Breathtaking Info About Depreciation In P&l

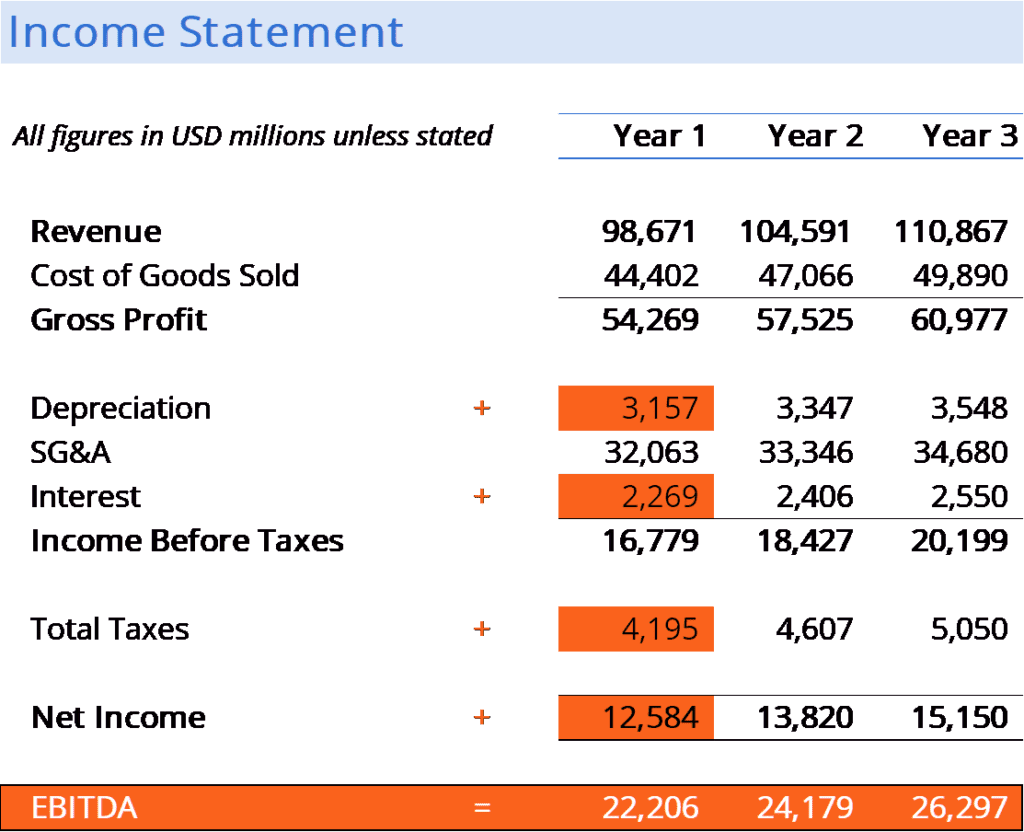

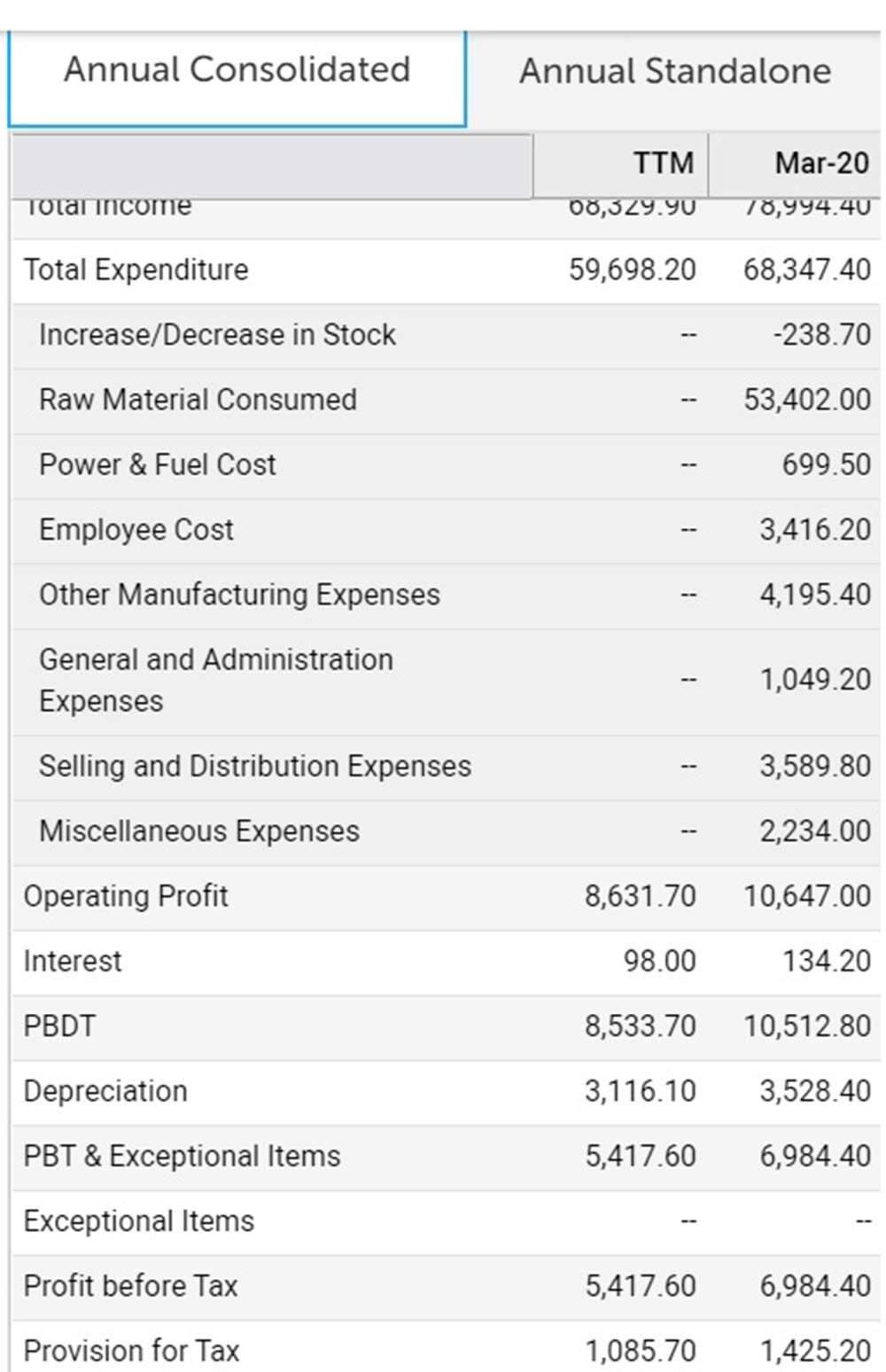

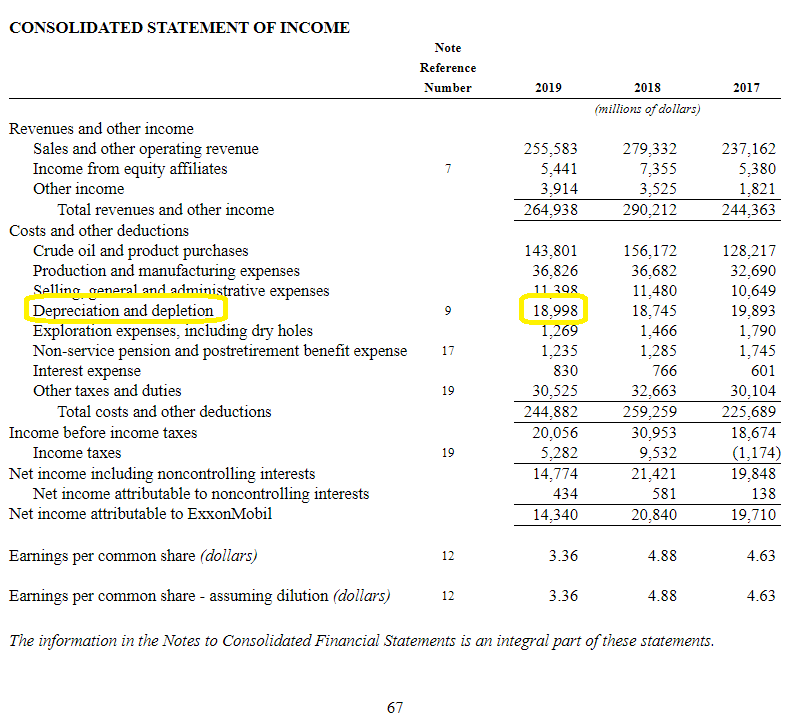

Depreciation expense is an income statement item.

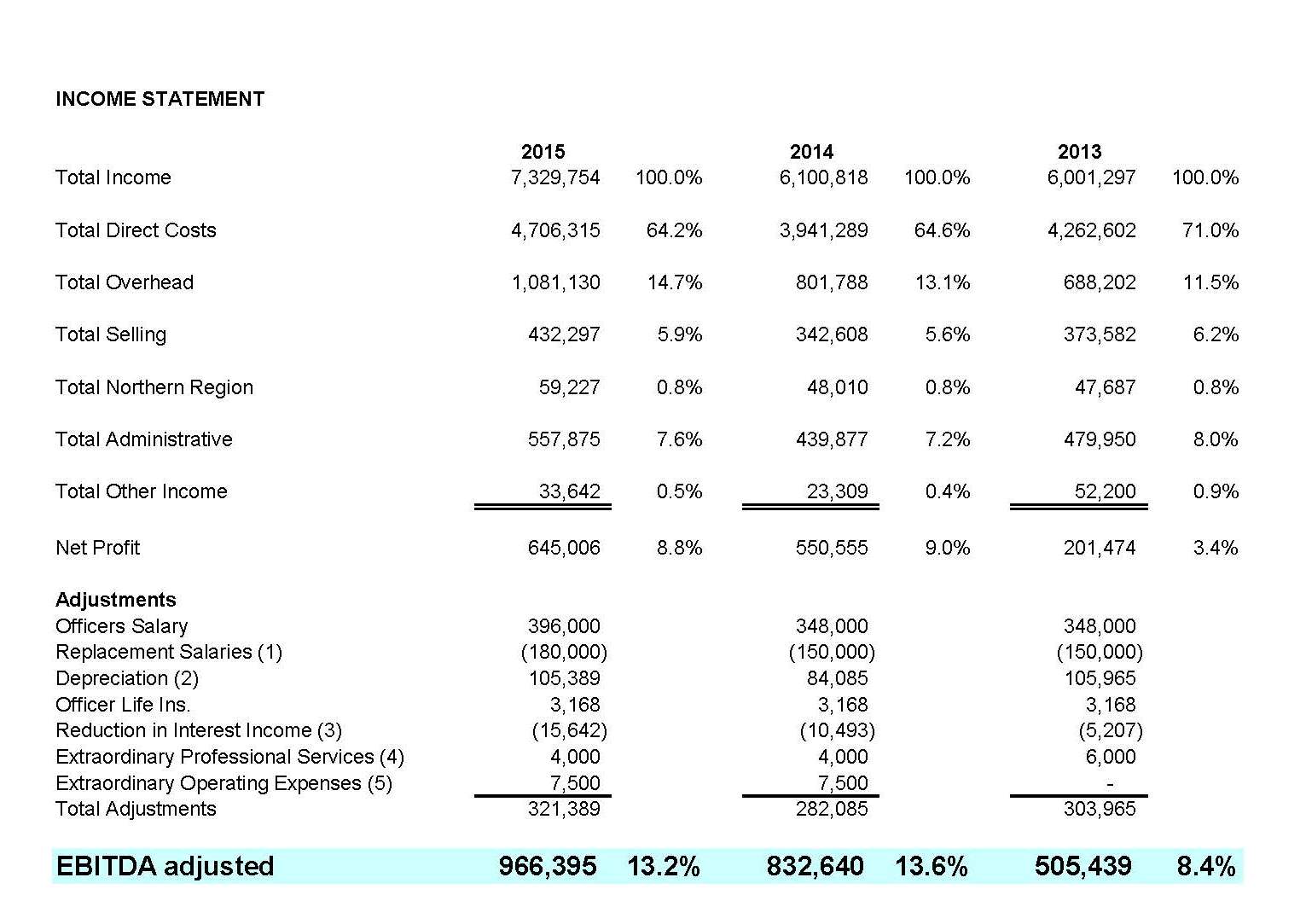

Depreciation in p&l. Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. The accumulated depreciation reduces the value of the asset on the balance sheet. It contains information pertaining to a company’s revenue and expenses over a given period.

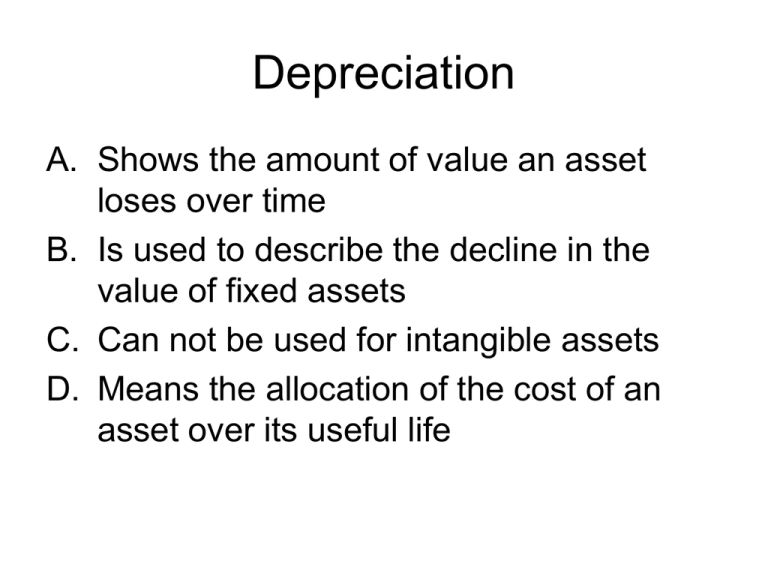

It shows your revenue, minus expenses and losses. But do you know the difference between the two and how they are shown on your financial statements? It is accounted for when companies record the loss in value of their fixed assets through depreciation.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. The nigerian currency, the naira which has been in a freefall since the year began has crossed the 2000 mark against the british pound. Due to the absence of local production and the recent liberalization of commodity imports, the exchange rate is expected to undergo.

February 19, 2024 2:20 pm. It is also known as an income statement or statement of operations. What is a profit and loss statement?

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Each entry on a p&l statement provides insight into. Photoalto/odilon dimier/getty images depreciation is a financial concept that affects both your business accounting financial statements and taxes for your business.

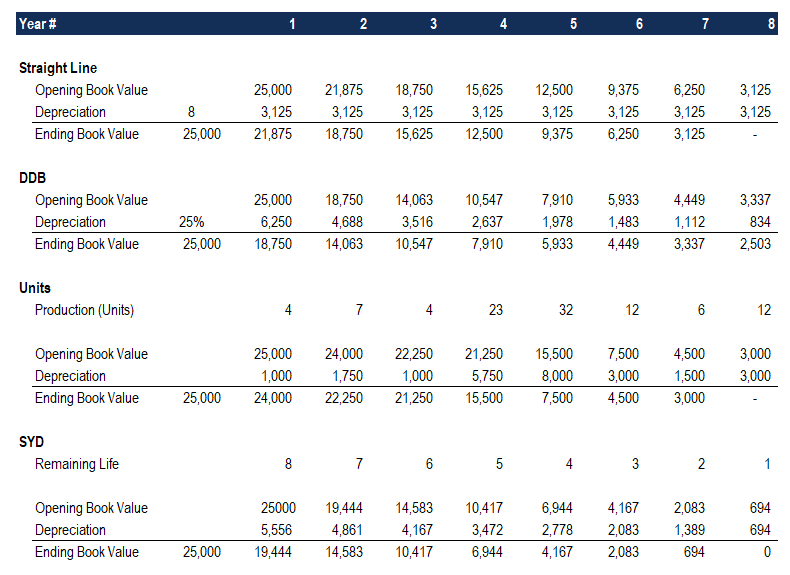

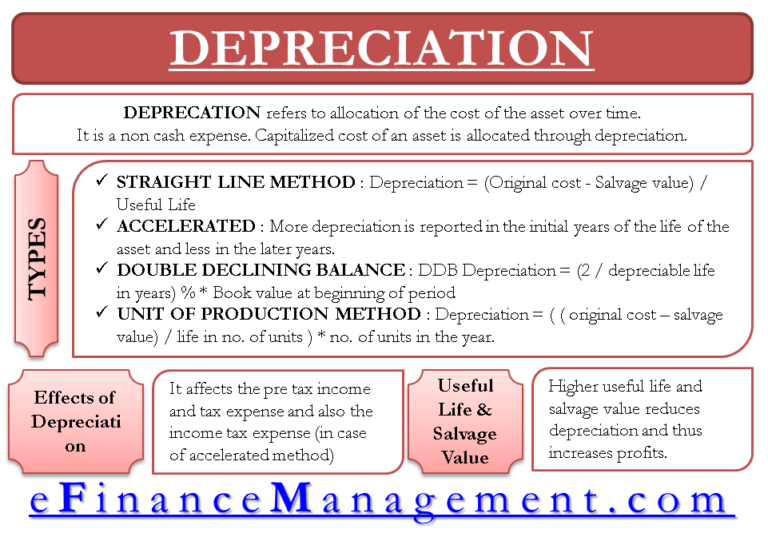

The international monetary fund (imf) said nigeria's exchange rate might experience an additional 35 per cent depreciation this year. Here are the different depreciation methods and how they work. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The depreciation expense during a specific period reduces the income recorded on the p&l. Depreciation expense is the amount that a company's assets are depreciated for a single period (e.g, quarter or the year), while accumulated depreciation is the total amount of wear to date. Examples are plant and machinery, motor van, furniture and fittings, land and building, etc.

The p&l statement is one of three financial. The profit and loss statement summarizes all revenues and expenses a company has generated in a given. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes.

Depreciable assets mainly fixed assets. What does p&l mean? Physical assets, such as machines, equipment, or vehicles, degrade.

Depreciation on a p&l statement depreciation in business tax forms depreciation on financial and tax documents. Depreciation method you can use two main approaches to. A profit and loss (p&l) statement, also known as the income statement, is one of the three financial statements that companies prepare.

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)

:max_bytes(150000):strip_icc()/Amazon4-8ae1cf9e4d2e49f08002f3eacc6f081b.JPG)