Unbelievable Info About Easy Financial Statement

There are four main financial statements.

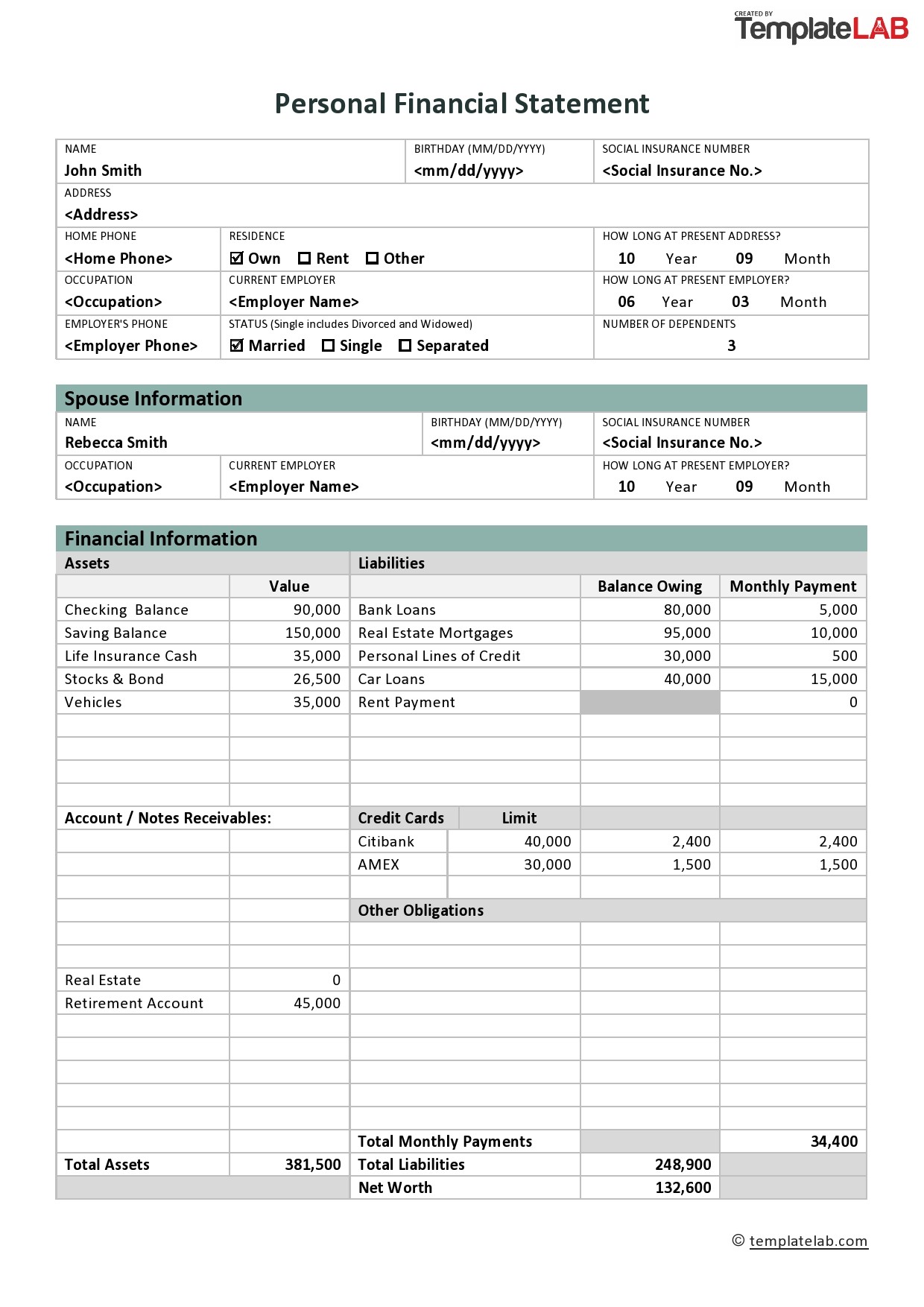

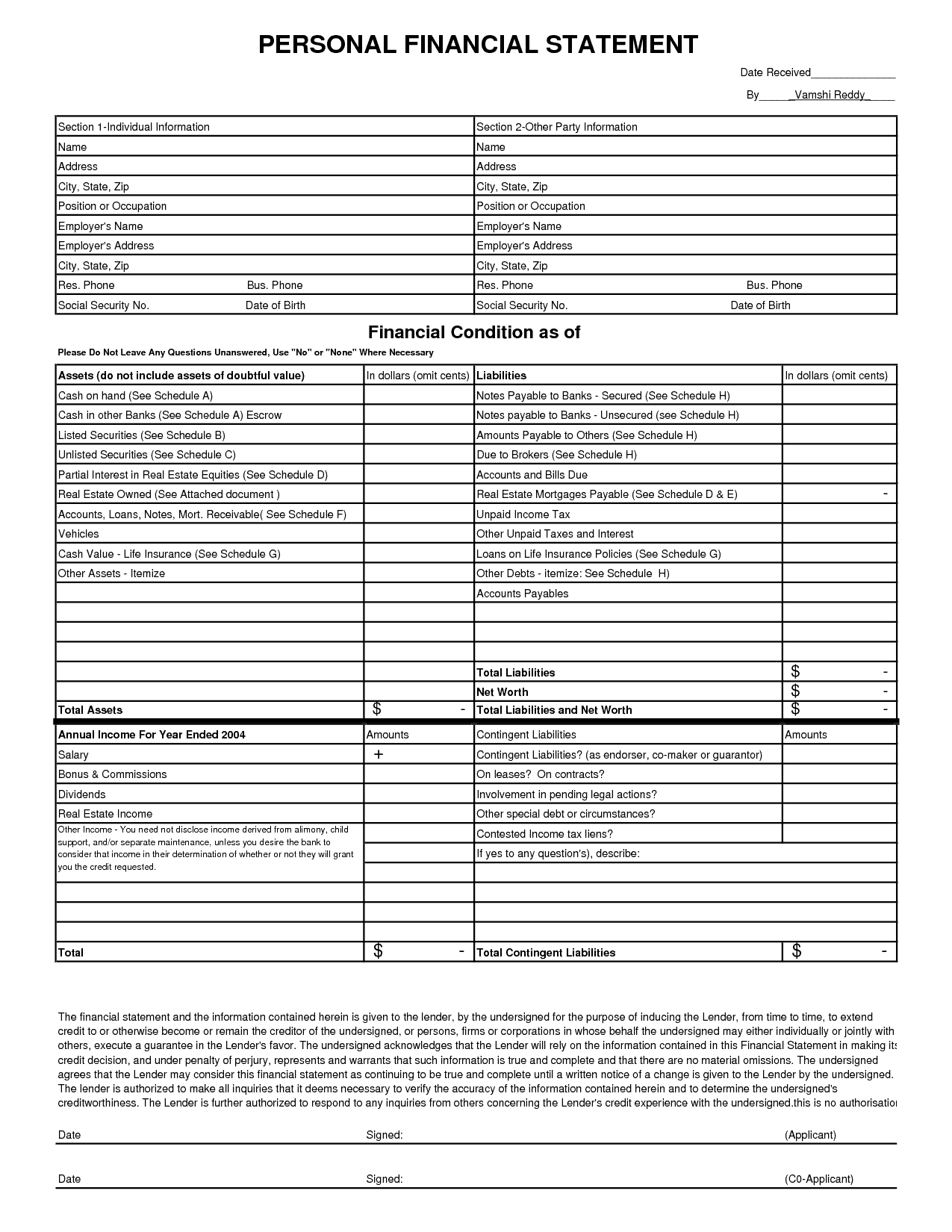

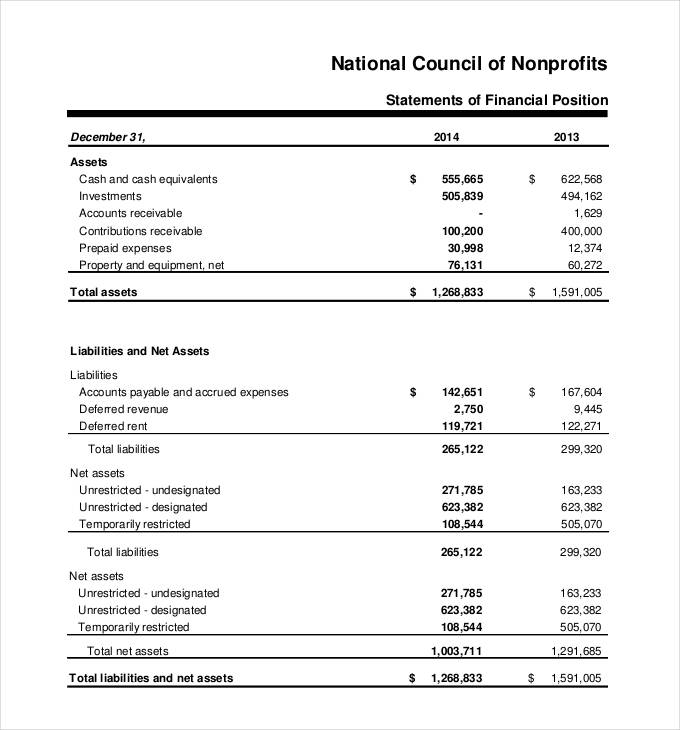

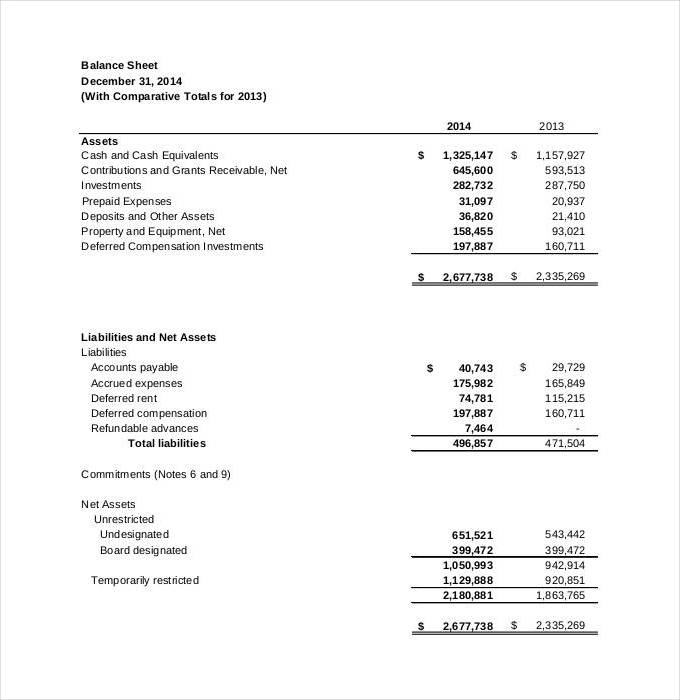

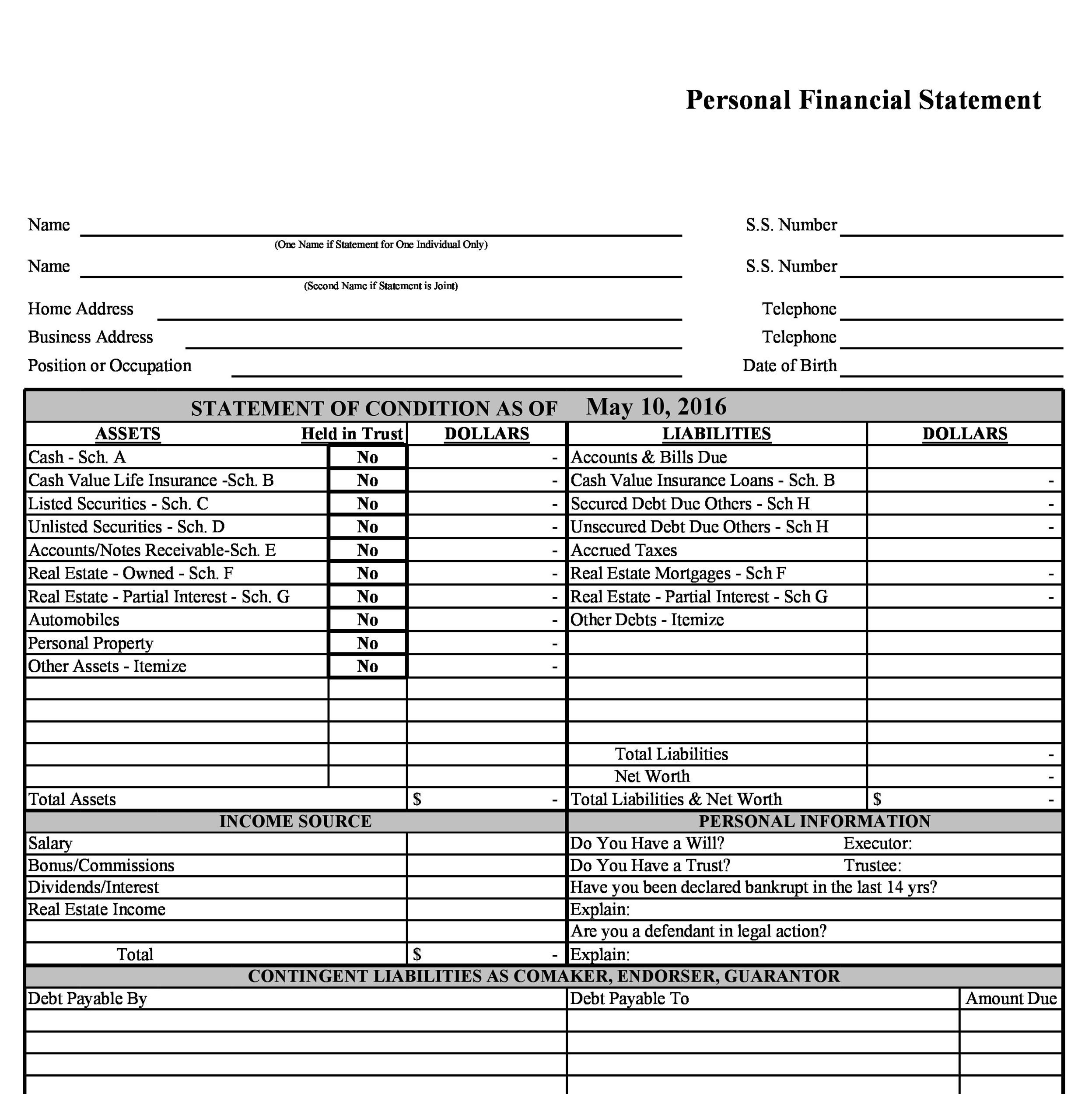

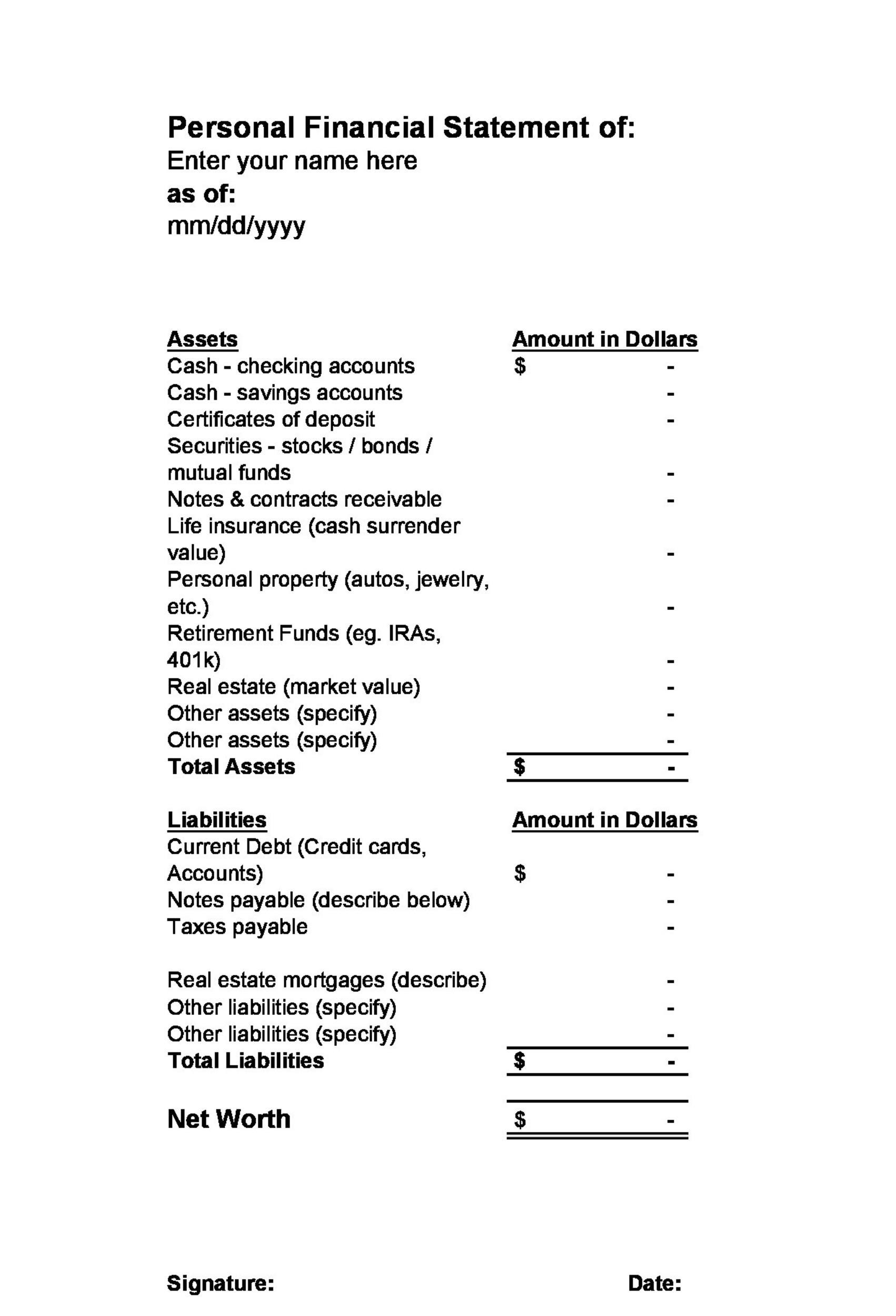

Easy financial statement. What are financial statements? Assets = liabilities + equity. The analysis of these statements helps in understanding the current financial condition of an organization.

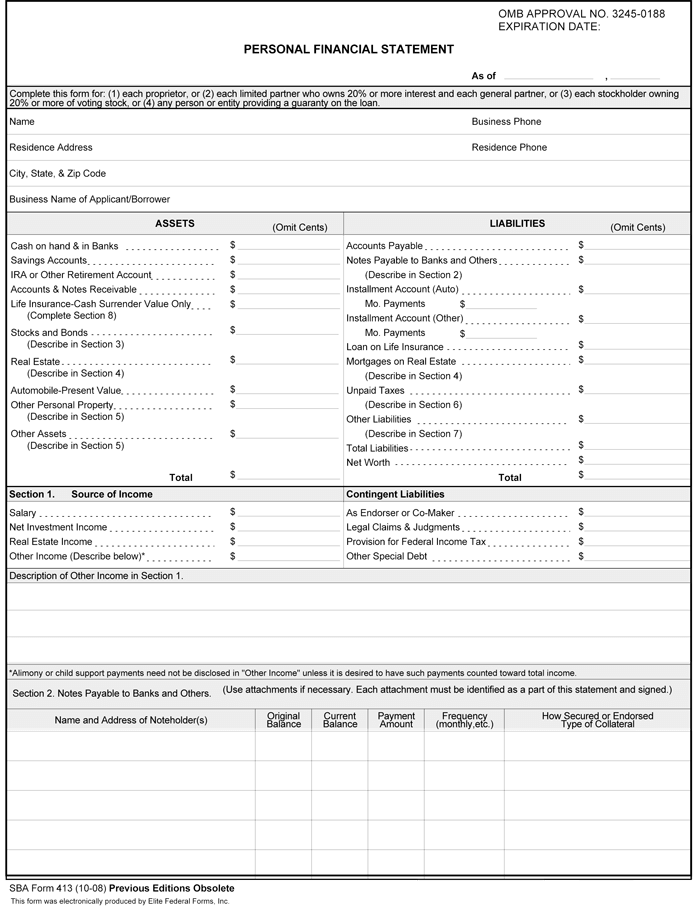

For this reason, financial statements are used by many users, such as shareholders, investors, lenders, and suppliers, as the tools to make a business decision involving the company. Record quarterly revenue of $22.1 billion, up 22% from q3, up 265% from year ago. Understanding the balance sheet.

The following financial statement example provides an outline of the most common financial statements. It is called a balance sheet because it adheres to the basic accounting equation: Written by tim vipond reviewed by jeff schmidt guide to financial statement analysis one of the main tasks of an analyst is to perform an extensive analysis of financial statements.

1m views 5 years ago. The value of these documents lies in the story they tell when reviewed. Statements prepared for dummies are simple in their format.

Our main task is to maintain price stability in the euro area and so preserve. 1 understand the basics of the balance sheet. In this free guide, we will break down the most important types and techniques of financial statement analysis.

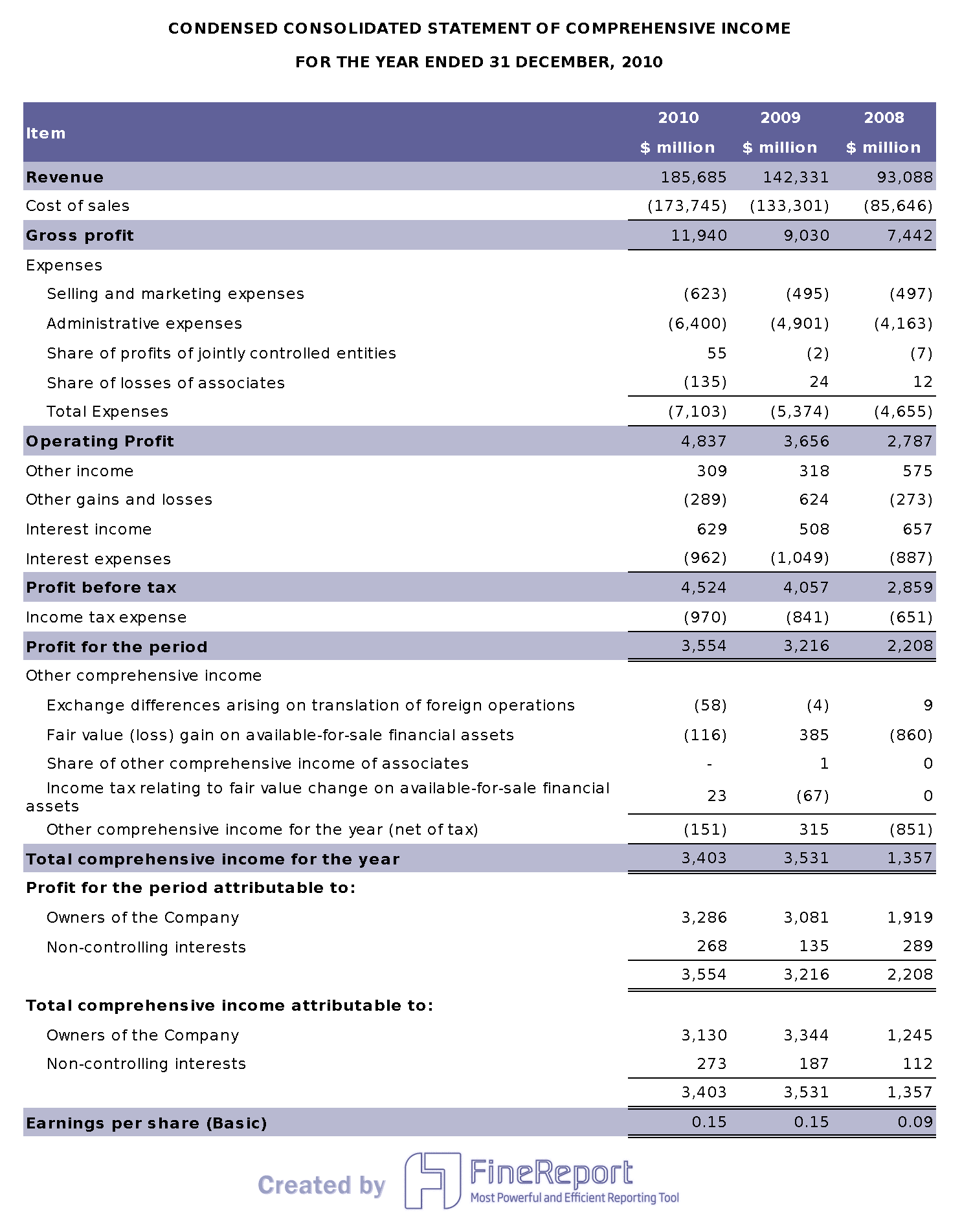

The statement then deducts the cost of goods sold to find gross profit.from there,. Financial statement analysis is an essential tool that is used by analysts, investors and internal decision makers to better understand a company’s financial position, performance, and growth potential. The balance sheet is called so because it shows the company's balance between assets and liabilities.

On february 12, 2024, the federal financial institutions examination council (ffiec) issued a statement of principles that relate to valuation discrimination and bias for its member. In this article, you’ll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them. Balance sheets show what a company owns and what it owes at a fixed point in time.

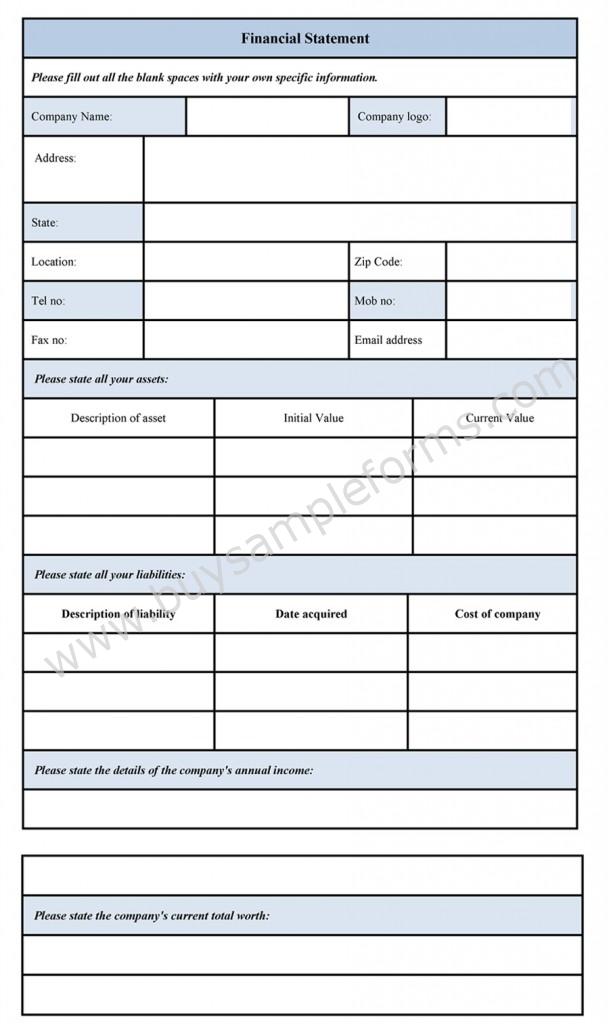

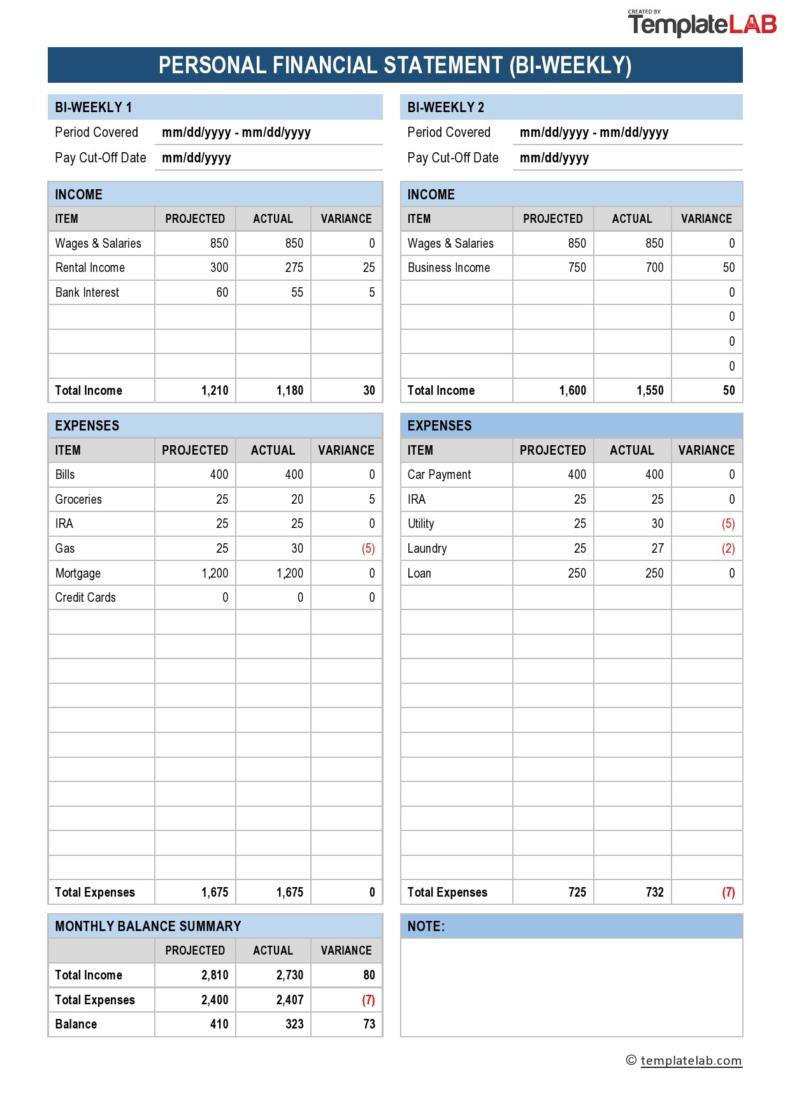

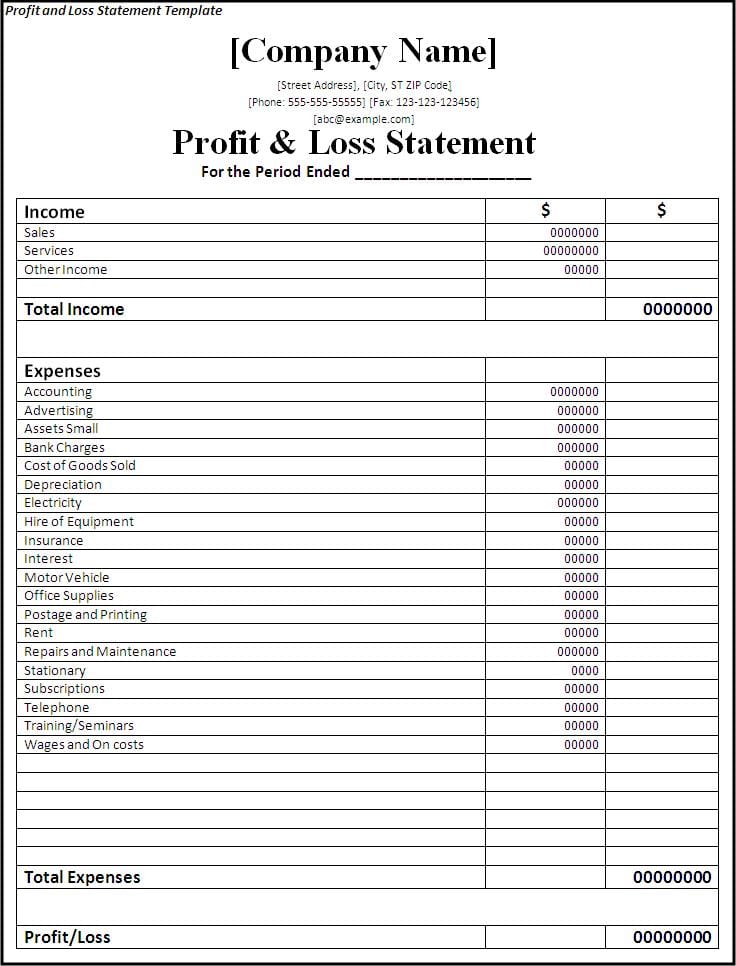

While most accounting software can help you create financial statements, you can use this free template to create your own manually, if needed. What’s the difference between a cash flow statement and an income statement? Overview of the three financial statements 1.

Assessing a company’s risk profile: Rearranging the equation, you can see that equity is equal to assets minus liabilities. External stakeholders use it to understand the overall health of an.

The 4 basic types of financial statements are income statement, balance sheet, cash flow statement, and the statement of retained earnings. Often, the first place an investor or analyst will look is the income statement. And (4) statements of shareholders’ equity.

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)