Outstanding Info About Operating Income Includes

Widely publicized research from 2010 said income doesn’t boost happiness past $75,000.

Operating income includes. Operating income is a company's profit after deducting operating expenses such as cost of goods sold, wages and depreciation. Operating income is the amount of profit left after considering all operating expenses and subtracting those expenses from the company’s revenue. Operating income shows a company's profit after subtracting operating expenses incurred to make a product or provide a service.

Operating income and net income are sometimes used as synonyms. Operating income is an accounting figure that measures the amount of profit realized from a business's operations after deducting operating expenses such as wages, depreciation, and cost of goods sold(cogs). Operating income vs.

The calculation also doesn't include income from ancillary businesses, which are connected businesses that don't share the same product line. But happiness may increase with a bigger paycheque more than. Operating income indicates how profitable a company will be after it has deducted operational expenses and cost of goods sold (cogs).

Plunged its most in two years after slashing projections for sales of the aging playstation 5 gaming console,. It is calculated with the. Operating income refers to the profit realized after deducting operating expenses such as wages, cost of goods sold, and depreciation from gross income.

Operating income, also referred to as operating profit or earnings before interest & taxes (ebit), is the amount of revenue left after. Then, you’ll be left with the business's operating profit. Operating income, also known as ebit or recurring profit, is an important yardstick of profit measurement and reflects the operating performance of the business and doesn’t.

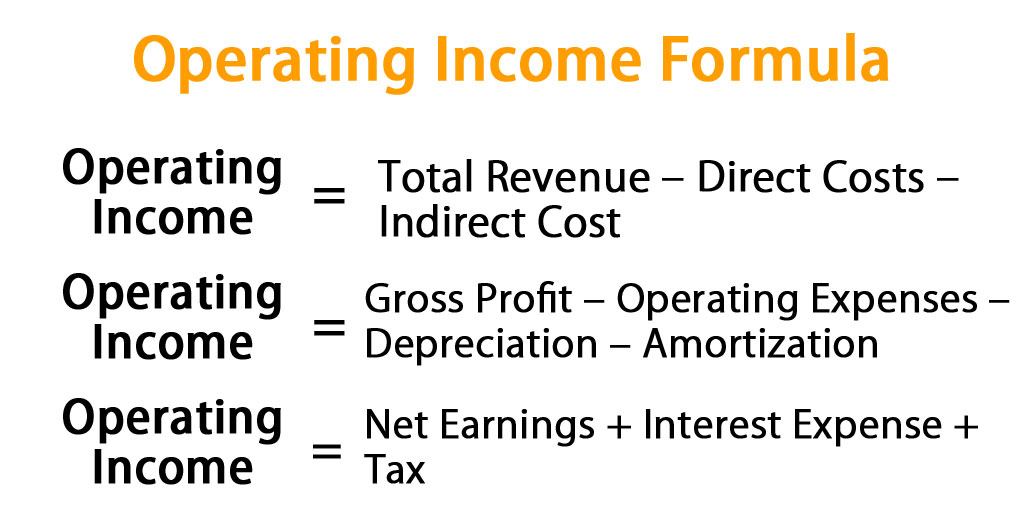

Operating income is the amount of money that remains after operating expenses and cost of goods sold have been deducted from revenue. This calculation can be even more efficient if you start with the gross profit, as that will already consider the. Operating income = net earnings + interest expense + taxes.

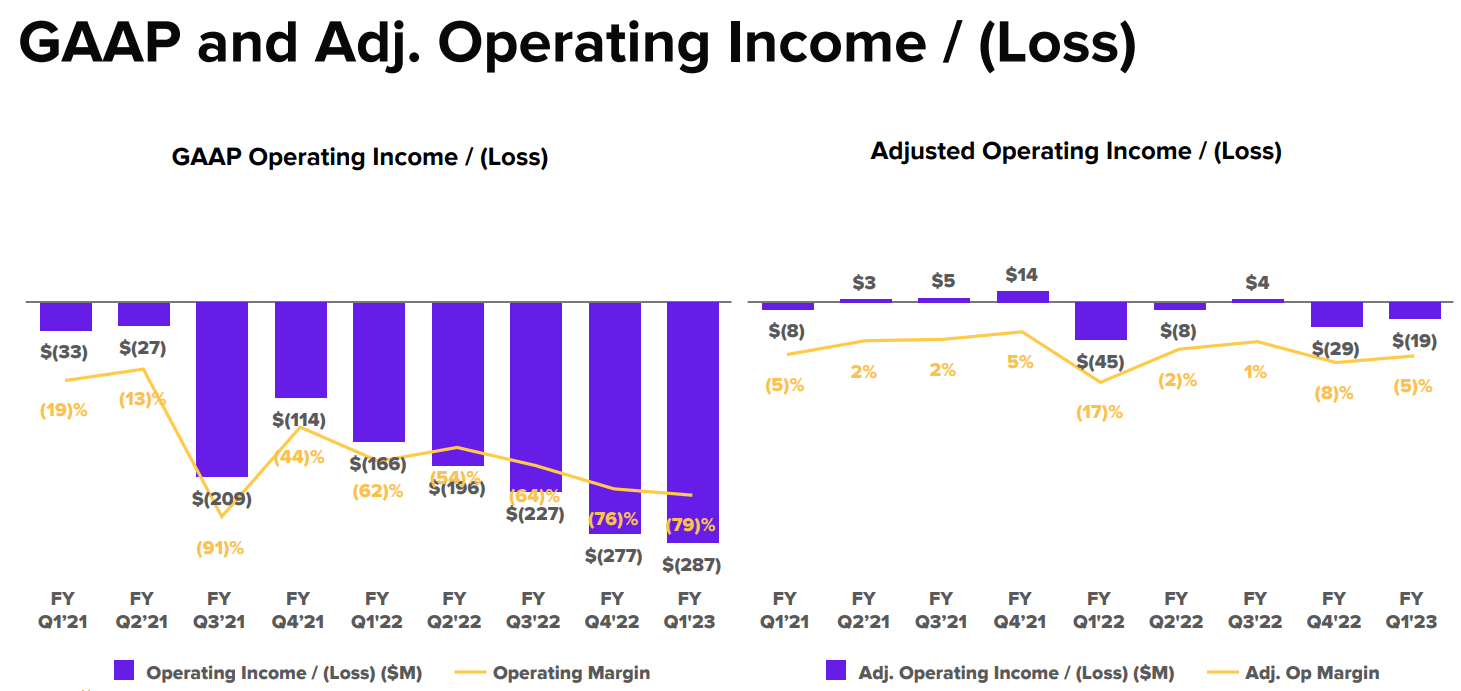

However, these two are separate figures. Operating expenses = selling, general, and administrative expenses (from the income statement) depreciation = decline in value of fixed assets. Operating income, excluding special items and u.s.

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/operating-income-dde2b7c5ff7b49d3a6f7216c7830d0e4.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/non-operating-income-final-d3154875b2944bd8b6592741aa791f1c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)