Ideal Tips About Prepaid Expenses In Cash Flow

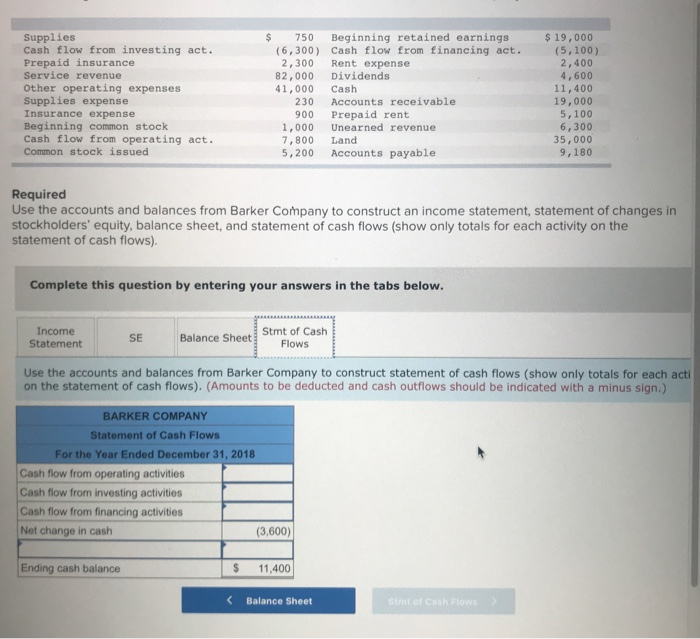

Analyze cost and cash flow implications.

Prepaid expenses in cash flow. The most common types of prepaid expenses are prepaid rent and prepaid insurance. If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term. Cash flow kings 100 etf ( flow), which debuted last july, features an approach that’s similar to what’s found with the aforementioned cowz.

The global x u.s. Consider factors such as upfront payment amounts, potential discounts or incentives, and the impact on your budgeting and forecasting processes. Accounting for prepaid expenses accrual basis vs.

Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. In this guide, we'll cover what prepaid expenses are, how to manage them, and why they should be a part of your budgeting and accounting strategy. However, this payment must occur through cash and cash equivalent resources.

Optimizing cash flow and budgeting through prepaid expense management: A prepaid expense is a financial asset that businesses pay in advance for goods or services they will receive in the future. Forecasting future prepaid outflows allows businesses to plan their expenses more effectively, ensuring sufficient funds for other critical expenditures.

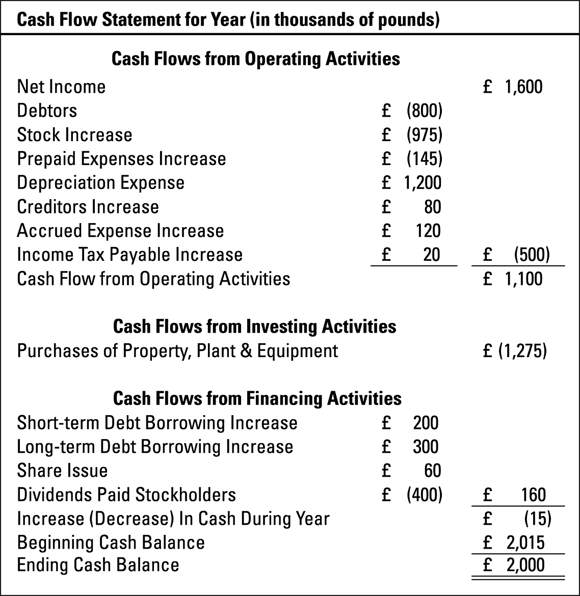

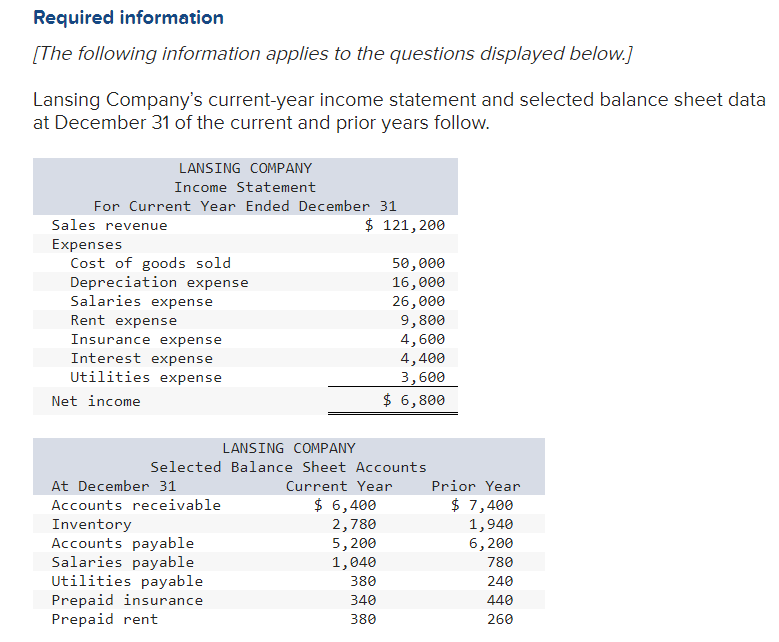

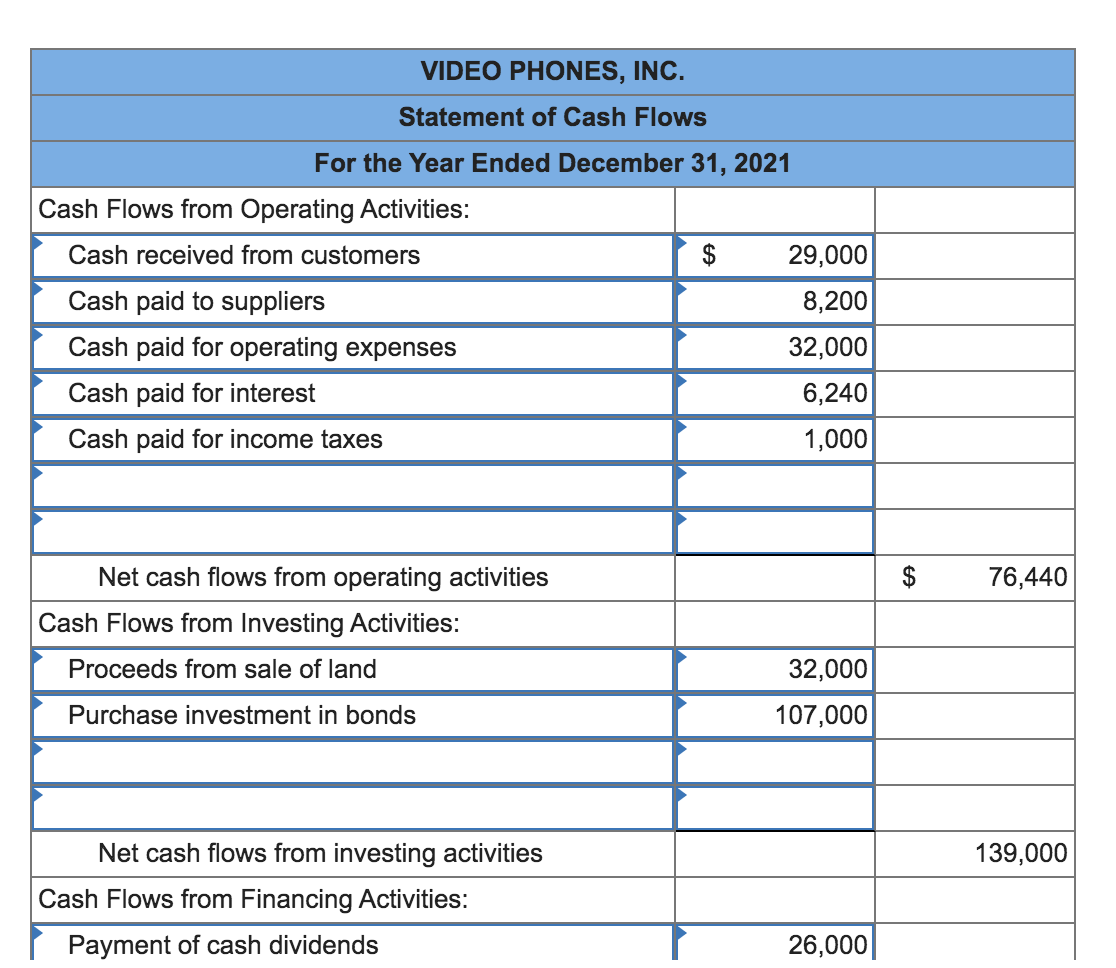

Usually, prepaid rent goes under cash flow from operating activities in the cash flow statement. Prepaid expenses debit or credit? More specifically, they are listed under current assets.

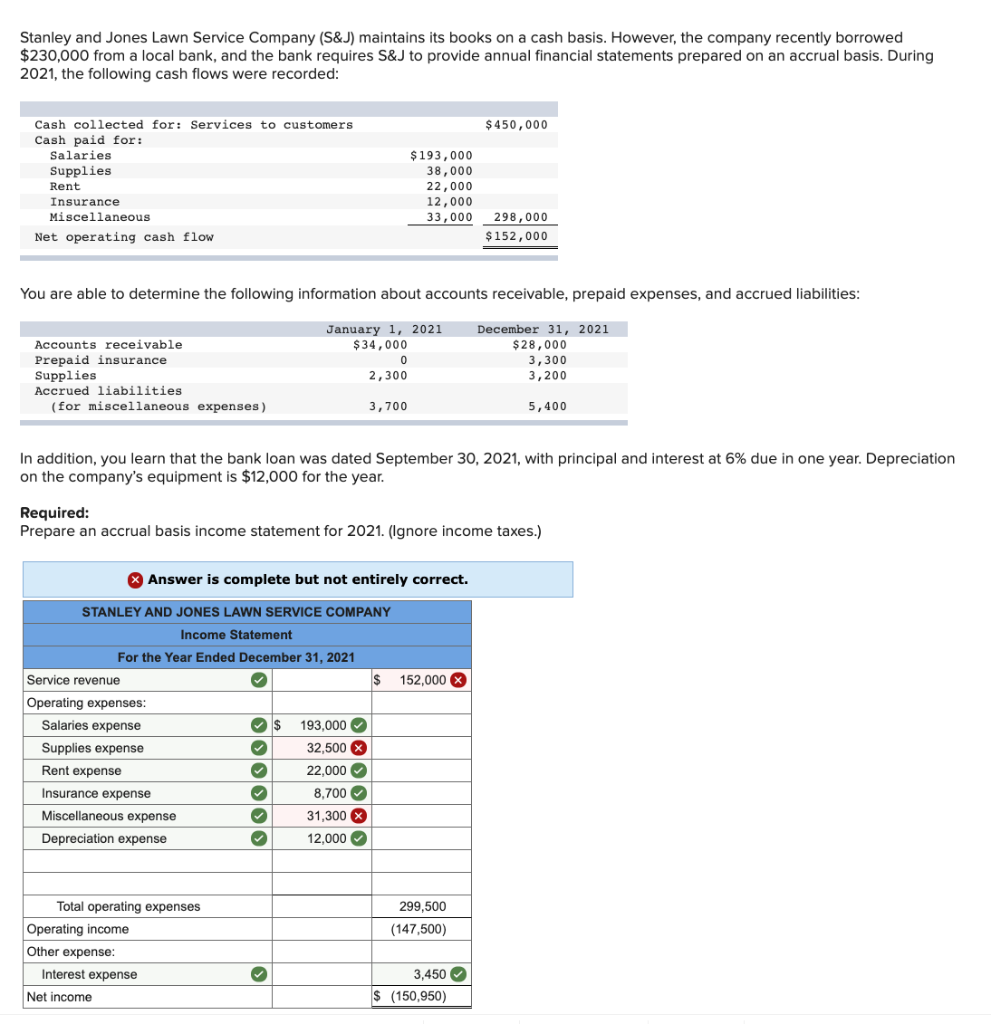

Likewise, an increase in prepaid expenses will result in a decrease in cash flow for the current period. It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations. Strategically managing prepaid expenses enables businesses to optimize cash flow and budgeting.

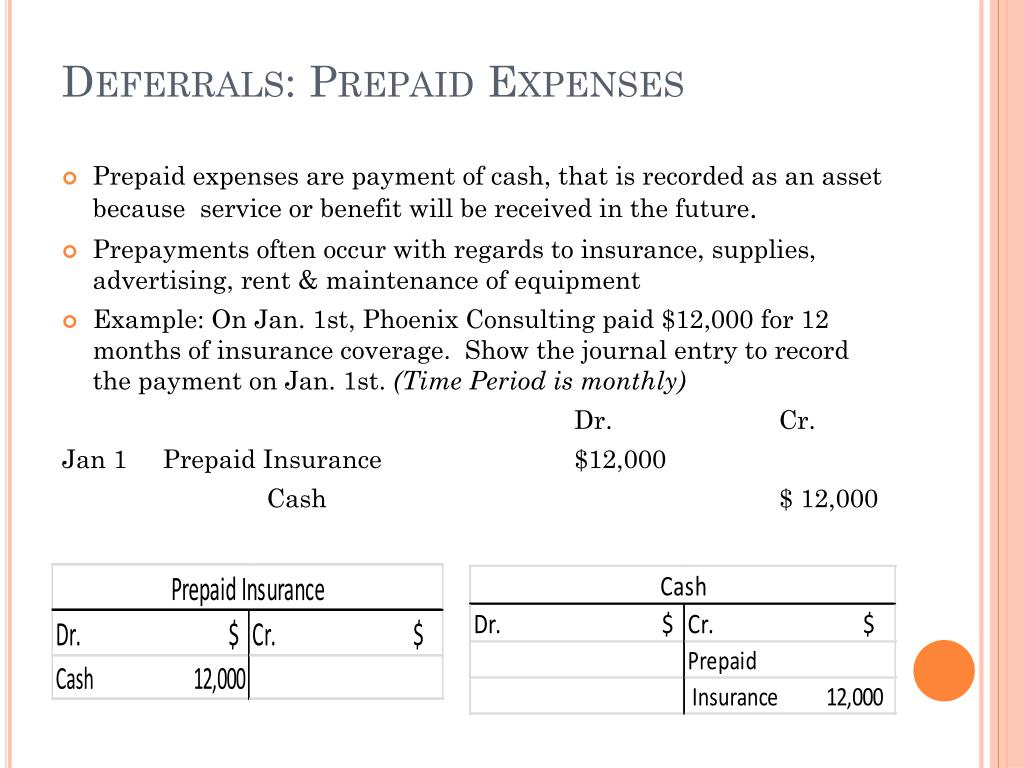

David kindness fact checked by vikki velasquez expenses that are used to make payments for goods or services that will be received in the future are known as prepaid expenses. Prepaid expenses are one way to help manage cash flow more effectively and ensure you're not overspending or leaving money on the table. When the prepaid expense balance increases, that means the company has a cash outflow for expenses that have not yet been recognized in the income statement.

Prepaid expenses are listed as an asset in the balance sheet. Cash flow predictability:

In business, a prepaid expense is recorded as an asset on the balance sheet that results from a. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Operating expenses are typically paid on a monthly basis, which is why any reduction in prepaid expenses will immediately benefit cash flow for the current month.

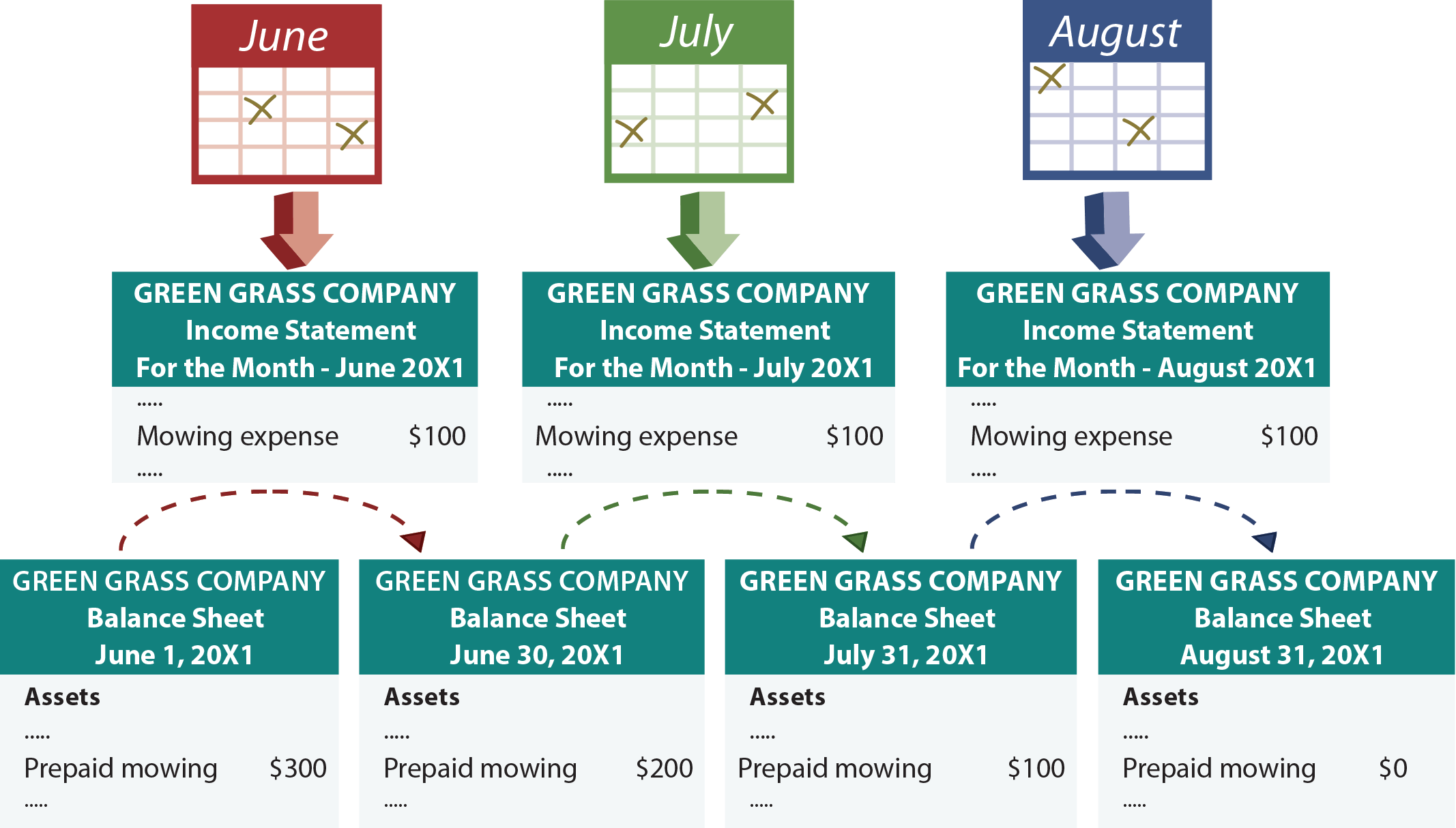

Increase in prepaid expenses on cash flow statement. An example that you might see on the cpa exam might indicate that if the company prepays rent for 12 months, the prepaid rent balance will increase for the 12 months of rent. There are a couple ways you can prioritize which balances to target first, and both have advantages for improving your cash flow.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)