Brilliant Strategies Of Info About 3 Types Of Financial Statements Opening Balance Sheet Template

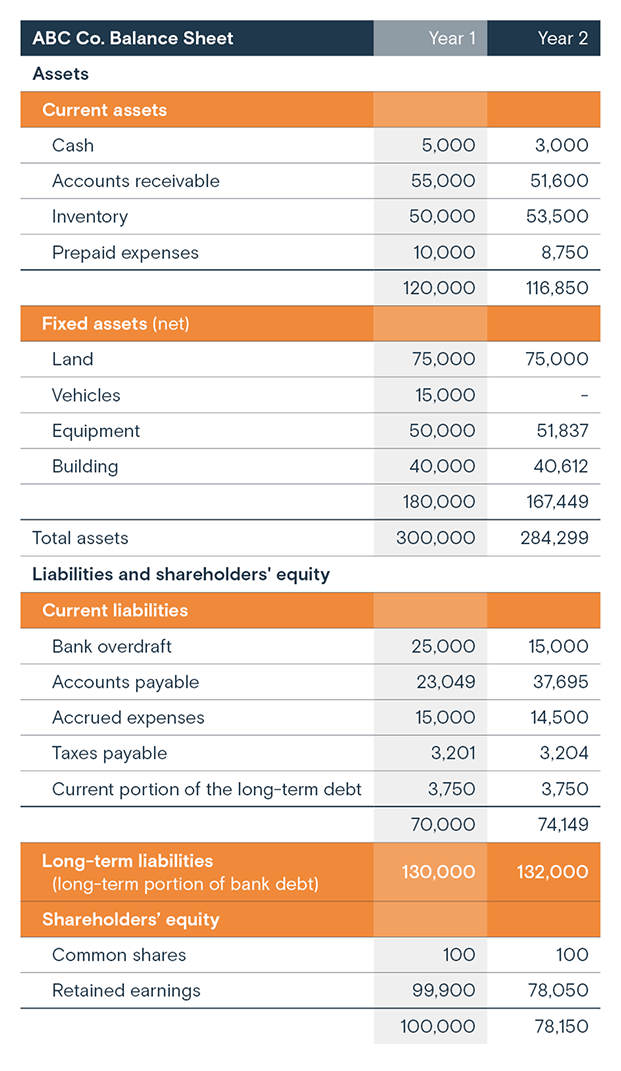

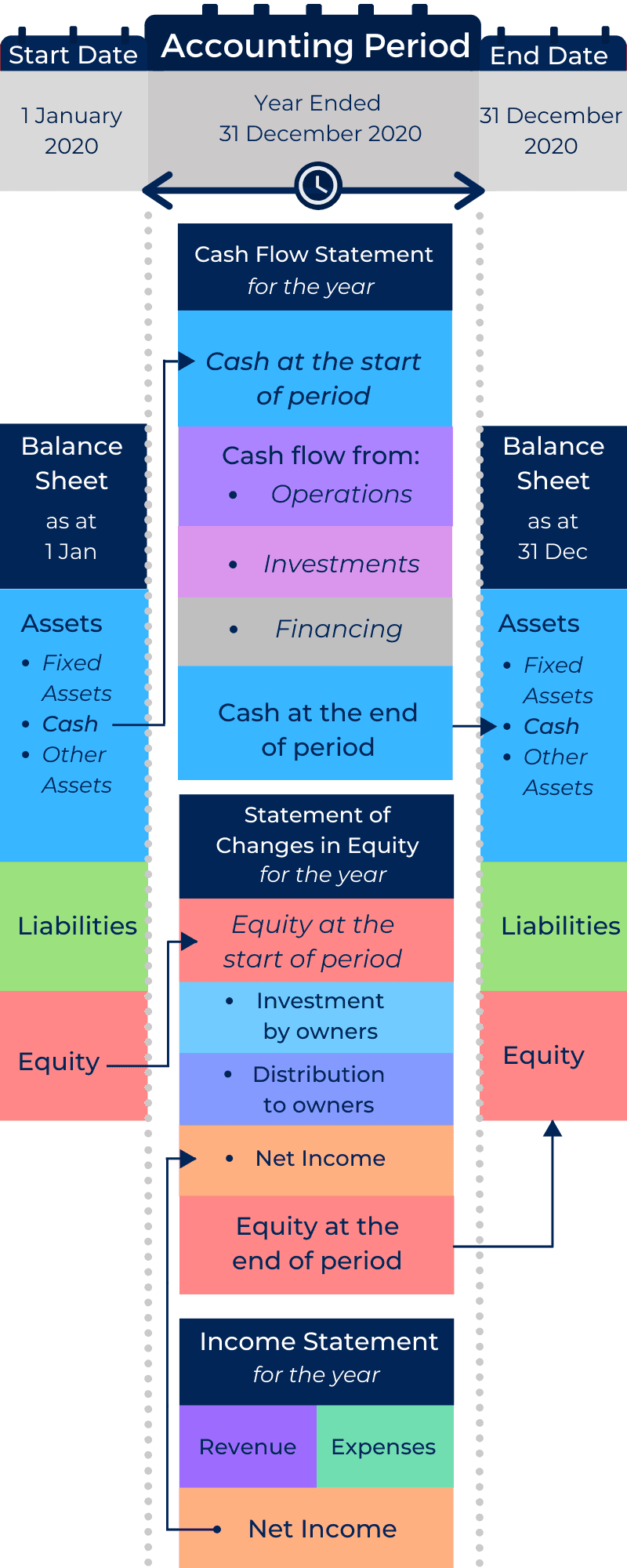

These principles require a company to create and maintain three main financial statements:

3 types of financial statements opening balance sheet template. Read on to explore them one by one and learn how to create these financial statements in excel easily. The four general purpose financial statements include: The balance sheet is one of the three core financial statements that are.

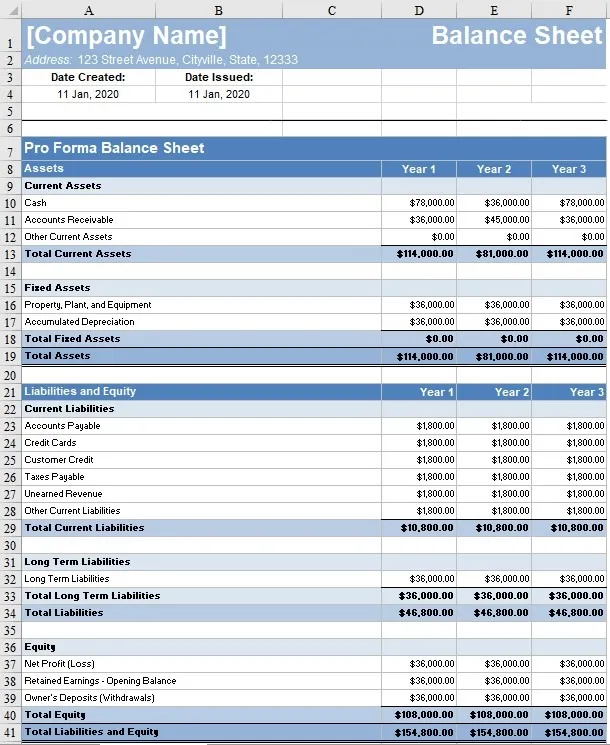

Sequence of accounts in a balance sheet analyzing the balance sheet a. 1.3 describe typical accounting activities and the role accountants play in identifying, recording, and reporting financial activities; Pro forma cash flow statements;

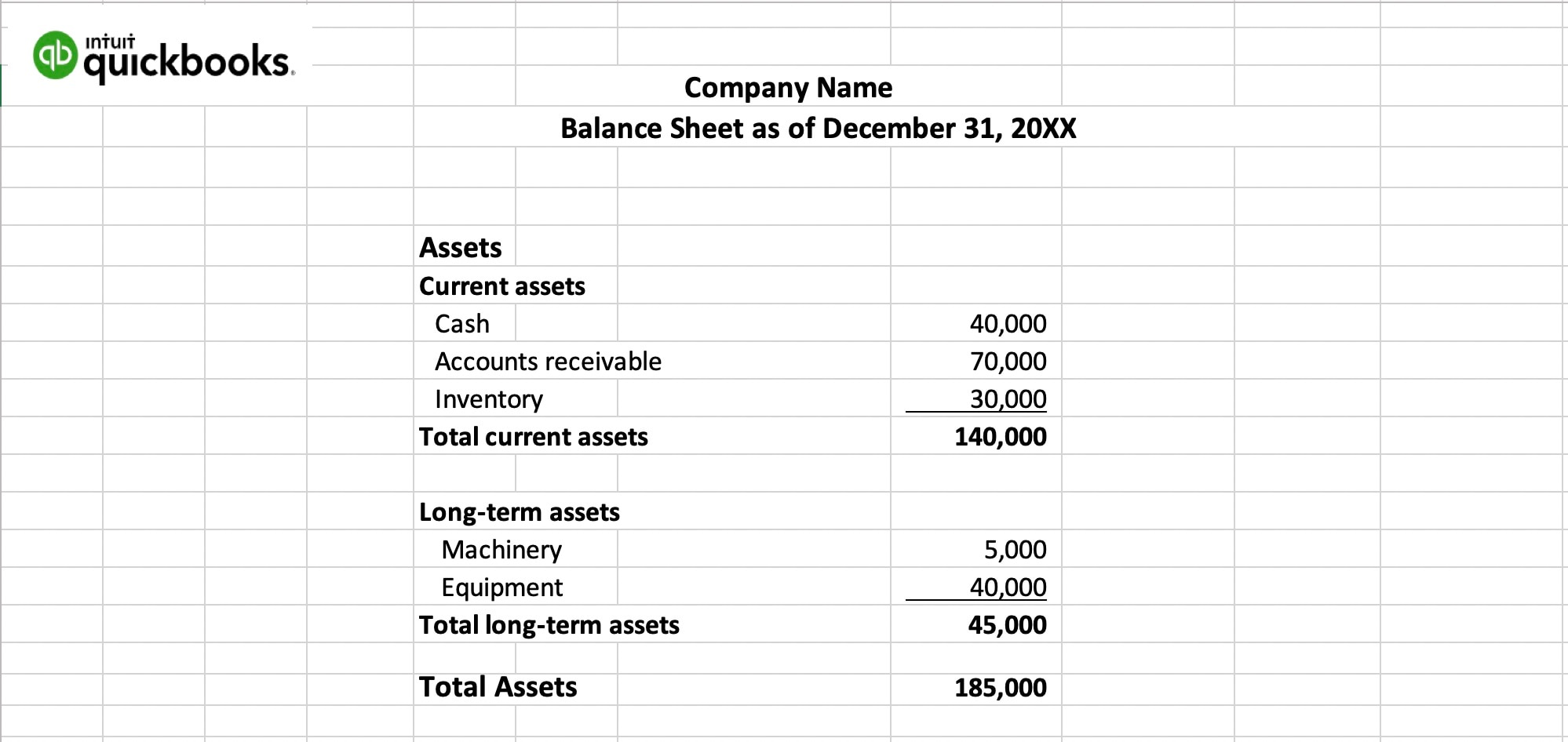

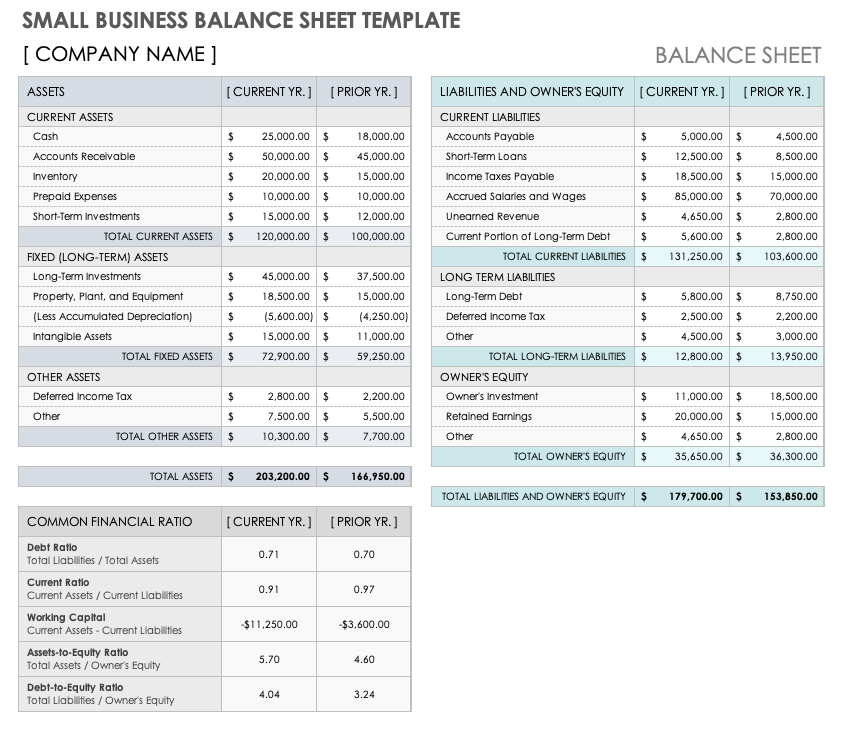

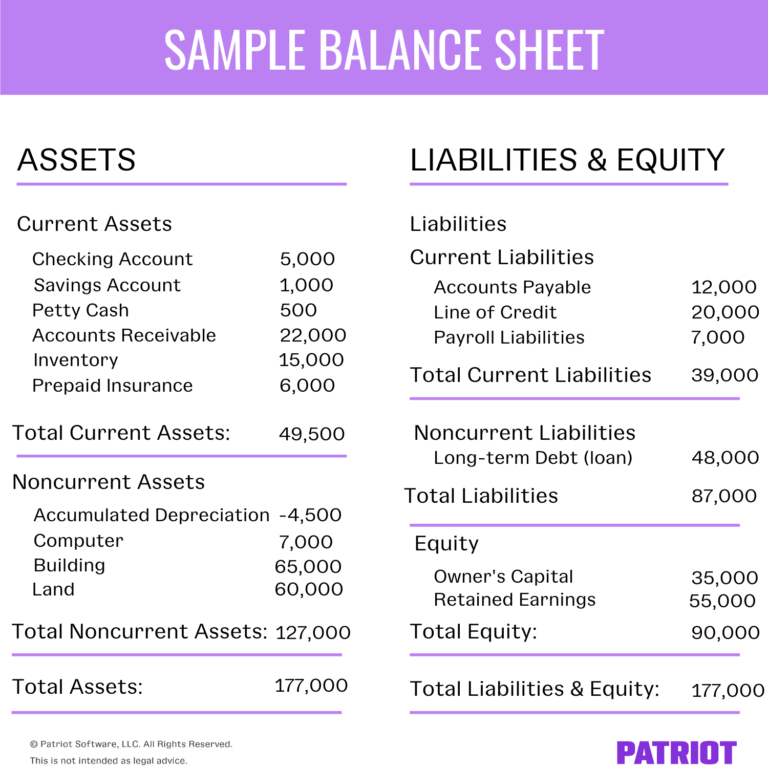

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity.

Financing events such as issuing debt affect all three statements in the following way: Overview of the three financial statements 1. Types of balance sheets what is balance sheet format in excel?

The opening balance of any real account is the value of a particular class of account on the first day of the financial year. The balance sheet expresses the financial position of a business. It represents the brought forward or opening amount of an asset, liability , or equity item from the preceding financial year.

Compile financial data for the given period. It serves as a foundation for complex financial models, offering insights into a company's financial health. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position.

There are three major pro forma statements: The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position.

Analyzing these three financial statements is one of the key steps when creating a financial model. Draft initial balance sheet with these results. The p&l feeds net income on the liabilities and equity side of the balance sheet.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. The interest expense appears on the income statement, the principal amount of debt owed sits on the balance sheet, and the change in the principal amount owed is reflected on the cash from financing section of the cash flow statement. As fixed assets age, they begin to lose their value.

Let’s take a deeper look at each one with examples. These three statements together show the assets and liabilities of. It shows three things about a business’s financial health:

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)