First Class Tips About Salary Statement For Income Tax

Page last reviewed or updated:

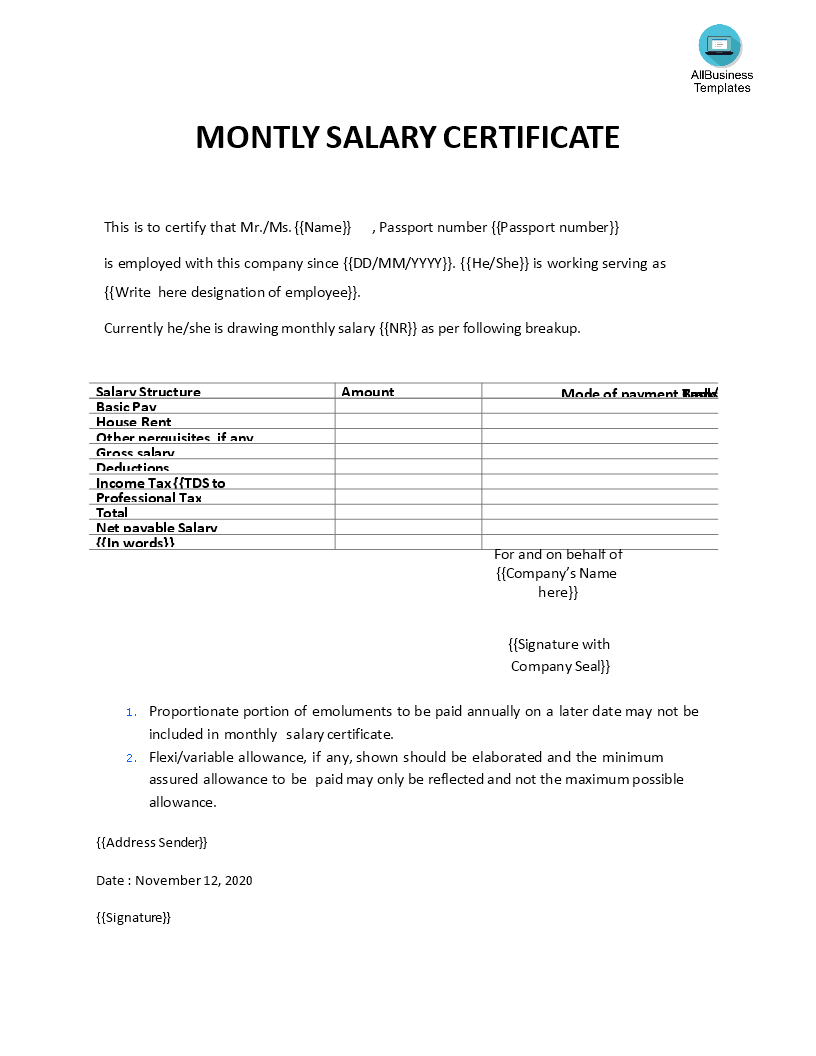

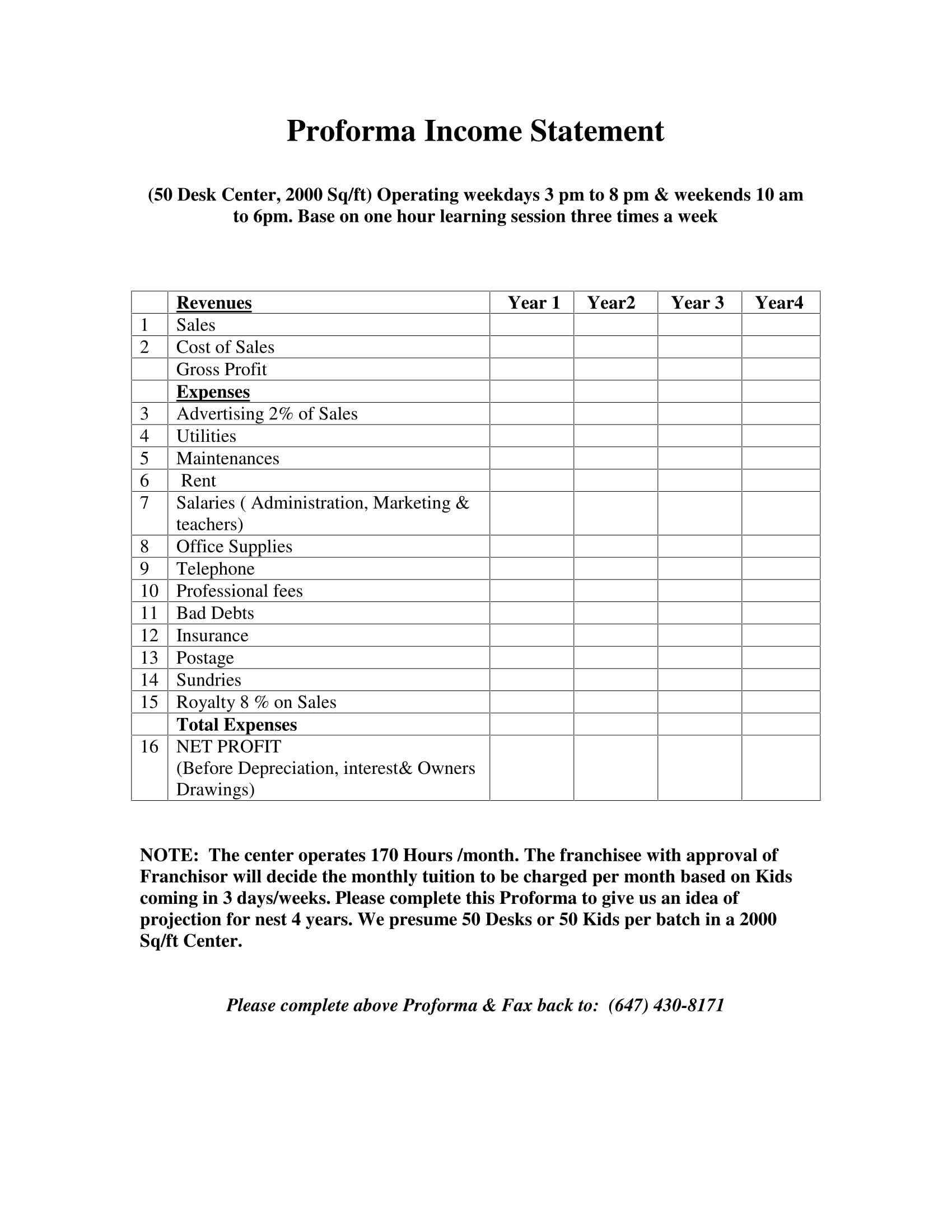

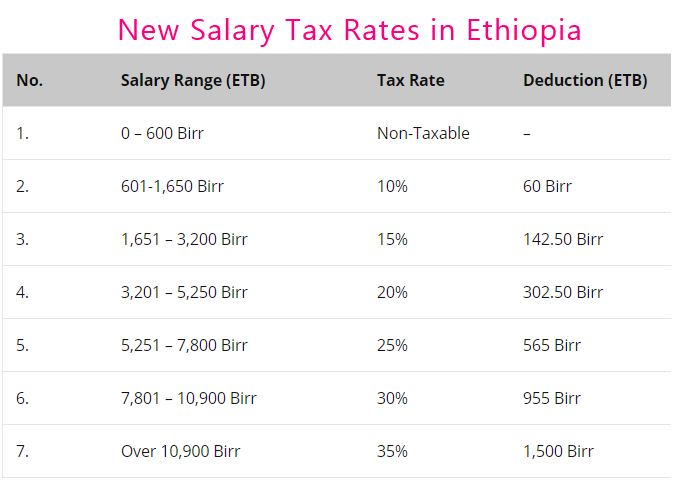

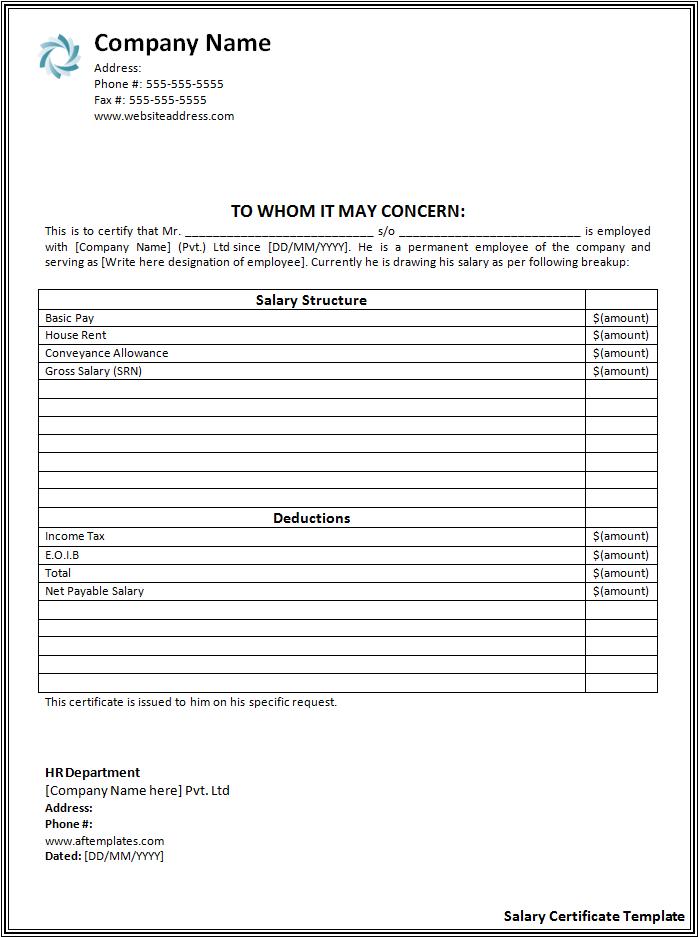

Salary statement for income tax. Salaries and wages of a company's employees working in nonmanufacturing functions (e.g. Checking your browser before accessing incometaxindia.gov.in this process is automatic. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year.

Tax that has been withheld; Among the options for the chancellor are to scrap the planned 5p increase in fuel duty at a cost of £2bn next year, cutting the basic rate of income tax by 1p or. A salary slip contains a detailed breakdown of employee salary and.

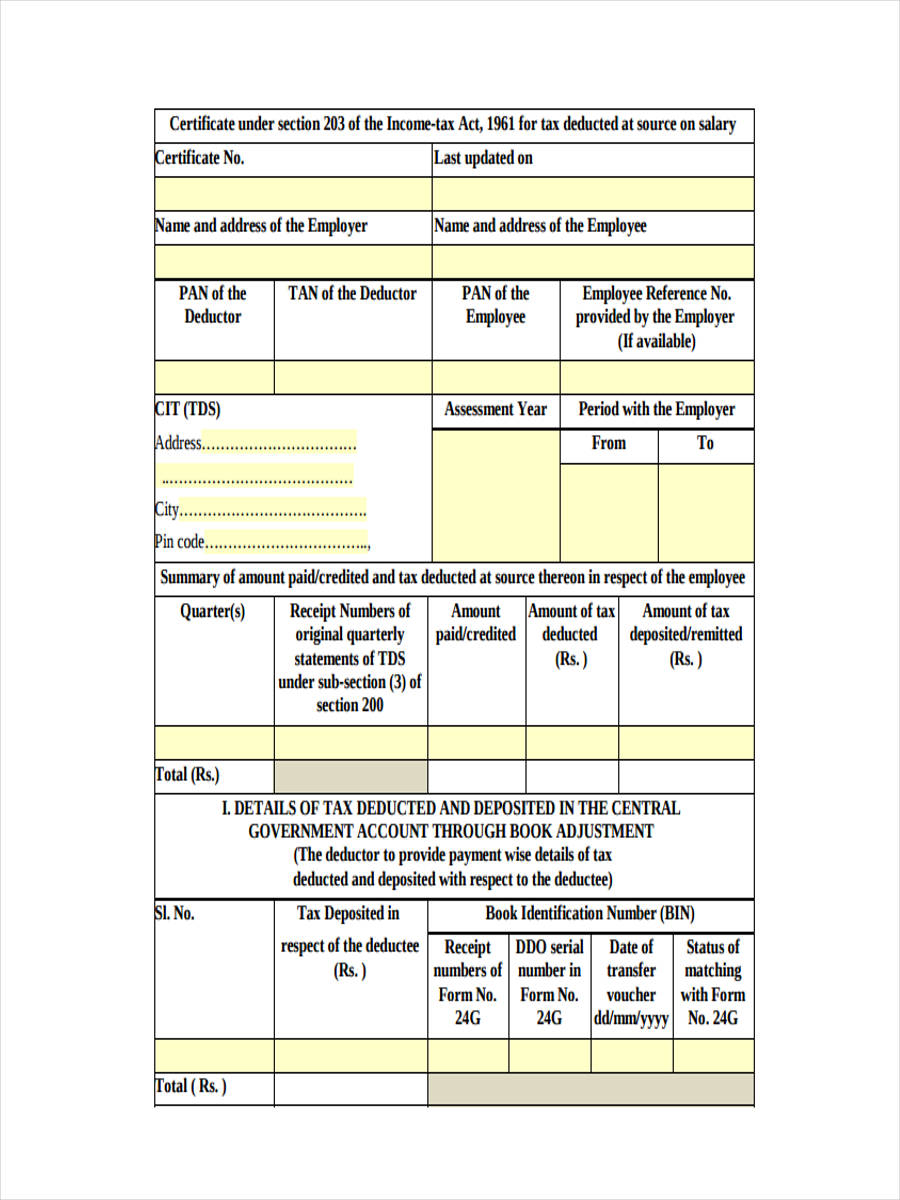

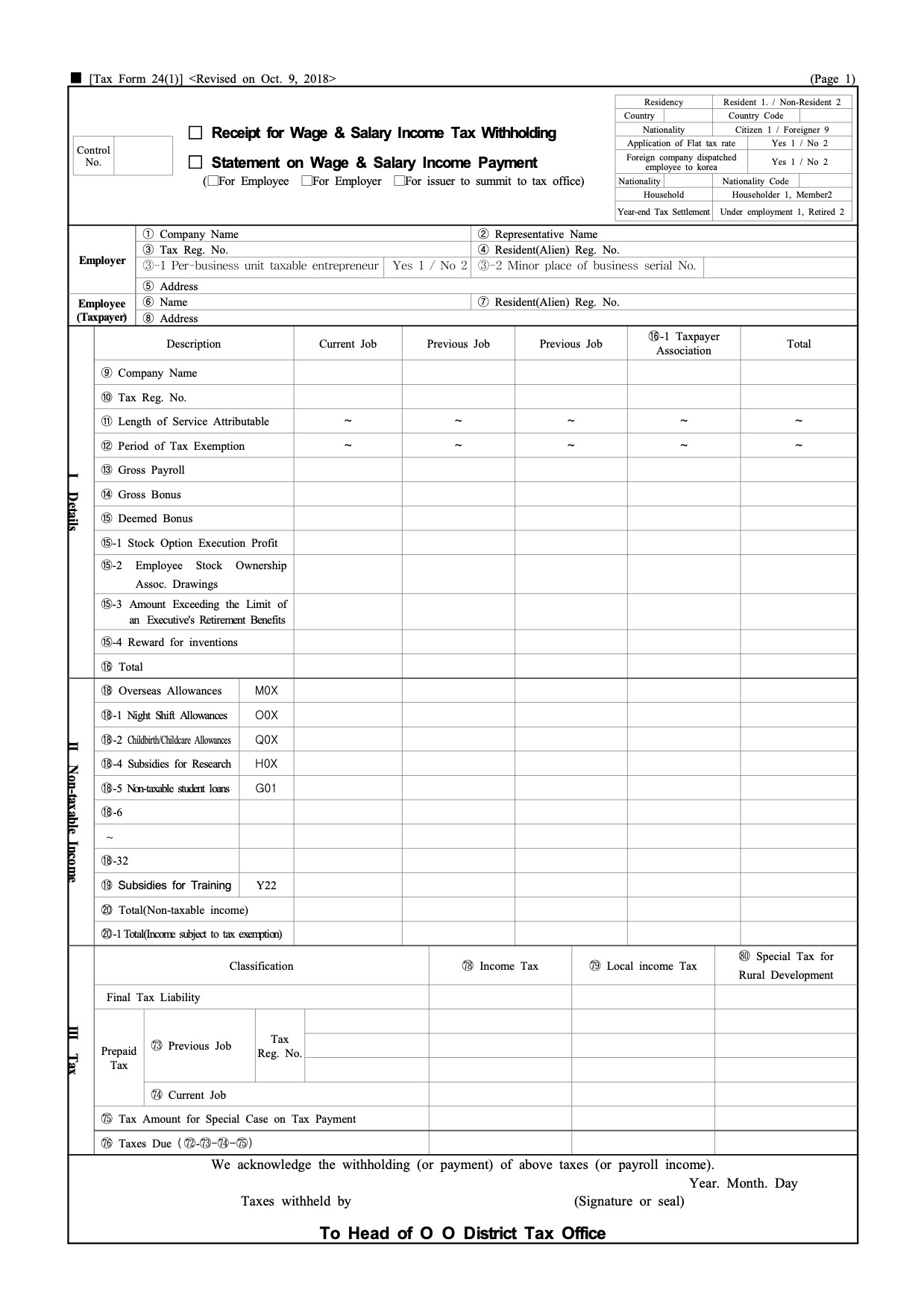

This year’s budget promises to be one of the most consequential in years. The tax rates are determined by the government and are based on. Statement regarding the payment of salary under section 108 of the income tax ordinance, 1984 (xxxvi of 1984) statement for financial year:

Not only could it help determine the result. You can also clear the latest. Income tax statements are generally issued at the end of each year and include information.

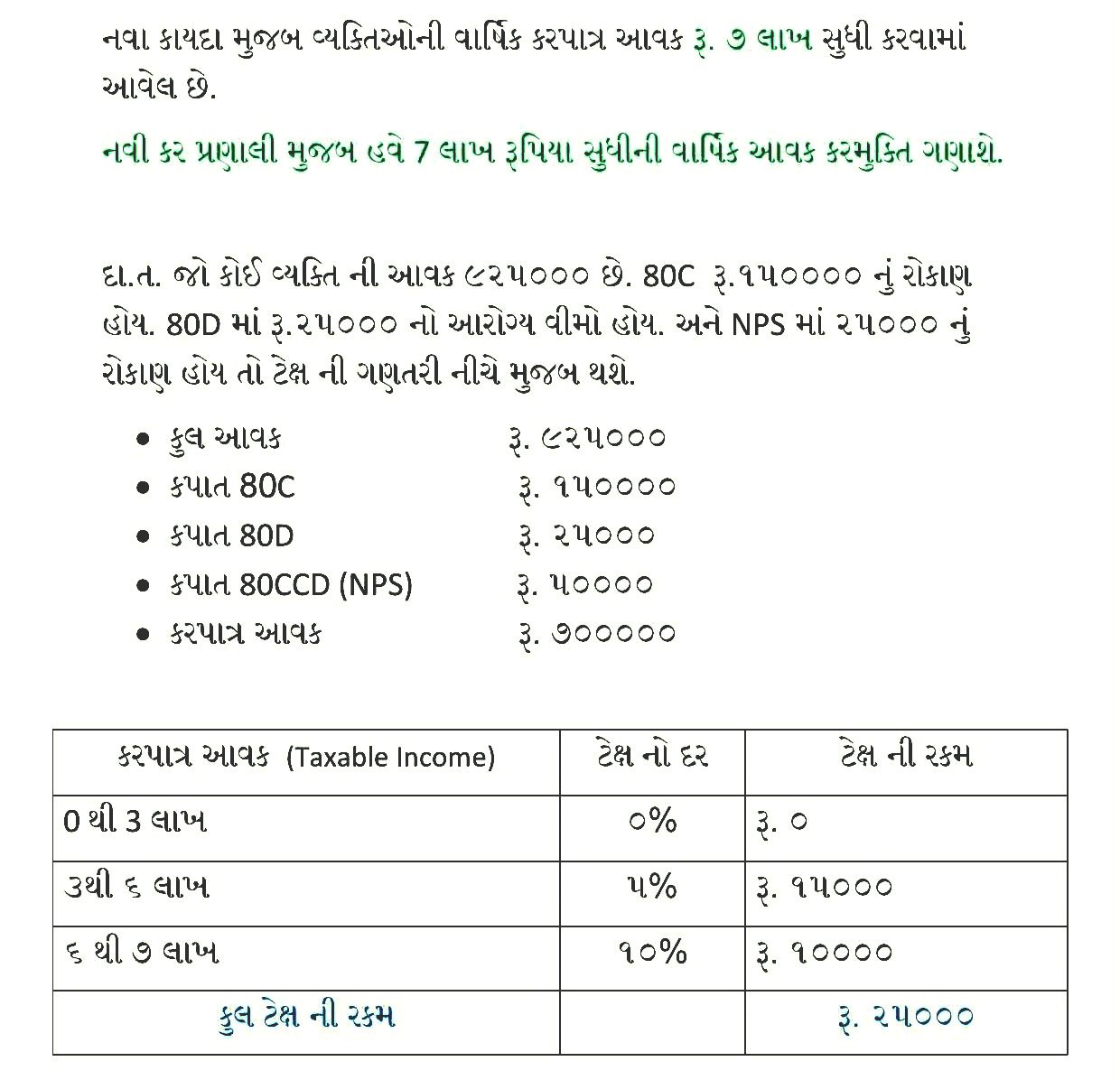

Natascha income tax statements: 50,000 in the old regime. To be eligible, the applicant:

Chancellor jeremy hunt's march 6 speech. Taxes paycheck calculator advertiser disclosure paycheck calculator for salary and hourly payment 2023 curious to know how much taxes and other deductions will reduce.

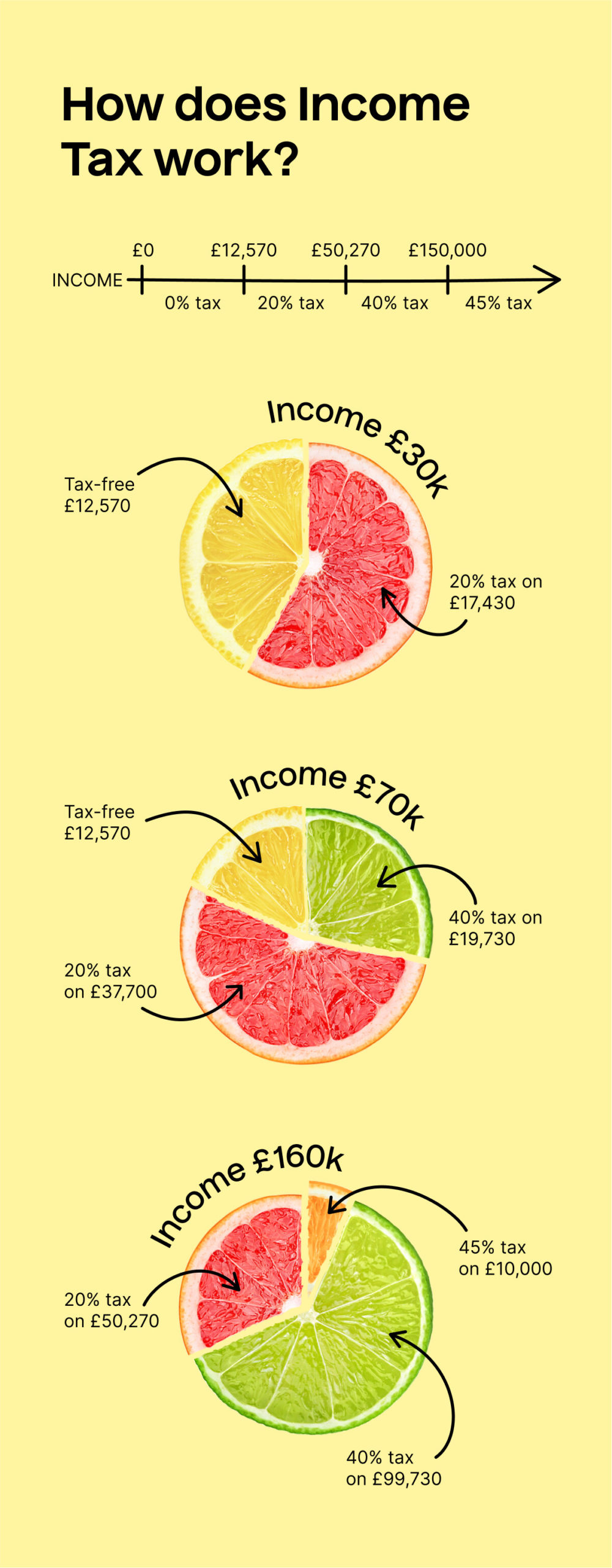

What is income tax? The actual receipt of salary in the previous year is not. Must be a resident of new brunswick at the time of application.

If you file on paper, you should receive your income tax package in the mail by this date. Your browser will redirect to requested content shortly. This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following.

Everything you need to know! Explore the complexities of income tax on salary income. It is governed by the income tax act of.

Selling, general administration, etc.) are part of the expenses reported on the company's. Statement regarding the payment of salary under section 108 of the income tax ordinance, 1984 (xxxvi of 1984) statement for financial year: For example, if an employee earns $1,500 per week, the.