Nice Tips About Steps To Prepare Cash Flow Statement

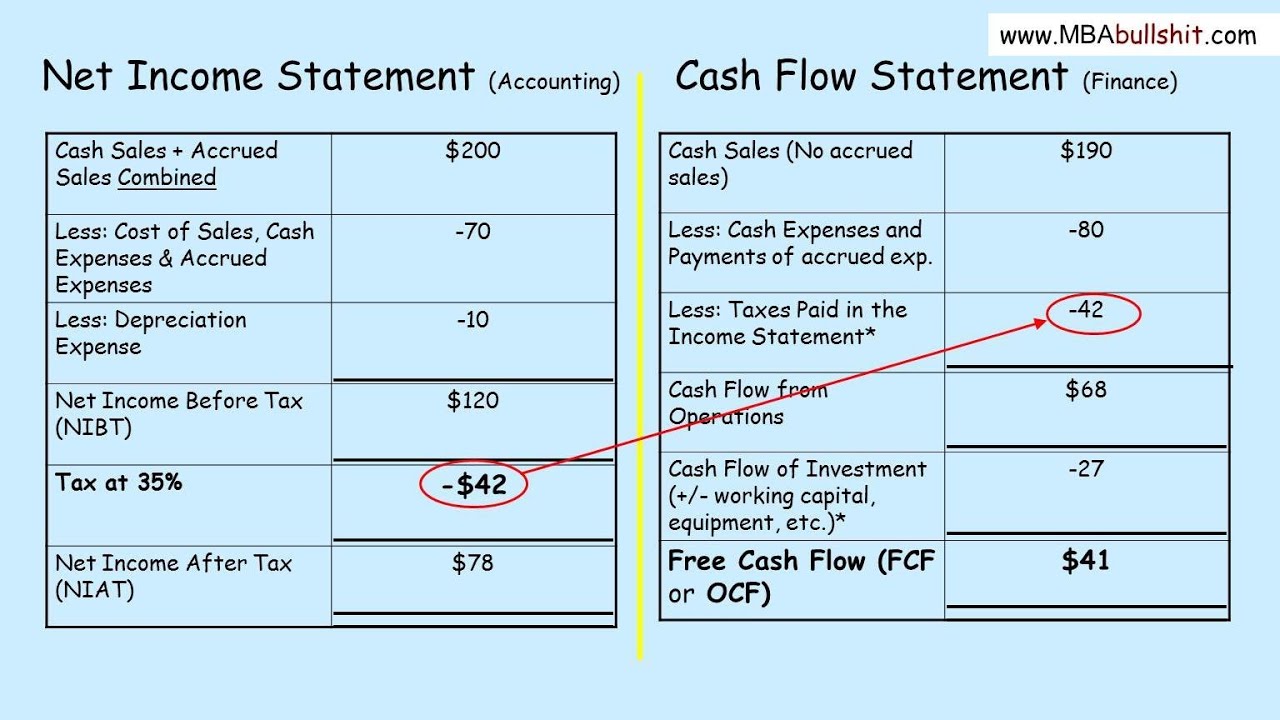

A cash flow statement is afinancial report that details how cash entered and left a business during a reporting period.

Steps to prepare cash flow statement. There are two ways to prepare a cash flow statement: Follow these steps to prepare a statement of cash flows: Direct method of preparing a statement of cash flow.

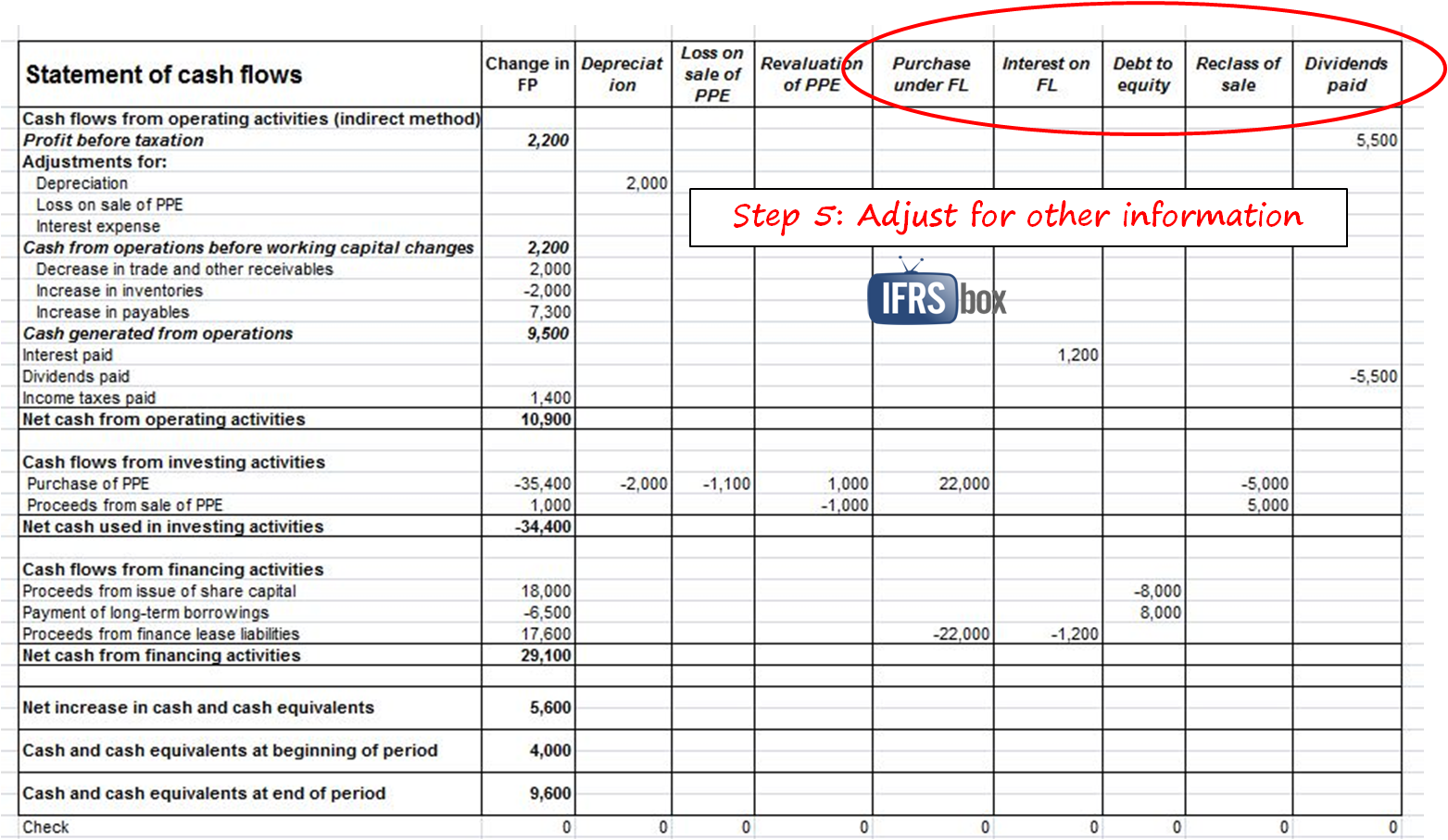

Remove the effect of gains and/or losses from. Add back noncash expenses, such as depreciation, amortization, and depletion. Explore cash flow analysis basics, components, and key indicators for financial insights.

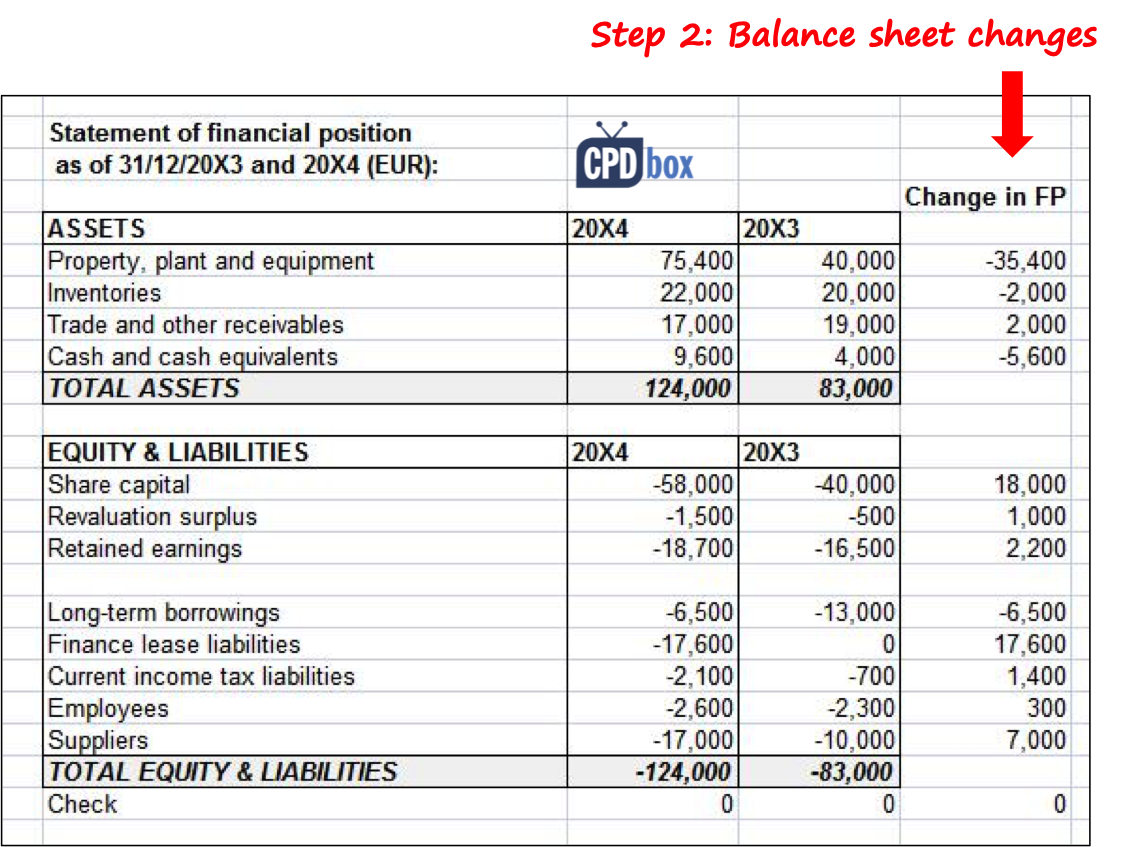

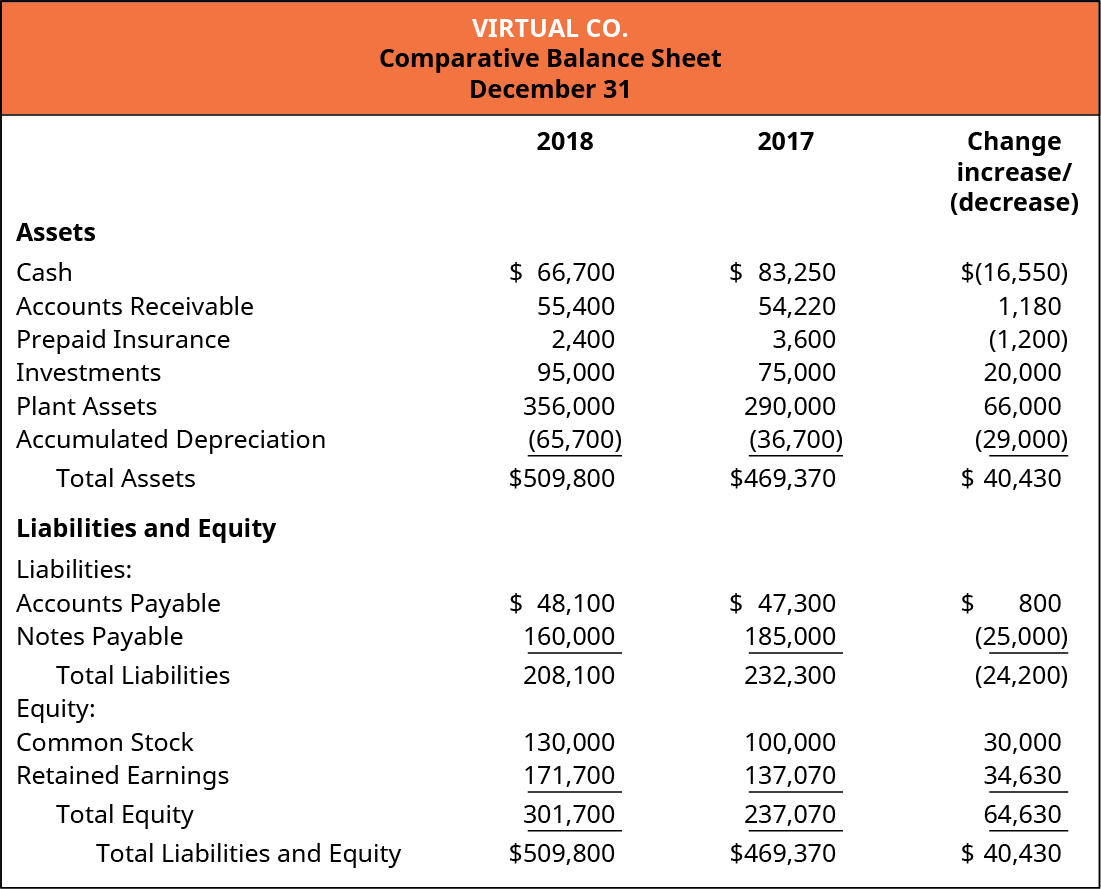

Effect of changes in working capital is to be taken into as. Steps you need to take to prepare a statement of cash flows using the direct method. Work out any changes to your balance sheet over the current period… calculate cash flow from operating activities.

Determine your starting balance #2. After compiling these documents, you can. The direct method and the indirect method:

Cash flow from operating activities. To prepare a statement of cash flows, you need to prepare your income statement and two balance sheets first. In this article, we define cash flow statements, review its uses, explain the benefits of these types of statements, analyze the relationship between cash flow.

According to the online course financial accounting: Need to know how to prepare a cash flow statement? Operating profit before changes in working capital can be calculated as follows:

This is the most important portion of the. Learn what goes into the preparation of a cash flow statement, how to understand it, and a few different. The four steps required to prepare the statement of cash flows are described as follows:

The statement of cash flows is classified into the following three separate categories of cash flows: The general layout of the direct method statement of cash flows is shown. Choose a time frame and method to use each statement of cash flows corresponds to a specific.

From these financial statements, we are asked to prepare the cash flow statement of the company.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)