Lessons I Learned From Tips About Bad Debts Expense Is Reported On The Income Statement As

Yes, bad debts are recorded in the income statement.

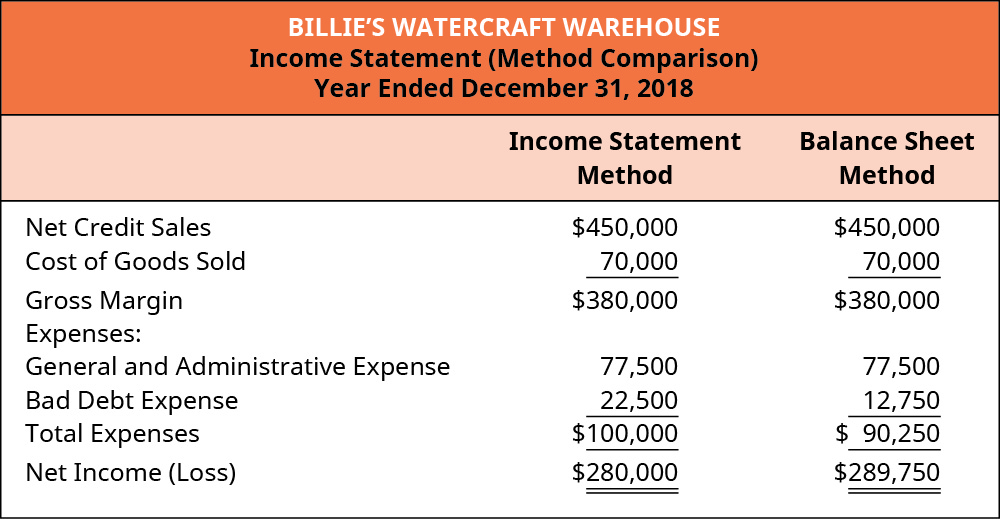

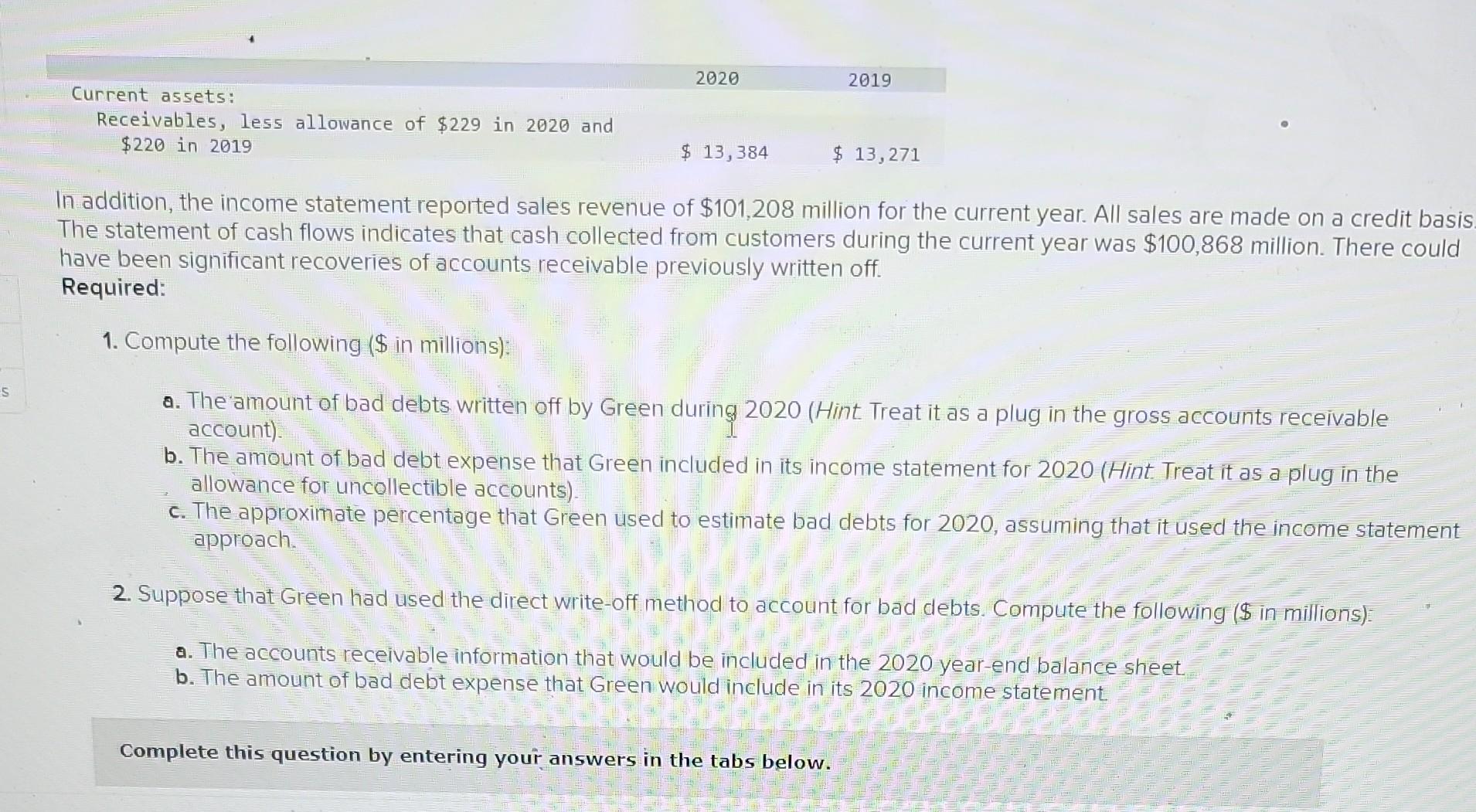

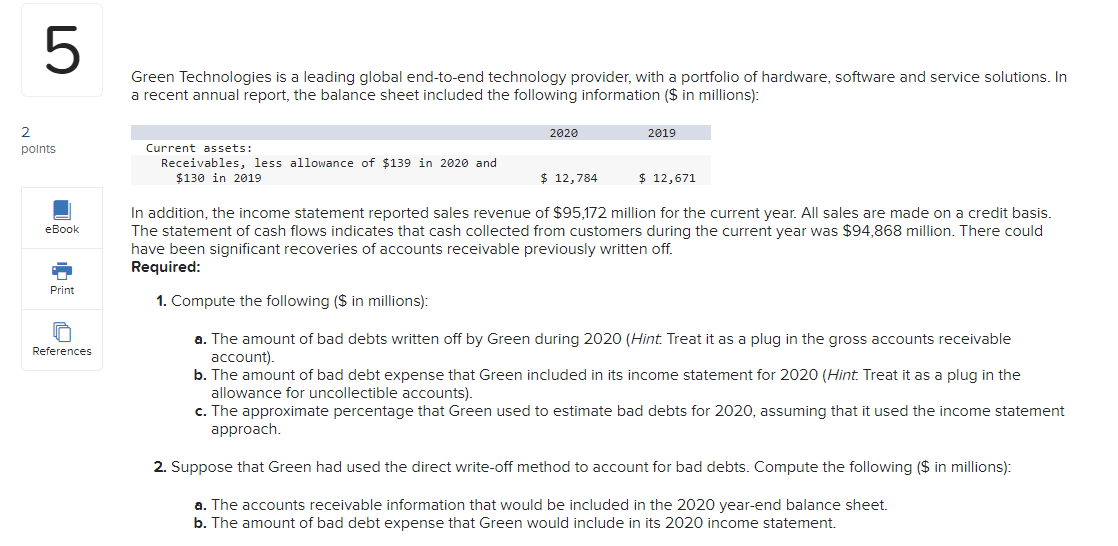

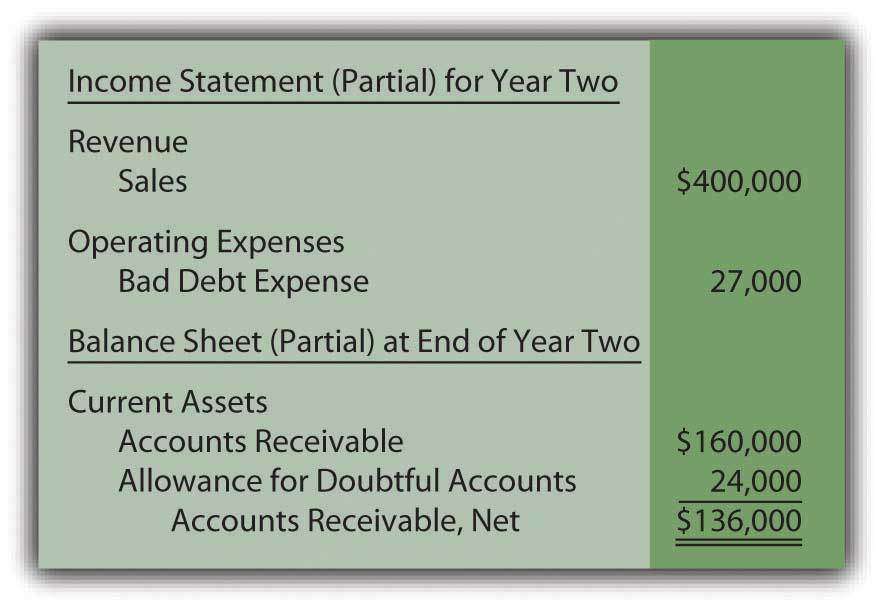

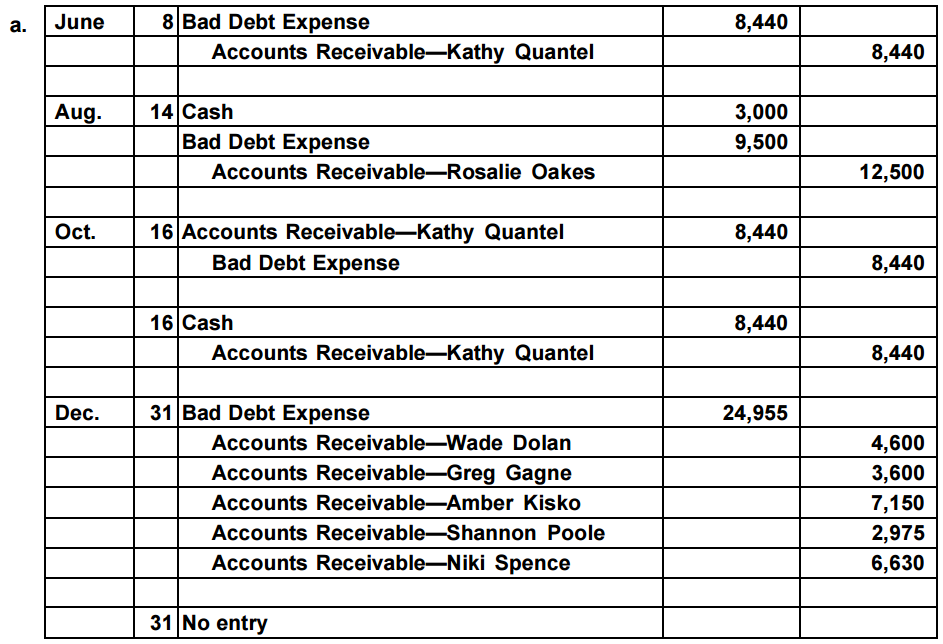

Bad debts expense is reported on the income statement as. Part of cost of goods sold. Accounting accounting questions and answers bad debt expense is reported on the income statement as this problem has been solved! On the income statement, bad debt expense would still be 1%of total net sales, or $5,000.

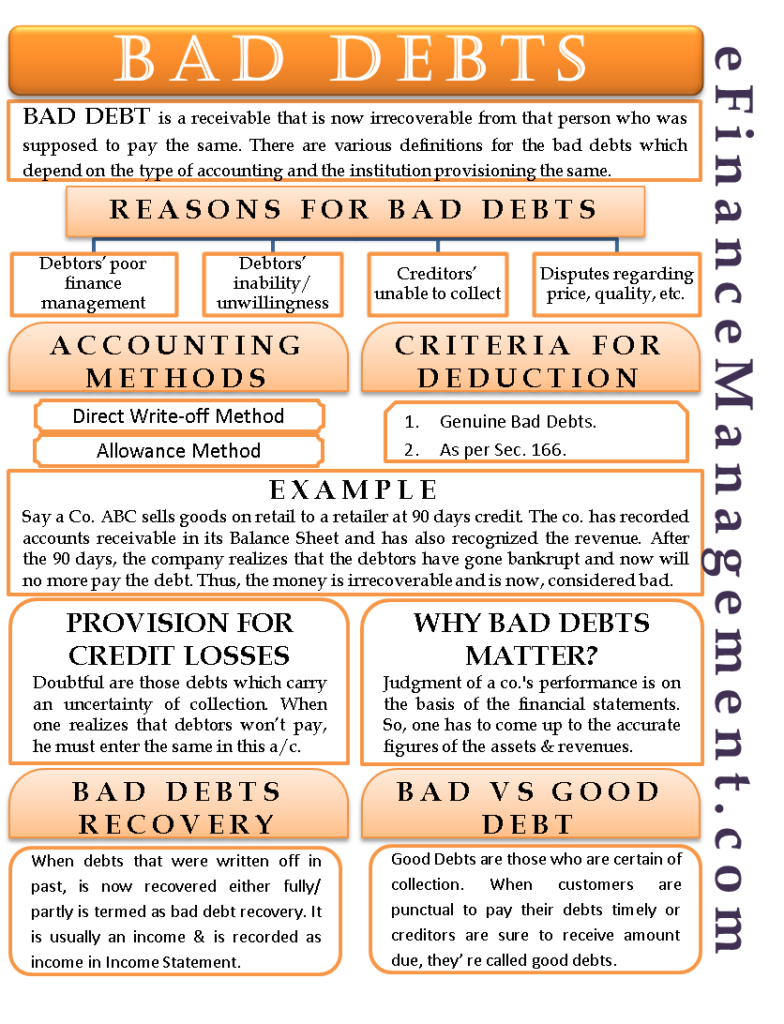

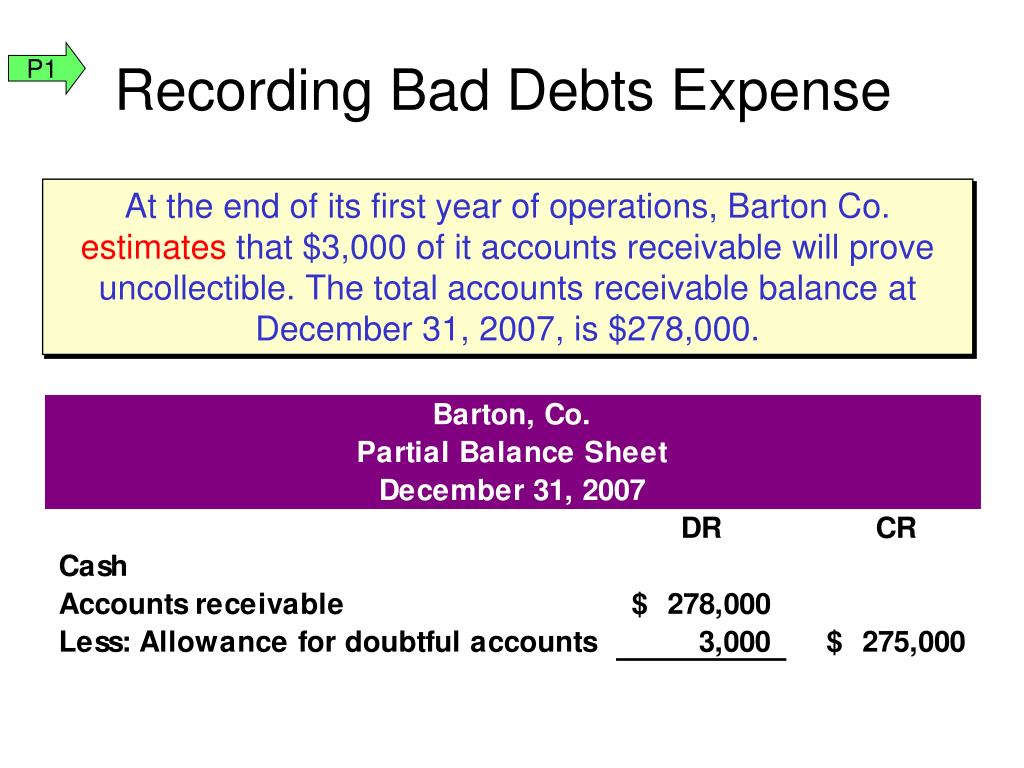

Presentation of bad debt expense. Bad debt expense is something that must be recorded and accounted for every time a company prepares its financial statements. Recording uncollectible debts will help keep your books balanced and give you a more accurate view of your accounts receivable balance, net income, and cash flow.

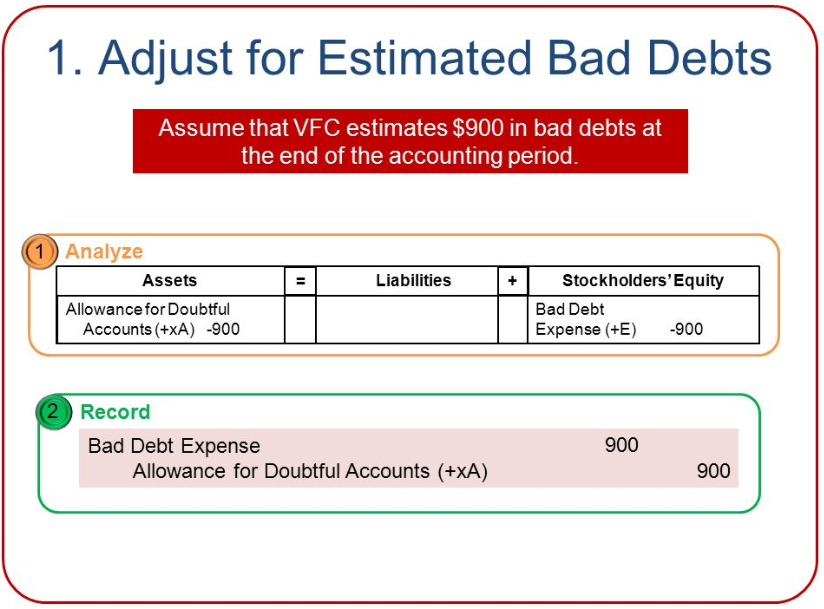

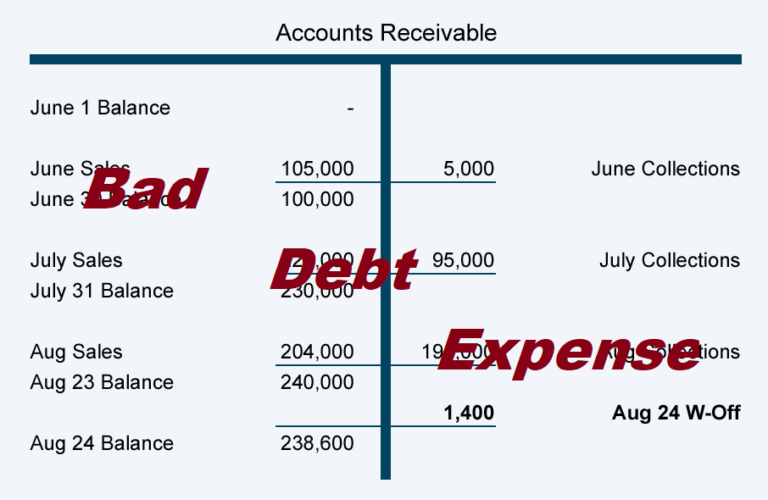

Bad debt expense is used to reflect receivables that a company will be unable to collect. The journal entry for our hypothetical scenario is as. How to calculate bad debt expenses there are two ways to calculate your business’ bad debts:

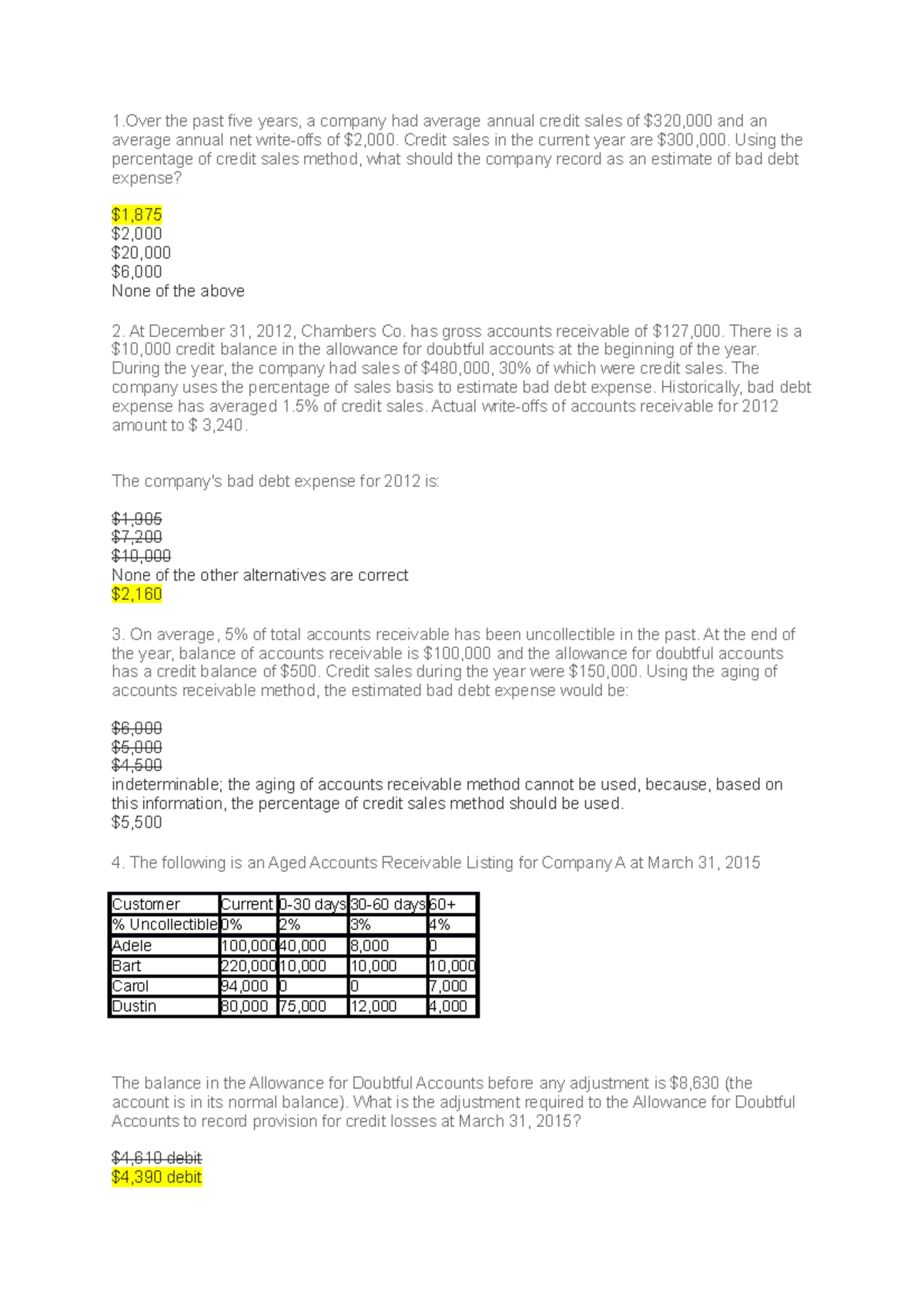

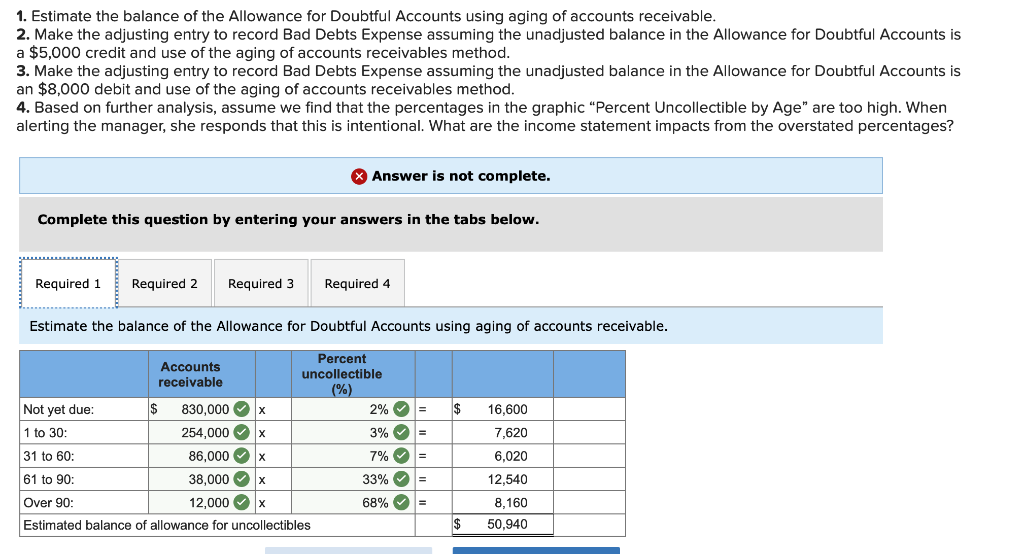

Bad debt expense = net sales (total or credit) × percentage estimated as uncollectible. Technically, we should base bad debt. With regard to depreciation and income taxes, which of the following statements is not true?

The bad debt expense is recorded when an account receivable is written off, or as a result of a bad debt reserve calculation. Recognizing and accurately recording bad debt expense when they occur is crucial. The estimated amount of bad debts expense could be based on:

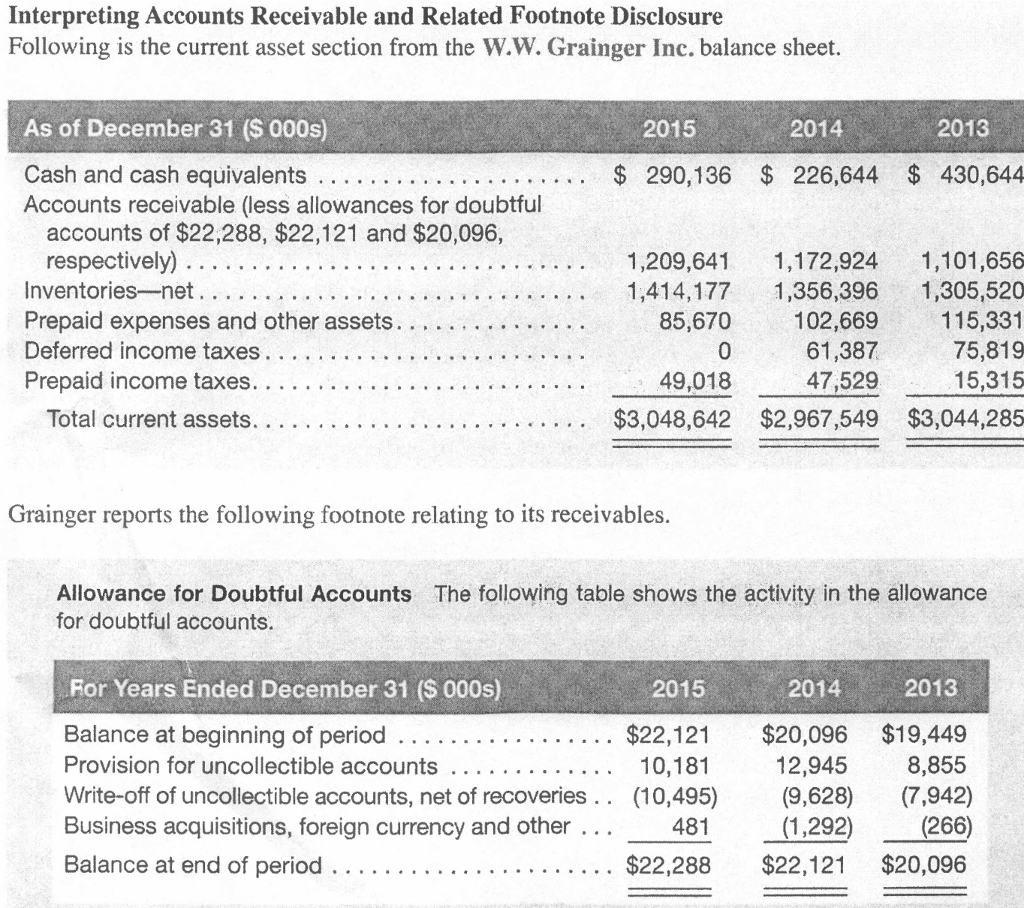

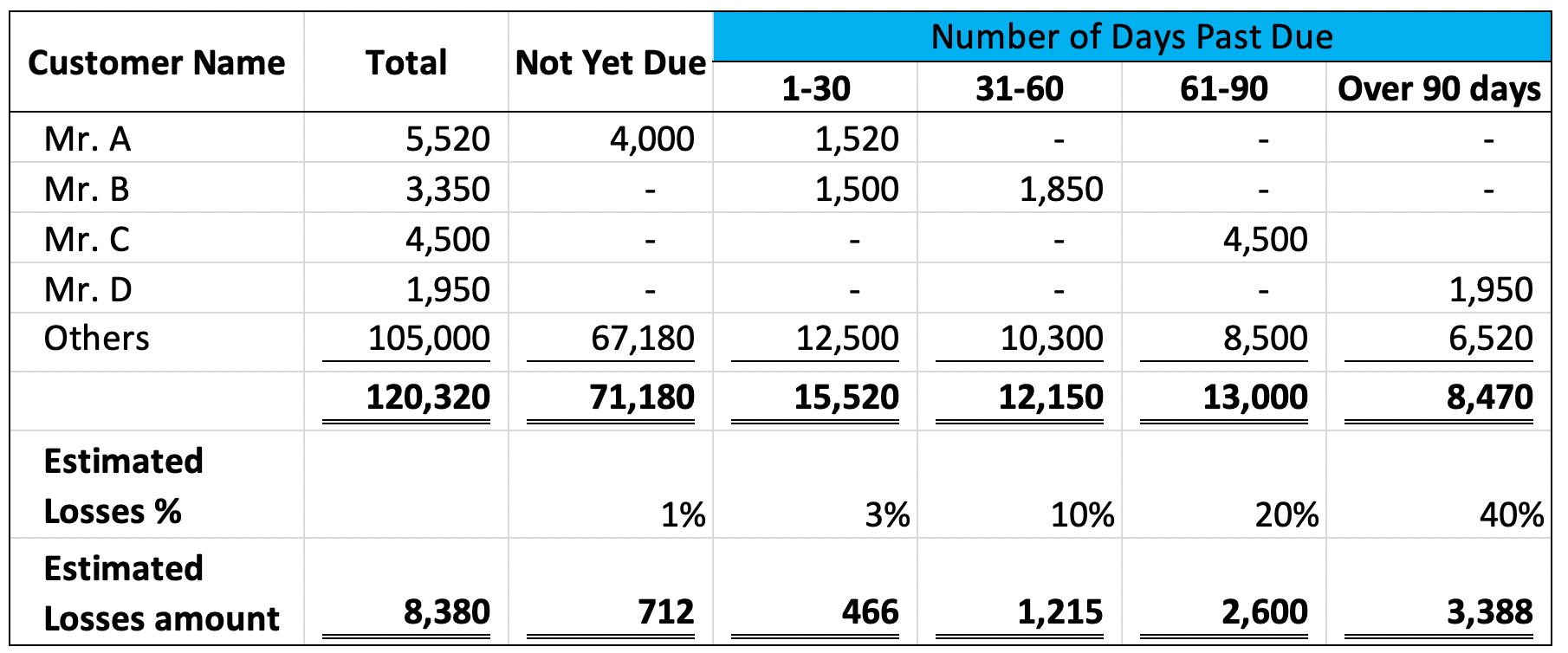

Bad debt expense = $20 million × 1.0% = $200k; The amount of bad debt expense can be estimated using the accounts receivable aging method or the percentage sales method. By directly writing off your accounts receivable, and via the allowance method.

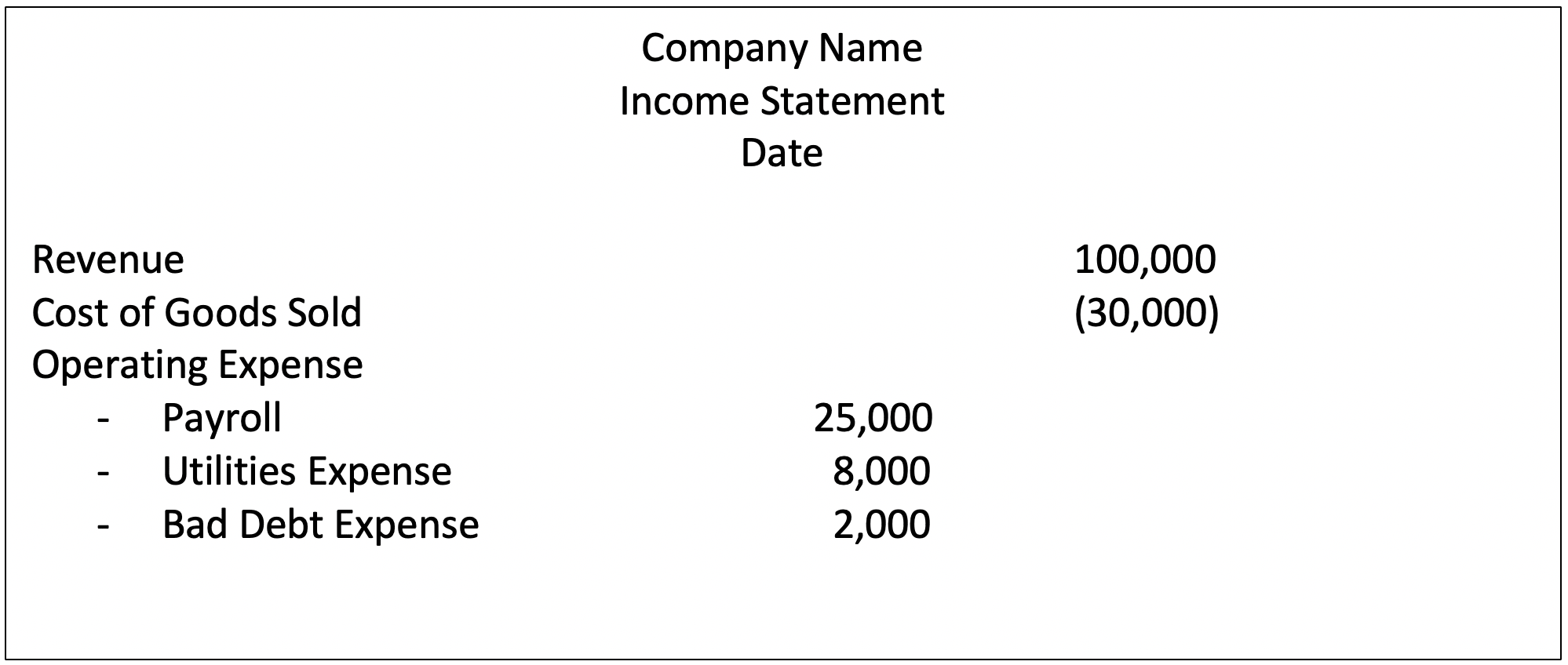

Bad debt expenses are classified as operating costs, and you can usually find them on your business’ income statement under selling, general & administrative costs (sg&a). This practice ensures the income statement reflects the company’s profitability with transparency. Let’s say the historical bad debt experience of a company has been 5% of sales, and the current month’s sales are $100,000.

Bad debt expense is reported within the selling, general, and administrative expense section of the income statement. With respect to financial statements, the seller should report its estimated credit losses as soon as possible using the allowance method. Amount reported as bad debts expense.

Bad debt expense also helps companies identify which customers default on payments more often than others. Bad debt expenses are usually categorized as operational costs and are found on a company’s income statement. Bad debts expense results because a company delivered goods or services on credit and the customer did not pay the amount owed.

Part of cost of goods sold. Bad debts being an expense are recorded under operating expenses in the income statement or on the debit side. A percentage of the company's credit sales during.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)