The Secret Of Info About Issuance Of Common Stock Cash Flow Statement

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

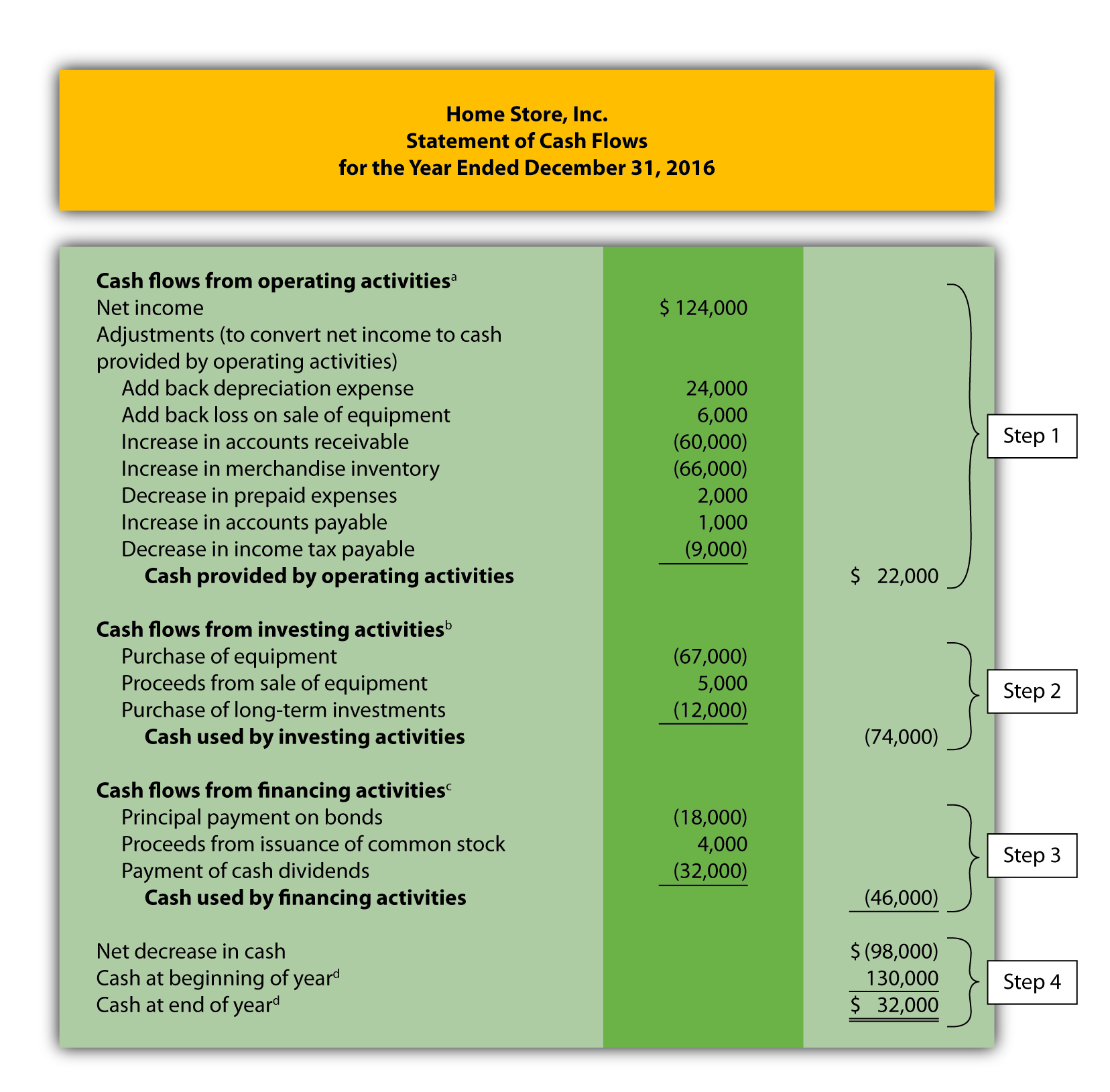

The financing activities section of the statement of cash flows.

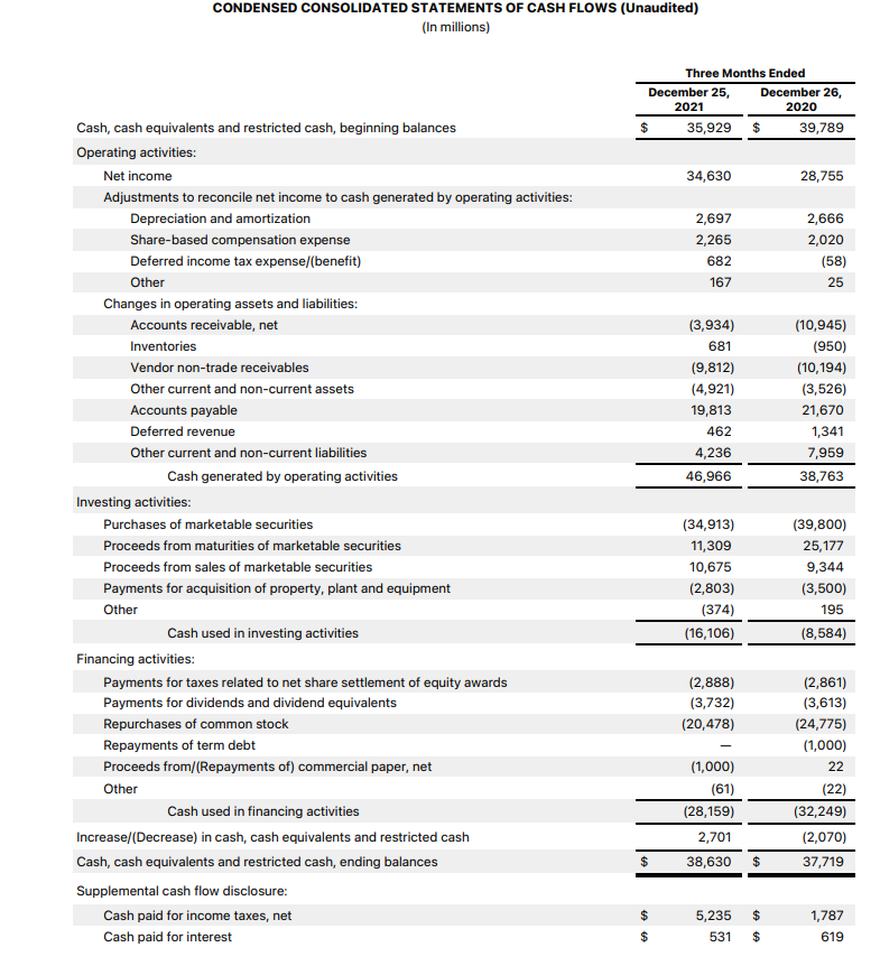

Issuance of common stock cash flow statement. Although issuing common stock often increases cash flows, it doesn't always. How to prepare a cash flow statement The cash flow statement provides information about a company cash receipts and cash payments during an accounting period, showing how these cash flows link the ending cash balance to the beginning balance shown on the company balance sheet.

Us financing guide common stock should be recognized on its settlement date (i.e., the date the proceeds are received and the shares are issued). Figure 16.2 issuance of a share of common stock for cash. Overall, the cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing.

Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. The investing activities section of the statement of cash flows. Record the issuance of common stock for a service or for an asset other than cash.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. This phrase does not mean that cash flows can be reflected in a statement of cash flows before. The cash inflow from the issuing of new share fall under financing activities.

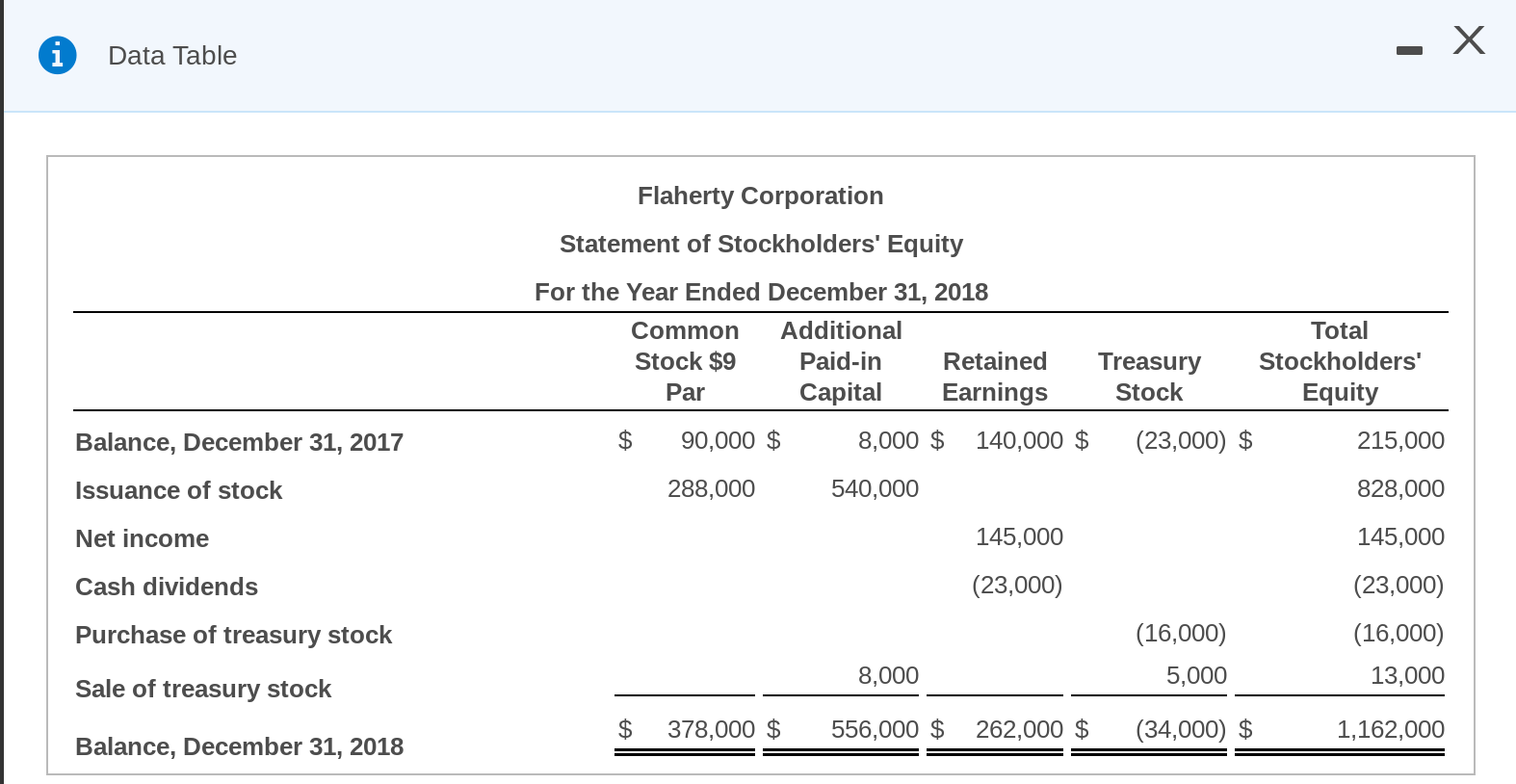

Increases in net cash flow from financing usually arise when the company issues share of stock, bonds, or notes payable to raise capital for cash flow. Several accounts frequently appear in the shareholders’ equity section of a balance sheet reported by a corporation. Cash flow from financing = debt issuances + equity issuances + (share buybacks) + (debt repayment) + (dividends) note that the parentheses signify that the item is an outflow of cash (i.e.

A typical cash flow statement comprises three sections: Acquiring a business through the issuance of stock; Common items in this section of the statement include the payment of dividends, issuance of common or preferred stock, and issuance or payment of notes payable (see figure 5.18).

In the current year, clear lake took out additional notes payable (a cash inflow). Upon issuance, common stock is generally recorded at its fair value, which. Treasury stock will decrease the share equity balance, so it will present as the contra account in the equity account on balance sheet.

The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time. Accounting questions and answers. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

The largest line items in the cash flow from financing activities statement are dividends paid, repurchase of common stock, and proceeds from the issuance of debt. The issuance of common stock in exchange for cash is reported in: During stock splits, for instance, a company issues.

The cfs highlights a company's cash management, including how well it generates cash. The operating activities section of the statement of cash flows. Operating, investing, and financing activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)