Beautiful Info About Bank Balance In Sheet

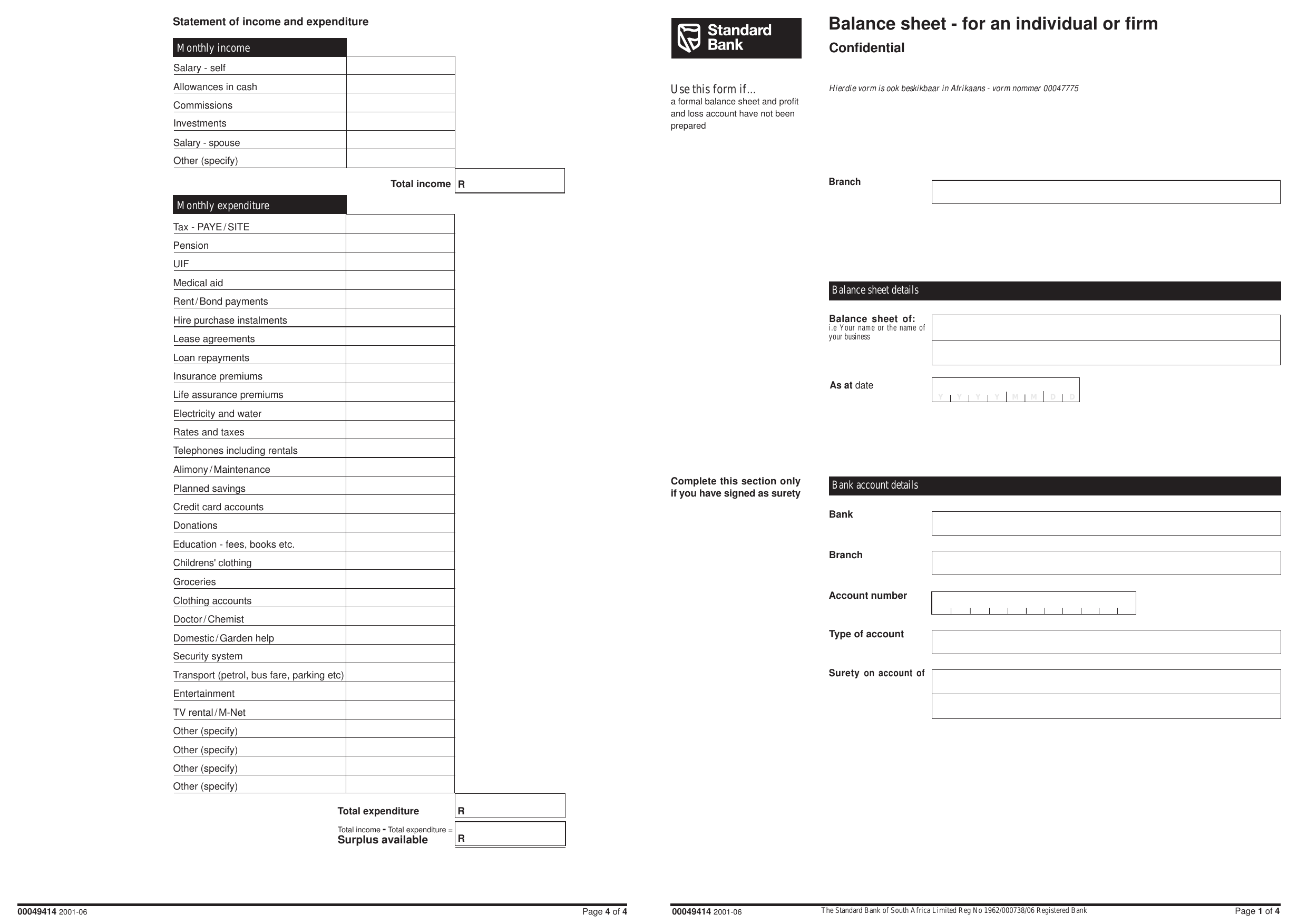

This financial statement is used.

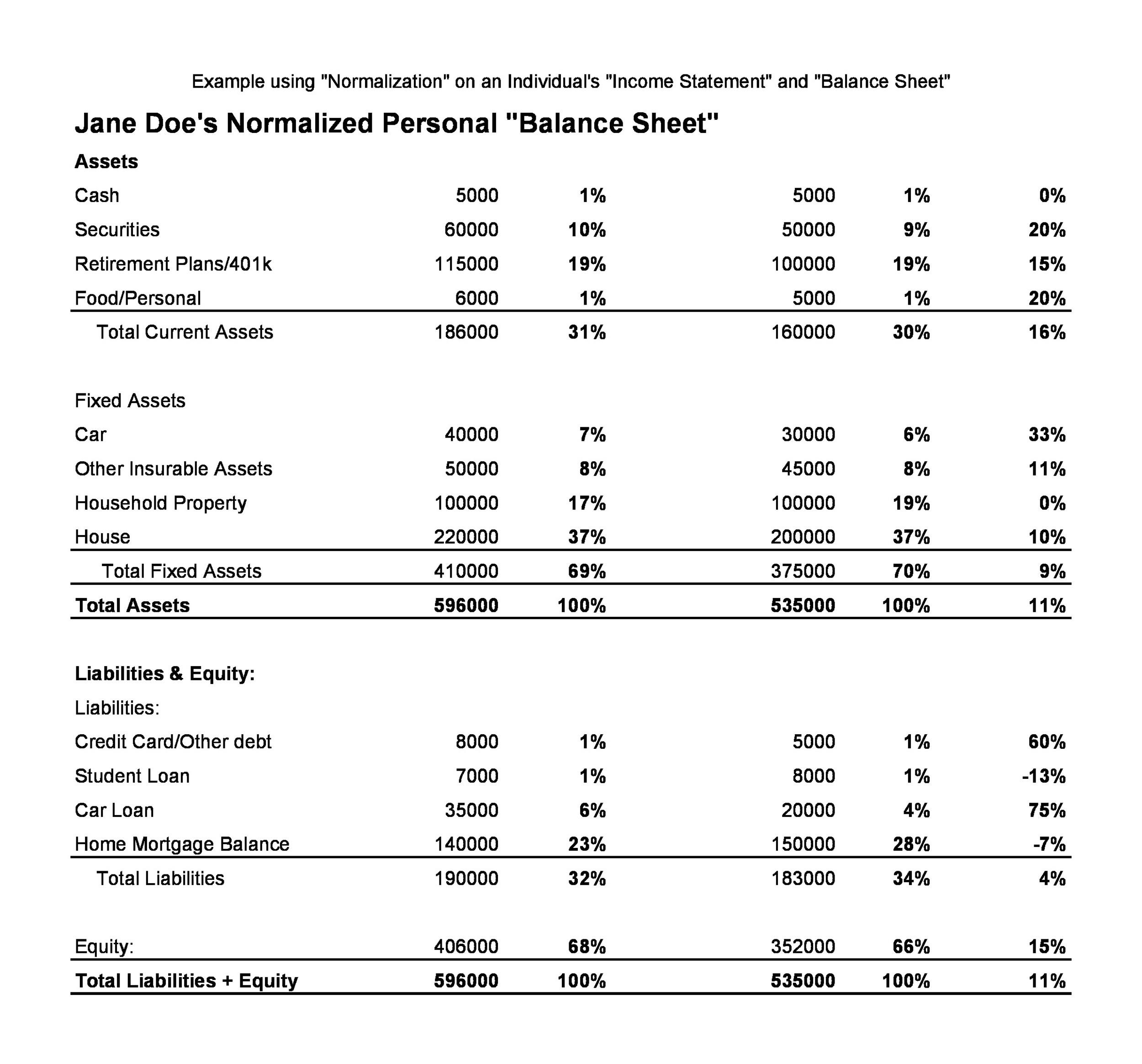

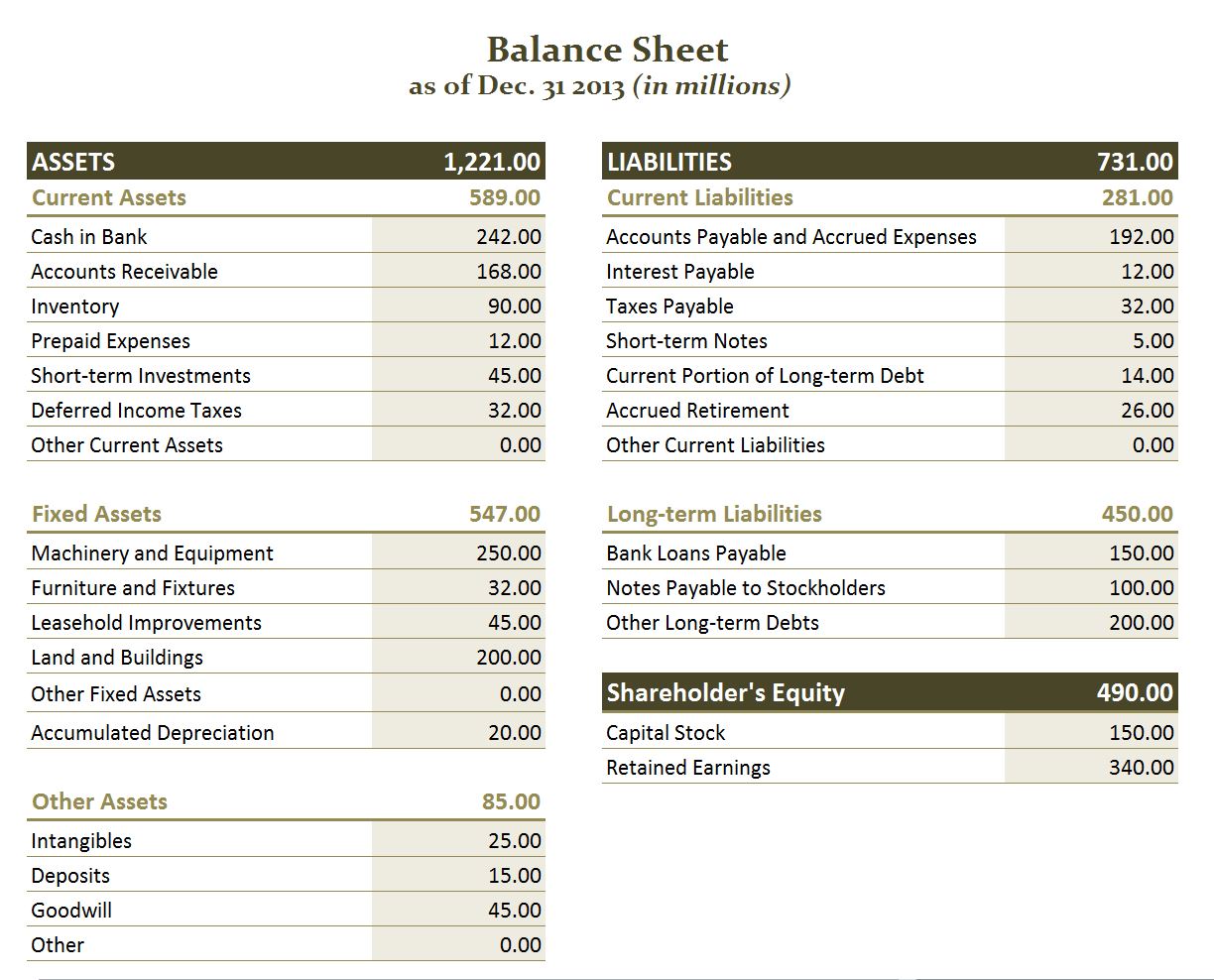

Bank balance in balance sheet. The bank reconciliation has been completed. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s regulatory authority.

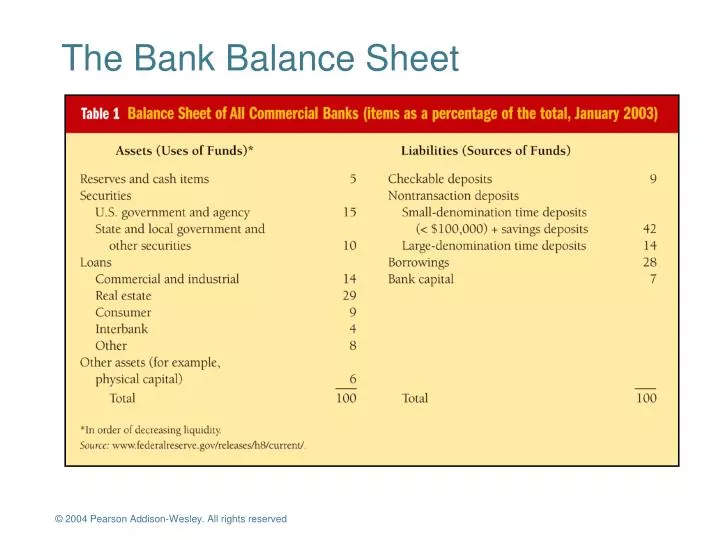

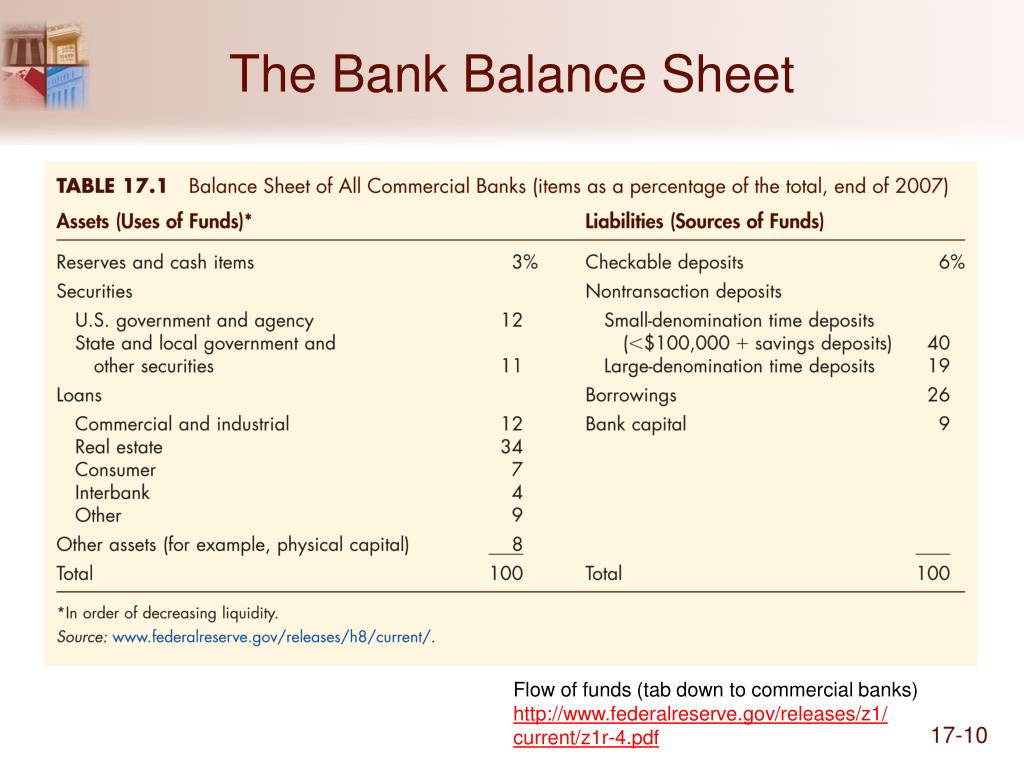

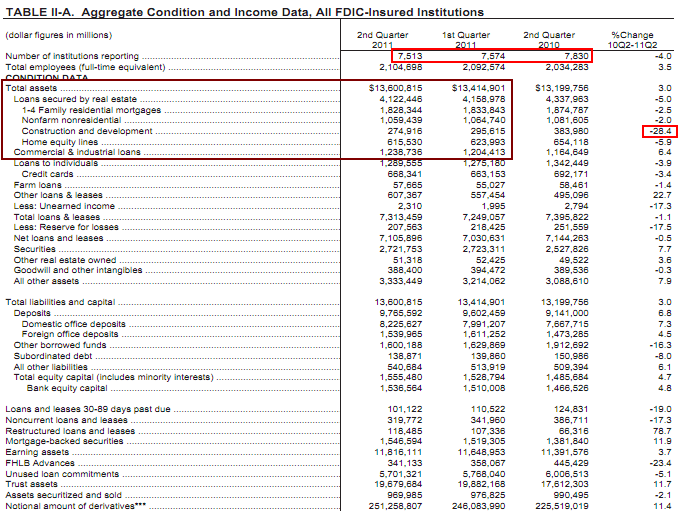

Assets property trading assets loans to customers deposits to the central bank liabilities loans from the central bank. Both parts should be equal to each other or balance each other out. However, banks still grapple with two issues in.

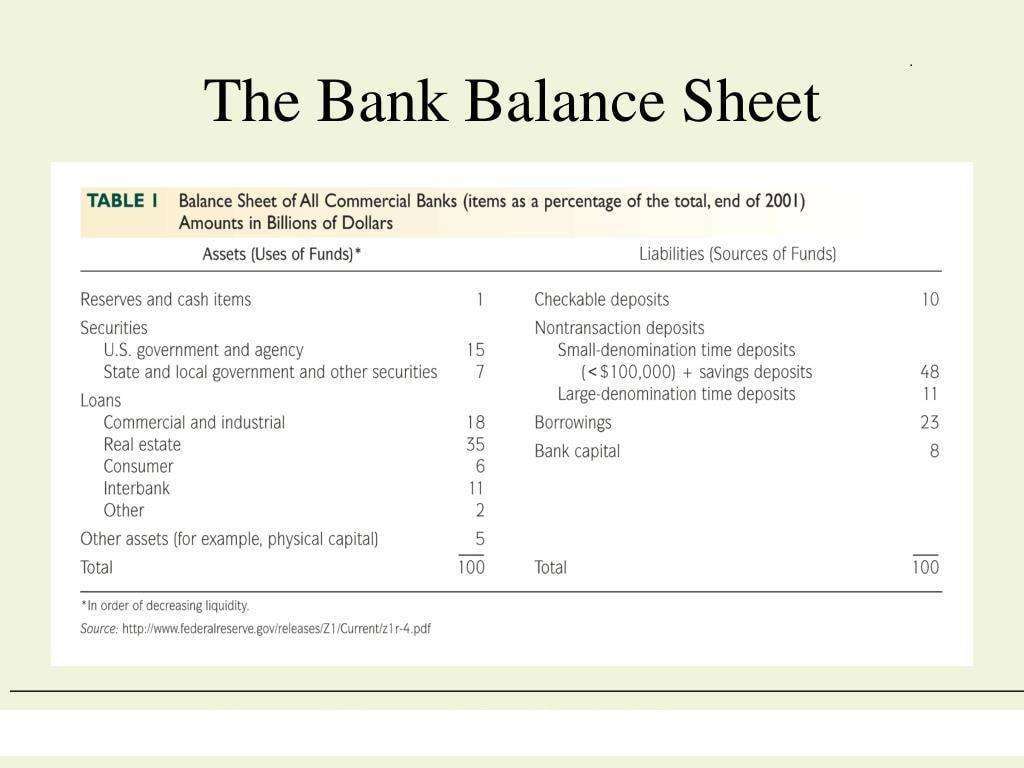

The assets in the financial statement for banks are the lending resources available with the banks, while the liabilities in these balance sheets indicate the deposits that customers make along with other financial. The typical structure of a balance sheet for a bank is: A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending.

At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. Company balance sheet [infographics] structure of bank’s. A balance sheet is guided by the accounting equation:

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the. On february 22, 2022 balance sheets can help you see the big picture: Bank balance sheets report the assets, liabilities, and bank capital for an individual bank.

But banks do not operate like regular companies do. The assets are items that. The bank balance sheet ratio calculator is a tool that you can use to determine a bank’s financial stability and liquidity using items found on a balance sheet.

The volume of business of a bank is. Banks balance sheet reflects the capacity of the banking institutions to lend money to customers. What is a balance sheet?

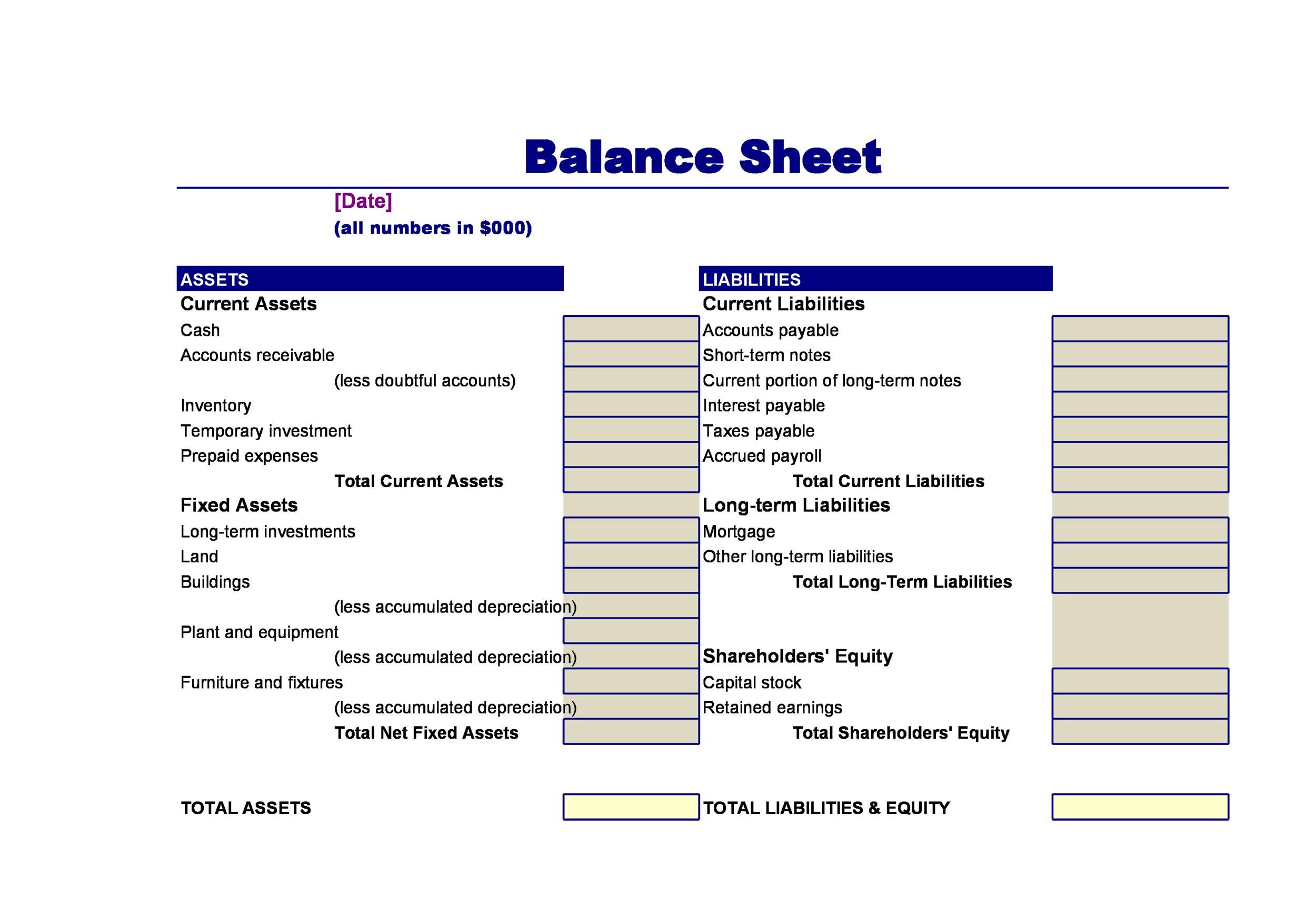

Most balance sheets are arranged according to this equation: The balance sheet identity is: Assets = liabilities + shareholders’ equity the equation above includes three broad buckets, or.

The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet. Assets = liabilities + capital. Their main function is to.

This means that the assets of a company. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations. A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)