Supreme Info About Financial Statements Prepared On A Non Going Concern Basis

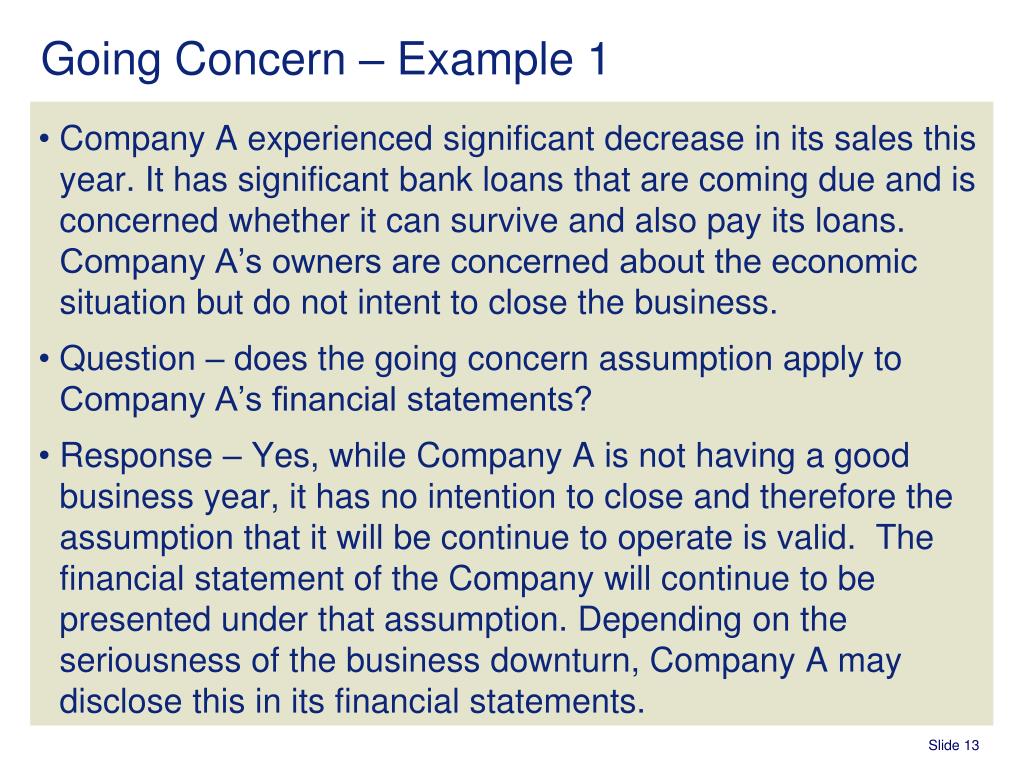

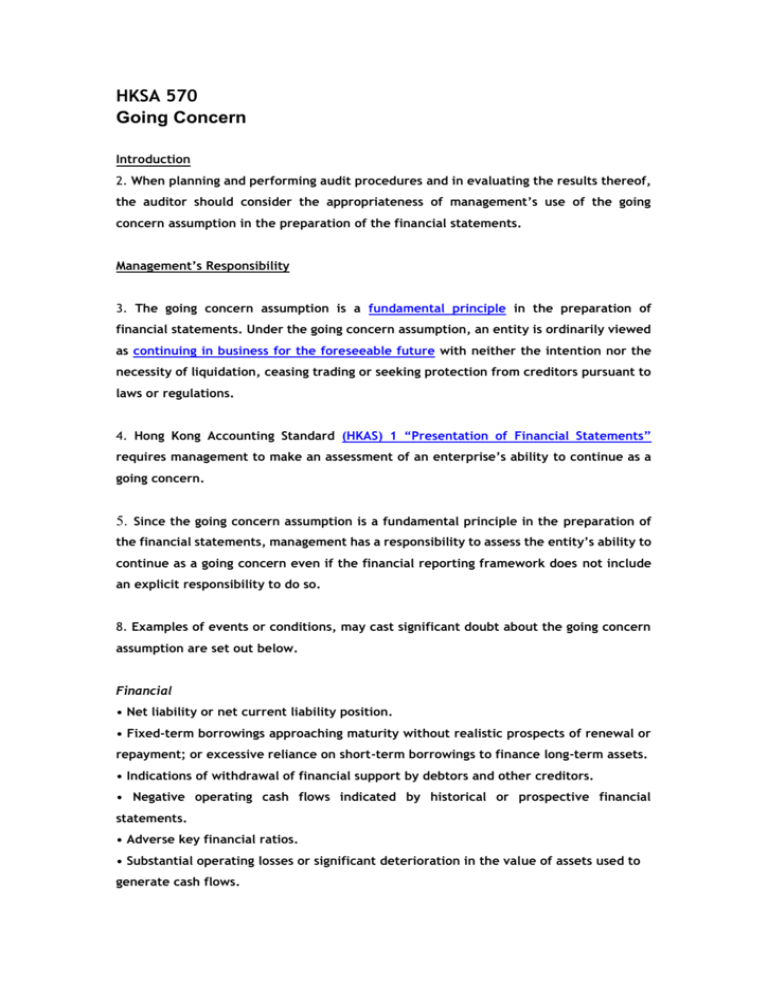

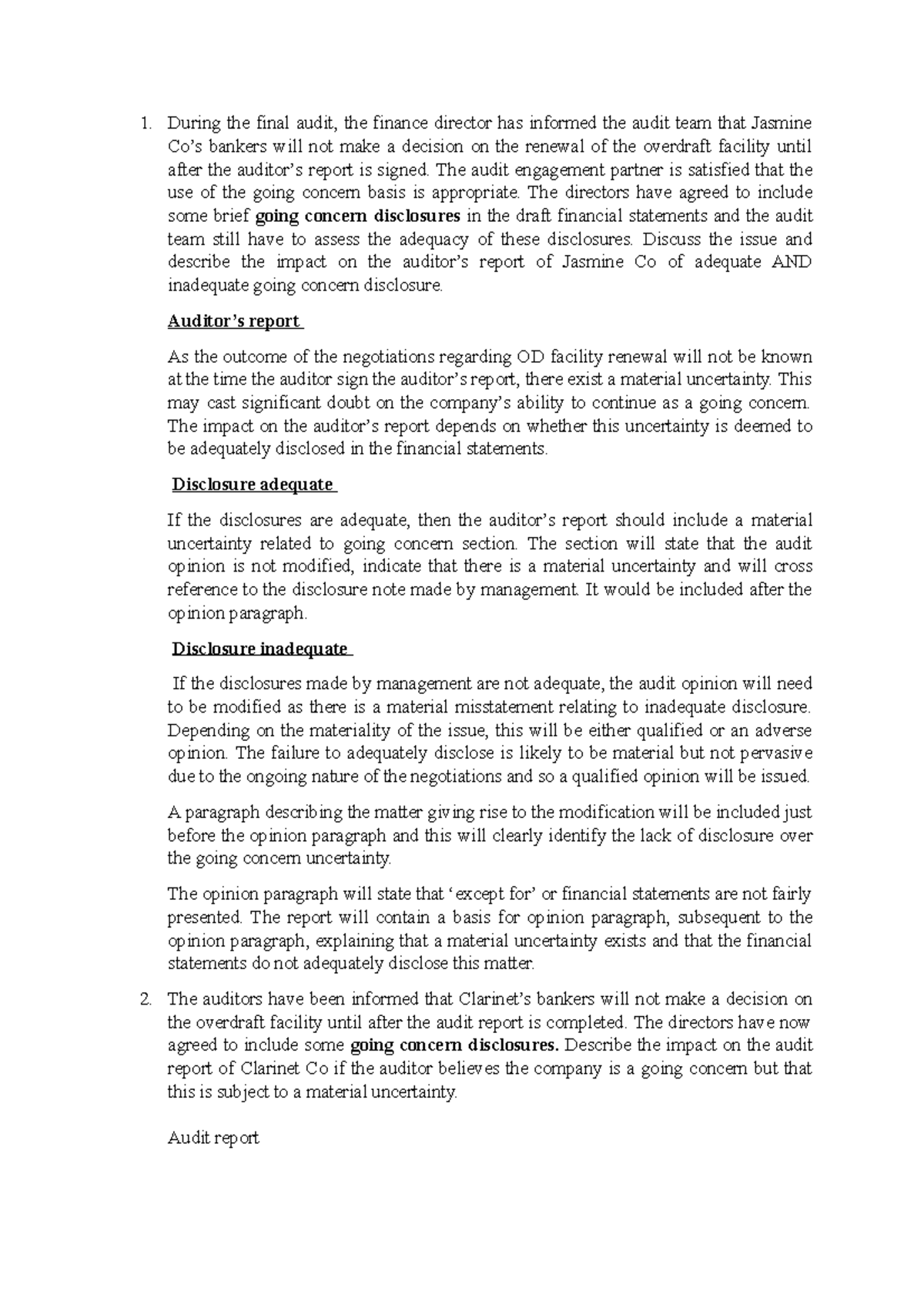

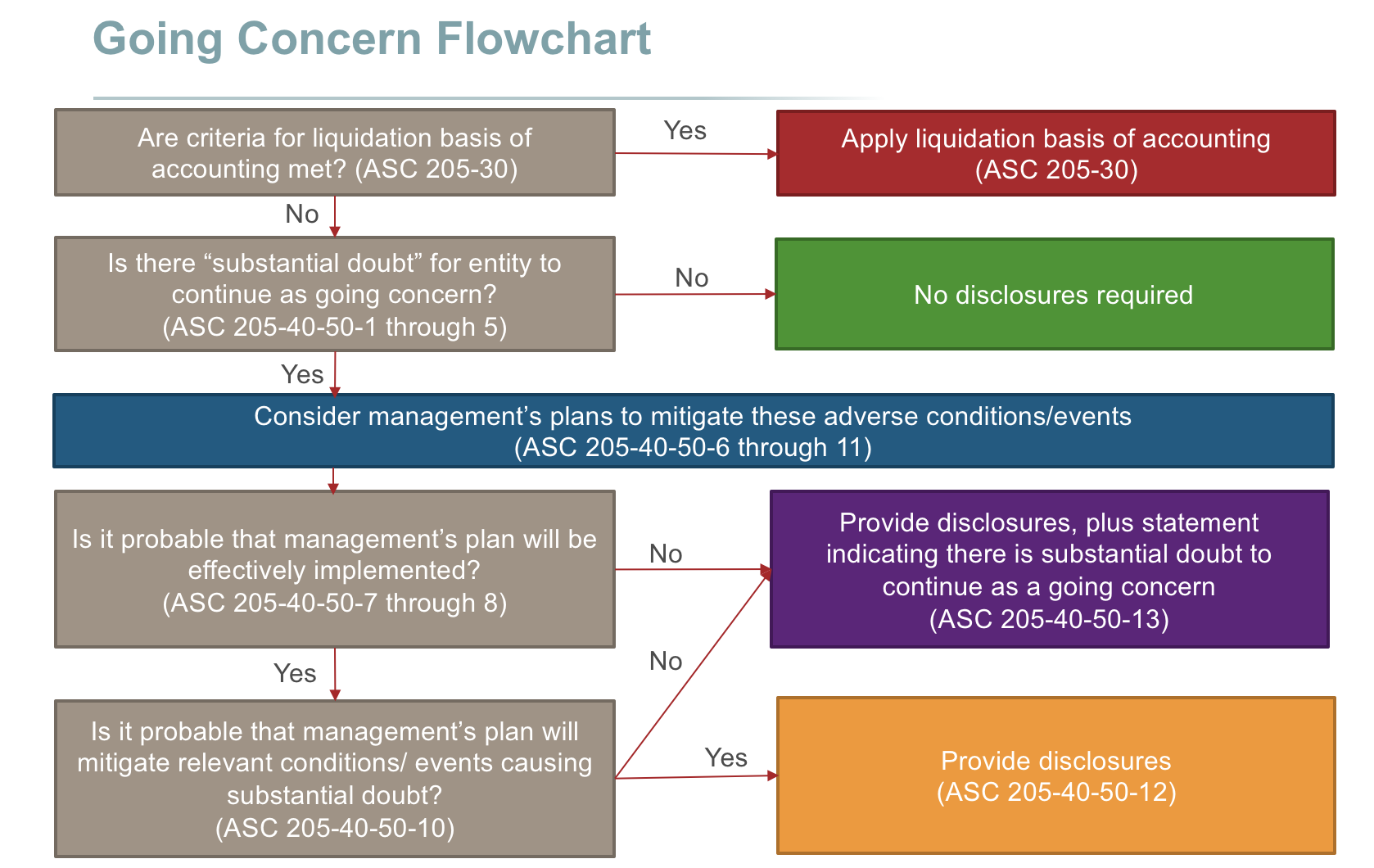

It says that all entities have to prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so.

Financial statements prepared on a non going concern basis. Frs 102 would require an entity to prepare its financial statements on a going concern basis, even if the business is in serious financial difficulty. Its 2018 financial statements on a going concern basis. Frs 102, paragraph 32.7a states:

Both ias 1 ‘presentation of financial statements’ and ias 10 ‘events after the reporting period’ suggest that a departure from the going concern basis is required when specified circumstances exist. Our view the fact that a going concern basis is inappropriate does not automatically mean that a They did not identify any entity restating comparative information to reflect the.

The problem is that ias 1 does not tell us how to prepare the financial statements when going concern does not apply. Both ias 1 ‘presentation of financial statements’ and ias 10 ‘events after the reporting period’ suggest that a departure from the going concern basis is required when specified circumstances exist. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis in which it prepared the financial statements, and the reason for the entity is not regarded as a going concern.

Unlike us gaap, there is no liquidation basis of accounting under ifrs; Preparing financial statements when the going concern basis is not appropriate. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern' (ias 1.25).

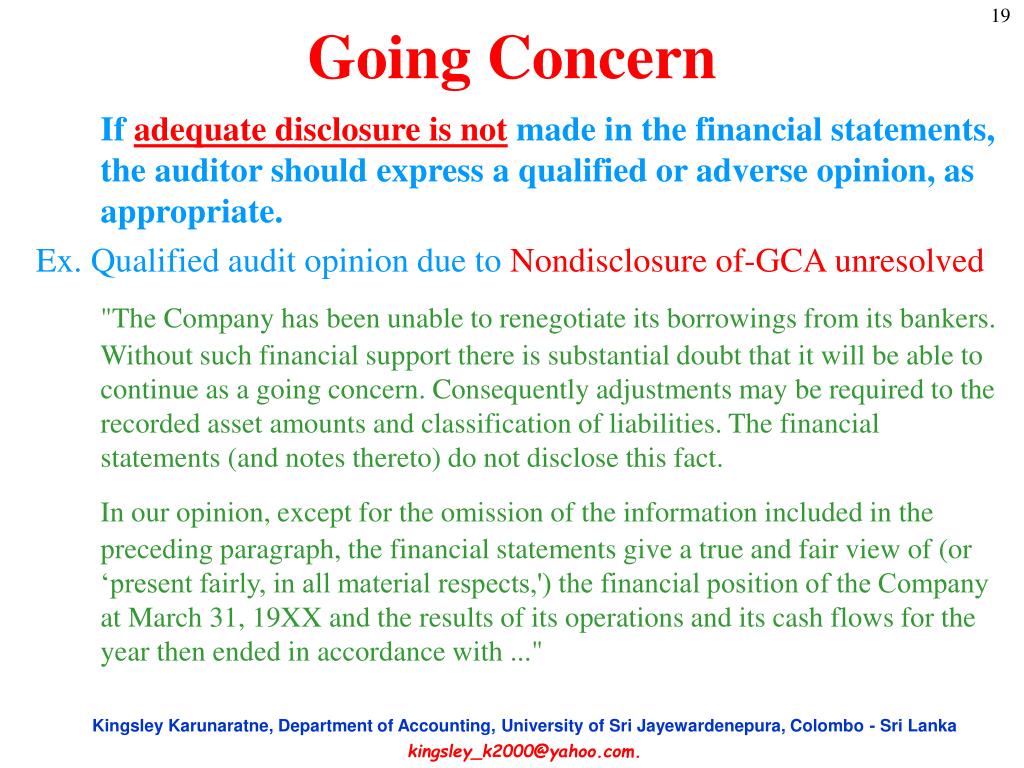

Paragraph 25 of ias 1 requires the entity to disclose the fact that the financial statements have not been prepared on a going concern basis and the reasons why the entity is not regarded as a going concern, as well as disclosing the basis on which the financial statements have been prepared. Ifrs viewpoint preparing financial statements when the going concern basis is not appropriate what’s the issue? If the financial statements have been prepared on a going concern basis but, in the auditor's judgement, the use of the going concern assumption in the financial statements is inappropriate, isa (uk) 570 requires the auditor to express an adverse opinion.

The financial statements are normally prepared on the assumption that an entity is a going concern and will continue in operation for the foreseeable future. Under ifrs standards, financial statements are prepared on a going concern basis, unless management intends or has no realistic alternative other than to liquidate the company or stop trading. This guide is designed to explain the main changes that are needed to the audit report of a company where the financial statements are prepared on a basis other than going concern.

If such an intention or need exists, the financial Paragraph 25 of ias 1 presentation of financial statements states that one of the principles in the preparation of the financial statements is the ability of the entity to continue as a going concern.this is because the financial statement is prepared. Hence, it is assumed that the entity has neither the intention nor the need to liquidate or curtail materially the scale of its operations;

Ias 1 appears then to suggest that a departure from the going concern basis is required when the specified circumstances exist. Paragraph 14 of ias 10 states that ‘an entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period either that it intends to liquidate the entity or to cease trading, or that it. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern' (ias 1.25).

The requirements of the ifrs on going concern and subsequent events. It would not be appropriate, therefore, for the financial statements for the year ended 31 august 2019 to be prepared on a going concern basis.

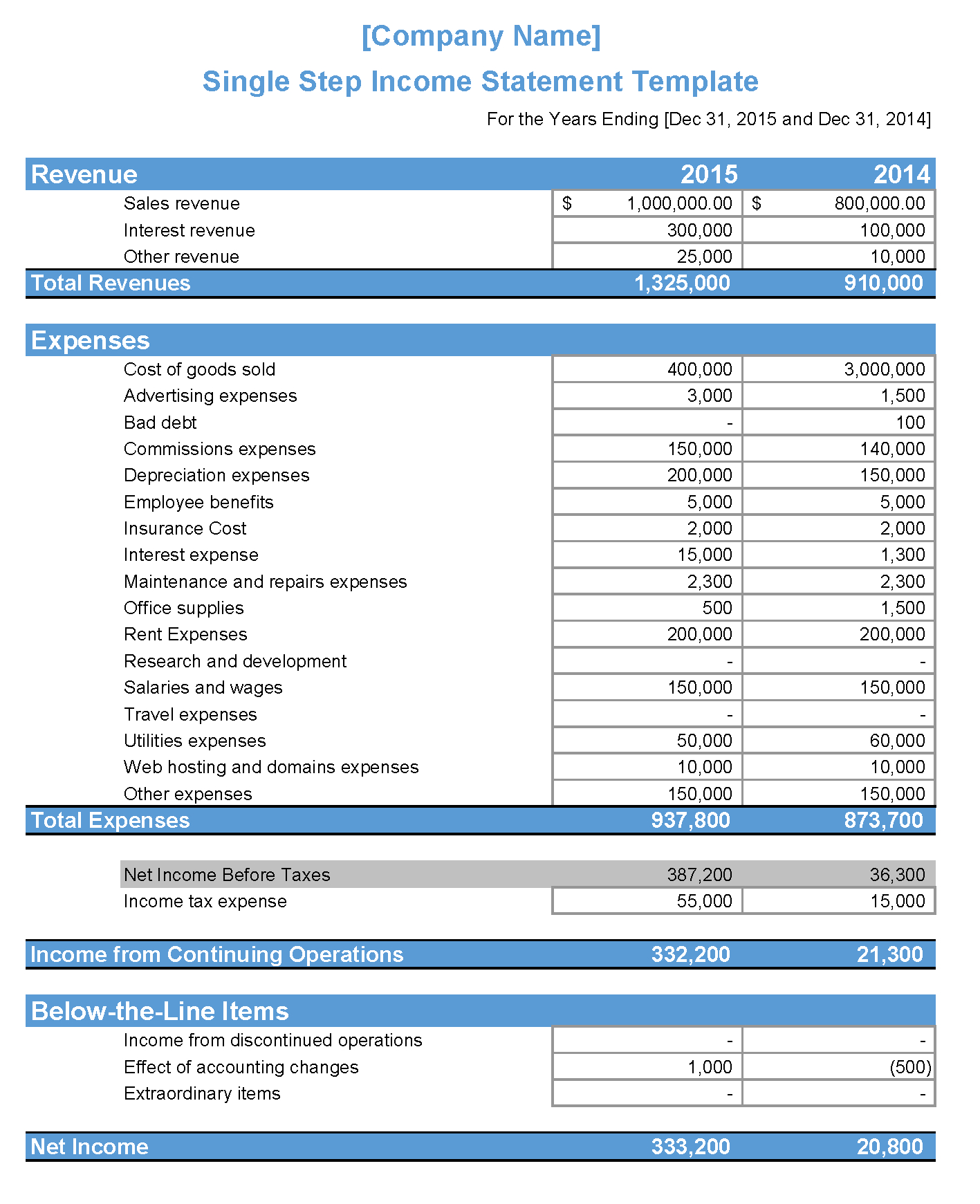

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)