Perfect Tips About Consolidated Meaning Accounting

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

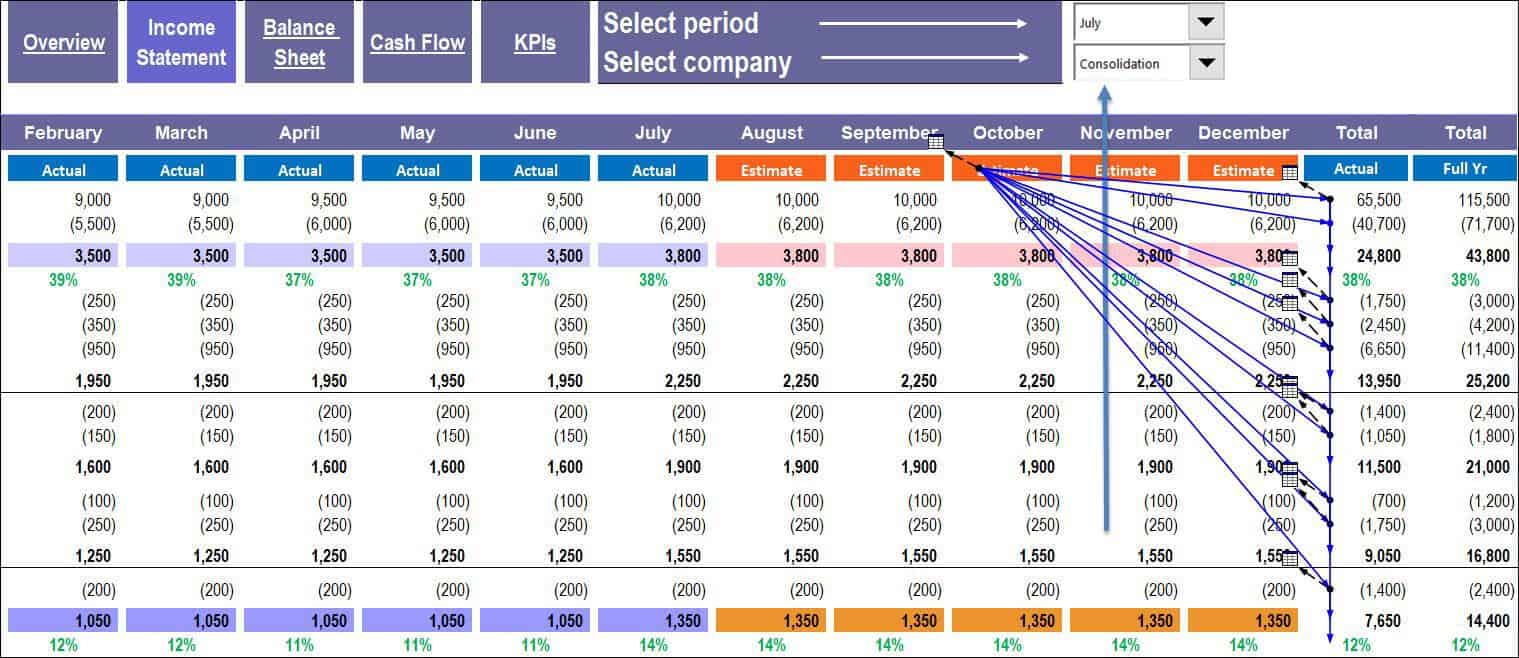

Consolidation in financial accounting relates to when financial statements of all the subsidiaries of a parent company are grouped together.

Consolidated meaning accounting. The objective of consolidated financial statements is to present the results of the group in line with its economic substance, which is that of a single reporting entity. Ifrs 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities. What is consolidation accounting?

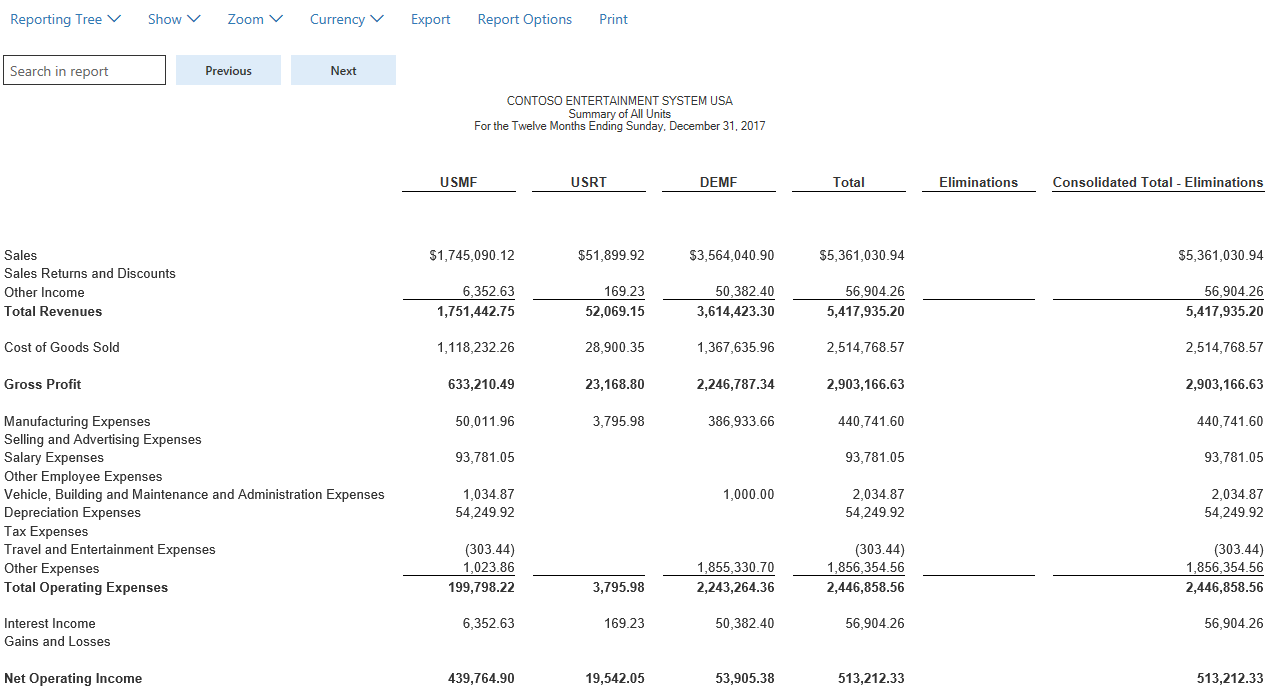

Consolidation is the process of combining multiple entities or assets into one. In other words, it’s a report that combines all the activities of a parent company and its subsidiaries on one report. For example, on a consolidated income statement a corporation having several subsidiaries would report the total of all of its companies' sales that were made to customers outside of its group.

The parent company owns the subsidiary company and holds control over it. Financial statements, including consolidated financial statements, must report the substance of transactions and arrangements. More than just joining together, consolidation in accounting is a list of precise processes fundamentally rooted in accounting’s best.

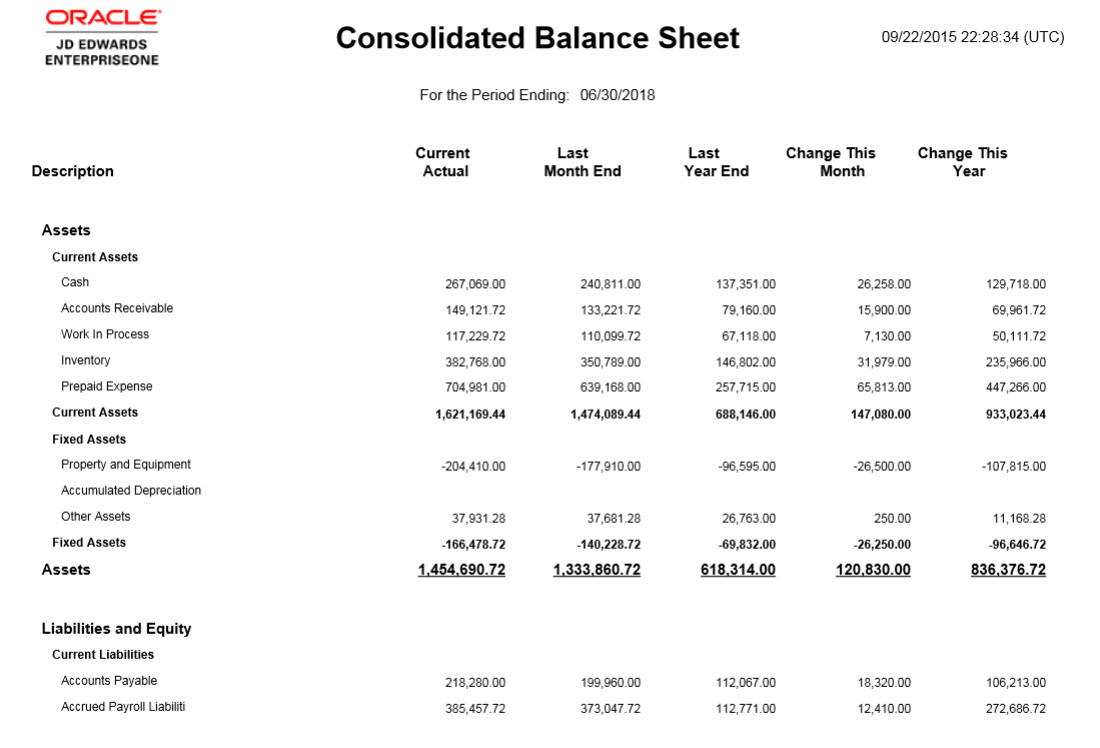

Companies often use consolidation to increase efficiency and profitability while reducing costs. A consolidated financial statement ( cfs) is the financial statement of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent company and its subsidiaries are presented as those of a single economic entity , according to international accounting standard 27 consolidated and separate financial stateme. This method is typically used when a parent entity owns more than.

Consolidation accounting is a process whereby financial reports of subsidiary companies are put together and then combined with those of the parent company. In the accounting world, financial consolidation is the process of combining financial data from several subsidiaries or business entities within an organization, and rolling it up to a parent company for reporting purposes. Consolidated financial statements definition.

Financial accounting consolidation works with companies that own more than. By jonathan marciano updated on february 2, 2024 consolidation accounting is a method of accounting used when a parent company owns subsidiaries (from 20% to upward of 50 %). Consolidated financial statements provide a comprehensive overview of a company's financial operations for the entire group of entities.

Companies often use the word consolidated loosely in financial statement. Consolidation accounting is the process of combining the financial results of several subsidiary companies into the combined financial results of the parent company. What does it mean to consolidate?

These statements are useful for reviewing the financial position and results of. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’ the diagram below shows an example of a typical group structure: To become, or cause something to become, stronger, and more certain:

Consolidated financial statements are a vital tool for businesses that operate multiple subsidiaries or have controlling interests in other companies. If you consolidate or go through consolidation, it means combining assets, liabilities, and other financials. Consolidation is the bringing together of all financial statements of affiliated companies within a group.

In financial accounting, the term consolidate often refers to. A set of consolidated financial statements consists of reports that show the operations, cash flows, and financial position of a parent company and all subsidiaries. Consolidated financial statements the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity control of an investee