Fabulous Tips About Charity Financial Statements Examples Of Off Balance Sheet Liabilities

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

This refers to everything you owe to other people and entities.

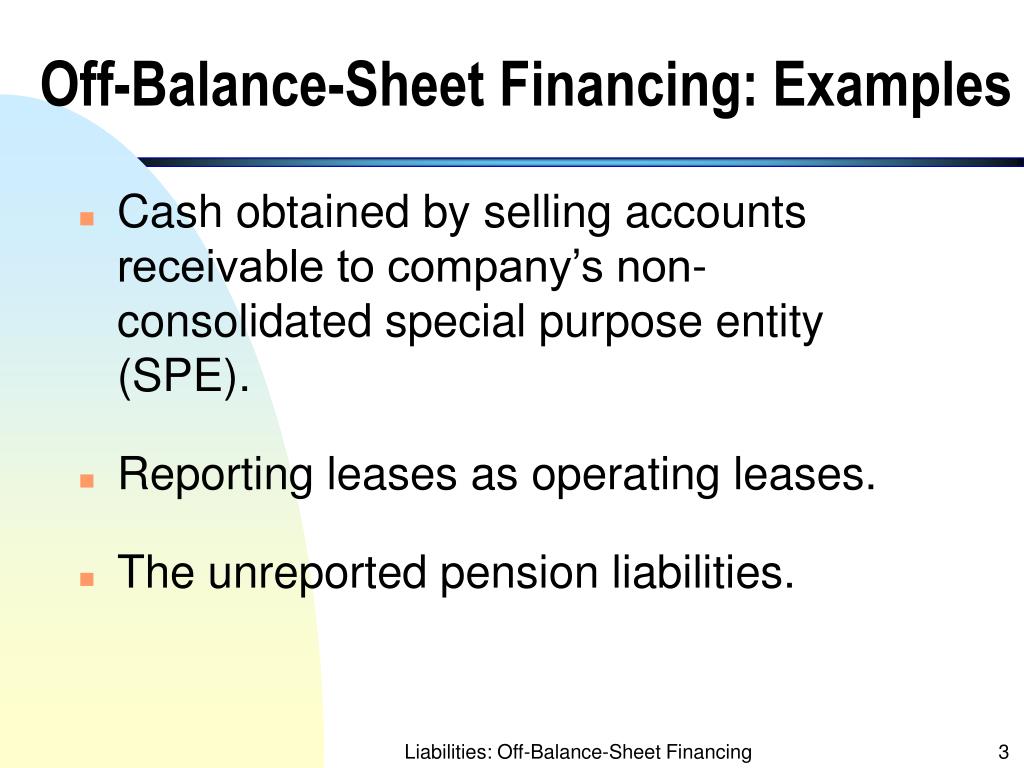

Charity financial statements examples of off balance sheet liabilities. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top. For example, a charity may have £150,000 of earned income and £200,000 of unearned. The balance sheet follows a.

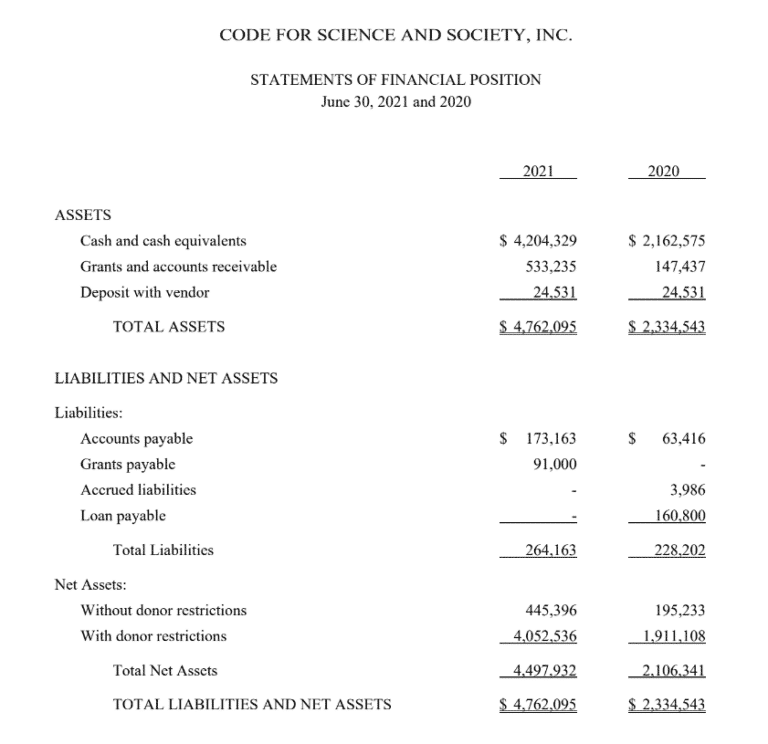

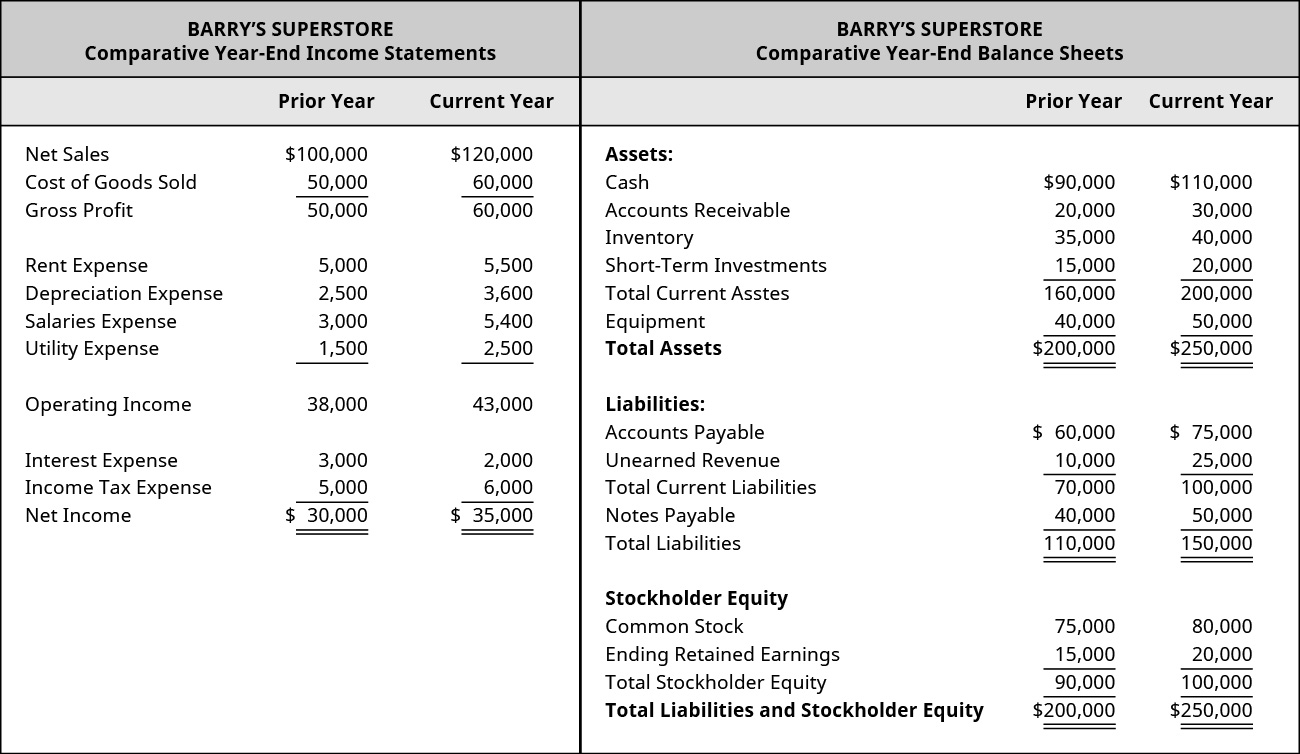

What’s included in a nonprofit’s balance sheet (statement of financial position)? A statement of assets and liabilities (balance sheet) a statement of revenue and expenditures (income statement) any prepared notes,. In the context of charity finance, the balance sheet offers crucial insights into the financial health and stability of a charitable organisation.

1 general guidance how can the accounting template be used? Another useful ratio for donors and funders is the ratio of earned to unearned income. A balance sheet in nonprofit accounting is also called the statement of financial position.

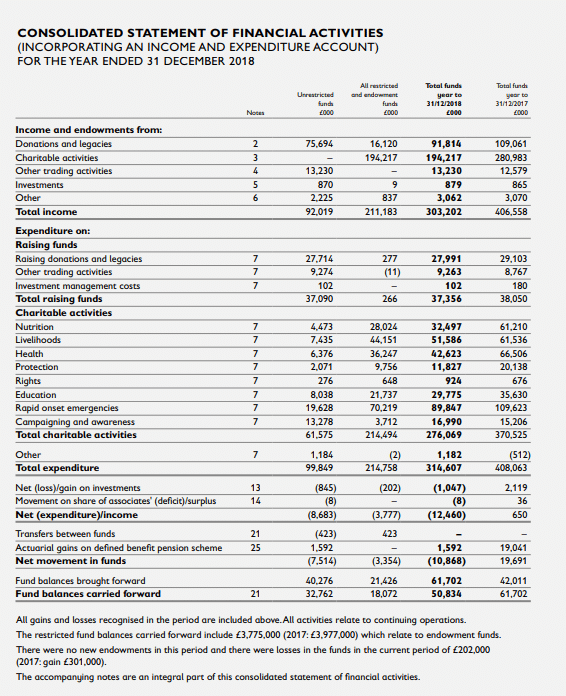

How precise do the charity’s financial statements need to be? A nonprofit statement of activities, also known as an income statement or statement of operations, is a financial statement that summarizes the organization’s. Review by the charity commission published in september 2018 analysing charities' income, expenditure, balance sheet and funds against accounts.

Information you will need 6 • the statement of financial activities (‘sofa’) which shows income and. A guide to charity financial analysis | getting started: Liabilities is one of the five main types of accounts in accounting and bookkeeping.

The sample above is a financial operations’ statement to teach you the format and components of such statements in total. If a donation or grant is conditional, the condition must have been. It is used to impact a.

Nonprofits must file four statements every year to comply with irs rules. The accounting template is based on the. It begins with the governor’s report on the.

Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses. Income income should be recognised on entitlement, when it is probable, and it can be measured reliably. The four required financial statements are:

It provides an overview of your finances and helps assess your. Financial statements should include at least: We have audited the financial statements of acca charitable foundation limited (“the company”) set out on pages 8 to 16, which comprise the balance sheet as at 31 march.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)