Who Else Wants Info About Objectives Of Comparative Income Statement

A comparative income announcement is the income account in whose multiple periods of the income.

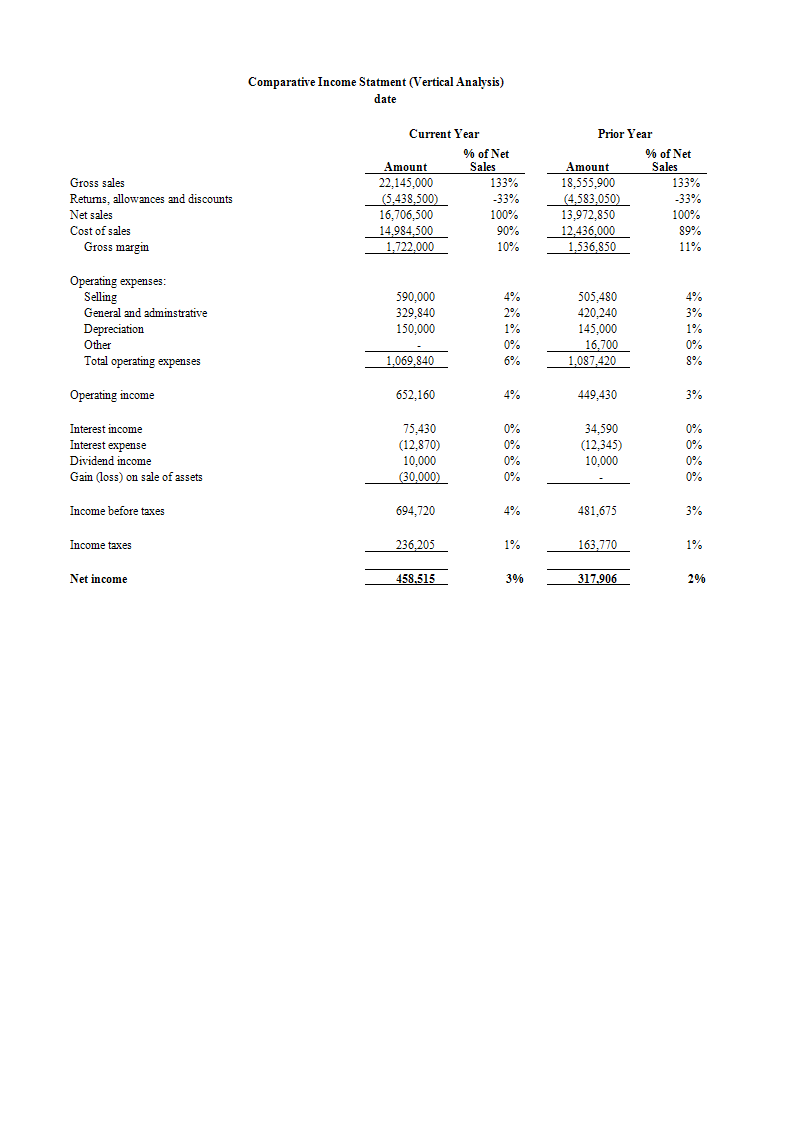

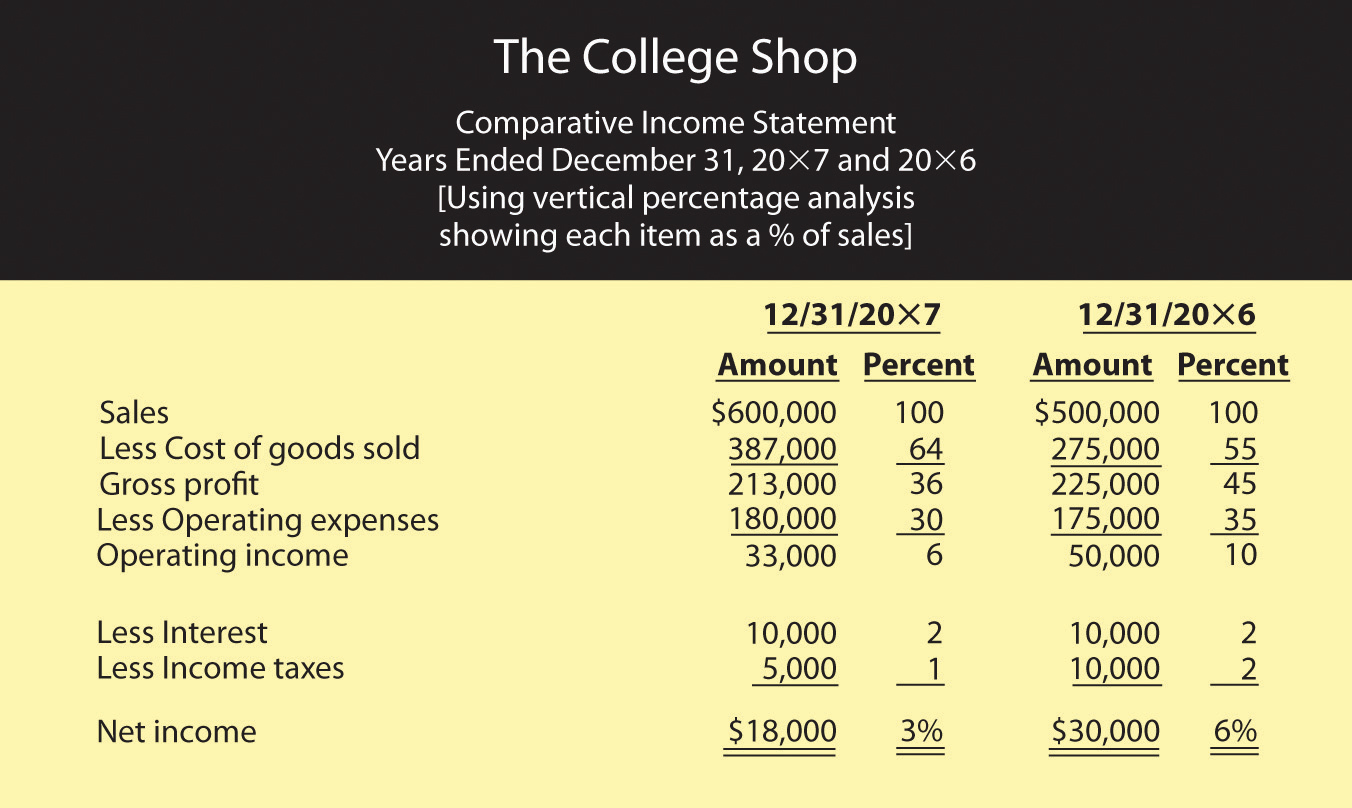

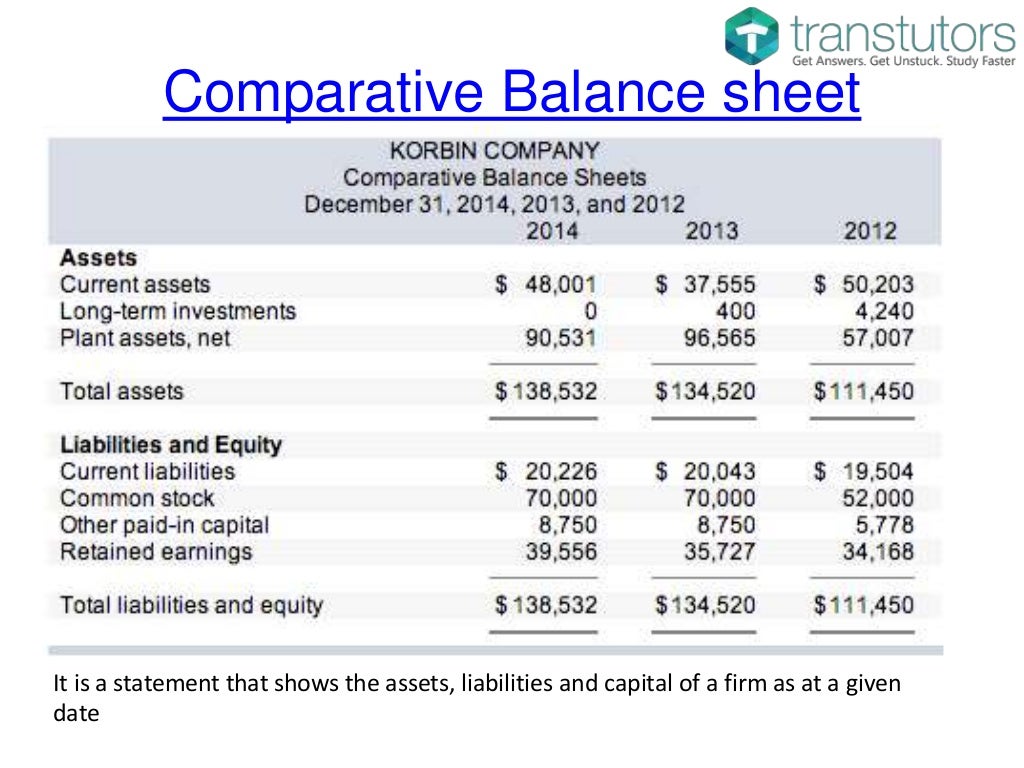

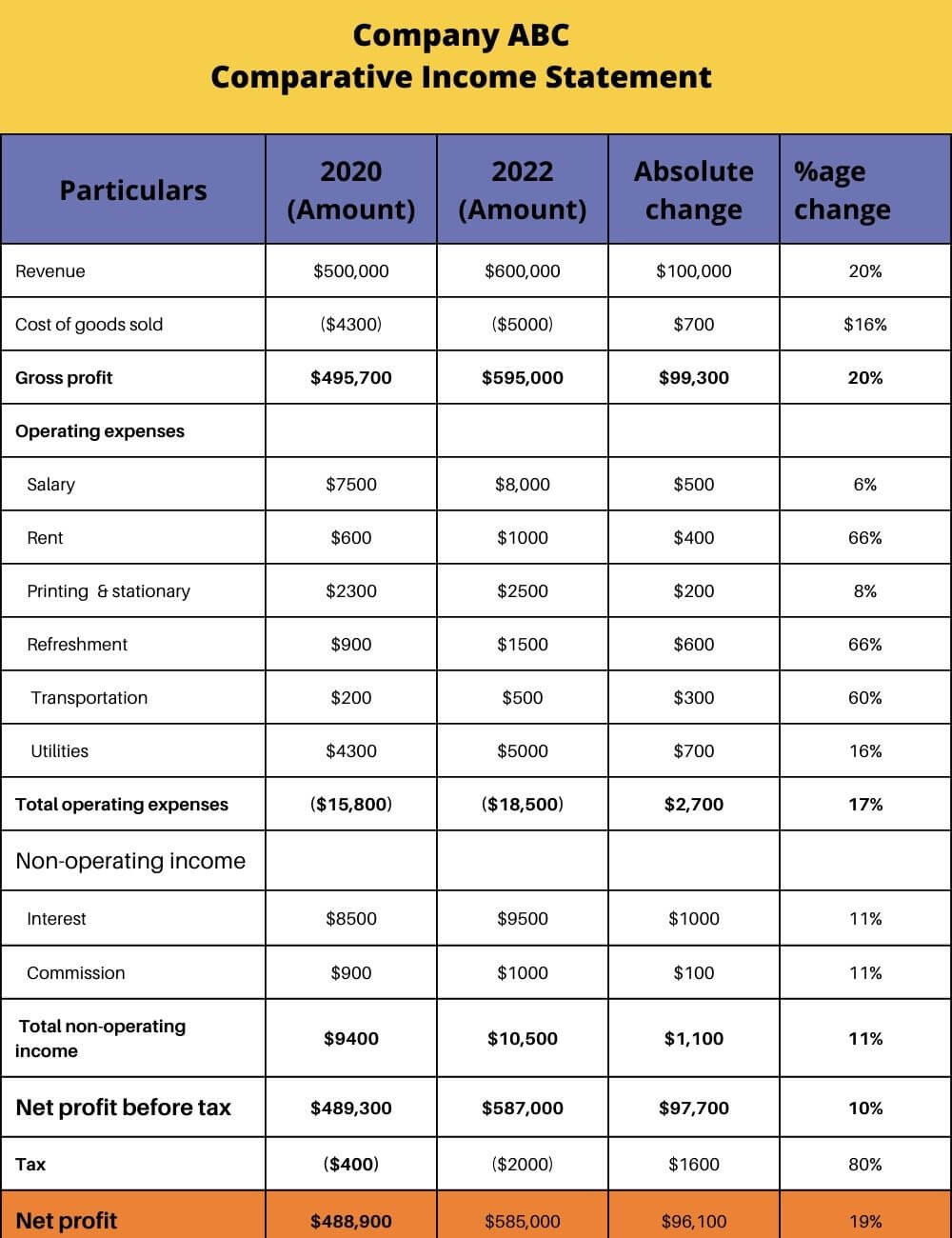

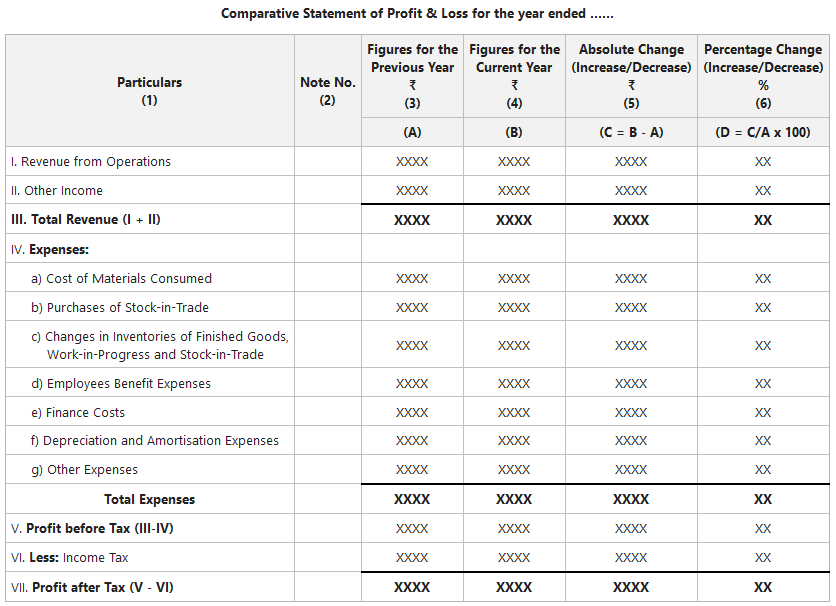

Objectives of comparative income statement. It helps you identify financial trends and measure performance over time. What are comparative financial statements, how such statements are prepared and why are these comparative statements important. This analysis detects changes in a company’s performance and highlights trends.

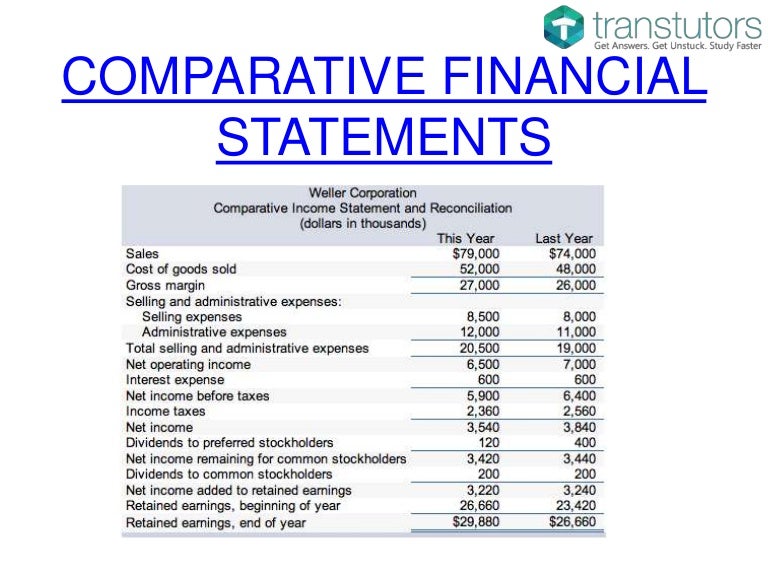

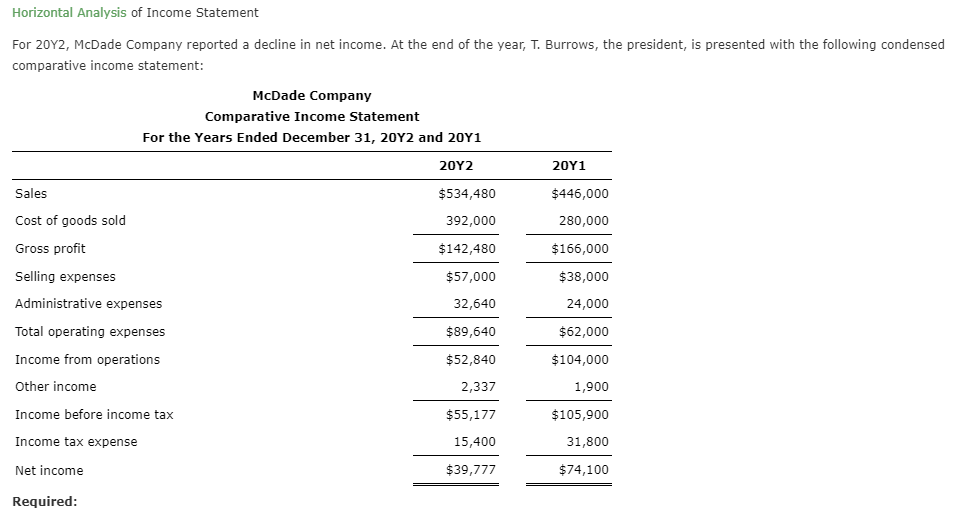

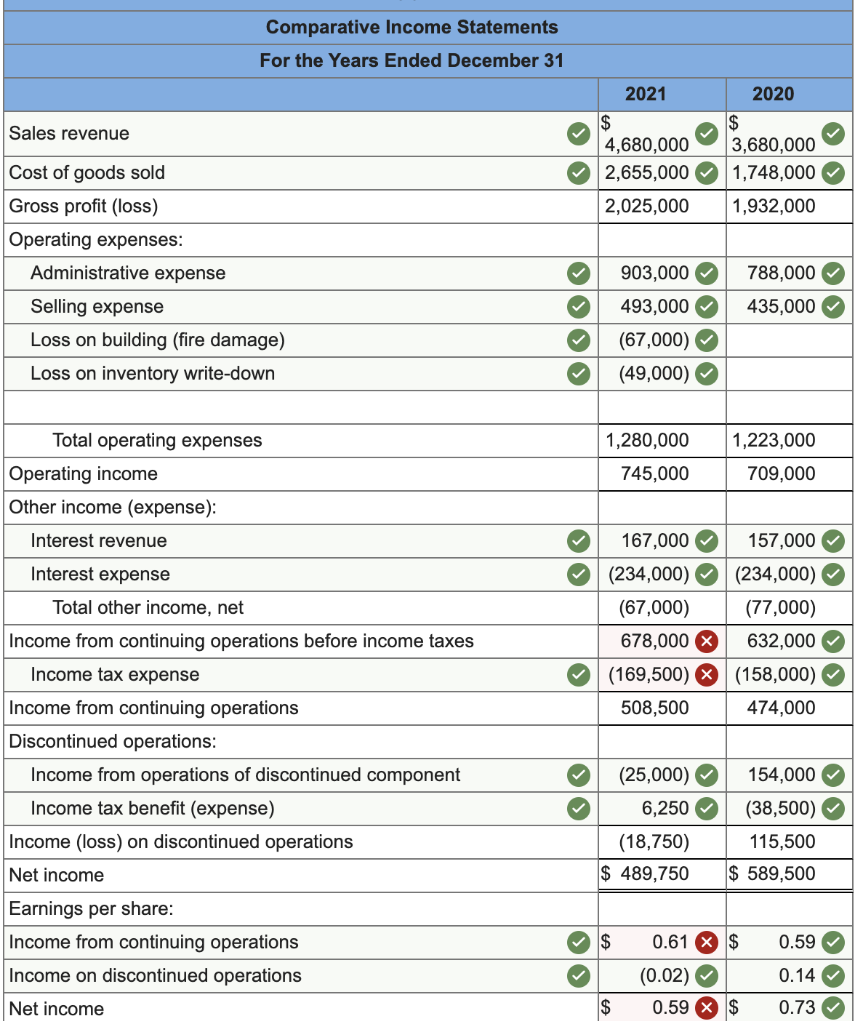

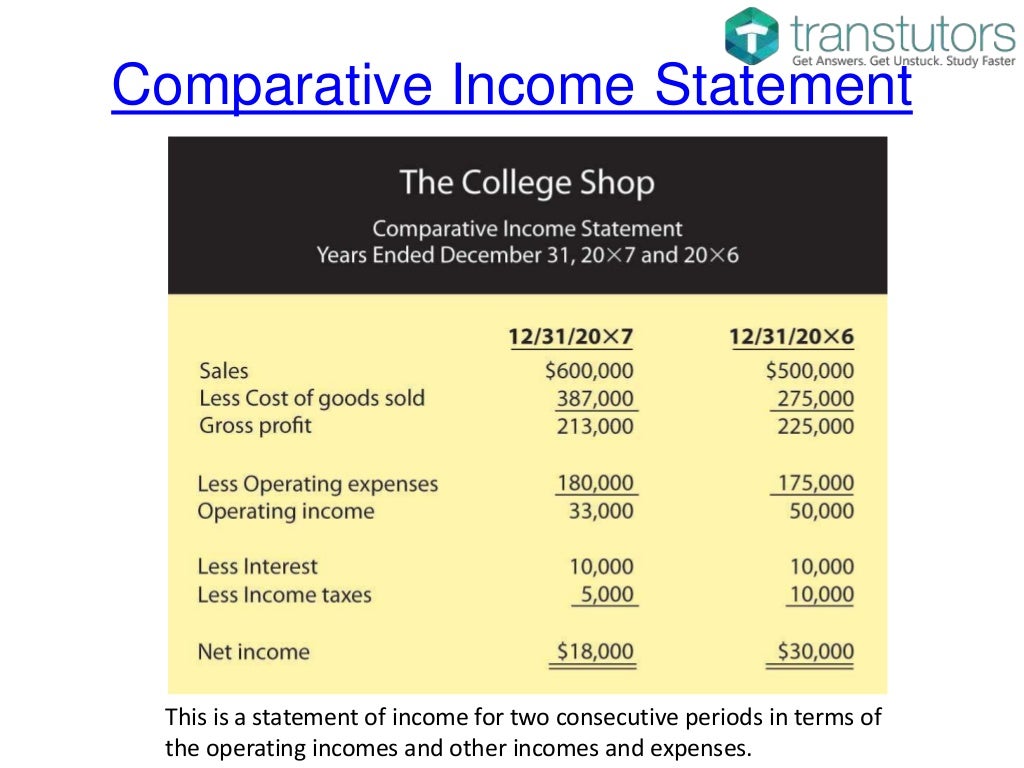

Trend analysis this article talks about comparative financial statements analysis. A comparative income statement is an income statement in which numerous periods are considered and compared to enable the reader to reach the last year’s income and decide about investing in the company. A comparative income statement will consist of two or three columns of amounts appearing to the right of the account titles or descriptions.

These statements aid in establishing a company's profitability by comparing financial data from two or more accounting periods. Compare the increase or decrease in sales with a relative increase in the cost of goods sold 2. What to study while analyzing a comparative income statement?

A comparative statement is a document used to compare a particular financial. Come learn the ins and outs of how to create a comparative income statement. Updated november 21, 2020 reviewed by margaret james fact checked by marcus reeves what is a comparative statement?

Objectives of financial statement analysis; Special dividend of € 1.00 per share. Different objectives of a comparative income statement are as follows:

The intent of this format is to allow the reader to compare the results of multiple historical periods, thereby giving a view of. The main aim behind the preparation of comparative financial statements is to put the data for a number of years in a simple and comparable form. The comparative financial statements of synotech, inc., will serve as a basis for an example of horizontal analysis and vertical analysis of a balance sheet and a statement of income and retained earnings.

This chapter discusses several common methods of analyzing and relating the data in financial statements and, as a result, gaining a clear picture of the solvency and profitability of a company. Moreover, it displays both the absolute change and % change of the values. Something is comparer income statement?

When the data for a number of years are put side by side, the comparison between their figures becomes easier. It helps in observing seasonality and growth patterns in an easy way. Objectives of financial statement analysis financial statements are based on historical accounting information, which reflects the transactions and other events that have affected the firm.

The goal of this format is to allow the reader to compare the results of multiple historical periods, providing a picture of how a business performs over time. Recall that horizontal analysis calculates changes in comparative statement items or totals. Studying the operational profits of the business 3.

A comparative income statement combines information from several income statements as columns in a single statement. A comparative statement is a financial statement that helps compare components of a business’s income statement and balance sheet over a duration of at least two periods, in percentage and absolute form. To make the data simpler and more understandable:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)