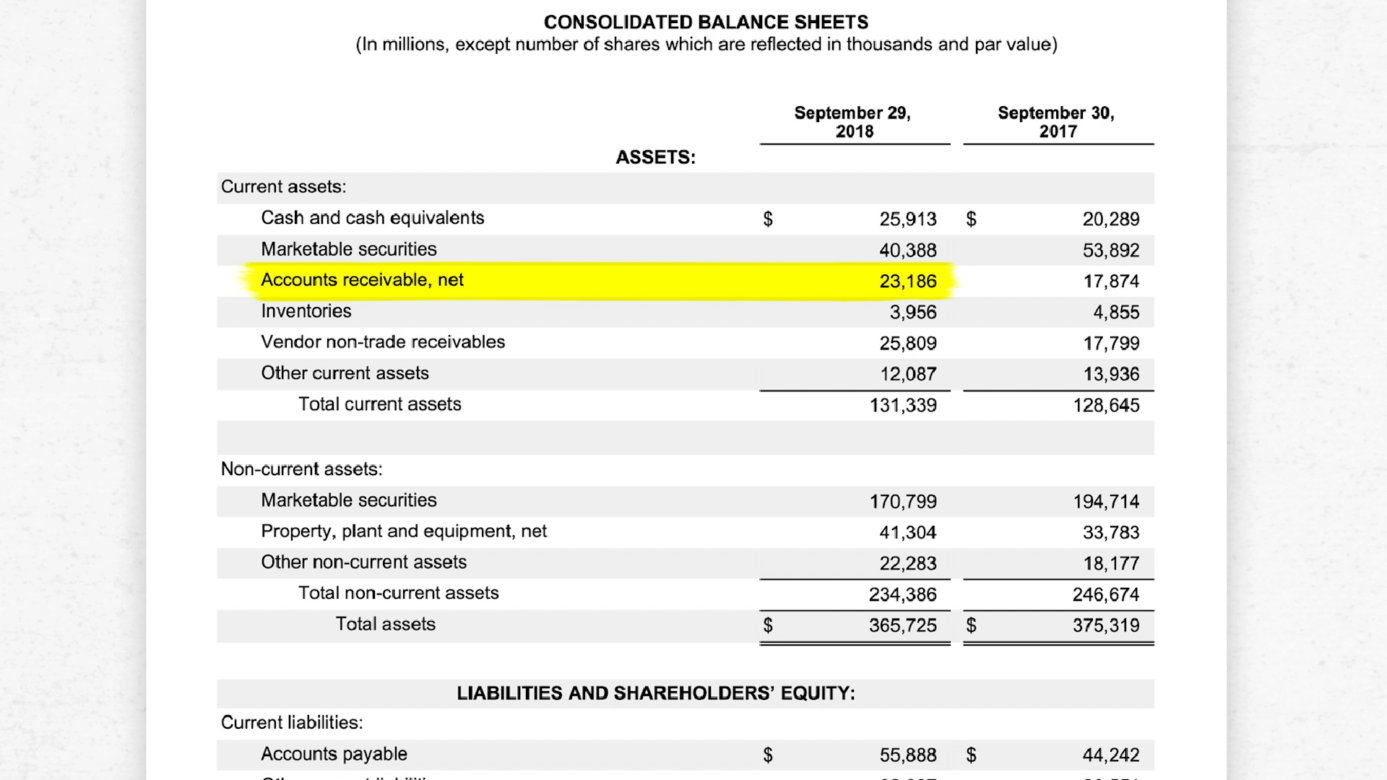

It shows what the ar team expects to collect within a specific timeframe. Given the above information, the company's december 31 balance sheet will report $1,500 as the current asset prepaid expenses. Accounts receivable is located in the asset section of the balance sheet usually right underneath cash or bank accounts.

The balance sheet is based on the fundamental equation: Net receivables are shown as an aggregated total on the company's balance sheet. For instance, if a sale is net 10, you have 10.

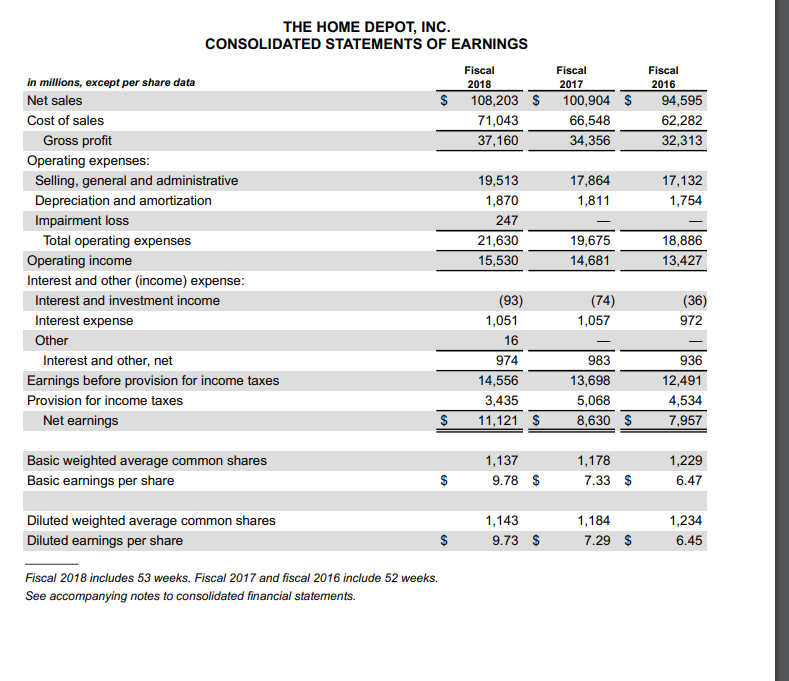

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The net receivables are categorized as a current asset, but this balance is reduced when the allowance for doubtful accounts has been deducted. The gross receivables are listed first and are followed by the allowance for doubtful accounts.

Understanding the formula is just the start; It can also be referred to as a statement of net worth or a statement of financial position. A video tutorial by perfectstockalert.com designed to teach investors everything they need to know about accounts receivable on the balance sheet.

Managers must use this information to enhance collection efforts. Assets = liabilities + equity. Gaap, the figure that is presented on a balance sheet for accounts receivable is its net realizable value—the amount of cash the company estimates will be collected over time from these accounts.

After two years, its net book value would be $24,000, and so on. Net receivables are also recorded in the balance sheet, they are shown as an aggregated total. Receivables fall under the same classification as cash, inventory, and other assets the company routinely uses to conduct business.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)