Spectacular Tips About Four Financial Statements Balance Sheet And Cash Flow Statement Example

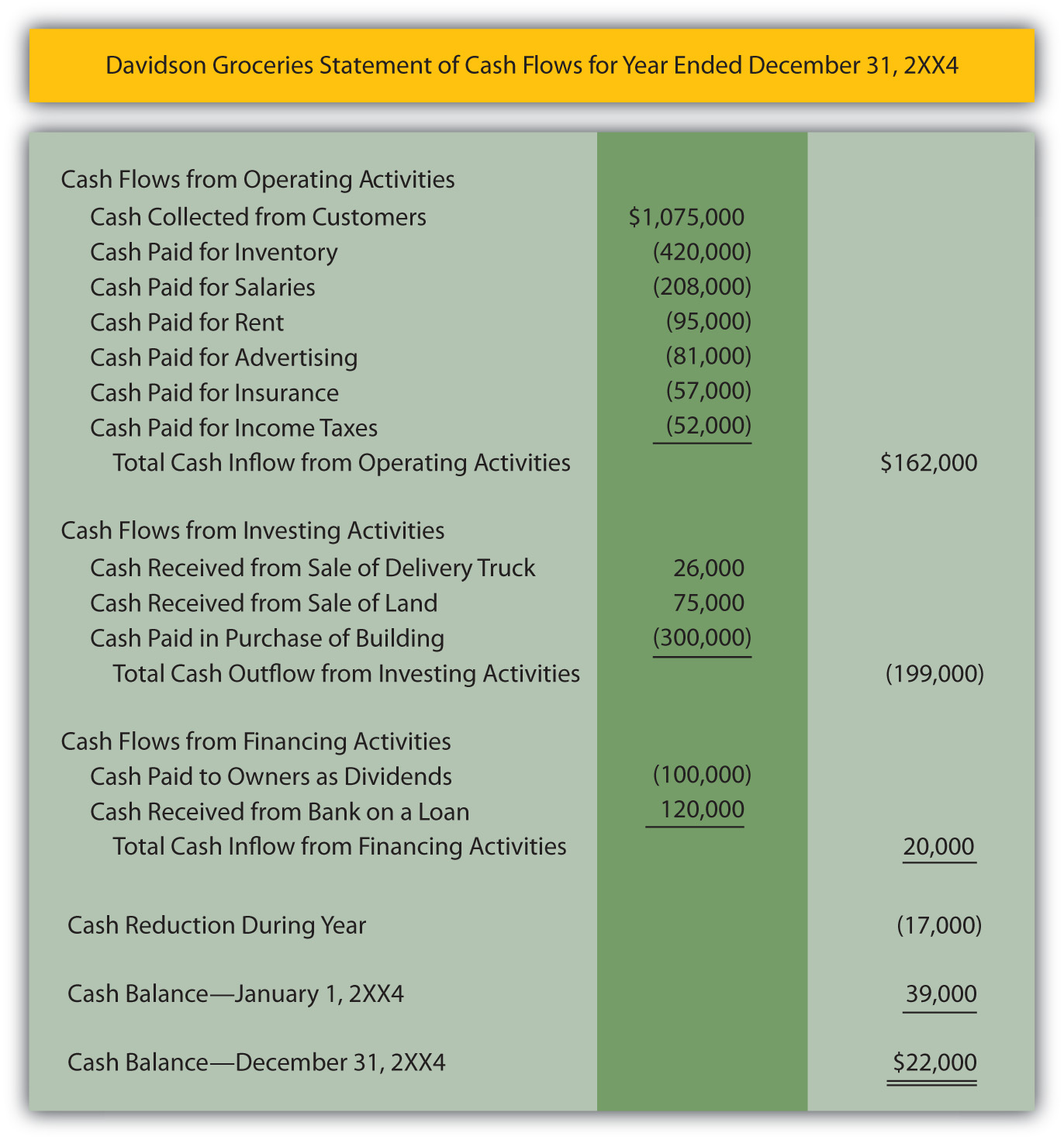

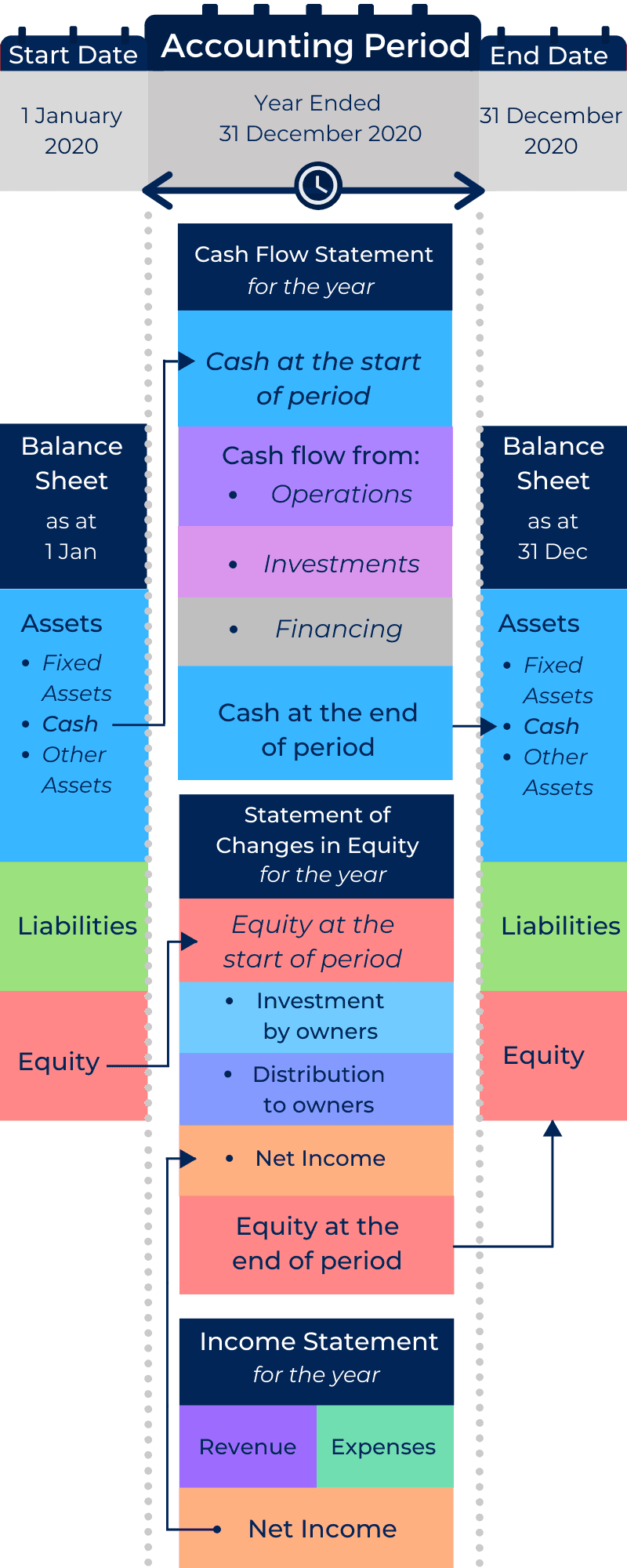

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the.

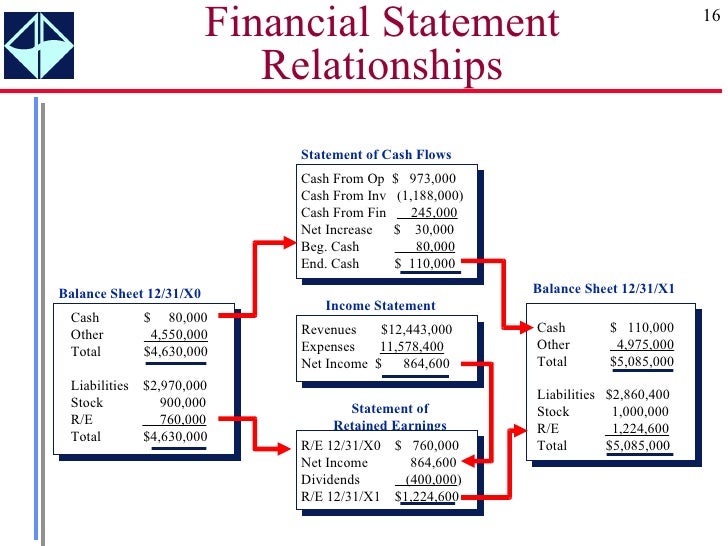

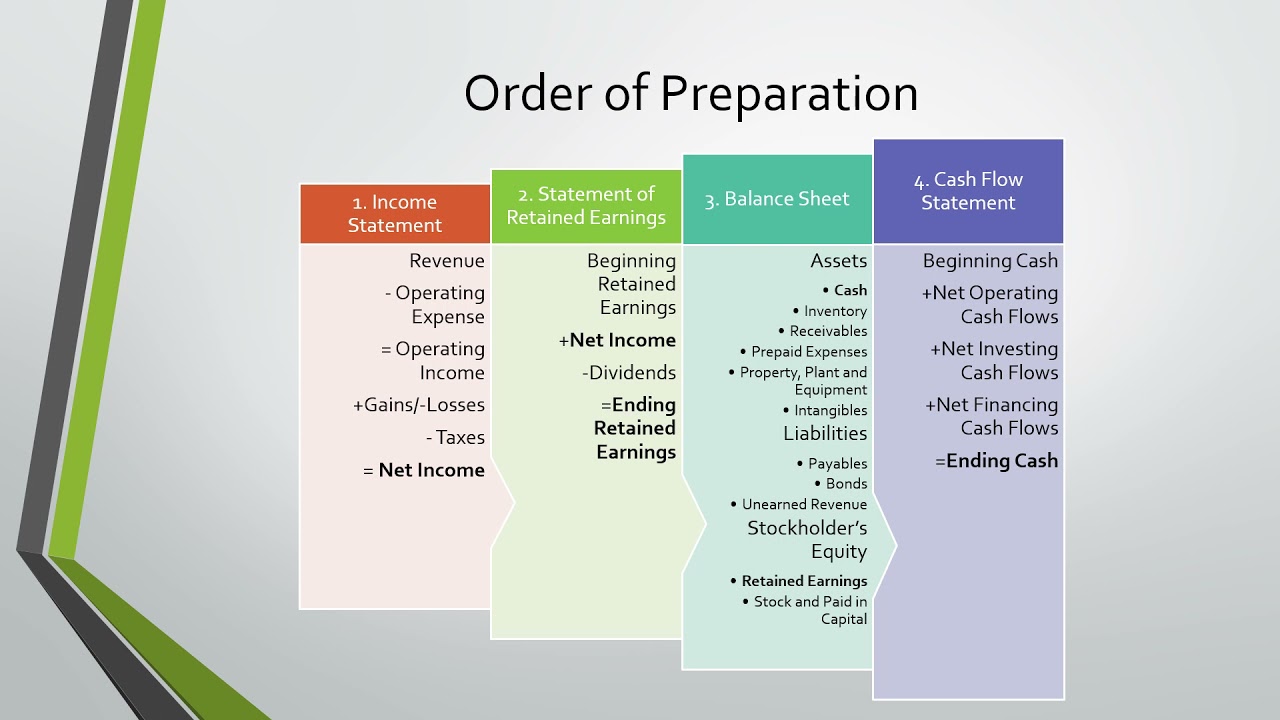

Four financial statements balance sheet and cash flow statement example. On the year 1 balance sheet, the $28m in ending cash that we. Remember that we have four financial statements to prepare: The three periodic financial statements include the cash flow statement, the income statement, and the statement of changes in equity.

Some of the most common include asset turnover, the quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity. The four financial statements that perform these functions and the order in which we prepare them are: Brent young, jenny beiermann, and jeffrey e.

The income statement, balance sheet,. Definition, examples, objectives (this page) lesson two: Transactions that show an increase in assets result in a decrease in cash flow.

The three financial statements are: Budgeted cash flow statements. (1) the income statement, (2) the balance sheet, (3) the.

There are three financial statements that work together to create a complete picture of your business’s finances: Transactions that show a decrease in assets result in an increase in cash flow. There are four primary financial statements used.

(1) the income statement, (2) the balance sheet, and (3) the cash. Depreciation flows out of the balance sheet from property plant and equipment (pp&e) onto the income statement as an expense, and then gets added back in the cash flow. The income statement, balance sheet, and statement of cash flows are required financial statements.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements are informative tools that traders can. An income statement, a statement of.

Reviewed by scott powell what are the three financial statements? Preparing financial statements is the seventh step in the accounting cycle. Just like the income statement and balance sheet, the cash flow statement can also be drawn up in budget form and later compared to actual.

\text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements. Four simple rules to remember as you create your cash flow statement:

This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering:

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)