Lessons I Learned From Info About Trial Balance Definition Accounting

A company prepares a trial balance.

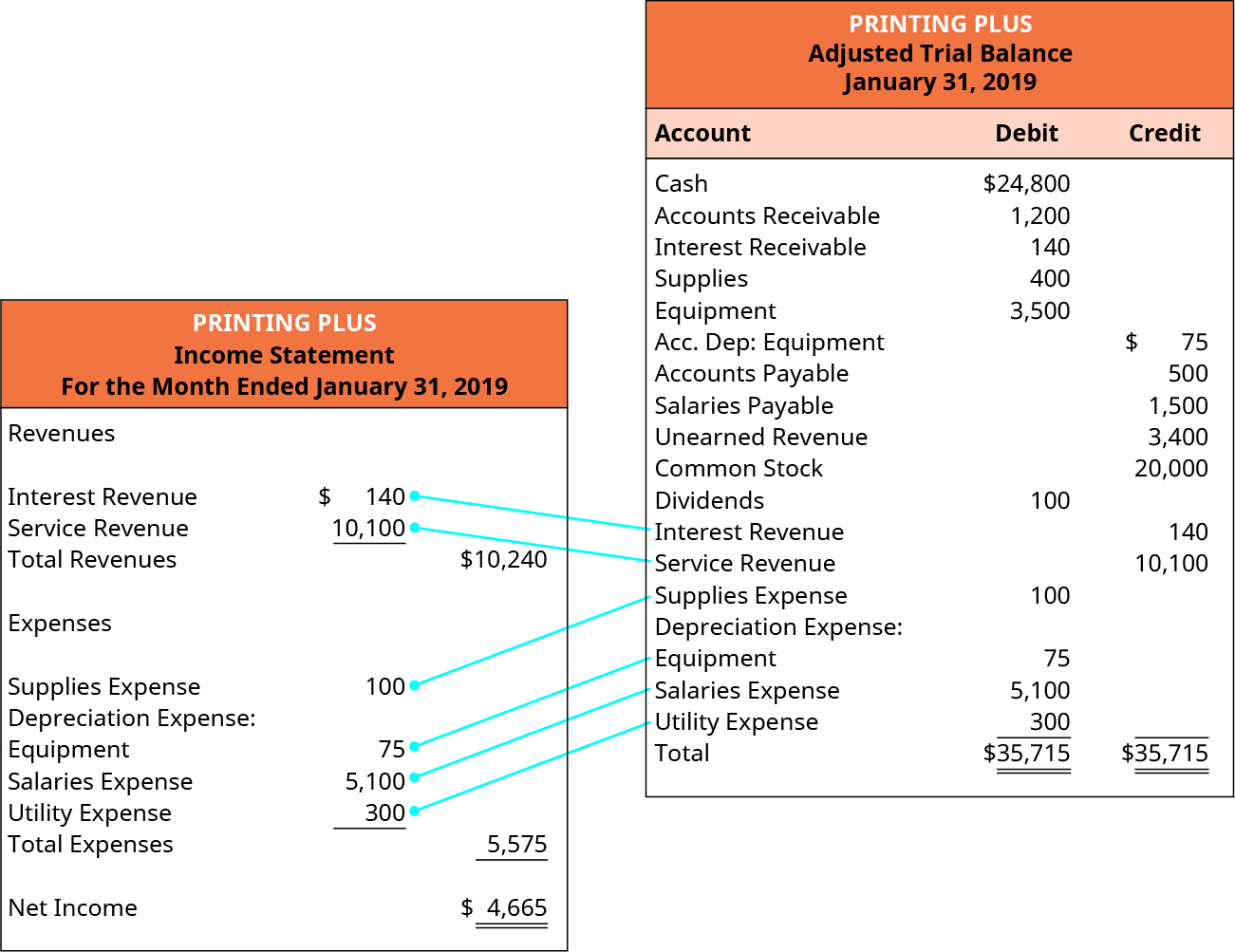

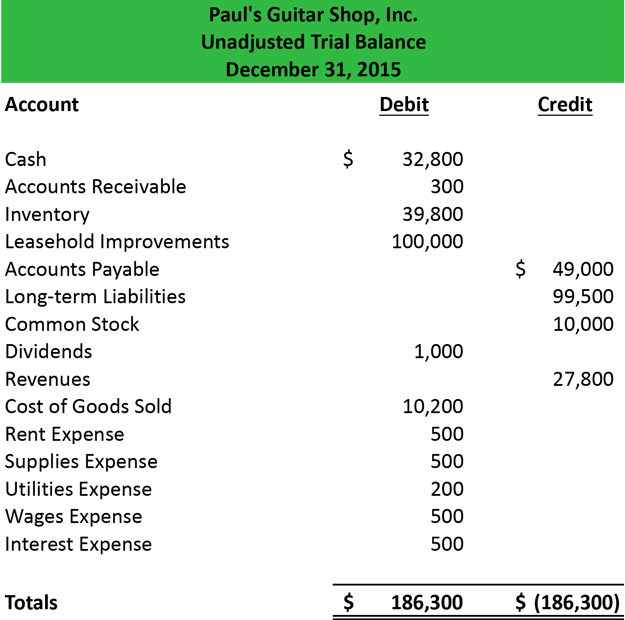

Trial balance definition accounting. This is something that needs to be done once a year. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. The trial balance is usually ready at the end of an accounting period before financial statements are ready.

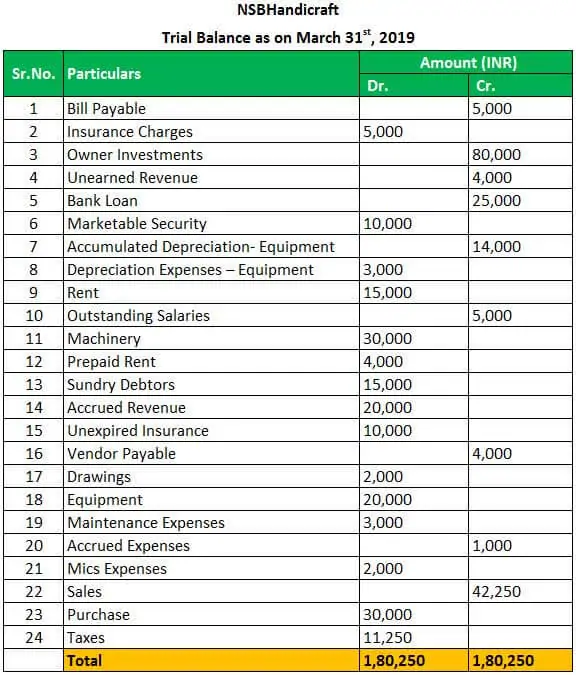

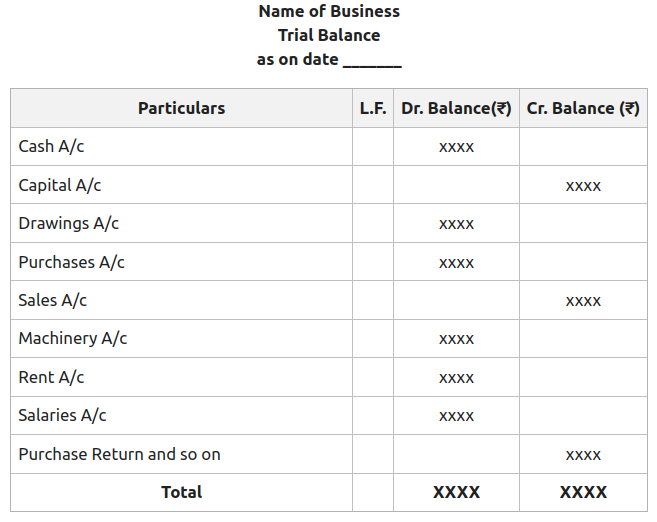

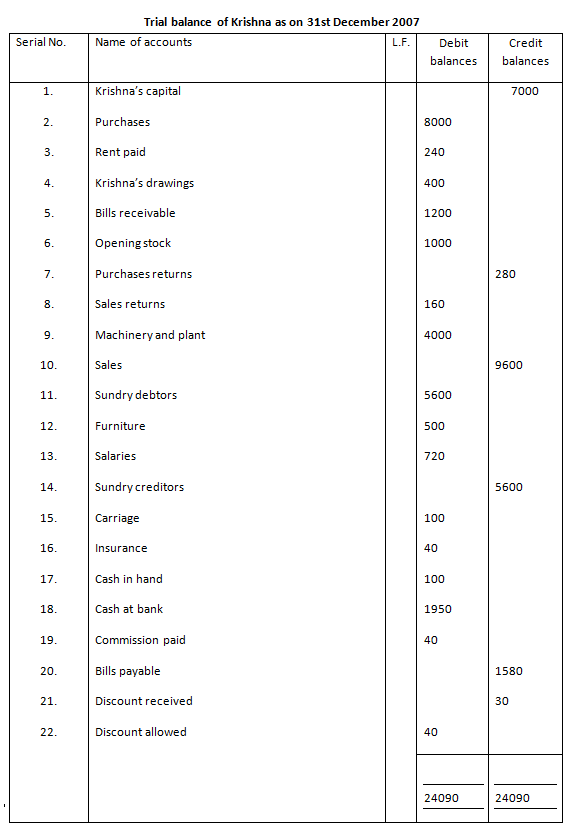

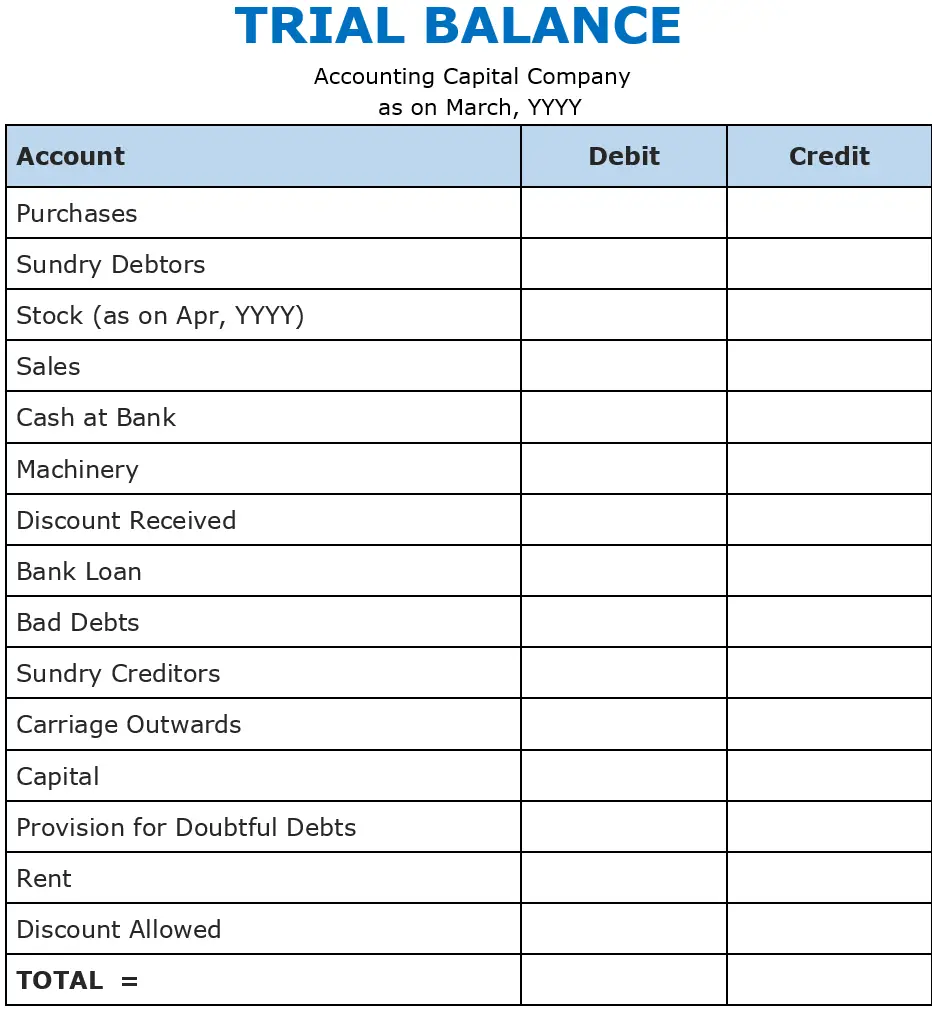

Definition of a trial balance. A trial balance is a bookkeeping tool that consolidates all the ledger accounts of a business into one report, showing the debits and credits made to each account. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

The tb specifies the dates defining the accounting period for which the balances are reported. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. Like a balance sheet, it shows the snapshot of the accounting records on a specific date.

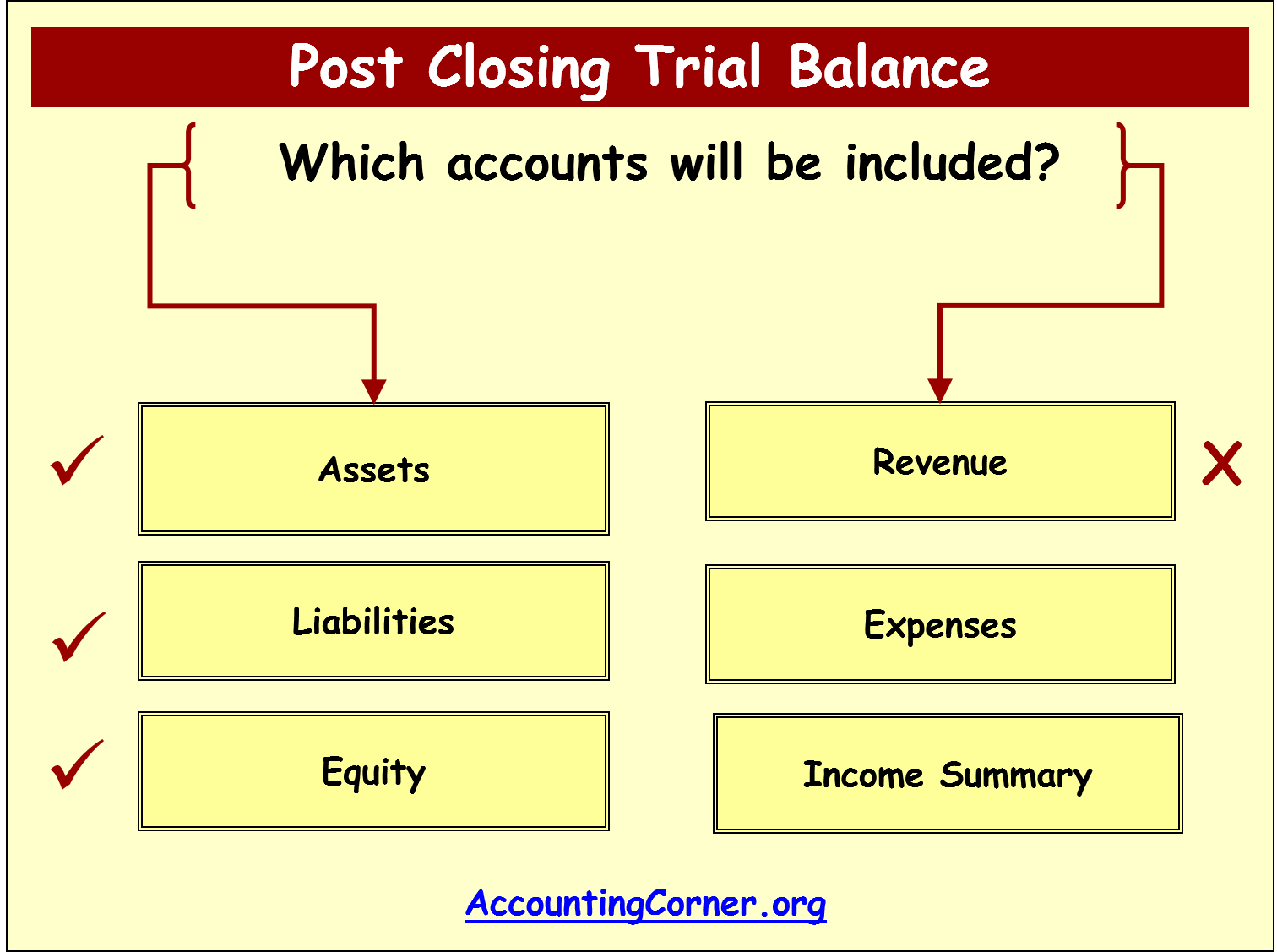

A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a business as at a specific date. Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements. Creating a trial balance is the first step in closing the books at the end of an accounting period.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. It’s primarily used to verify that the total of all debits equals the total of all credits, which means the company’s accounts are balanced. Trump and his legal team tried to shift the blame for any inaccuracies in his financial statements onto his outside accountants.

A trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time. What does trial balance mean? This statement comprises two columns:

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. The trial balance is an accounting report that lists the ending balance in each general ledger account. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and.

A trial balance is a list of all general ledger accounts and their balances at a point in time. Understanding the components of a. All the ledger accounts (from your chart of accounts) are listed on the left side of the report.

Trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. You count, measure, or weigh all tangible assets and list all tangible, fixed, current, and intangible assets as well as all debts.

It involves listing all the general ledger accounts and totaling the debit and credit values to ascertain if. Your trial balance is comprised of the results of stocktaking. What’s the role of a trial balance in accounting?

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)